This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8839

for the current year.

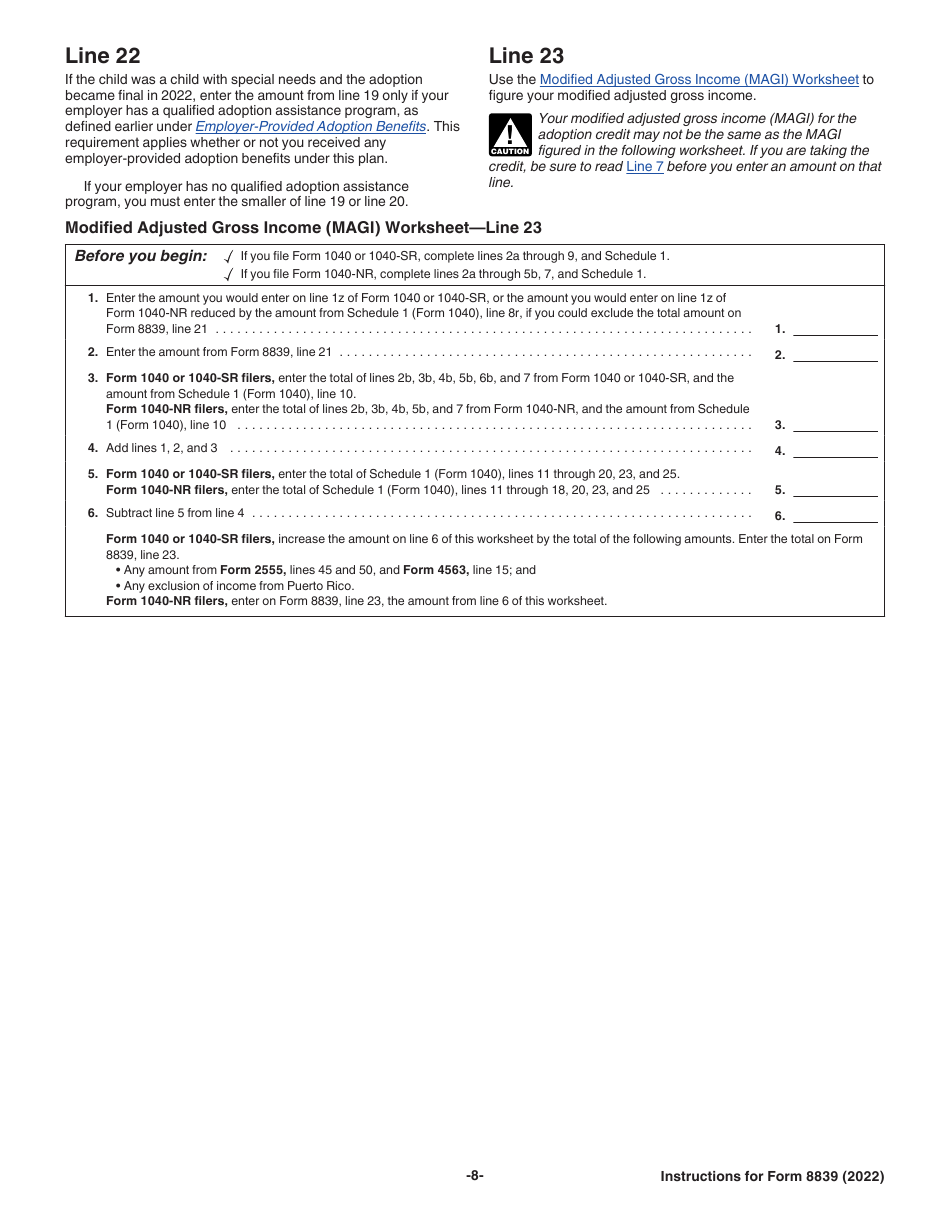

Instructions for IRS Form 8839 Qualified Adoption Expenses

This document contains official instructions for IRS Form 8839 , Qualified Adoption Expenses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8839 is available for download through this link.

FAQ

Q: What is IRS Form 8839?

A: IRS Form 8839 is a form used to claim qualified adoption expenses on your tax return.

