This version of the form is not currently in use and is provided for reference only. Download this version of

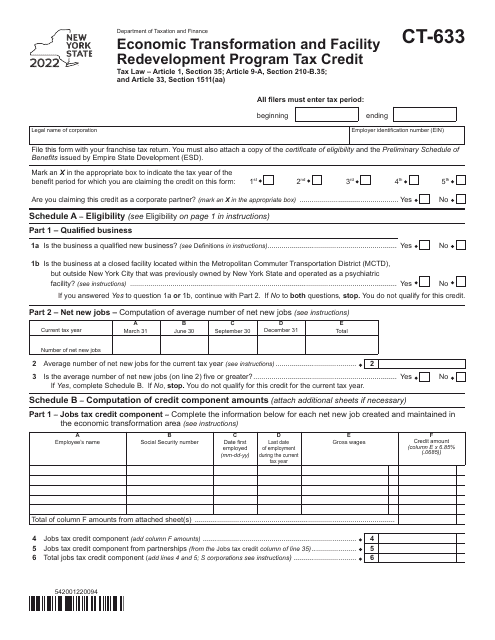

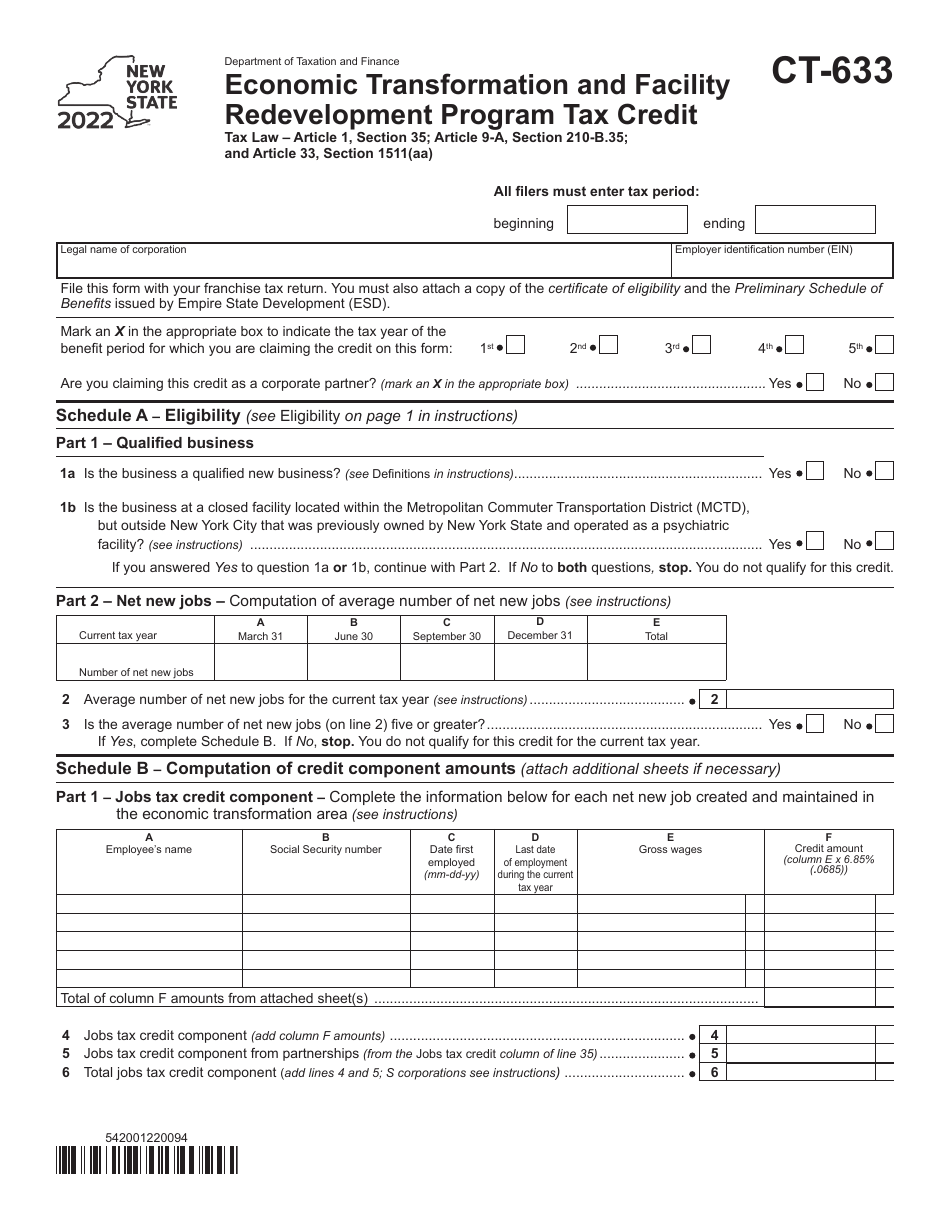

Form CT-633

for the current year.

Form CT-633 Economic Transformation and Facility Redevelopment Program Tax Credit - New York

What Is Form CT-633?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-633?

