This version of the form is not currently in use and is provided for reference only. Download this version of

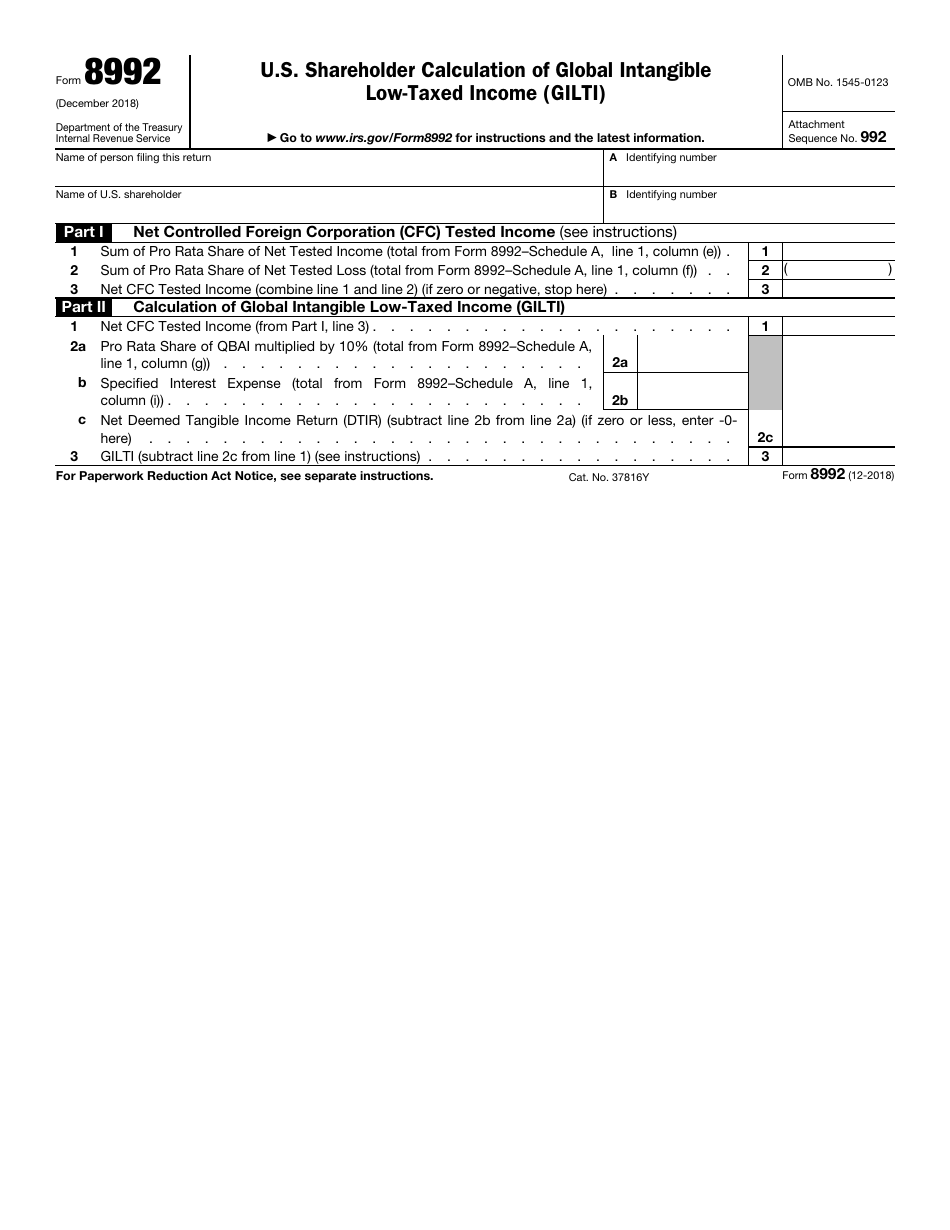

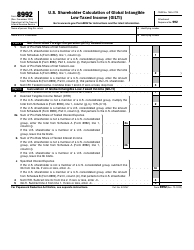

IRS Form 8992

for the current year.