Q: What are qualified adoption expenses?

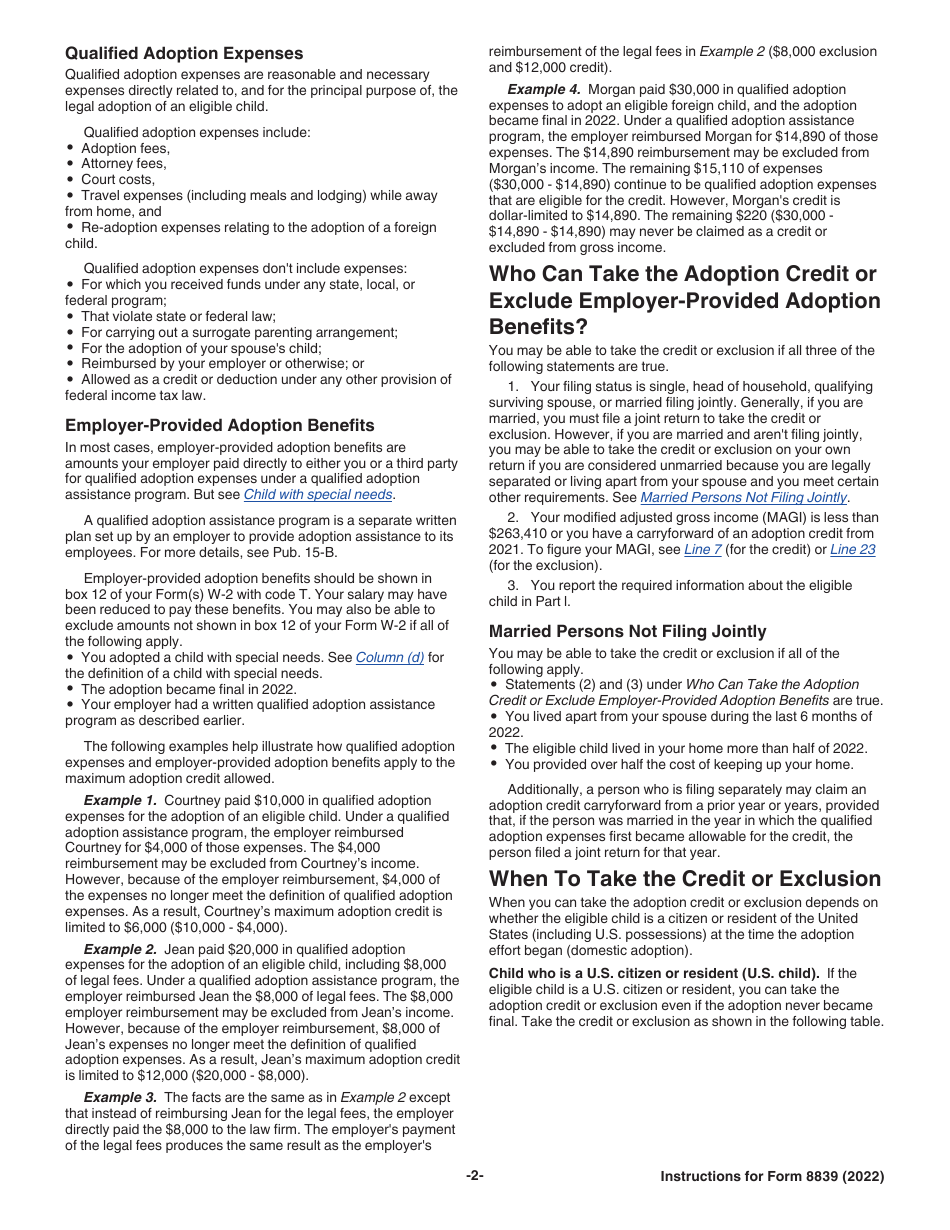

A: Qualified adoption expenses are reasonable and necessary expenses directly related to the adoption of an eligible child.

Q: Who can claim qualified adoption expenses?

A: The adoptive parents who paid the qualified adoption expenses can claim them.

Q: What information is required for Form 8839?

