This version of the form is not currently in use and is provided for reference only. Download this version of

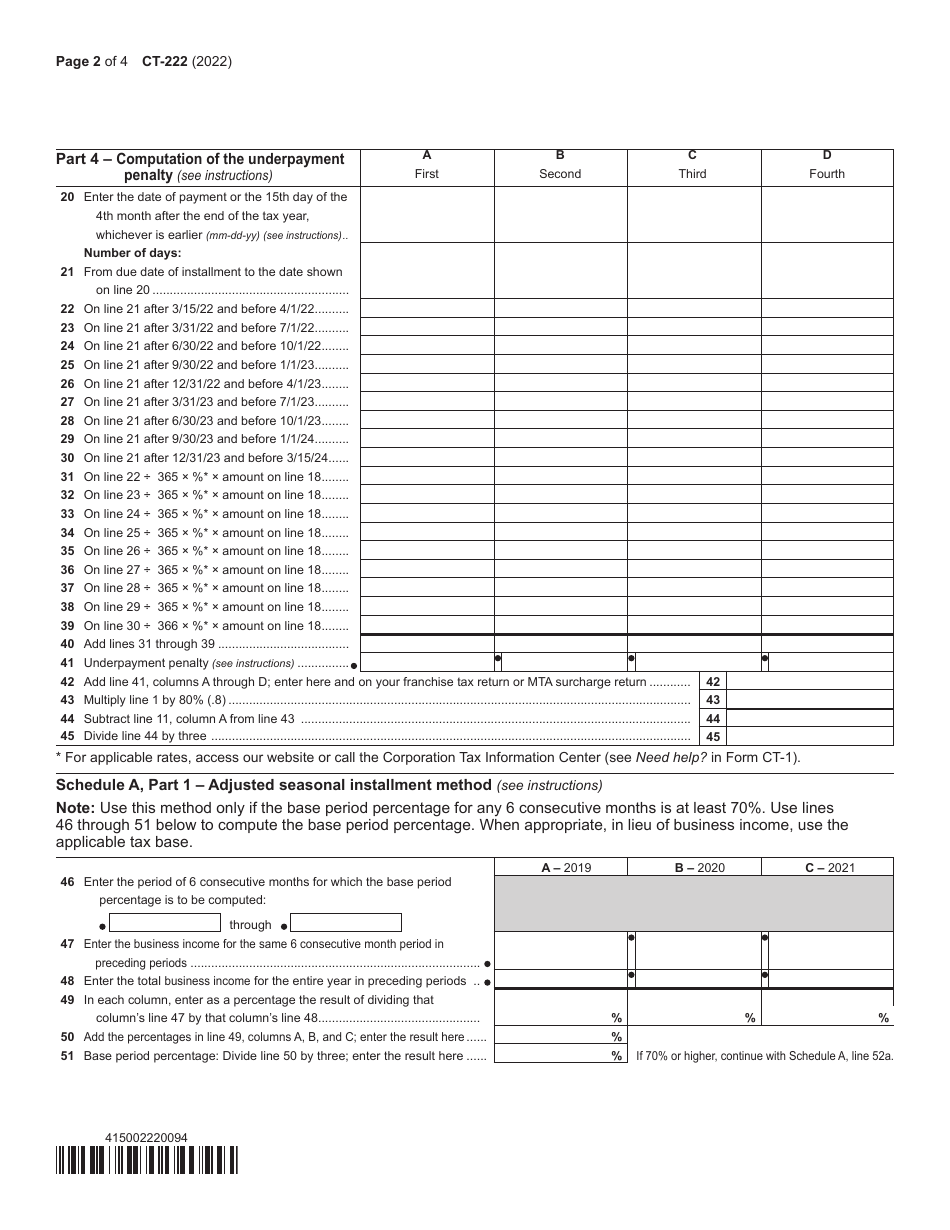

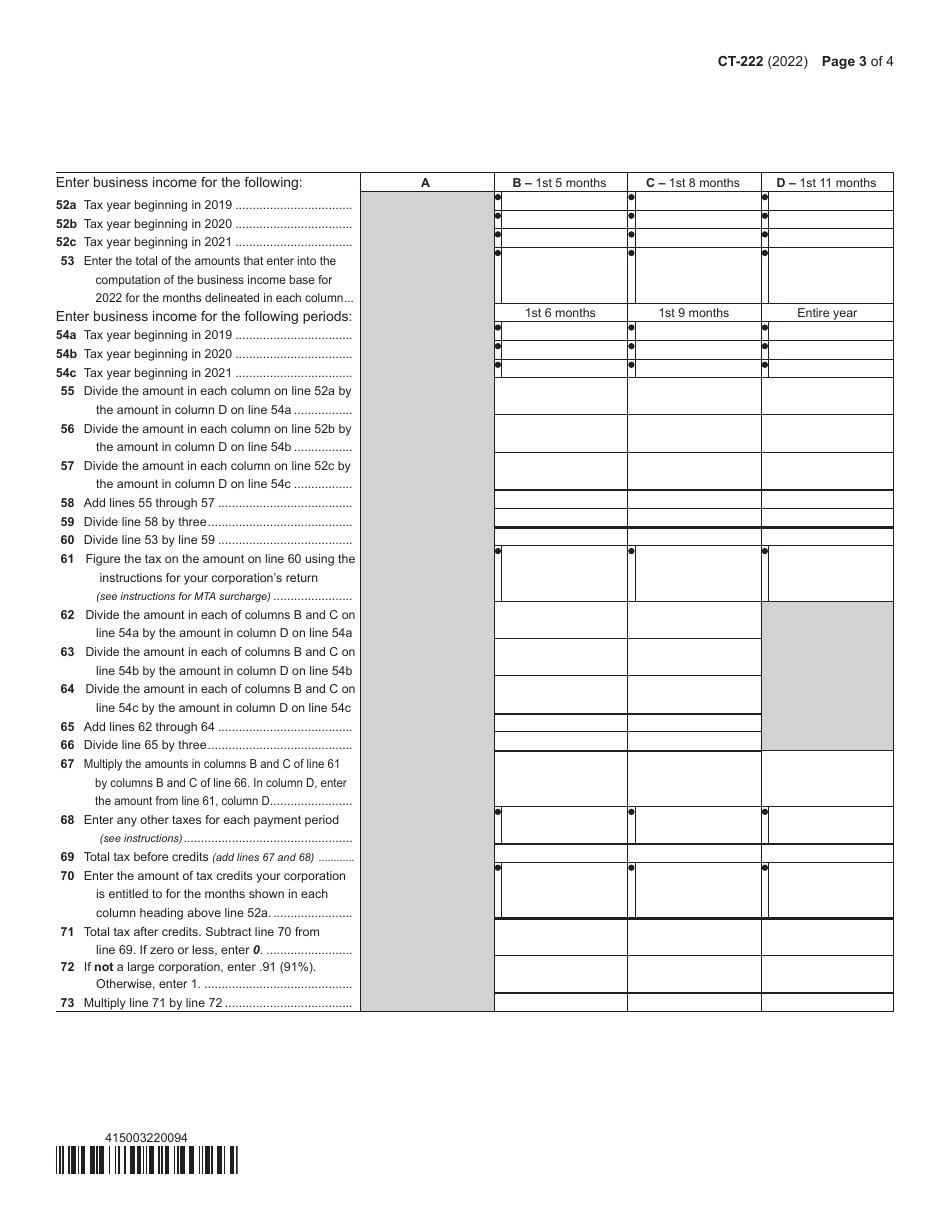

