Instructions for Form DTF-95-I Business Tax Account Update - New York

This document contains official instructions for Form DTF-95-I , Business Tax Account Update - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

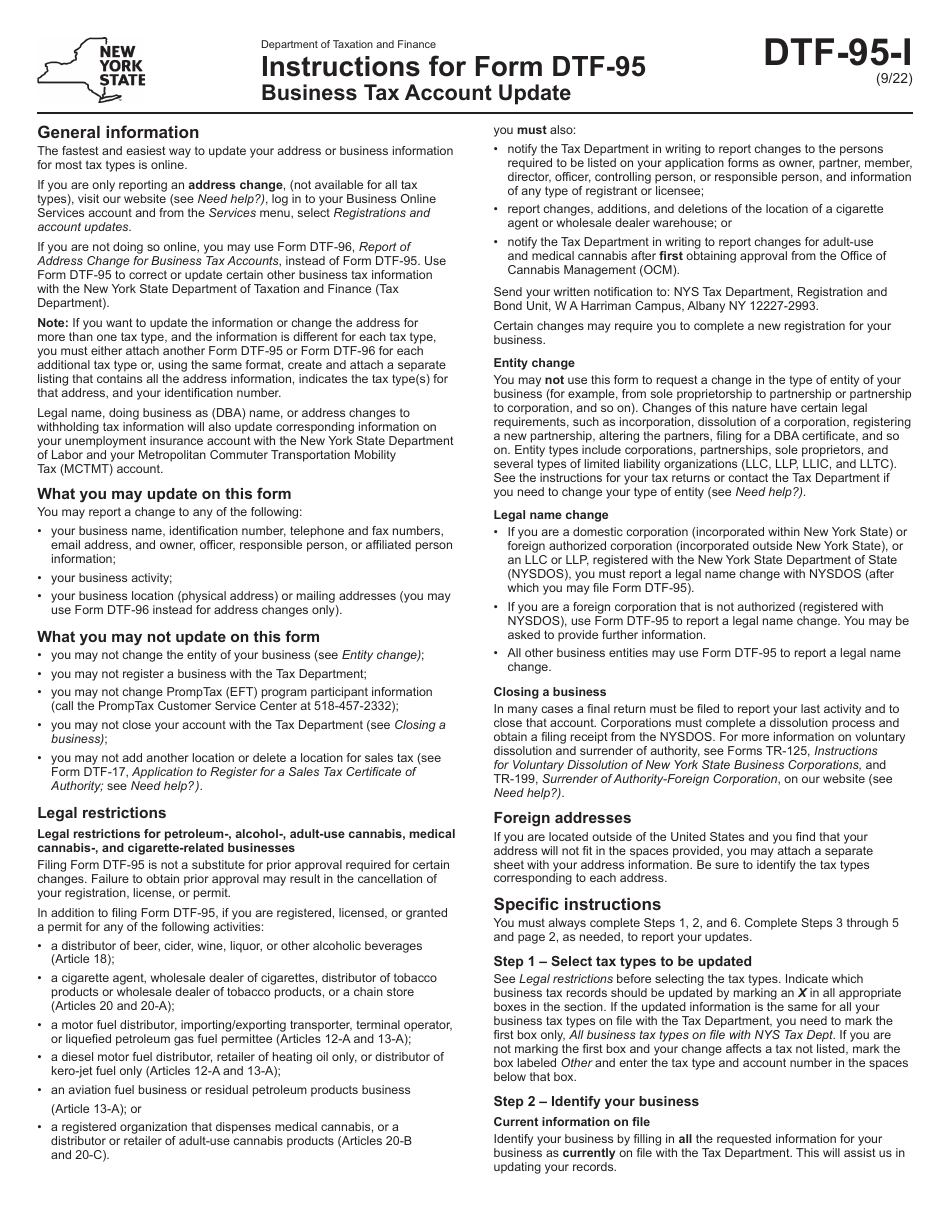

Q: What is Form DTF-95-I?

A: Form DTF-95-I is a form used for updating business tax accounts in New York.

Q: Who needs to file Form DTF-95-I?

A: Businesses in New York that need to make changes to their tax accounts.

