This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-633

for the current year.

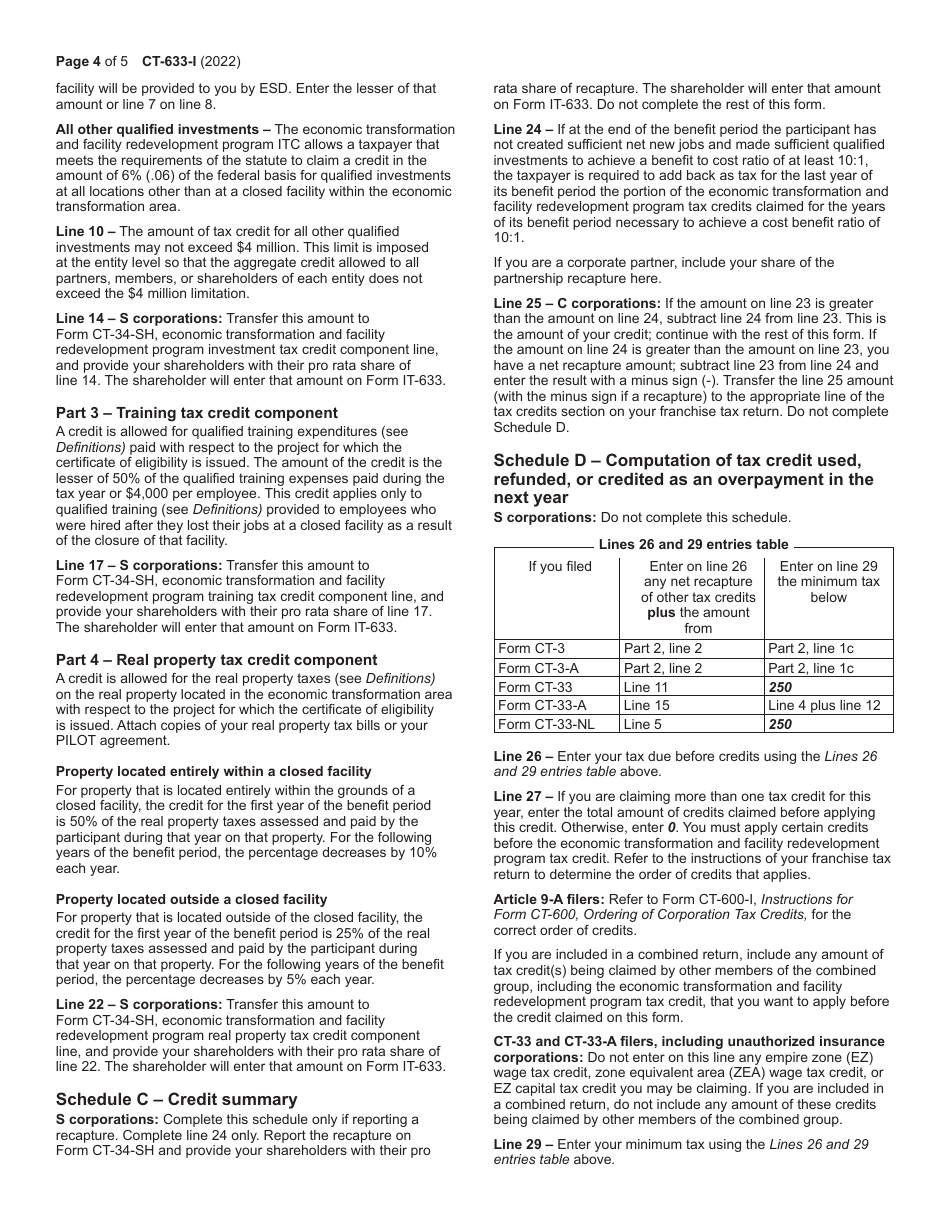

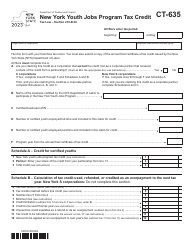

Instructions for Form CT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

This document contains official instructions for Form CT-633 , Economic Transformation and Facility Redevelopment Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-633 is available for download through this link.

FAQ

Q: What is Form CT-633?

A: Form CT-633 is a form used to apply for the Economic Transformation and Facility Redevelopment Program Tax Credit in New York.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax credit in New York that provides incentives for eligible businesses that undertake qualified projects to transform or redevelop underutilized industrial or commercial facilities.

Q: Who is eligible to claim this tax credit?

A: Eligible businesses that undertake qualified projects to transform or redevelop underutilized industrial or commercial facilities in New York are eligible to claim this tax credit.

Q: What information is required on Form CT-633?

A: Form CT-633 requires information about the taxpayer, the facility being transformed or redeveloped, and details about the qualified project.

Q: What is the deadline for filing Form CT-633?

A: The deadline for filing Form CT-633 is typically 30 days before the commencement of the qualified project.

Q: What happens after I file Form CT-633?

A: After filing Form CT-633, the New York State Department of Taxation and Finance will review the application and determine if the taxpayer is eligible for the tax credit.

Q: How is the tax credit calculated?

A: The tax credit amount is calculated based on a percentage of the eligible project costs, as determined by the New York State Department of Taxation and Finance.

Q: What can the tax credit be used for?

A: The tax credit can be used to offset the taxpayer's New York State tax liability.

Q: Are there any limitations or restrictions on this tax credit?

A: Yes, there are certain limitations and restrictions on this tax credit, such as caps on the total amount of tax credits available and requirements for maintaining employment levels.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.