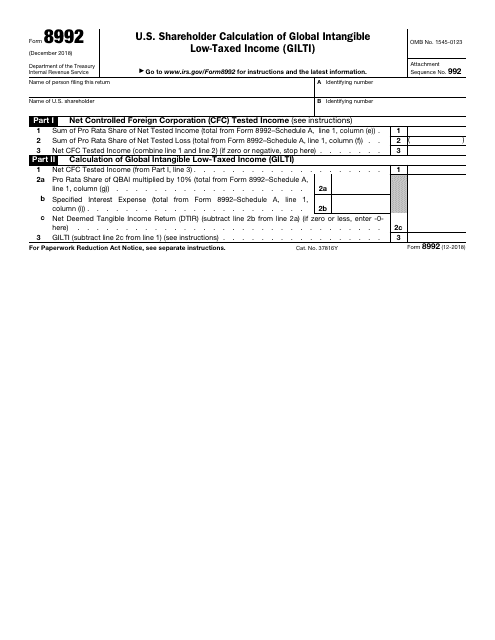

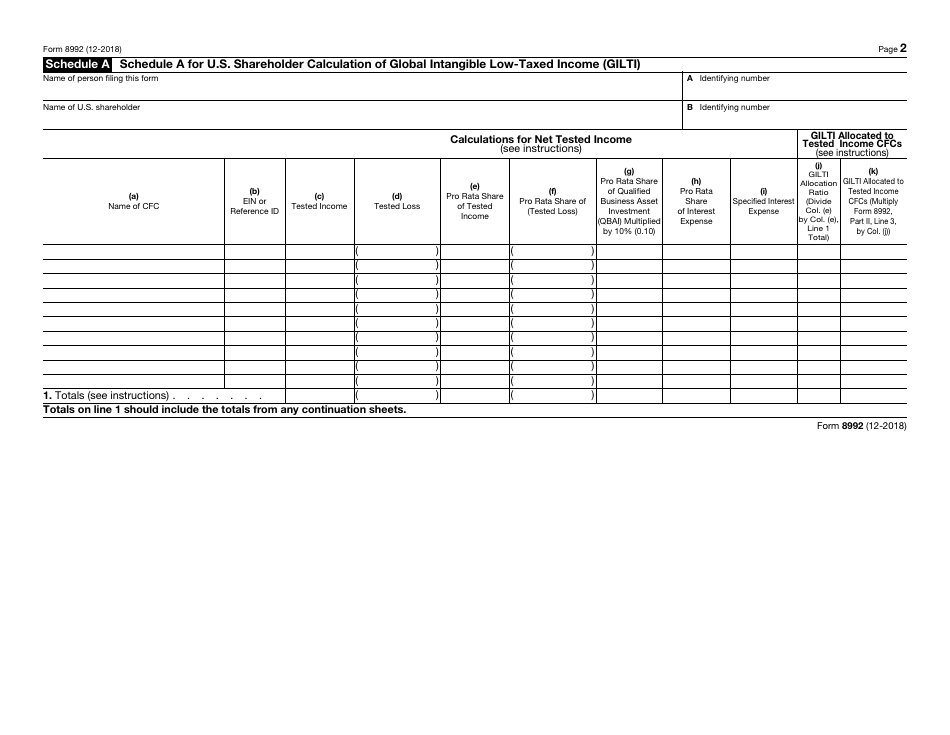

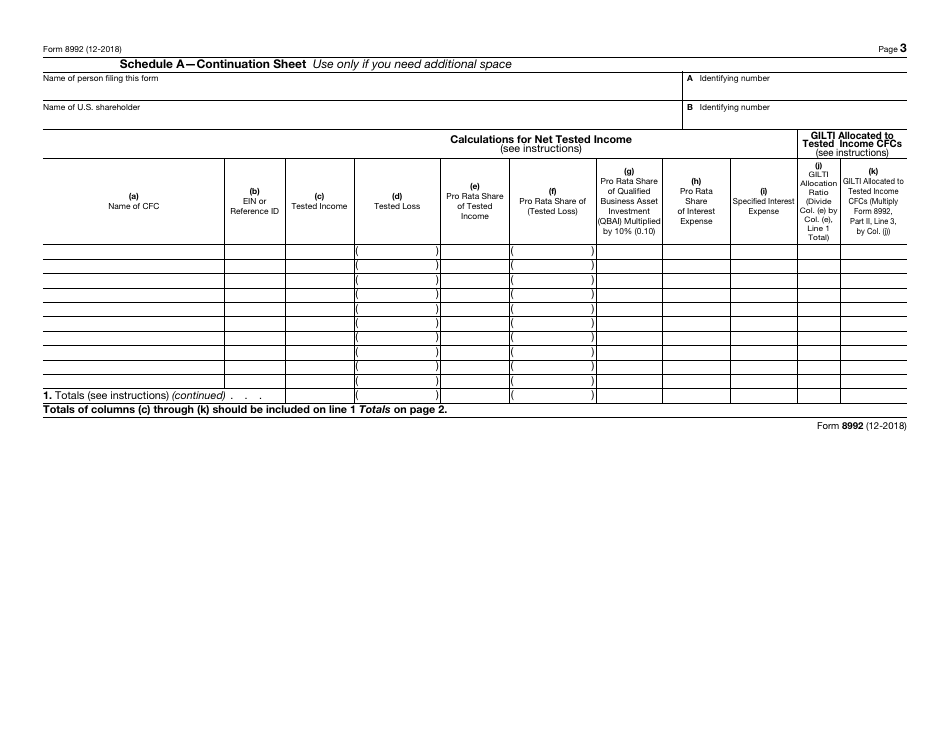

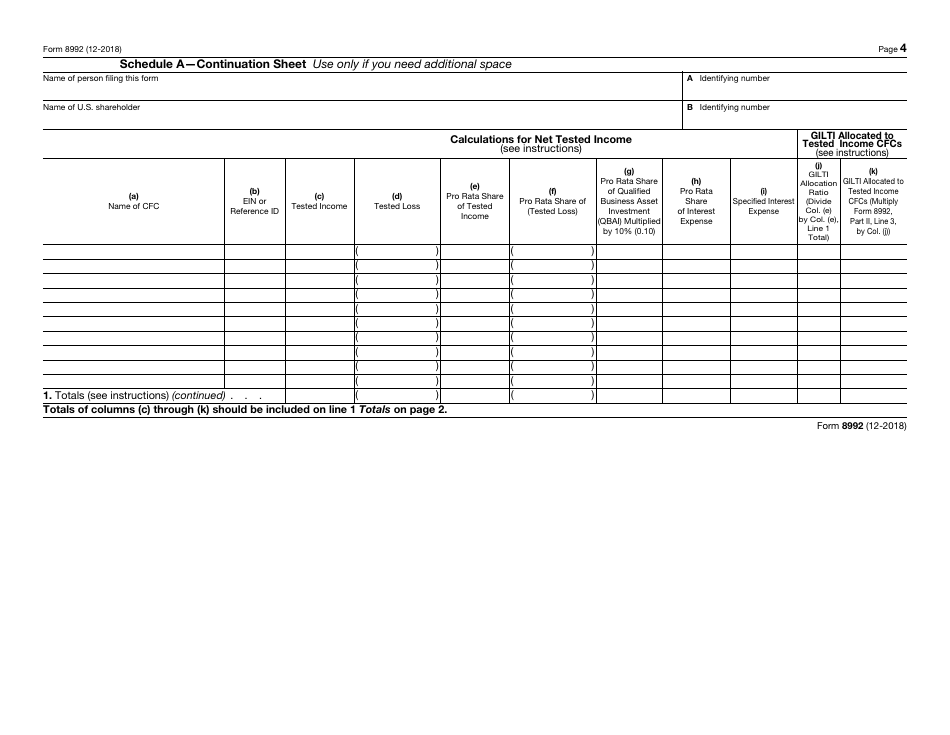

IRS Form 8992 U.S. Shareholder Calculation of Global Intangible Low-Taxed Income (Gilti)

What Is IRS Form 8992?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2018. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8992?

A: IRS Form 8992 is a form used by U.S. shareholders to calculate Global Intangible Low-Taxed Income (GILTI).

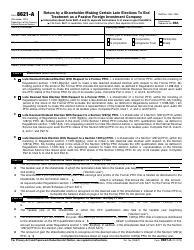

Q: Who needs to fill out IRS Form 8992?

A: U.S. shareholders who have Global Intangible Low-Taxed Income (GILTI) need to fill out IRS Form 8992.

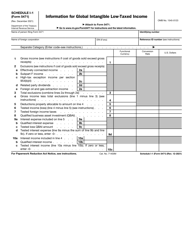

Q: What is Global Intangible Low-Taxed Income (GILTI)?

A: Global Intangible Low-Taxed Income (GILTI) is the income earned from intangible assets by a U.S. shareholder in a controlled foreign corporation (CFC).

