This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-222

for the current year.

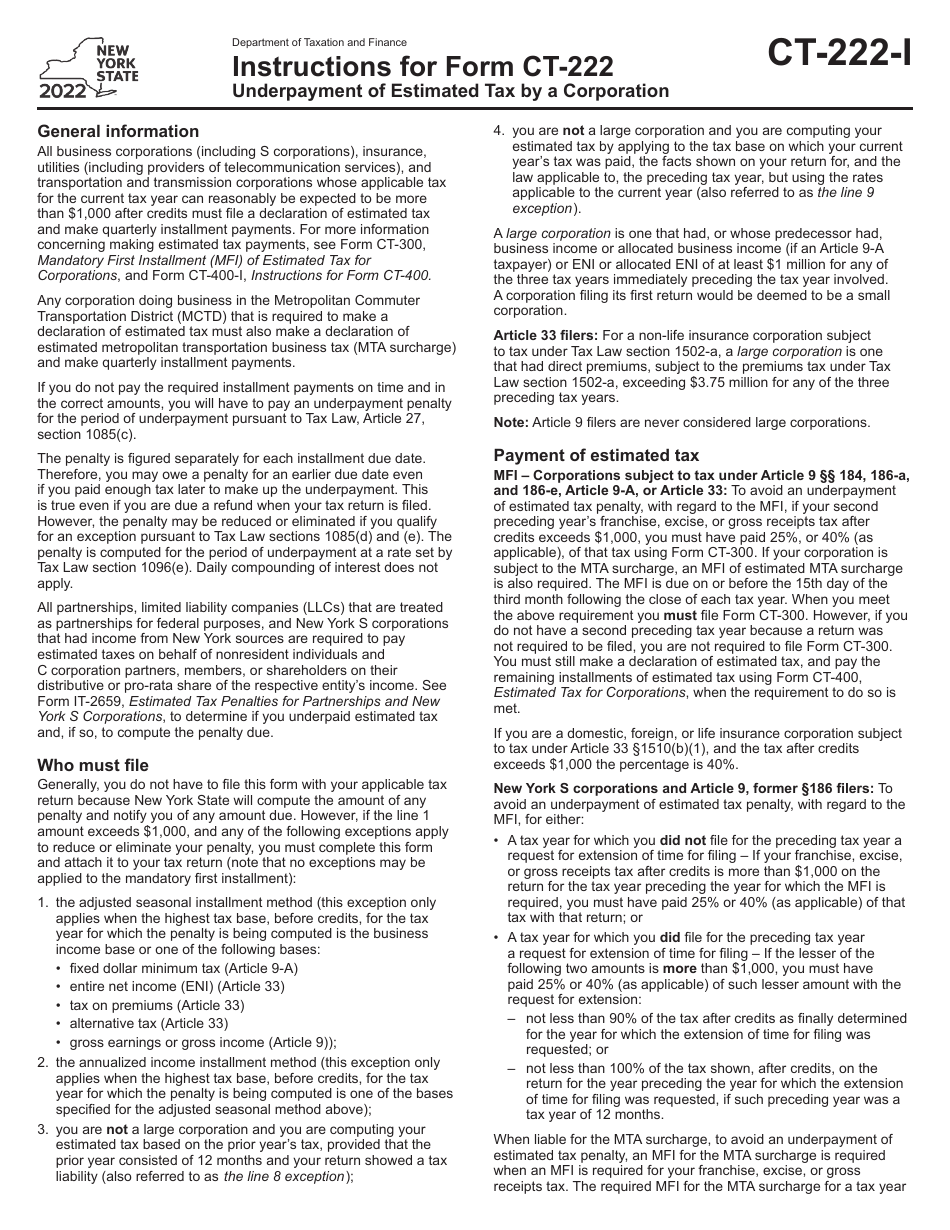

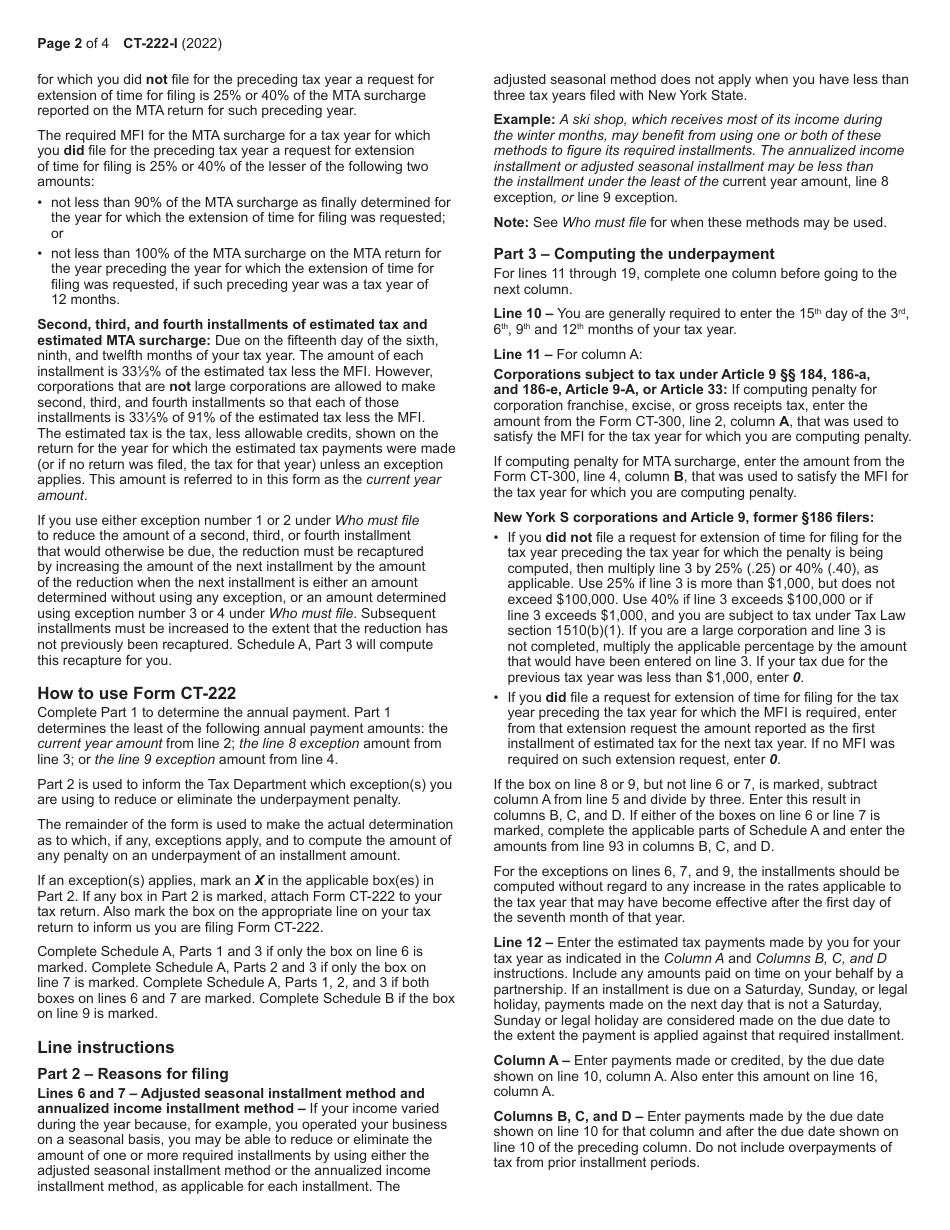

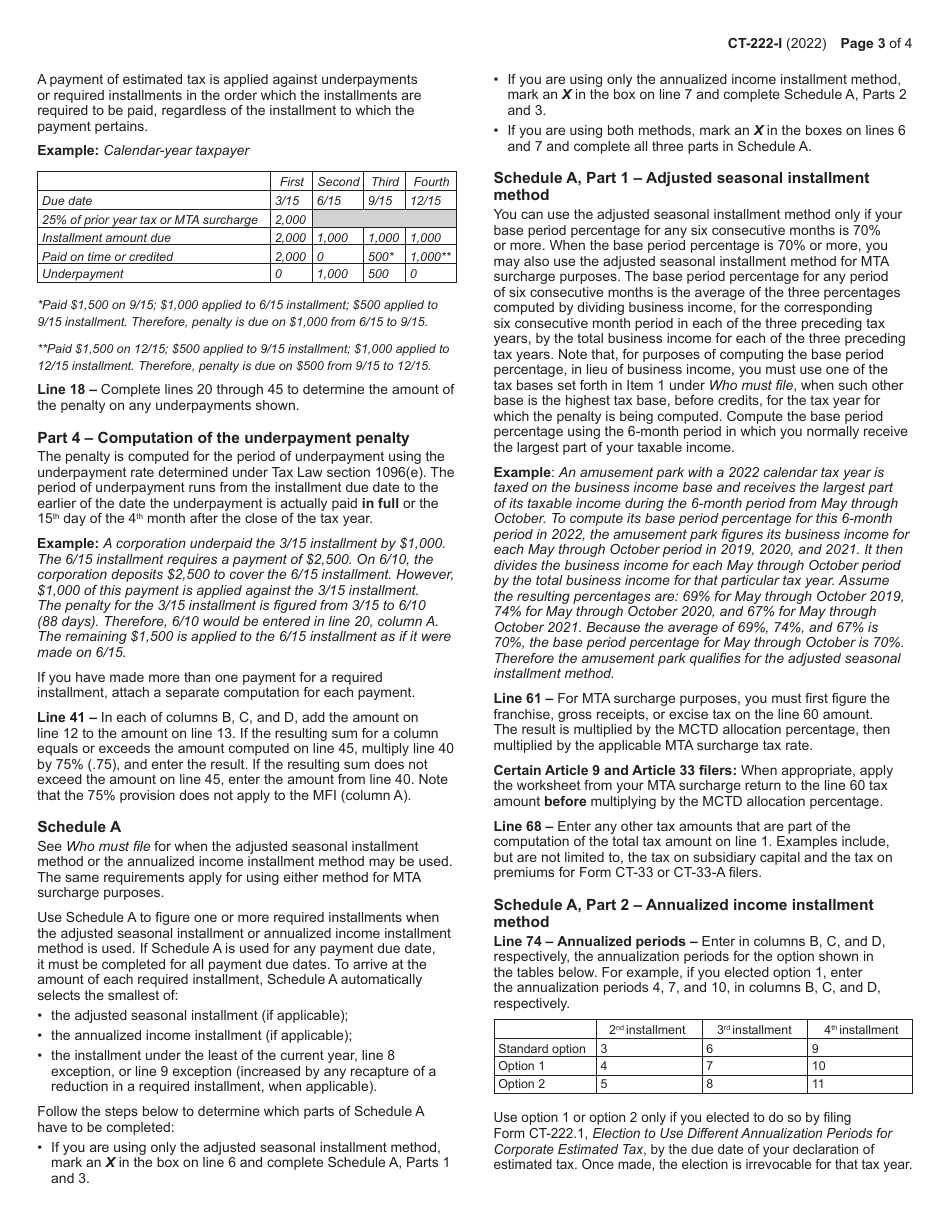

Instructions for Form CT-222 Underpayment of Estimated Tax by a Corporation - New York

This document contains official instructions for Form CT-222 , Underpayment of Estimated Tax by a Corporation - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-222 is available for download through this link.

FAQ

Q: What is Form CT-222?

A: Form CT-222 is a form used for reporting underpayment of estimated tax by a corporation in New York.

Q: Who needs to file Form CT-222?

A: Corporations in New York that did not pay enough estimated tax during the year need to file Form CT-222.

Q: What is the purpose of Form CT-222?

A: The purpose of Form CT-222 is to calculate and report any underpayment penalty incurred by a corporation for not paying enough estimated tax.

Q: When is Form CT-222 due?

A: Form CT-222 is due on the same date as the corporation's annual tax return, typically March 15th for calendar year filers.

Q: What information do I need to complete Form CT-222?

A: To complete Form CT-222, you will need to provide information such as the corporation's income, estimated tax paid, and any other relevant financial information.

Q: Is there a penalty for filing Form CT-222 late?

A: Yes, there is a penalty for filing Form CT-222 late. The penalty amount varies depending on the amount of underpayment.

Q: Can I file Form CT-222 electronically?

A: Yes, you can file Form CT-222 electronically using New York State's e-file system.

Q: Are there any exceptions to the underpayment penalty?

A: Yes, there are exceptions to the underpayment penalty. Certain circumstances, such as a corporation having a small tax liability or being subject to unforeseen events, may qualify for an exception.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.