This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8889

for the current year.

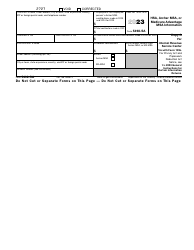

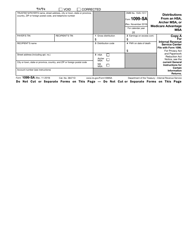

Instructions for IRS Form 8889 Health Savings Accounts (Hsas)

This document contains official instructions for IRS Form 8889 , Health Savings Accounts (Hsas) - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8889 is available for download through this link.

FAQ

Q: What is IRS Form 8889?

A: IRS Form 8889 is a form used to report contributions and distributions from Health Savings Accounts (HSAs).

Q: What is a Health Savings Account (HSA)?

A: A Health Savings Account (HSA) is a tax-advantaged account that can be used to pay for qualified medical expenses.

Q: Who is eligible for a Health Savings Account (HSA)?

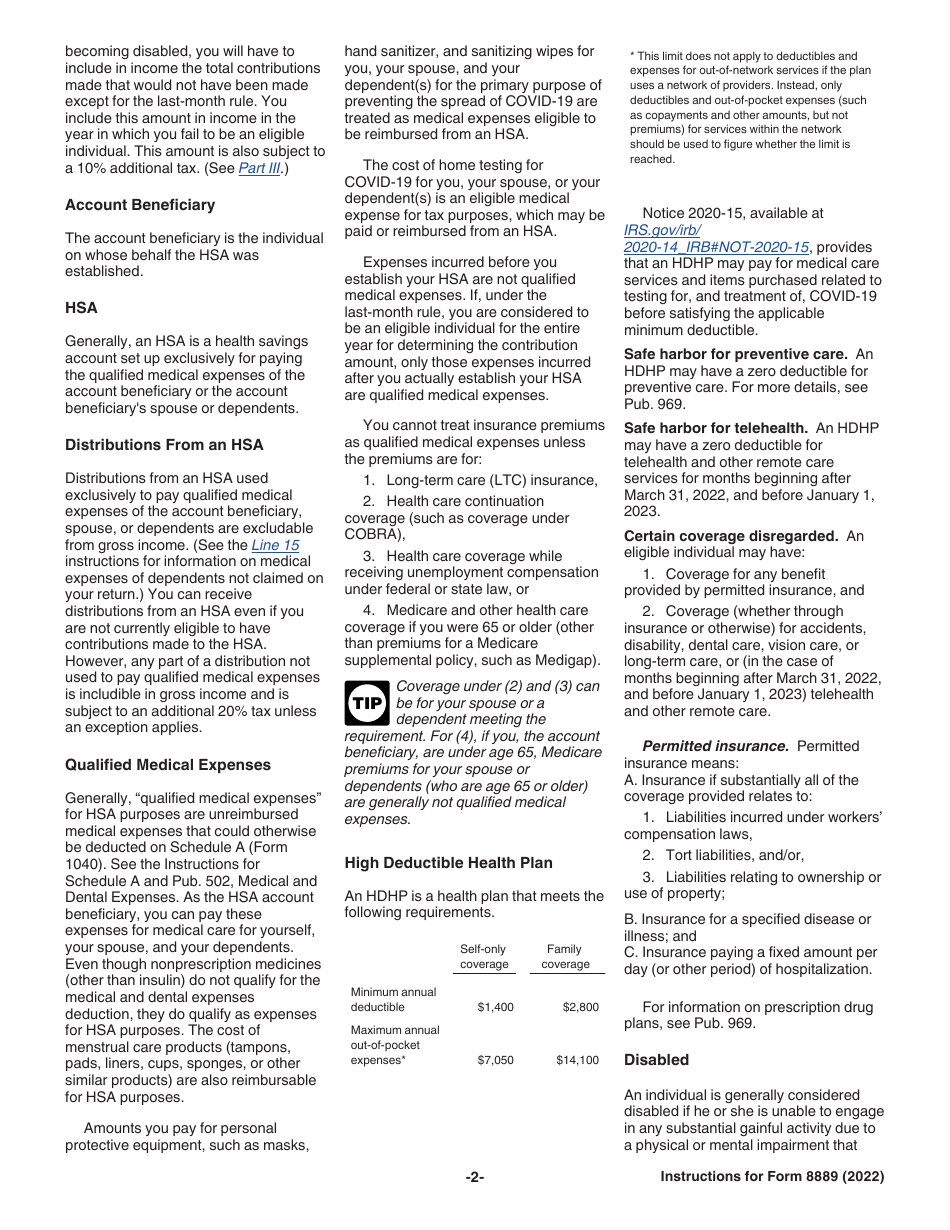

A: To be eligible for an HSA, you must be covered by a high deductible health plan (HDHP) and meet certain other requirements.

Q: What should I include on IRS Form 8889?

A: You should include information about your HSA contributions, distributions, and any other relevant information requested on the form.

Q: When is the deadline to file IRS Form 8889?

A: IRS Form 8889 is typically filed along with your annual tax return, which is due by April 15th.

Q: Are there any penalties for not filing IRS Form 8889?

A: Yes, there can be penalties for failing to file IRS Form 8889 or for inaccurately reporting HSA contributions or distributions.

Q: Can I claim a tax deduction for HSA contributions?

A: Yes, you may be able to claim a tax deduction for HSA contributions, subject to certain limits.

Q: What expenses can I use my HSA funds for?