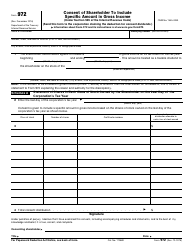

Q: How does IRS Form 8992 help calculate GILTI?

A: IRS Form 8992 provides a method for U.S. shareholders to determine their GILTI by applying specific calculations and adjustments.

Q: What information is needed to fill out IRS Form 8992?

A: To fill out IRS Form 8992, U.S. shareholders need to gather information about their ownership in controlled foreign corporations (CFCs) and the income earned from intangible assets.

Q: Are there any penalties for not filing IRS Form 8992?

A: Failure to file IRS Form 8992 or inaccurately reporting GILTI can result in penalties and potential audits by the IRS.

Form Details:

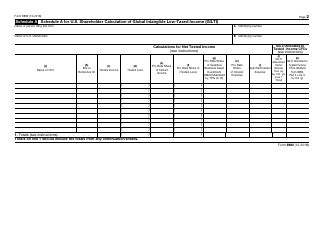

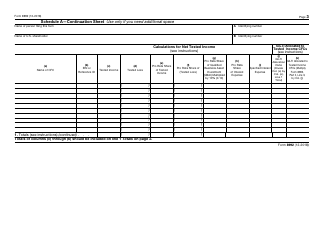

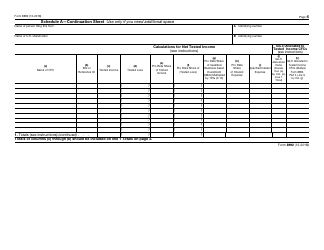

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8992 through the link below or browse more documents in our library of IRS Forms.