A: Form CT-633 is a tax form used in New York for the Economic Transformation and Facility Redevelopment Program Tax Credit.

Q: What is the Economic Transformation and Facility Redevelopment Program Tax Credit?

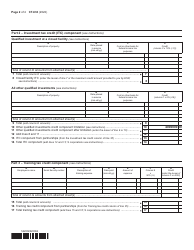

A: The Economic Transformation and Facility Redevelopment Program Tax Credit is a tax credit program in New York that provides incentives for businesses to invest in certain designated areas for redevelopment or transformation projects.

Q: Who is eligible for the tax credit?

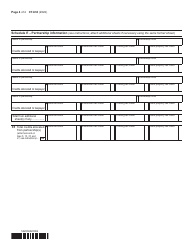

A: Businesses that meet certain requirements and invest in qualifying projects in designated areas may be eligible for the tax credit.

Q: What are the requirements for eligibility?

A: The specific requirements for eligibility may vary, but generally businesses must meet criteria such as investing a certain amount of money in a designated area, creating jobs, and meeting certain timelines for the project.

Q: How much is the tax credit?

A: The amount of the tax credit may vary depending on the specific project and other factors, but it can be up to a certain percentage of the qualifying expenses.

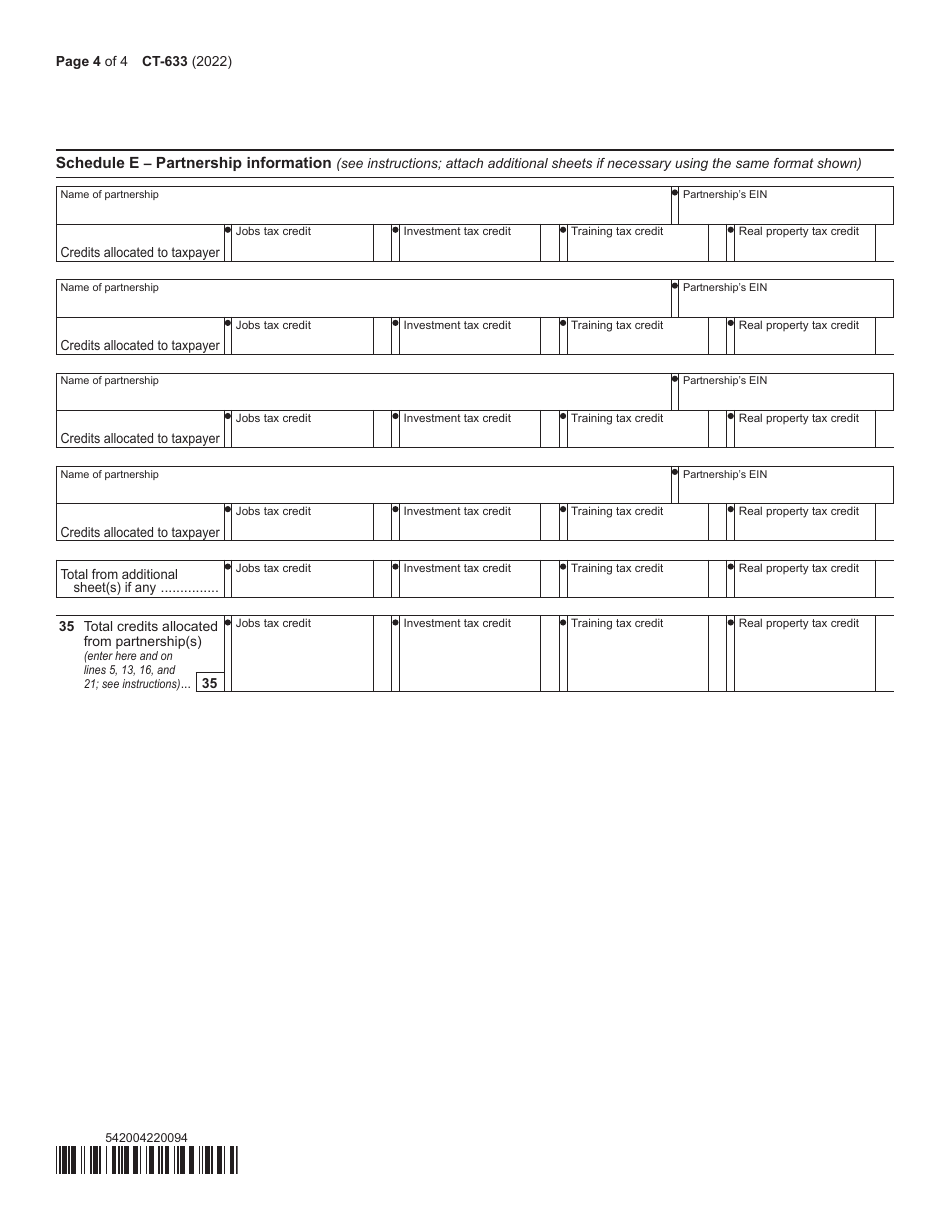

Q: How do I claim the tax credit?

A: To claim the tax credit, businesses must complete and submit Form CT-633 along with any required documentation to the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-633 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.