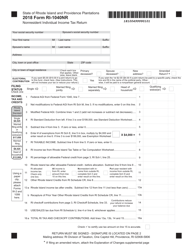

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form RI-1040NR

for the current year.

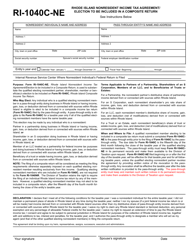

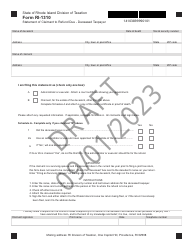

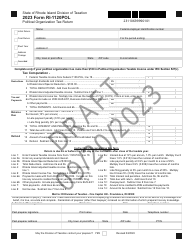

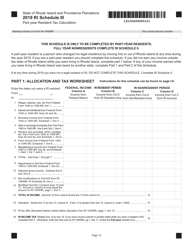

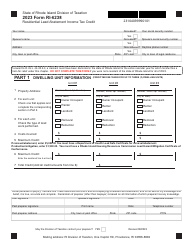

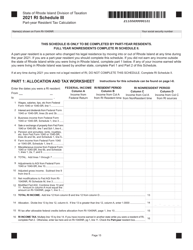

Instructions for Form RI-1040NR Nonresident Individual Income Tax Return - Rhode Island

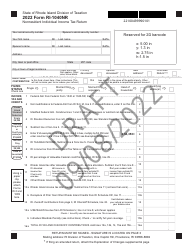

This document contains official instructions for Form RI-1040NR , Nonresident Individual Income Tax Return - a form released and collected by the Rhode Island Department of Revenue - Division of Taxation. An up-to-date fillable Form RI-1040NR is available for download through this link.

FAQ

Q: Who needs to file Form RI-1040NR?

A: Nonresidents who earned income in Rhode Island and need to file their state income tax return.

Q: What is Form RI-1040NR?

A: Form RI-1040NR is the Nonresident Individual Income Tax Return for the state of Rhode Island.

Q: What information do I need to fill out Form RI-1040NR?

A: You will need to provide your personal information, details about your income and deductions, and any applicable tax credits.

Q: When is the deadline to file Form RI-1040NR?

A: The deadline to file Form RI-1040NR is generally April 15th, but it may vary depending on the tax year.

Q: Are there any other forms or schedules that I need to include with Form RI-1040NR?

A: You may need to include additional forms or schedules if you have certain types of income or deductions. Check the instructions for Form RI-1040NR for more information.

Q: What if I can't pay the full amount of taxes owed with Form RI-1040NR?

A: If you can't pay the full amount of taxes owed, you should still file your return on time and contact the Rhode Island Division of Taxation to discuss payment options.

Q: What if I no longer have a filing requirement in Rhode Island?

A: If you no longer have a filing requirement in Rhode Island, you should complete and submit Form RI-1366 to officially terminate your filing obligation.

Instruction Details:

- This 13-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Rhode Island Department of Revenue - Division of Taxation.