This version of the form is not currently in use and is provided for reference only. Download this version of

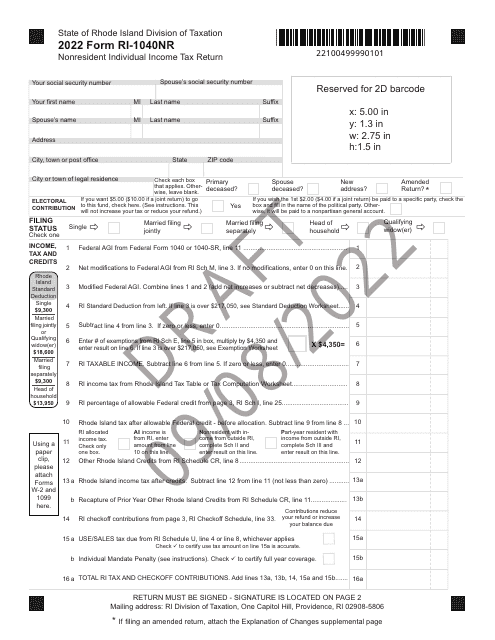

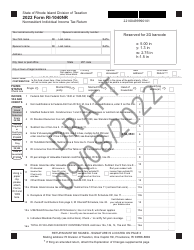

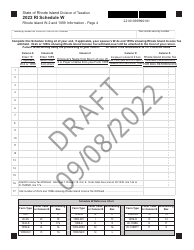

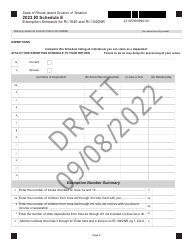

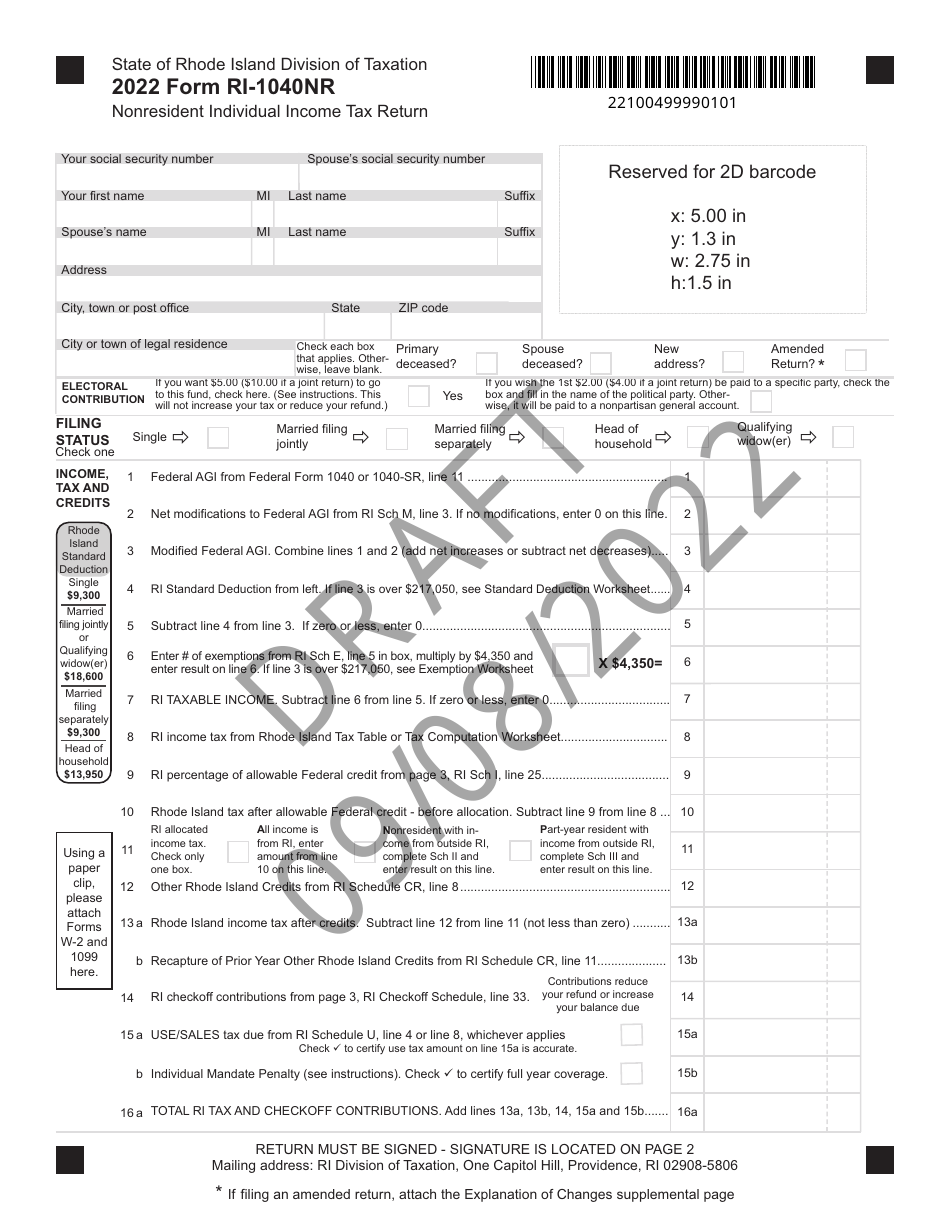

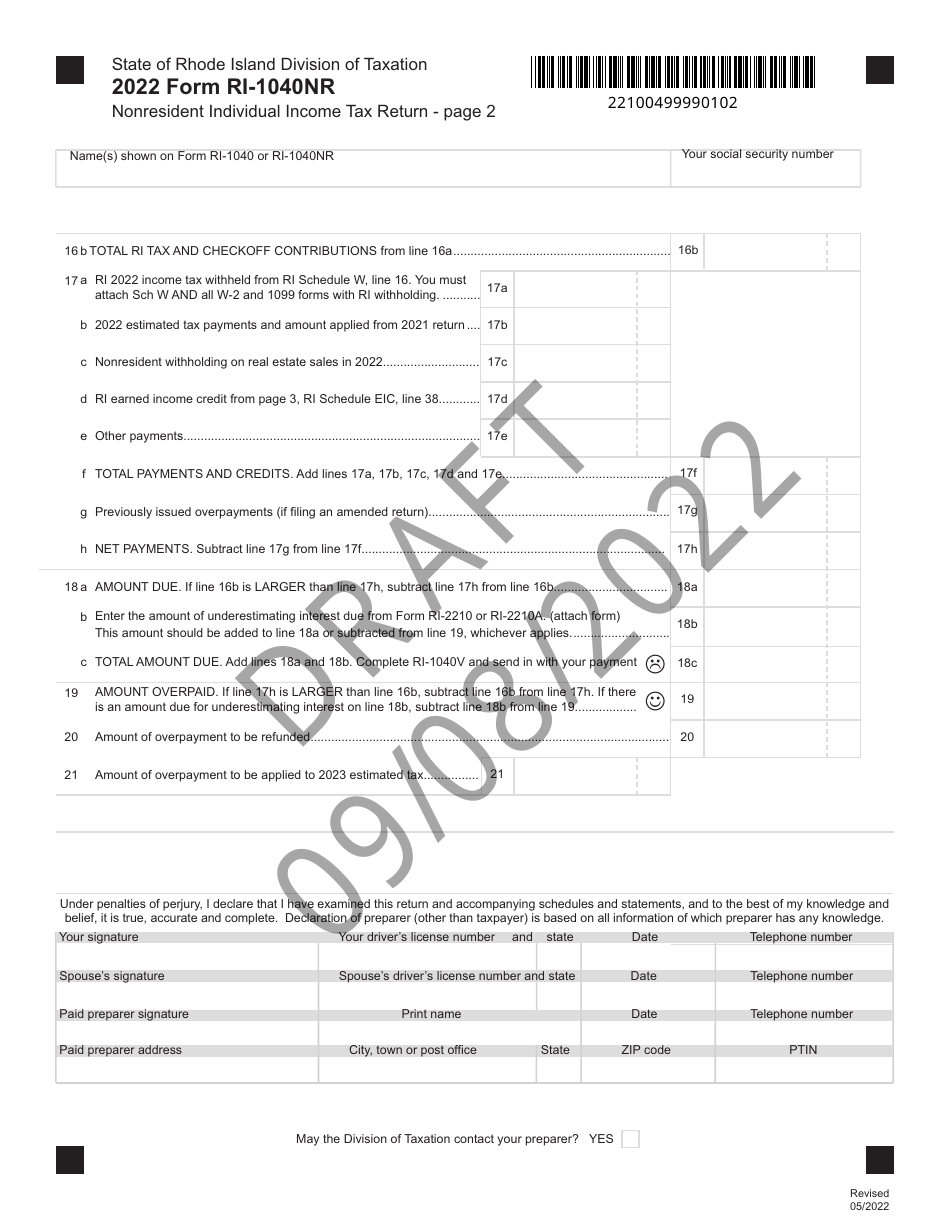

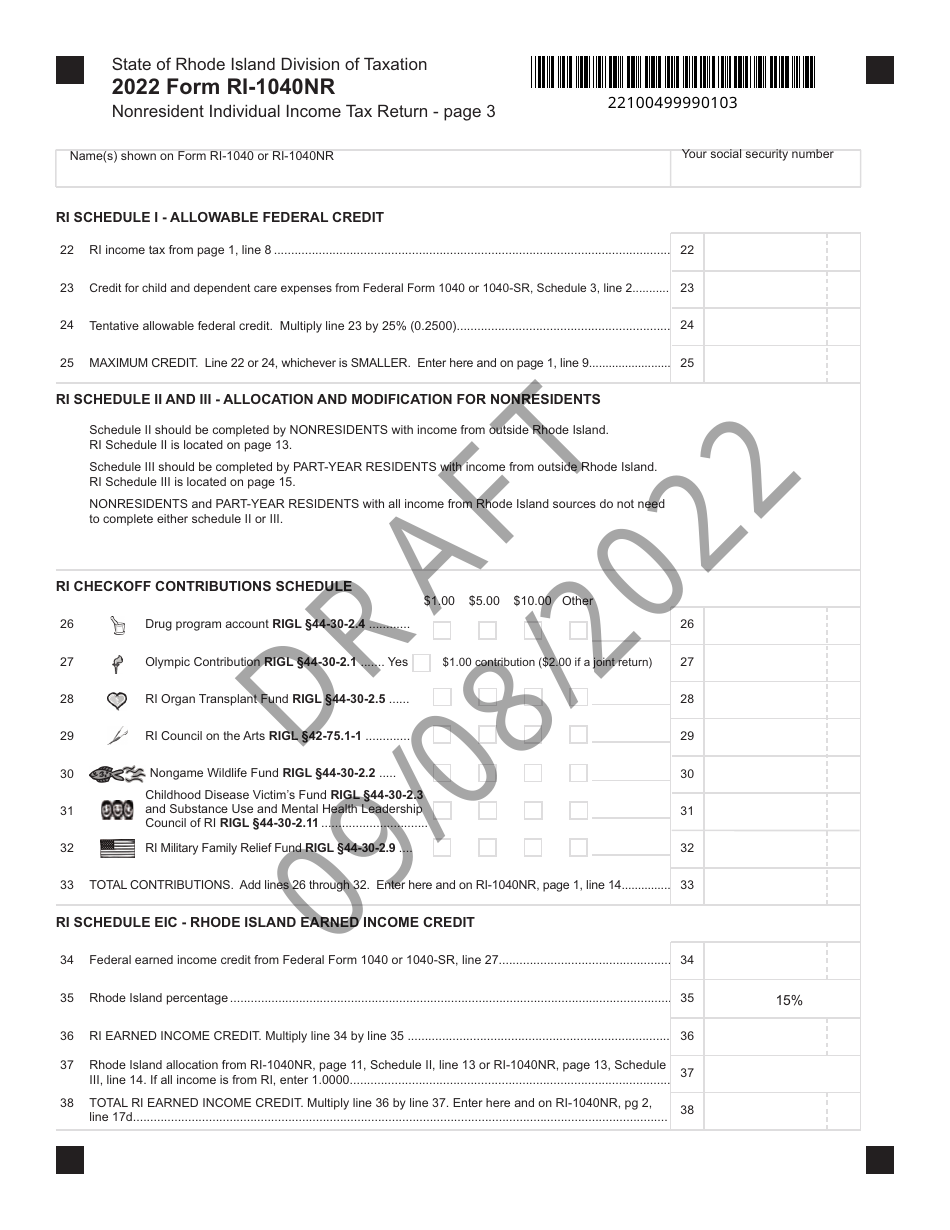

