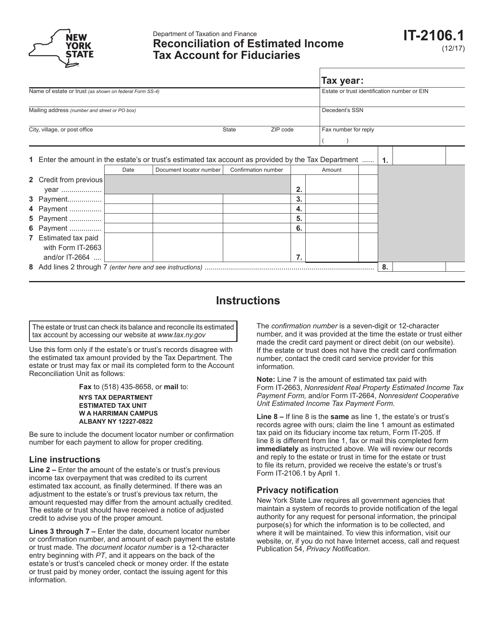

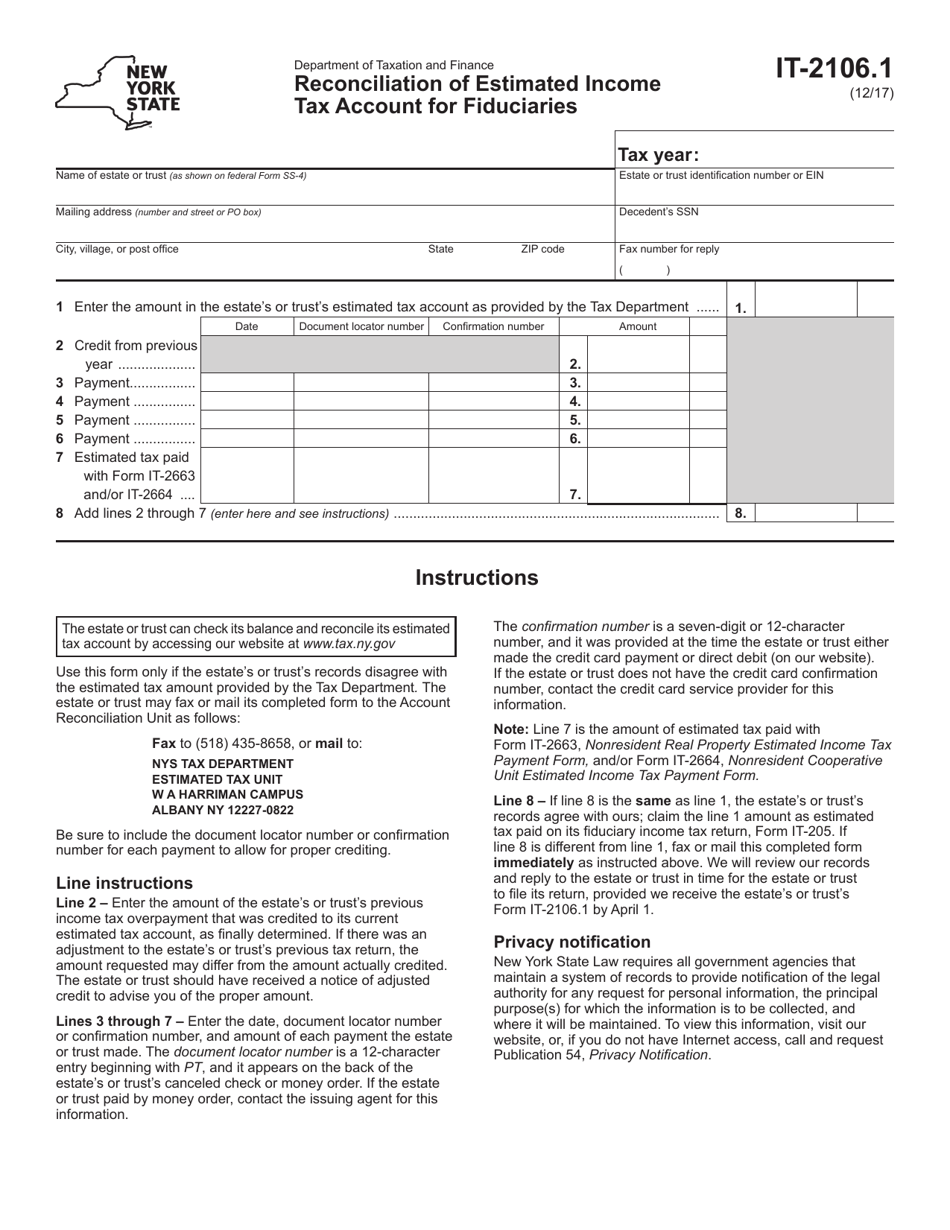

Form IT-2106.1 Reconciliation of Estimated Income Tax Account for Fiduciaries - New York

What Is Form IT-2106.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-2106.1?

A: Form IT-2106.1 is a tax form used in New York for fiduciaries to reconcile their estimated income tax account.

Q: Who should use Form IT-2106.1?

A: Form IT-2106.1 should be used by fiduciaries in New York who need to reconcile their estimated income tax account.

Q: What is the purpose of Form IT-2106.1?

A: The purpose of Form IT-2106.1 is to reconcile the estimated income tax payments made by fiduciaries with their actual tax liability.

Q: When is Form IT-2106.1 due?

A: Form IT-2106.1 is generally due on the same date as the fiduciary's annual tax return, which is typically April 15th.

Q: What are the consequences of not filing Form IT-2106.1?

A: Failure to file Form IT-2106.1 may result in penalties and interest being assessed by the New York State Department of Taxation and Finance.

Q: Is Form IT-2106.1 only for New York residents?

A: No, Form IT-2106.1 is specifically for fiduciaries who have income subject to New York State tax, regardless of residency.

Q: Is there a fee for filing Form IT-2106.1?

A: There is no fee for filing Form IT-2106.1.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-2106.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.