A: You can use your HSA funds to pay for qualified medical expenses, including doctor visits, prescription medications, and certain medical supplies.

Q: Can I use my HSA funds for non-medical expenses?

A: Using HSA funds for non-medical expenses may result in tax penalties, except in certain circumstances such as after age 65.

Q: What should I do if I made a mistake on IRS Form 8889?

A: If you made an error on IRS Form 8889, you should file an amended return to correct the mistake.

Q: Is there a limit on how much I can contribute to my HSA?

A: Yes, the IRS sets annual contribution limits for HSAs. The limits may vary depending on whether you have individual or family coverage.

Q: Can I have multiple HSAs?

A: Yes, you can have multiple HSAs, but the total contributions to all HSAs must not exceed the annual contribution limit.

Q: Can I rollover funds from my Flexible Spending Account (FSA) to my HSA?

A: No, you generally cannot rollover funds from an FSA to an HSA. However, there are certain exceptions that allow limited rollovers.

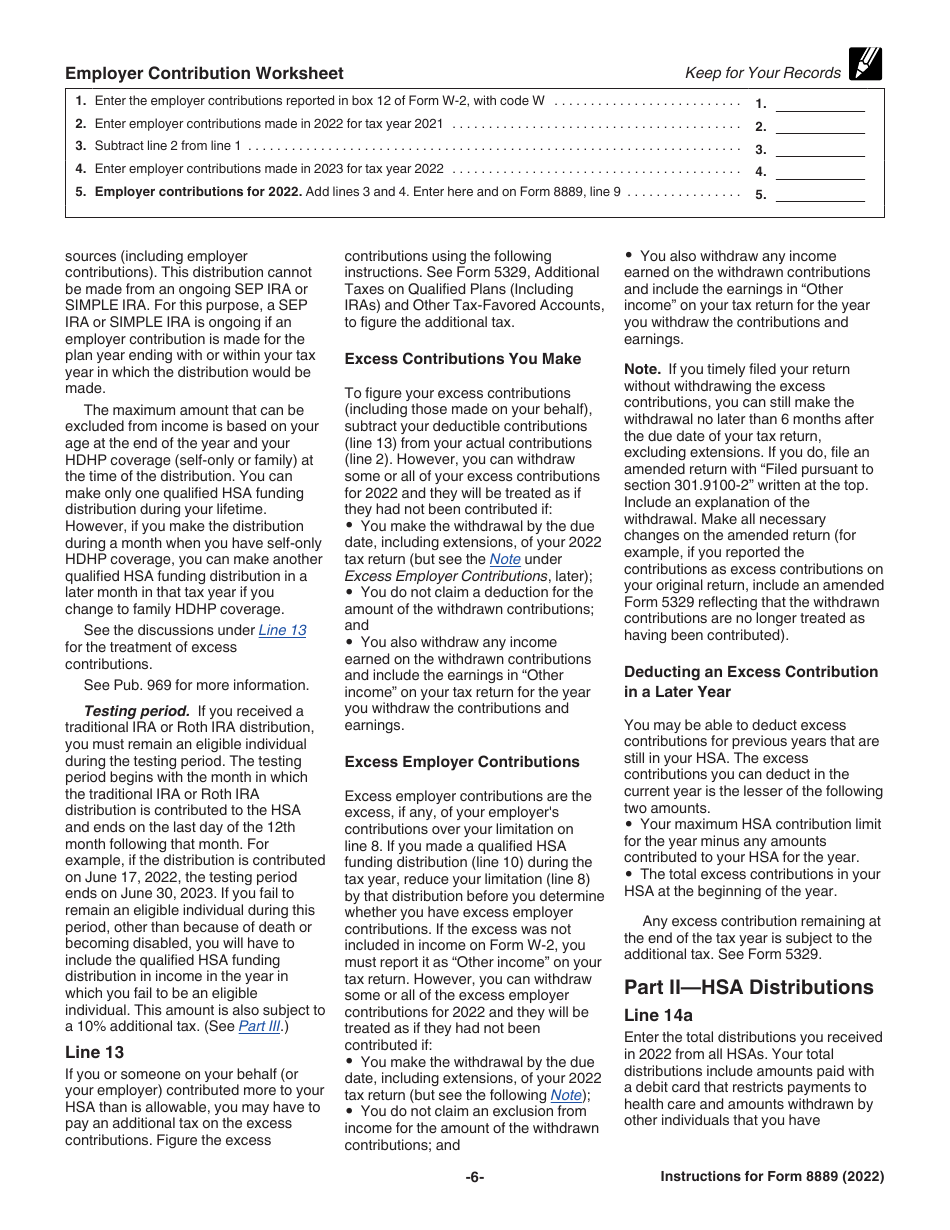

Q: Do I need to include HSA contributions made by my employer on IRS Form 8889?

A: Yes, you should include any HSA contributions made by your employer in the appropriate section of IRS Form 8889.

Q: Can I use my HSA funds to pay for health insurance premiums?

A: In general, you cannot use HSA funds to pay for health insurance premiums, unless certain criteria are met.

Q: What is the penalty for using HSA funds for non-qualified expenses?

A: If you use HSA funds for non-qualified expenses, you may be subject to income tax on the amount withdrawn, plus a 20% penalty.

Q: Can I transfer my HSA funds to another financial institution?

A: Yes, you can transfer your HSA funds to another financial institution, but you must follow the proper procedures to avoid tax penalties.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.