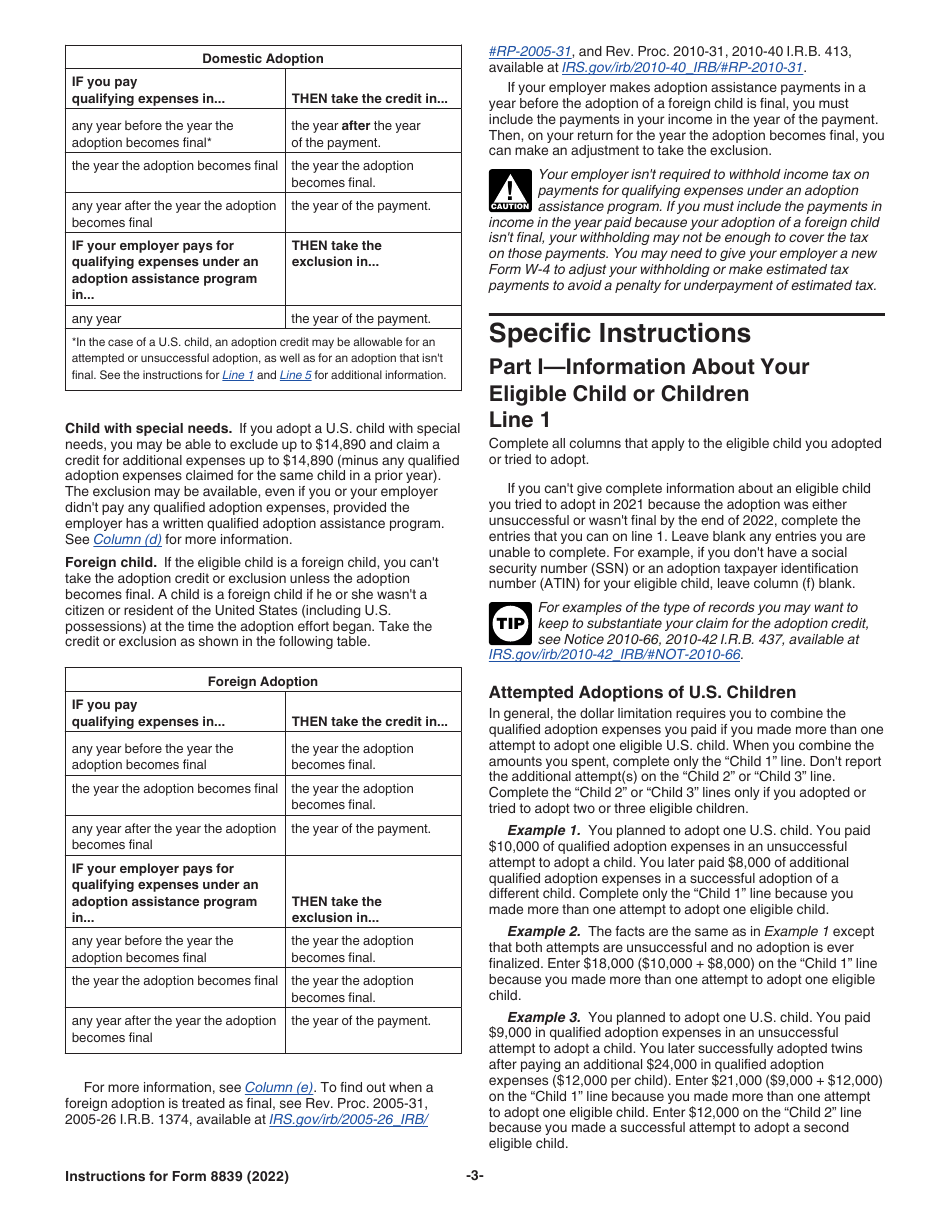

A: You will need to provide information about your adoption expenses, including the child's identifying information, any adoption agency involved, and the amount spent.

