This version of the form is not currently in use and is provided for reference only. Download this version of

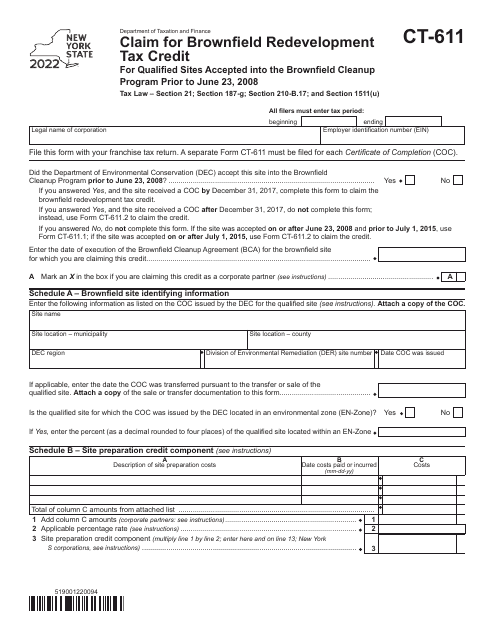

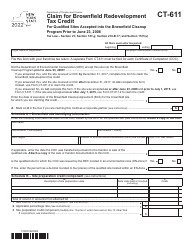

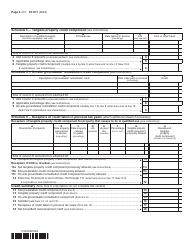

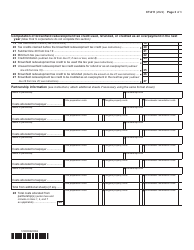

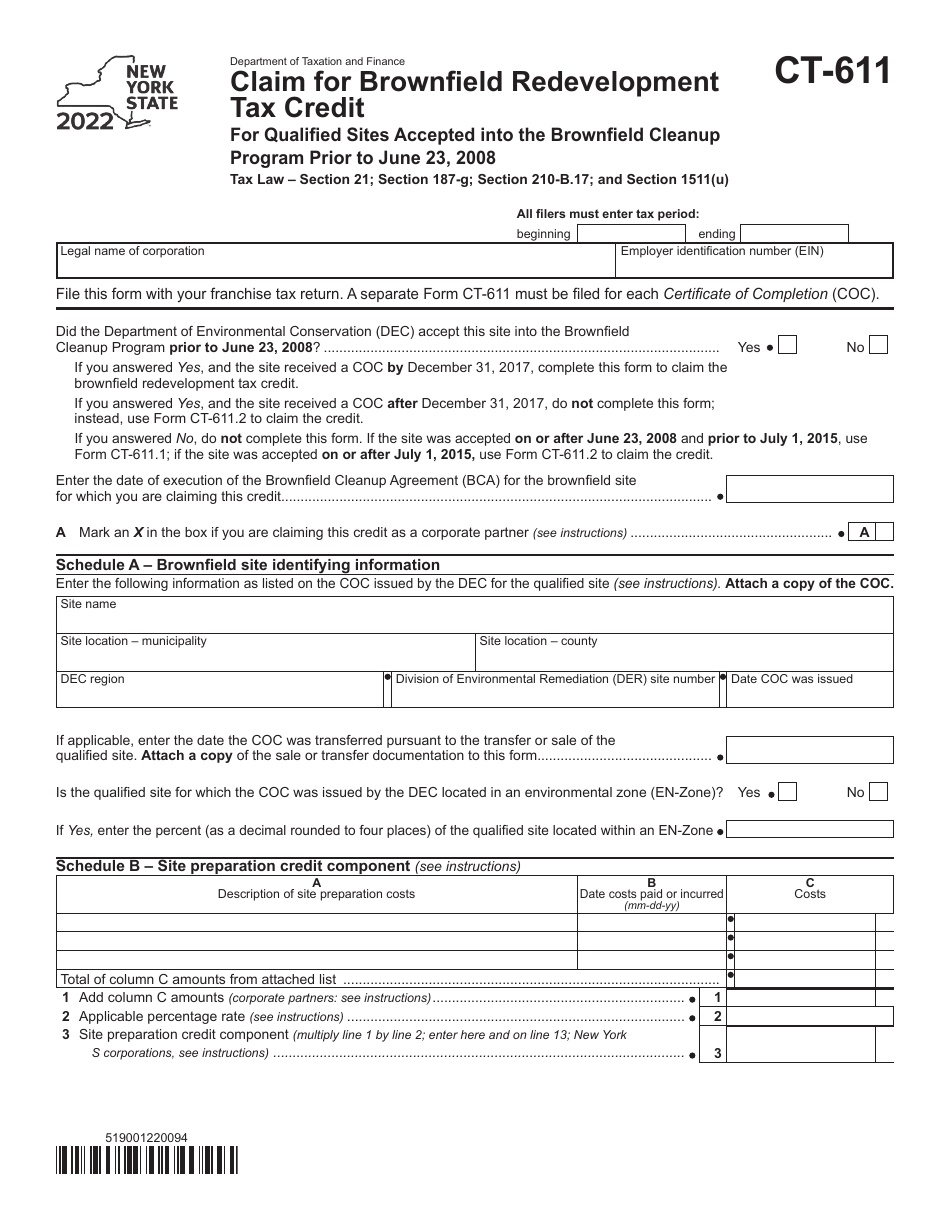

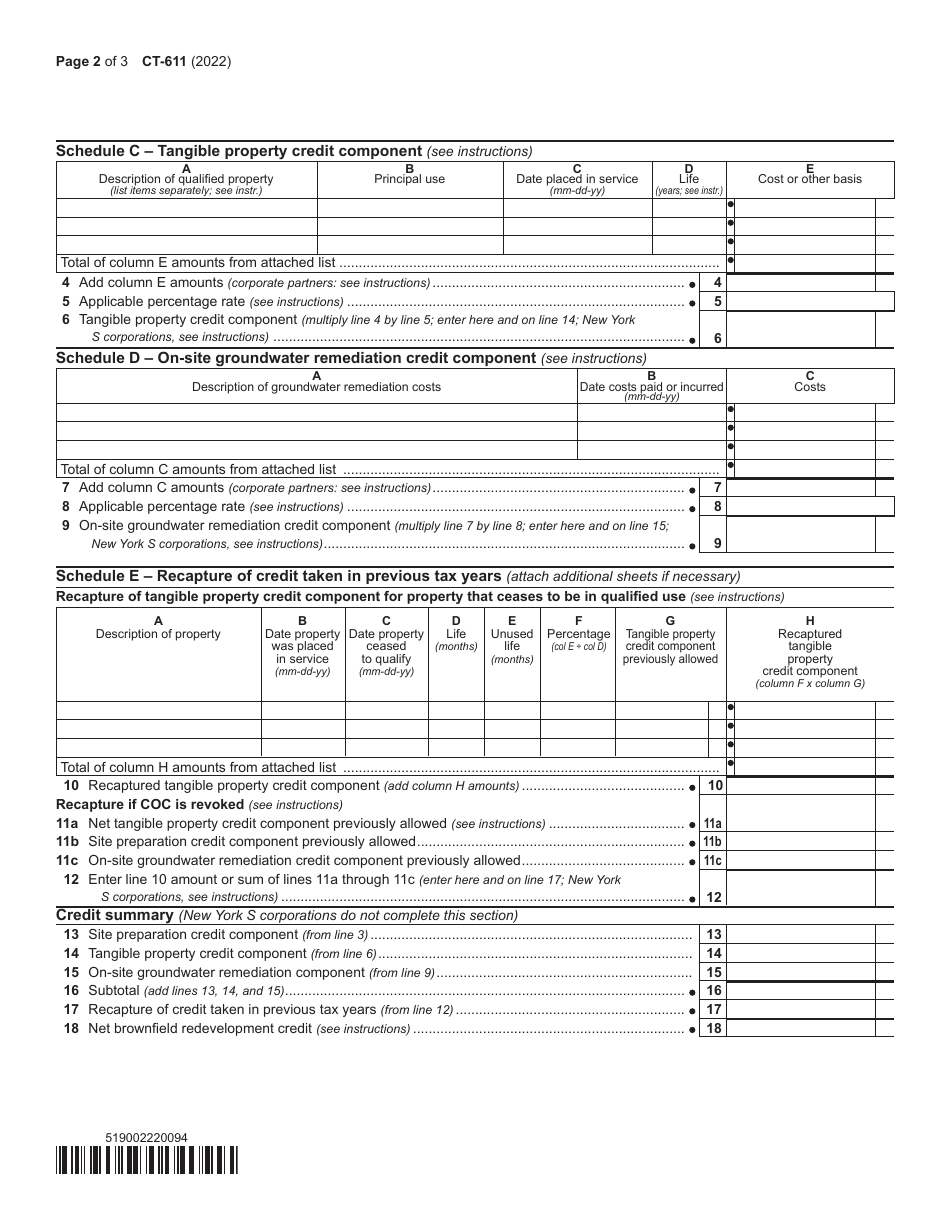

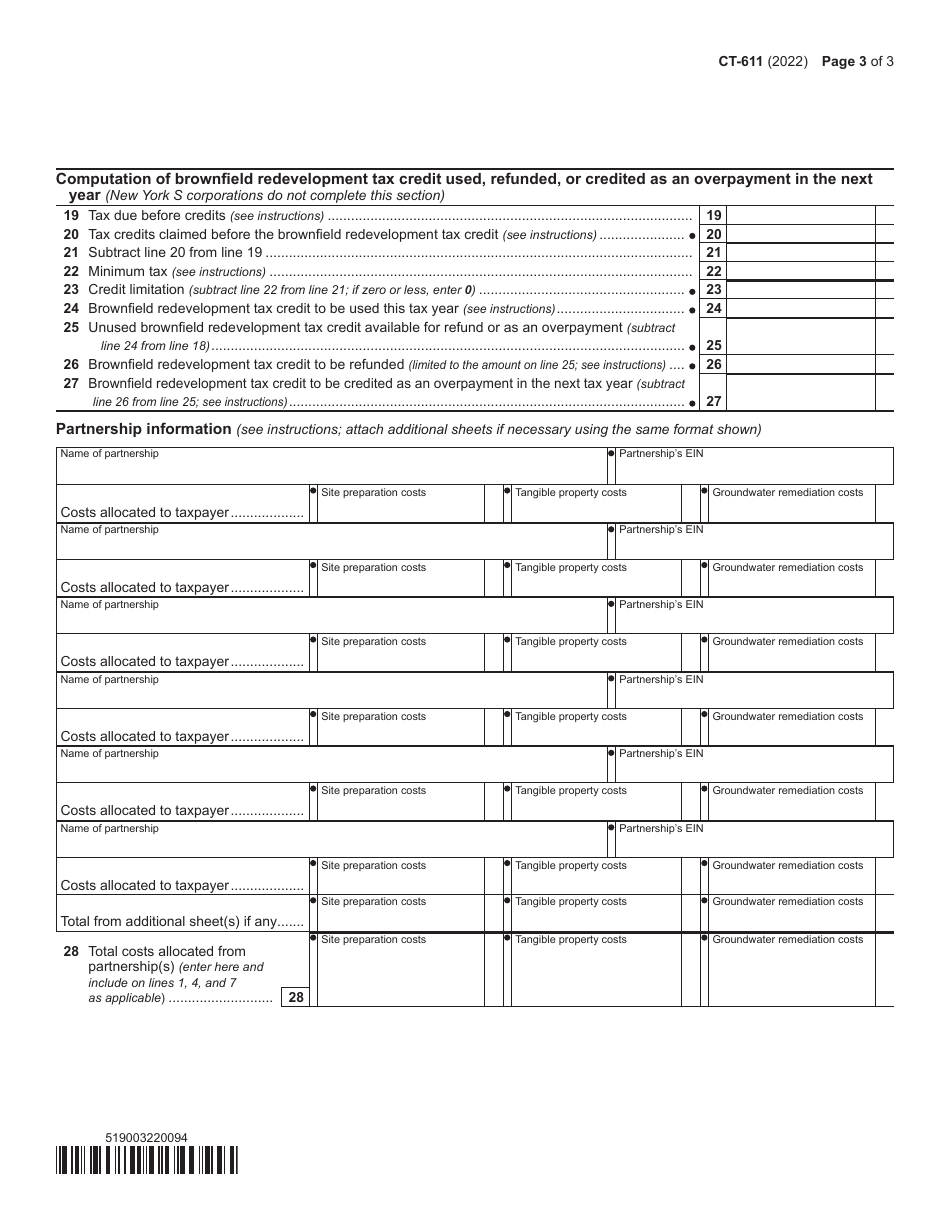

Form CT-611

for the current year.

Form CT-611 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to June 23, 2008 - New York

What Is Form CT-611?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-611?

A: Form CT-611 is a claim for Brownfield RedevelopmentTax Credit for qualified sites accepted into the Brownfield Cleanup Program in New York, prior to June 23, 2008.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a New York state initiative aimed at helping to clean up and redevelop contaminated properties, known as brownfields.

Q: Who is eligible to file Form CT-611?

A: Those who have qualified sites accepted into the Brownfield Cleanup Program in New York prior to June 23, 2008 can file Form CT-611 to claim the Brownfield Redevelopment Tax Credit.

Q: What is the purpose of the Brownfield Redevelopment Tax Credit?

A: The Brownfield Redevelopment Tax Credit is designed to encourage the cleanup and redevelopment of contaminated brownfield sites in New York by providing tax incentives to eligible individuals or entities.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-611 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.