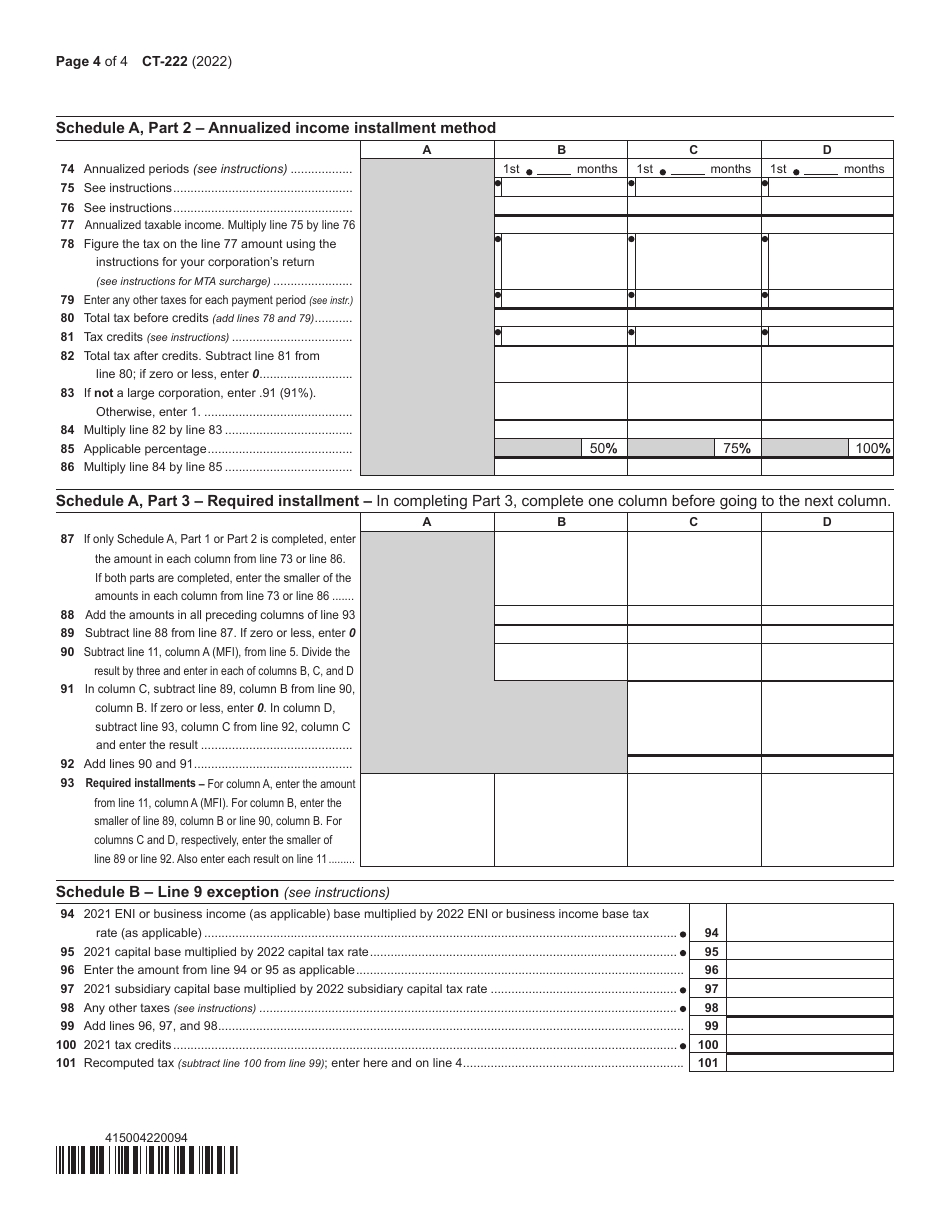

Form CT-222

for the current year.