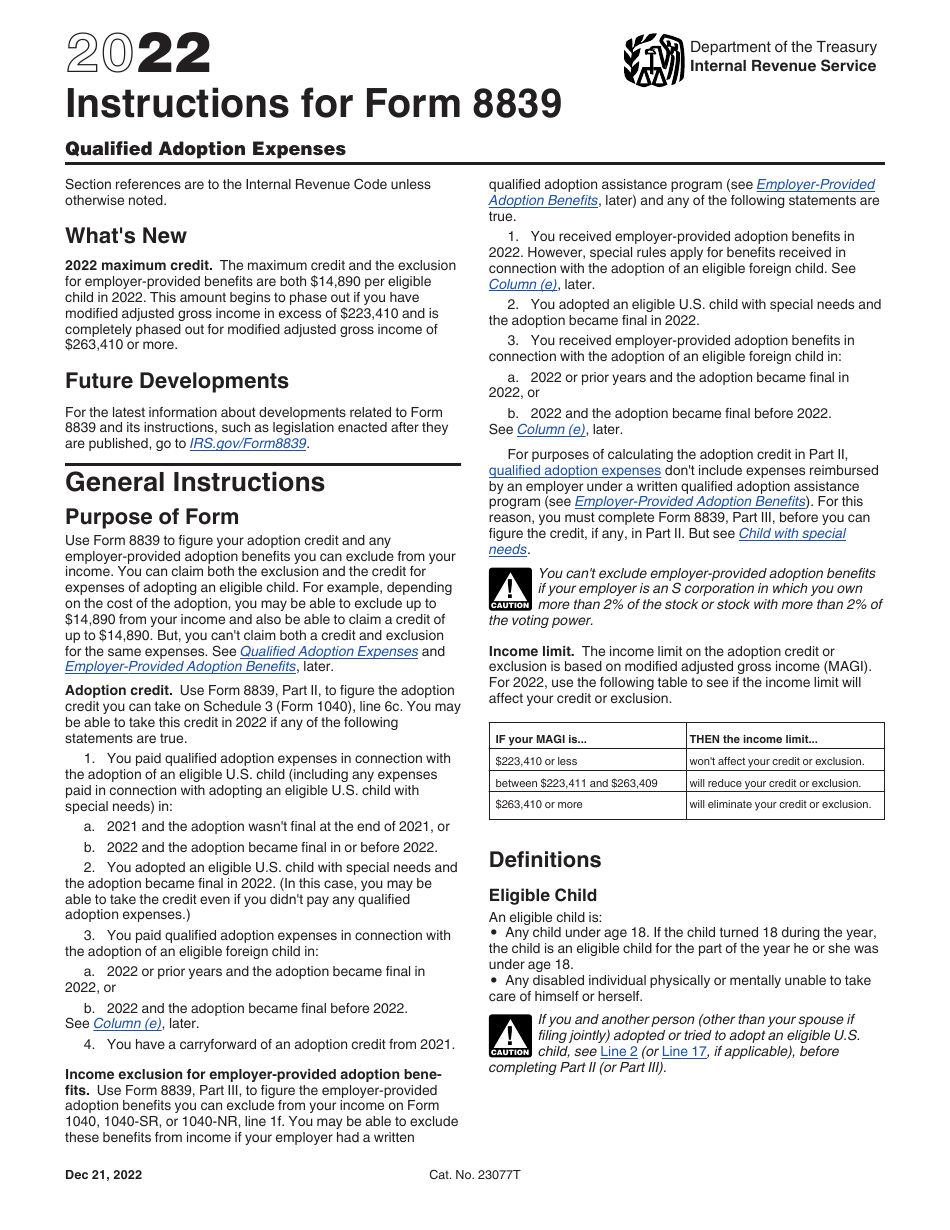

Q: Is there an income limit to claim qualified adoption expenses?

A: No, there is no income limit to claim qualified adoption expenses.

Q: Are there any limitations on the amount of adoption expenses that can be claimed?

A: Yes, there is a limit on the amount of adoption expenses that can be claimed. For 2021, the maximum credit is $14,440 per child.

Q: Can the adoption credit be carried forward or back?

A: Yes, any unused adoption credit can be carried forward for up to 5 years or carried back for 1 year.

Q: What supporting documents should be attached with Form 8839?

A: You should attach documents such as adoption agency statements, legal agreements, and receipts for your adoption expenses.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.