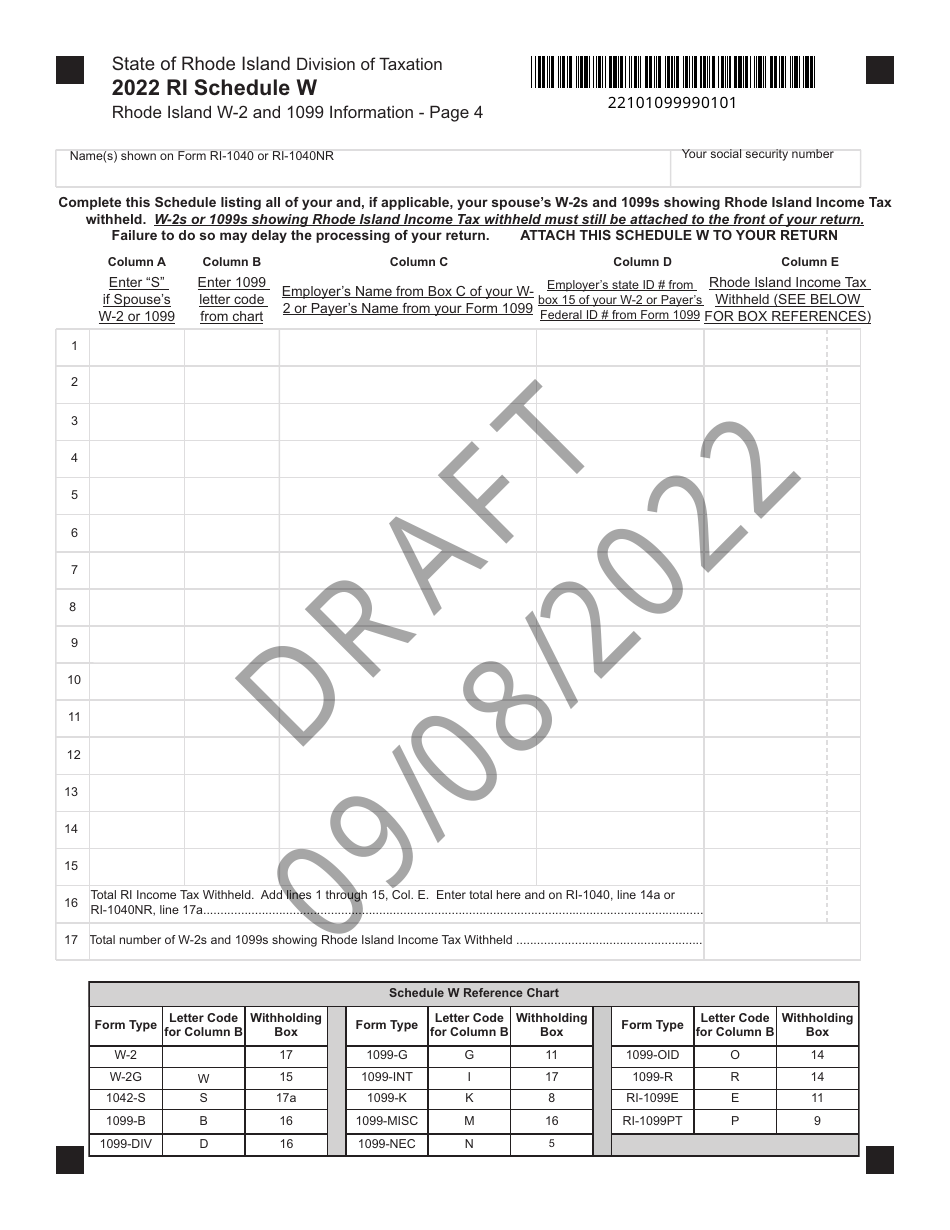

Form RI-1040NR

for the current year.

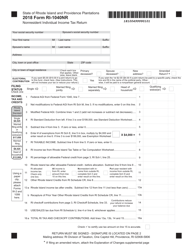

Form RI-1040NR Nonresident Individual Income Tax Return - Draft - Rhode Island

What Is Form RI-1040NR?

This is a legal form that was released by the Rhode Island Department of Revenue - Division of Taxation - a government authority operating within Rhode Island. Check the official instructions before completing and submitting the form.

FAQ

Q: What is RI-1040NR?

A: RI-1040NR is the Nonresident Individual Income Tax Return form for Rhode Island.

Q: Who should file form RI-1040NR?

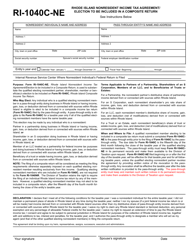

A: Nonresident individuals who have income from Rhode Island sources and need to report it for tax purposes should file form RI-1040NR.

Q: What is the purpose of form RI-1040NR?

A: The purpose of form RI-1040NR is to report and calculate the income tax liability of nonresident individuals in Rhode Island.

Q: What income should be reported on form RI-1040NR?

A: All income from Rhode Island sources, including wages, salaries, rental income, and business income should be reported on form RI-1040NR.