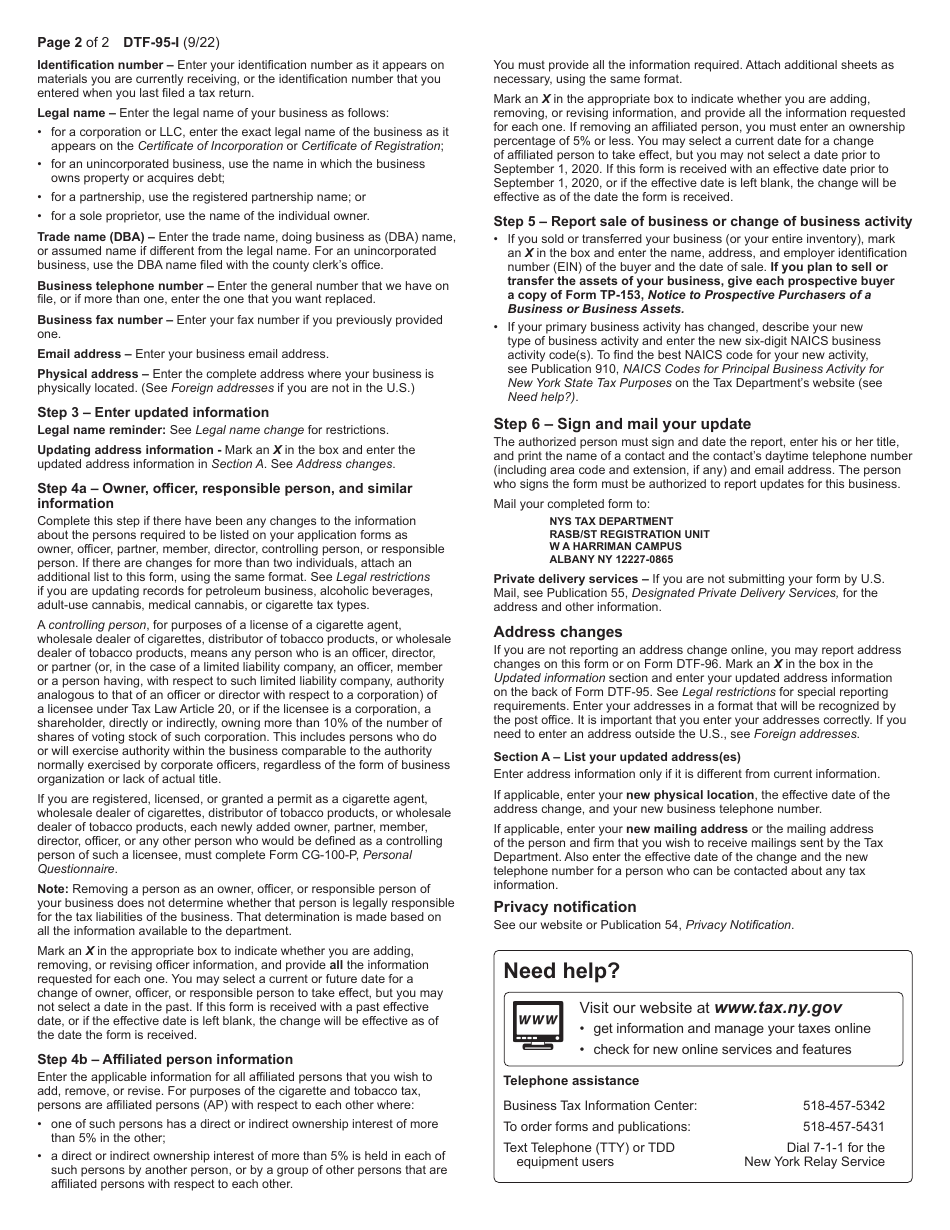

Q: What changes can be made using Form DTF-95-I?

A: Form DTF-95-I can be used to update business name, address, ownership, and other account information.

Q: Is there a filing fee for Form DTF-95-I?

A: No, there is no filing fee for Form DTF-95-I.

Q: Is Form DTF-95-I required every year?

A: No, Form DTF-95-I only needs to be filed when there are changes to the business tax account information.

Q: What is the deadline for filing Form DTF-95-I?

A: There is no specific deadline for filing Form DTF-95-I, but it should be filed as soon as possible after the changes occur.

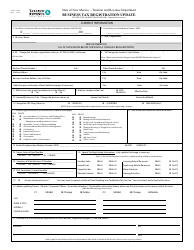

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.