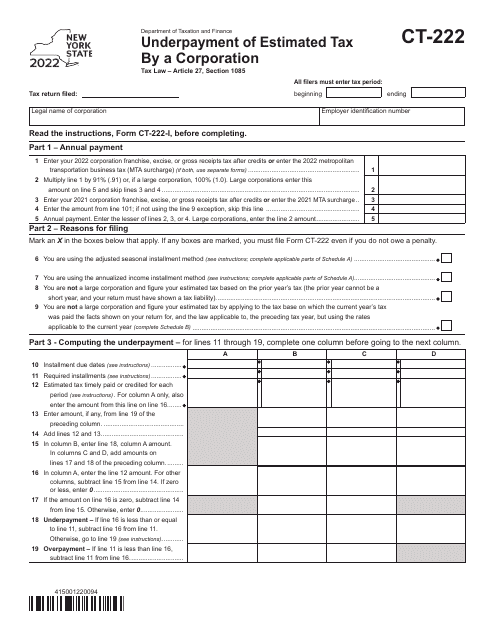

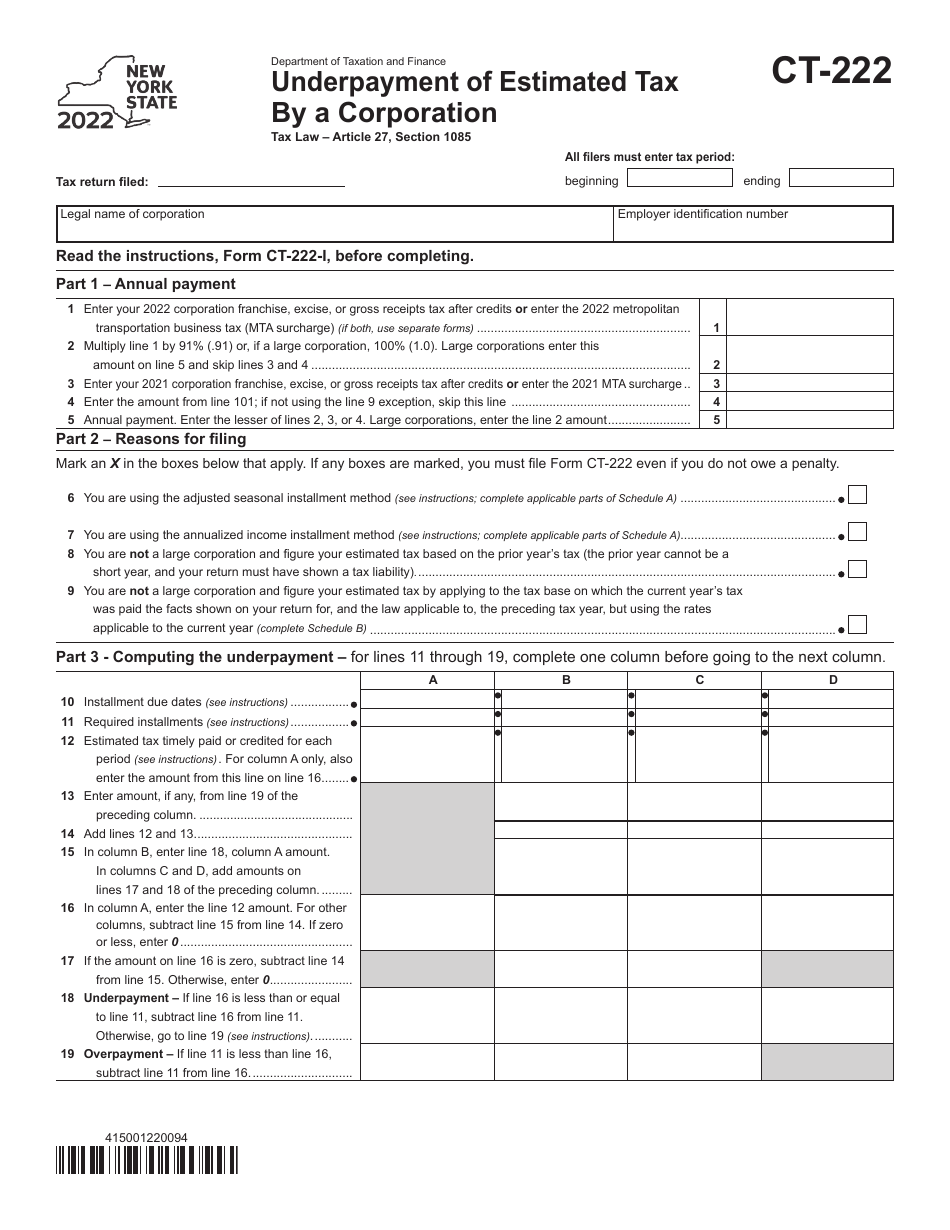

Form CT-222 Underpayment of Estimated Tax by a Corporation - New York

What Is Form CT-222?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-222?

A: Form CT-222 is a tax form used by corporations in New York to report and calculate any underpayment of estimated tax.

Q: Who needs to file Form CT-222?

A: Corporations in New York that have underpaid their estimated taxes are required to file Form CT-222.

Q: What is the purpose of Form CT-222?

A: The purpose of Form CT-222 is to calculate and report any underpayment of estimated tax by a corporation in New York.

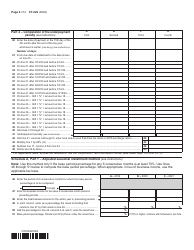

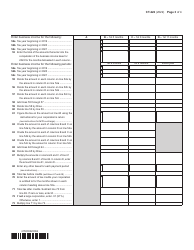

Q: How do I fill out Form CT-222?

A: You need to provide information about your corporation's estimated tax payments and calculate any underpayment on Form CT-222.

Q: When is Form CT-222 due?

A: Form CT-222 is due on or before the 15th day of the third month following the close of the corporation's taxable year.

Q: Are there any penalties for not filing Form CT-222?

A: Yes, there are penalties for not filing Form CT-222 or for underpaying estimated taxes. It is important to file the form and pay any underpayments to avoid penalties.

Q: Can I file Form CT-222 electronically?

A: As of now, Form CT-222 cannot be filed electronically. It must be filed by mail along with any necessary payments.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-222 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.