This version of the form is not currently in use and is provided for reference only. Download this version of

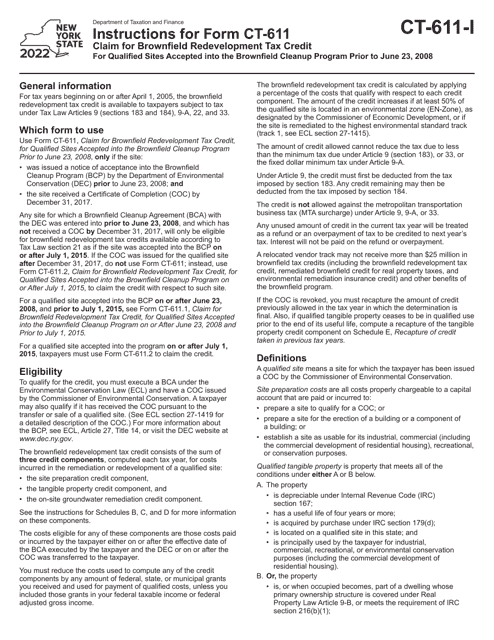

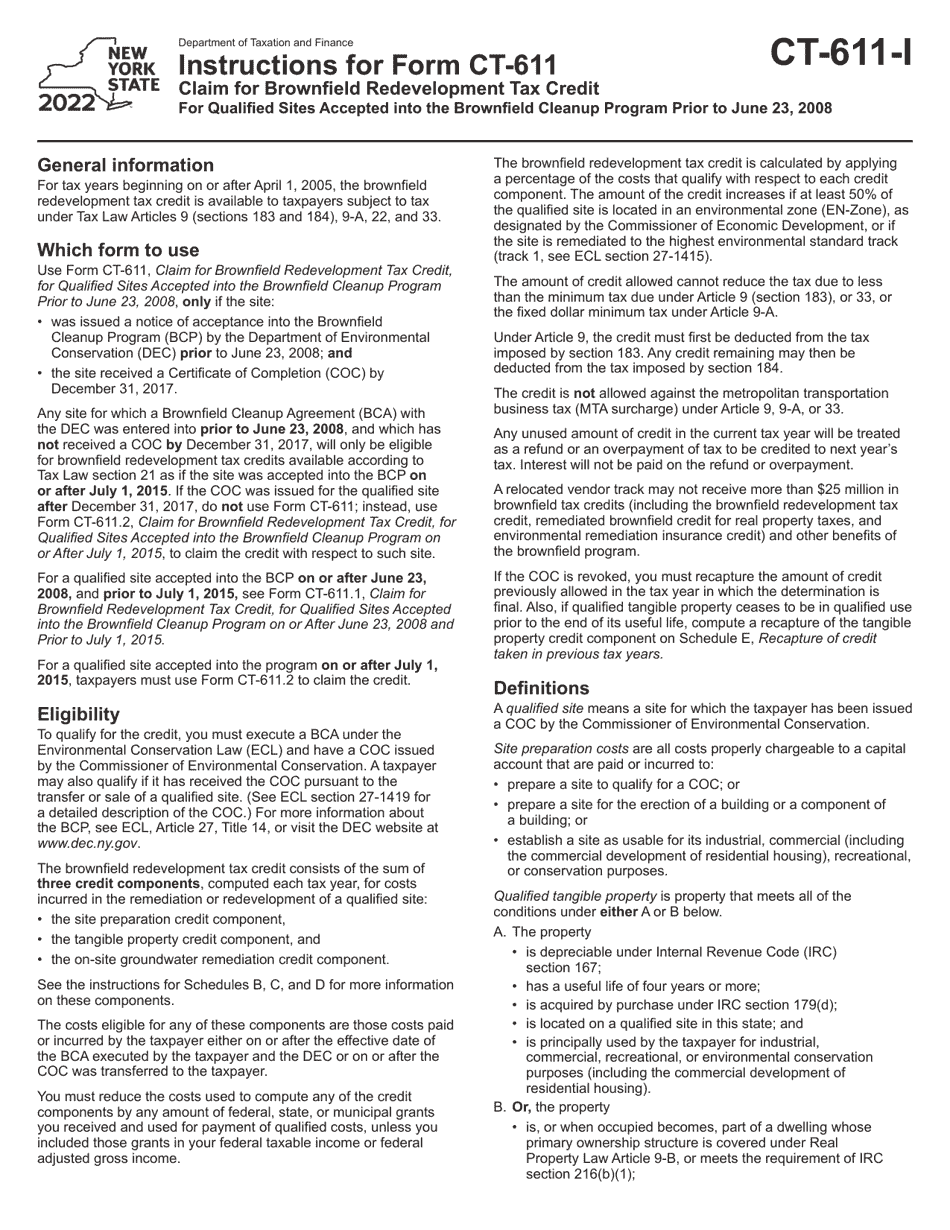

Instructions for Form CT-611

for the current year.

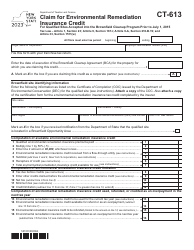

Instructions for Form CT-611 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

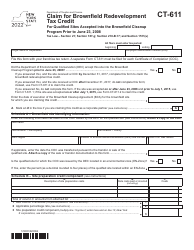

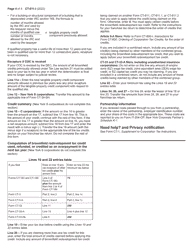

This document contains official instructions for Form CT-611 , Claim for Brownfield Cleanup Program Prior to June 23, 2008 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-611 is available for download through this link.

FAQ

Q: What is Form CT-611?

A: Form CT-611 is a claim for the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program prior to June 23, 2008 in New York.

Q: Who is eligible to file Form CT-611?

A: Property owners who had their sites accepted into the Brownfield Cleanup Program prior to June 23, 2008 in New York are eligible to file Form CT-611.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that encourages the cleanup and redevelopment of brownfields, which are unused or underutilized properties with real or perceived contamination.

Q: What is the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is a tax credit available to property owners who clean up and redevelop brownfield sites in New York.

Q: What is the deadline for filing Form CT-611?

A: The deadline for filing Form CT-611 is determined by the New York State Department of Environmental Conservation. Please refer to the instructions or contact the department for the specific deadline.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.