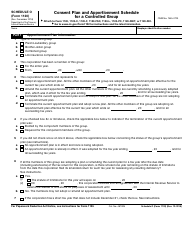

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8992

for the current year.

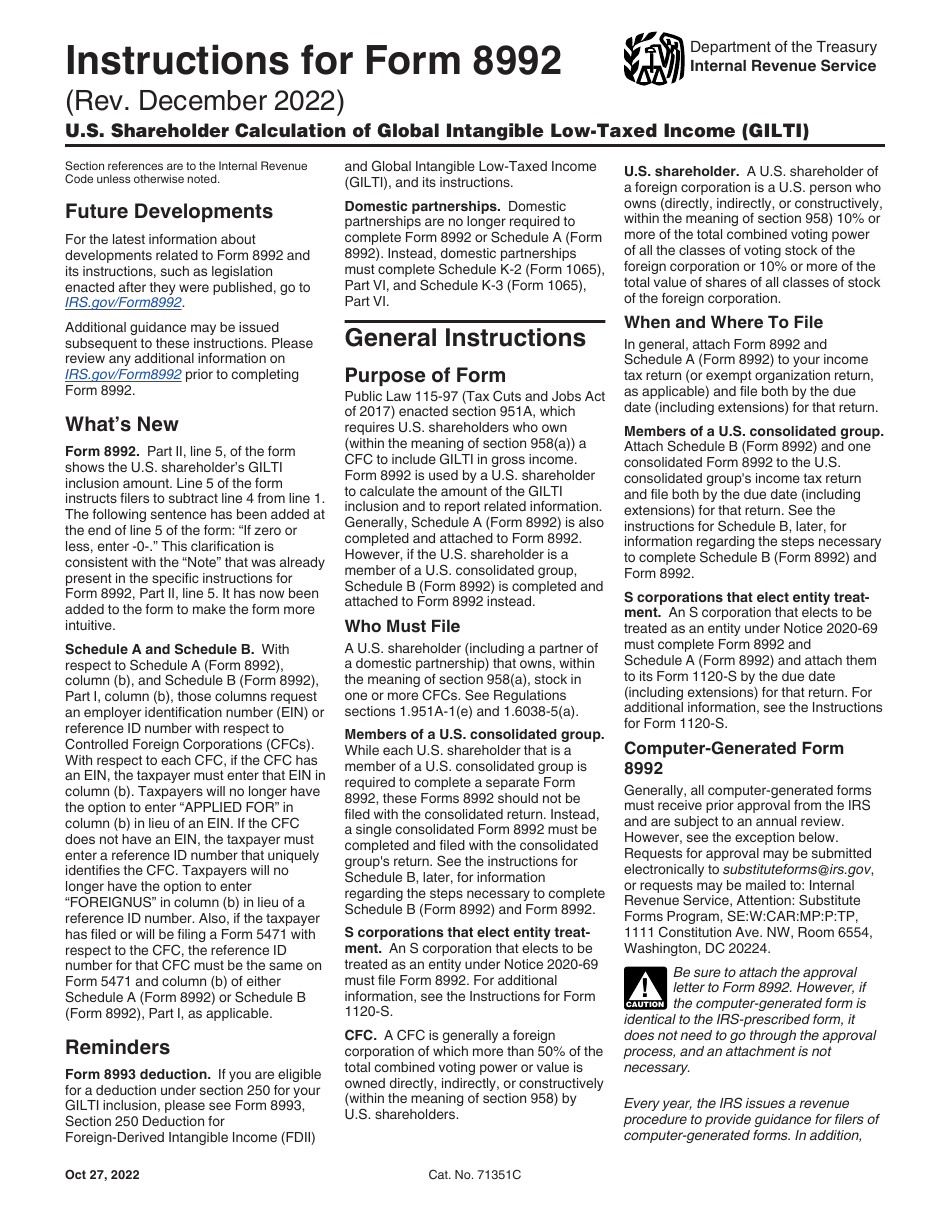

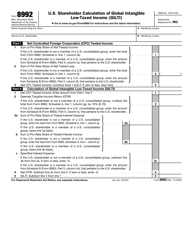

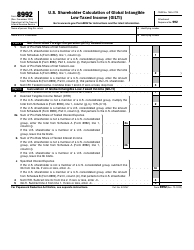

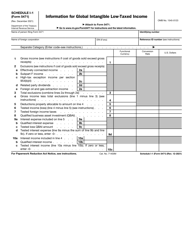

Instructions for IRS Form 8992 U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti)

This document contains official instructions for IRS Form 8992 , U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8992 is available for download through this link.

FAQ

Q: What is IRS Form 8992?

A: IRS Form 8992 is used for the U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (GILTI).

Q: Who needs to file IRS Form 8992?

A: U.S. shareholders who own a specified foreign corporation and have GILTI must file IRS Form 8992.