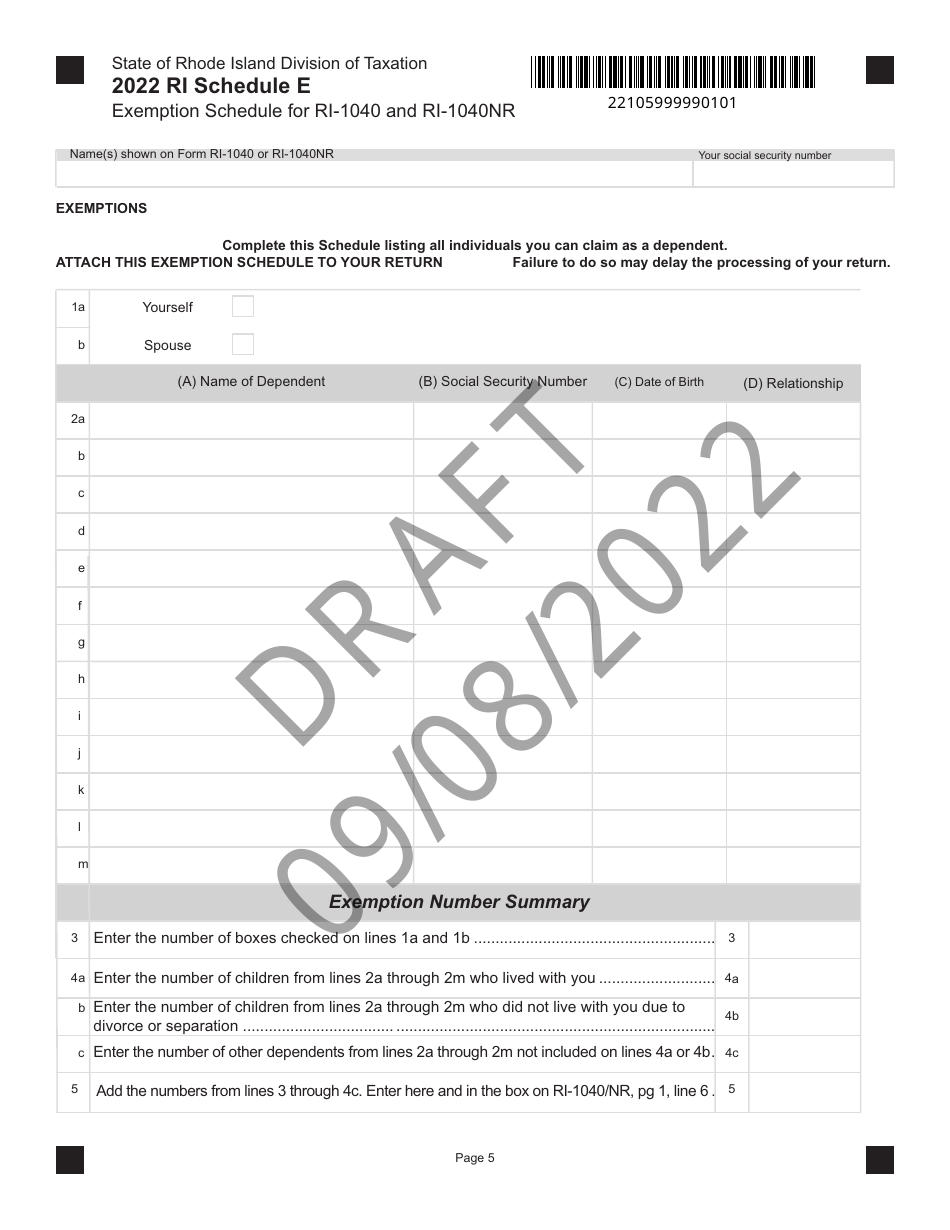

Q: Are there any exemptions or deductions available on form RI-1040NR?

A: Yes, nonresident individuals may be eligible for certain exemptions and deductions, such as the standard deduction or exemptions for dependents.

Q: When is the deadline to file form RI-1040NR?

A: The deadline to file form RI-1040NR is usually April 15th, but the date may vary depending on any extensions granted by the IRS.

Q: Is it mandatory to file form RI-1040NR?

A: Yes, if you are a nonresident individual with income from Rhode Island sources, it is mandatory to file form RI-1040NR.

Q: What should I do if I have questions or need help filling out form RI-1040NR?

A: If you have questions or need assistance with form RI-1040NR, you can contact the Rhode Island Division of Taxation or seek help from a tax professional.

Form Details:

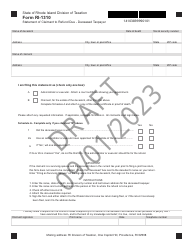

- Released on September 8, 2022;

- The latest edition provided by the Rhode Island Department of Revenue - Division of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RI-1040NR by clicking the link below or browse more documents and templates provided by the Rhode Island Department of Revenue - Division of Taxation.