Q: What is GILTI?

A: GILTI stands for Global Intangible Low-Taxed Income. It refers to the income earned by a U.S. shareholder from a specified foreign corporation.

Q: What is a U.S. shareholder?

A: A U.S. shareholder is a U.S. person who owns at least 10% of the voting power or value of a specified foreign corporation.

Q: What is a specified foreign corporation?

A: A specified foreign corporation is a foreign corporation in which a U.S. shareholder owns at least 10% of the voting power or value.

Q: What is the purpose of IRS Form 8992?

A: The purpose of IRS Form 8992 is to calculate the U.S. shareholder's GILTI and determine the resulting tax liability.

Q: Is filing IRS Form 8992 mandatory?

A: Yes, if you are a U.S. shareholder with GILTI, filing IRS Form 8992 is mandatory.

Q: How should I file IRS Form 8992?

A: IRS Form 8992 should be filed electronically through the IRS e-file system or by mail.

Q: Are there any penalties for not filing IRS Form 8992?

A: Yes, failure to file IRS Form 8992 or filing it incorrectly may result in penalties and interest charges.

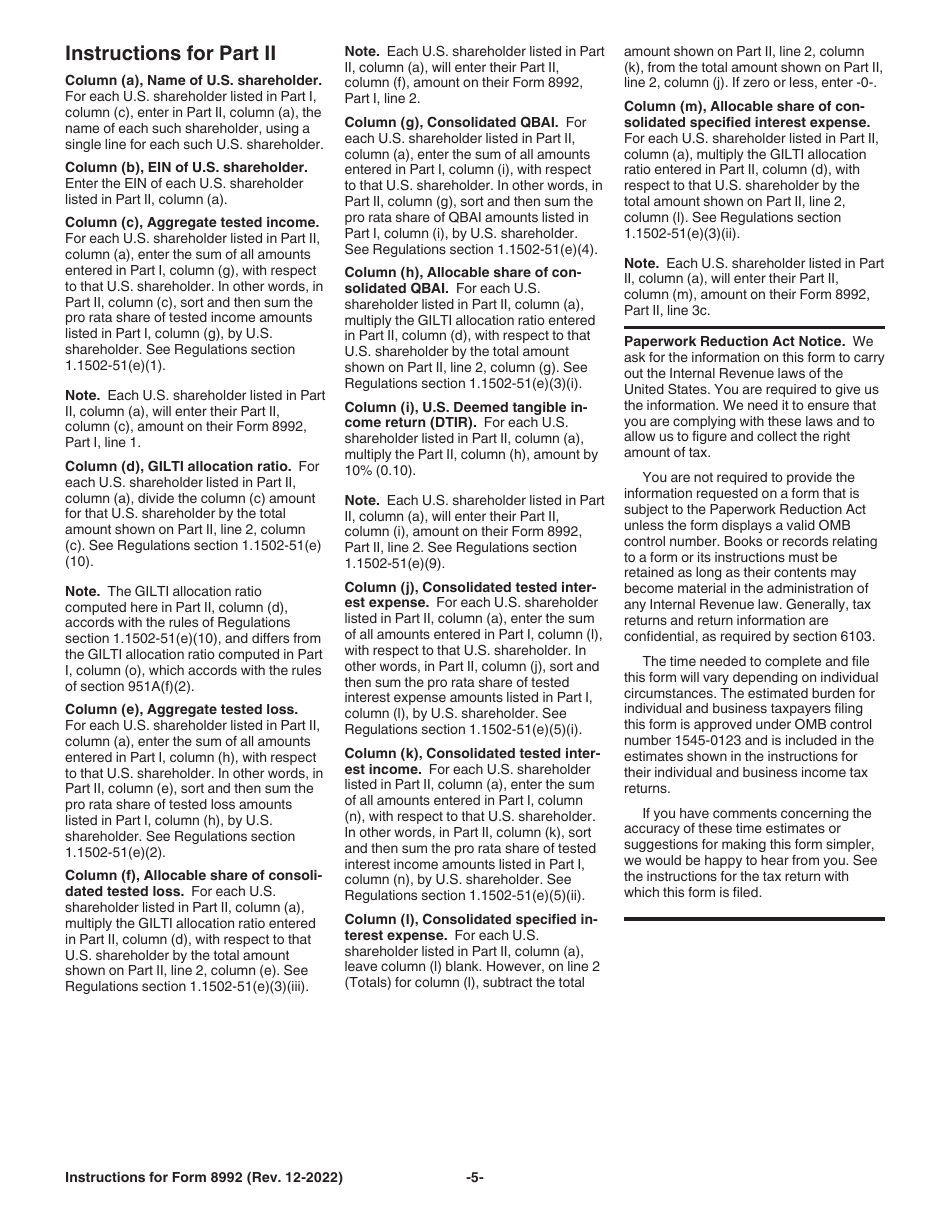

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.