This version of the form is not currently in use and is provided for reference only. Download this version of

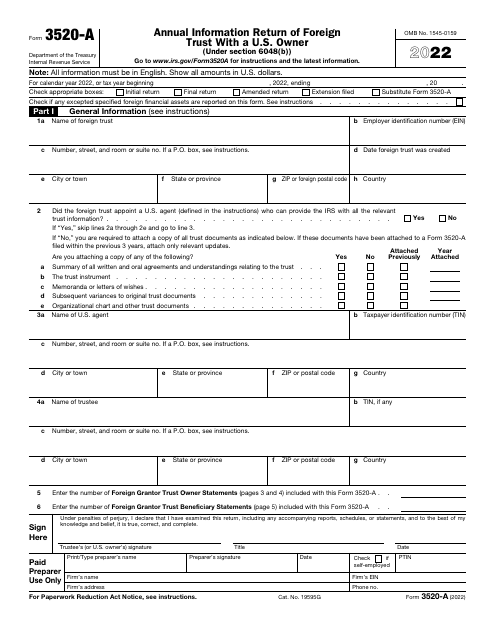

IRS Form 3520-A

for the current year.

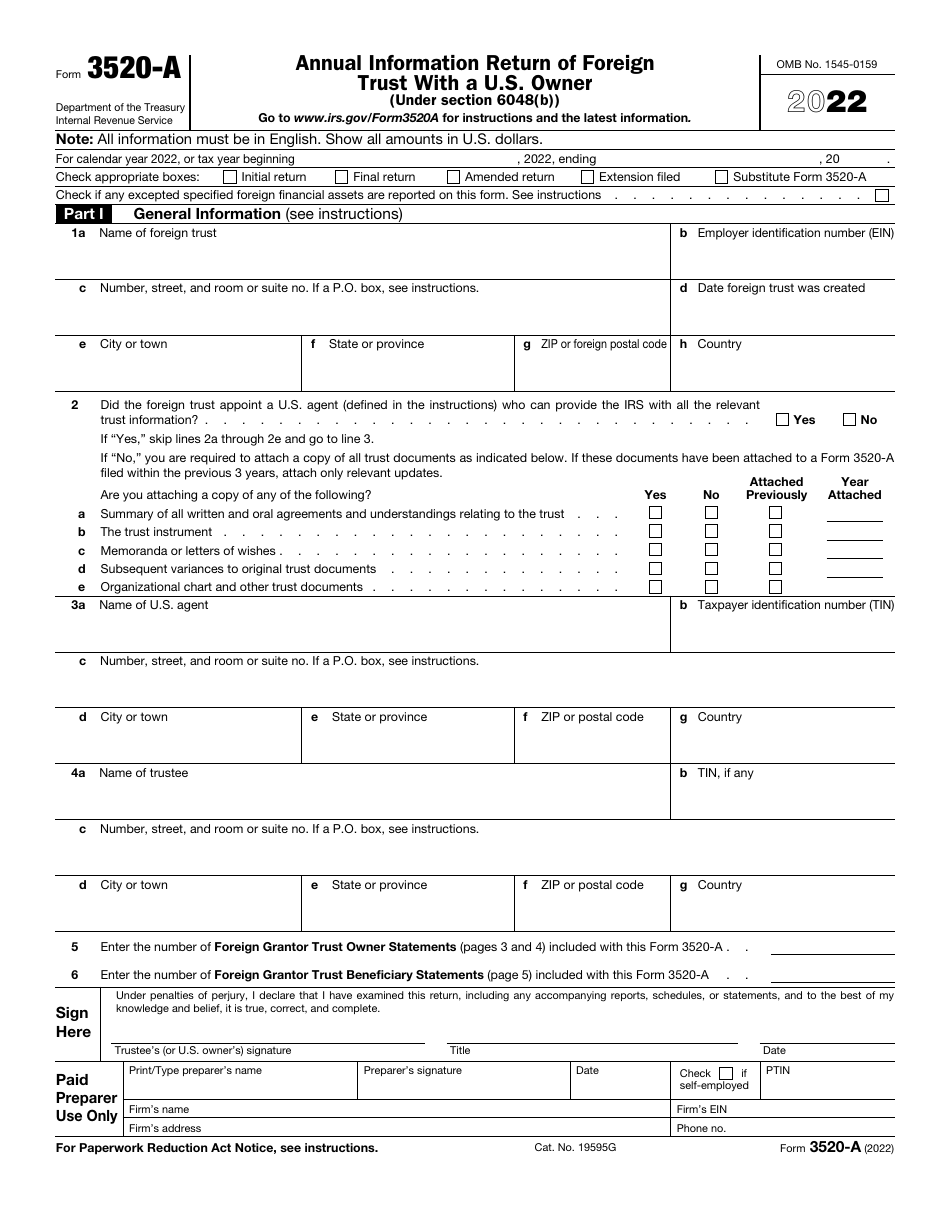

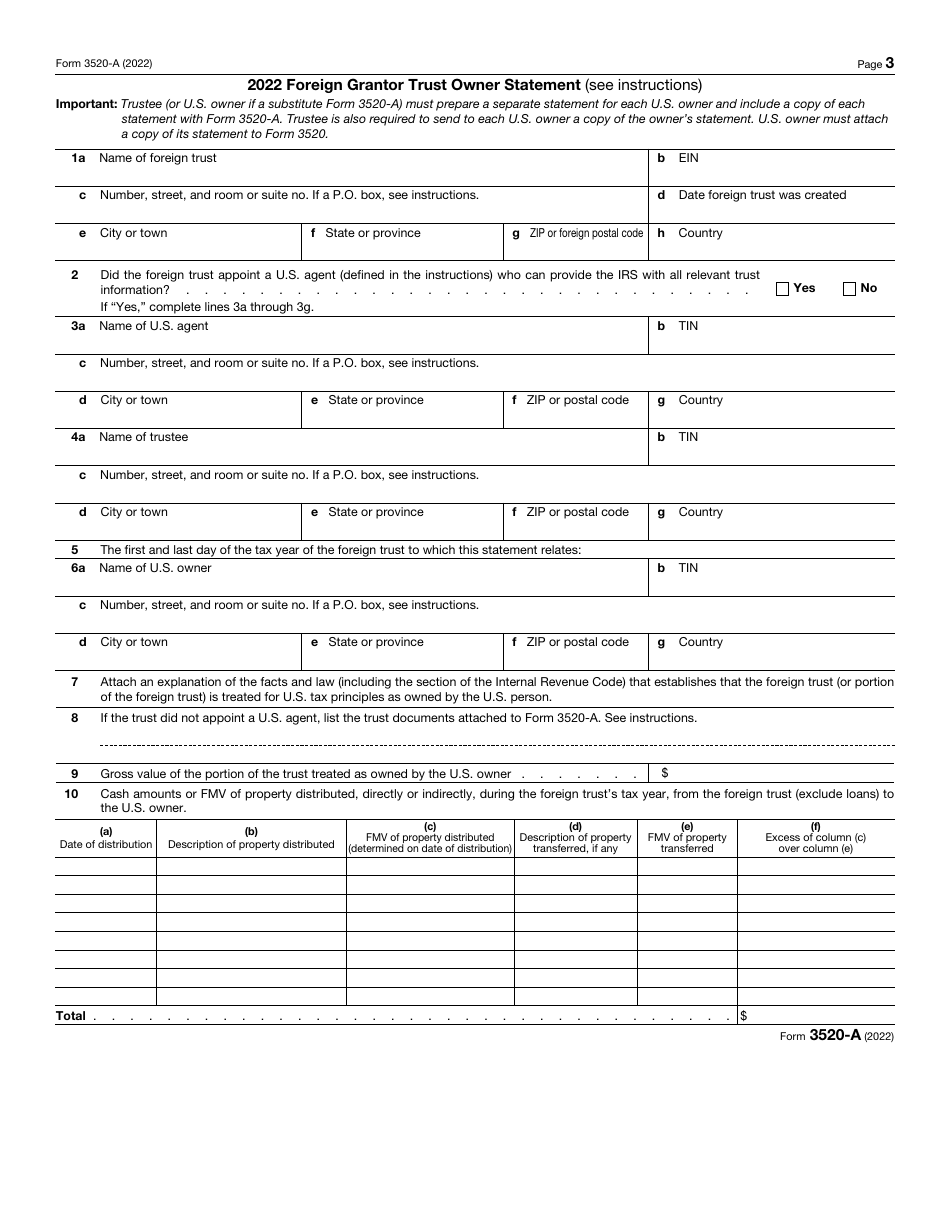

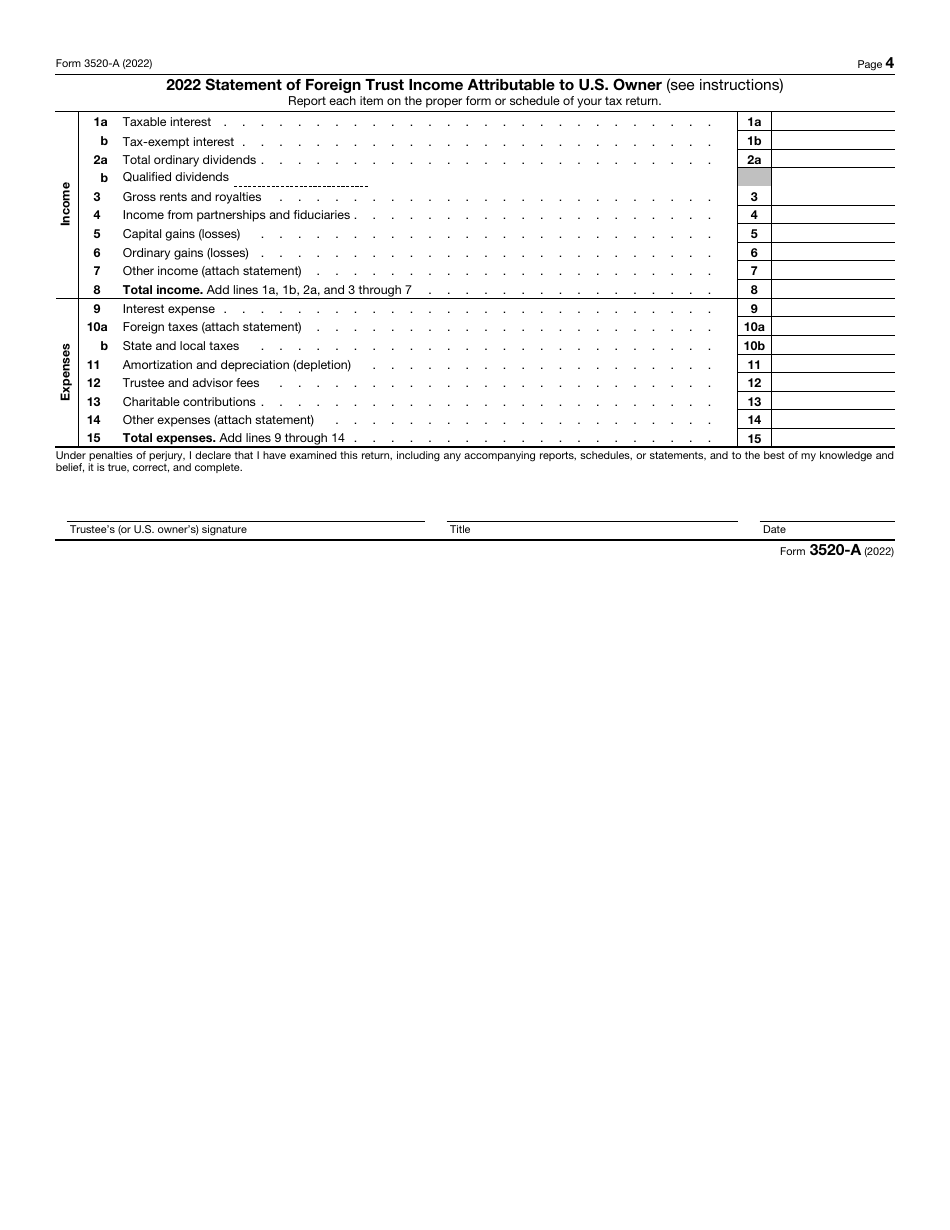

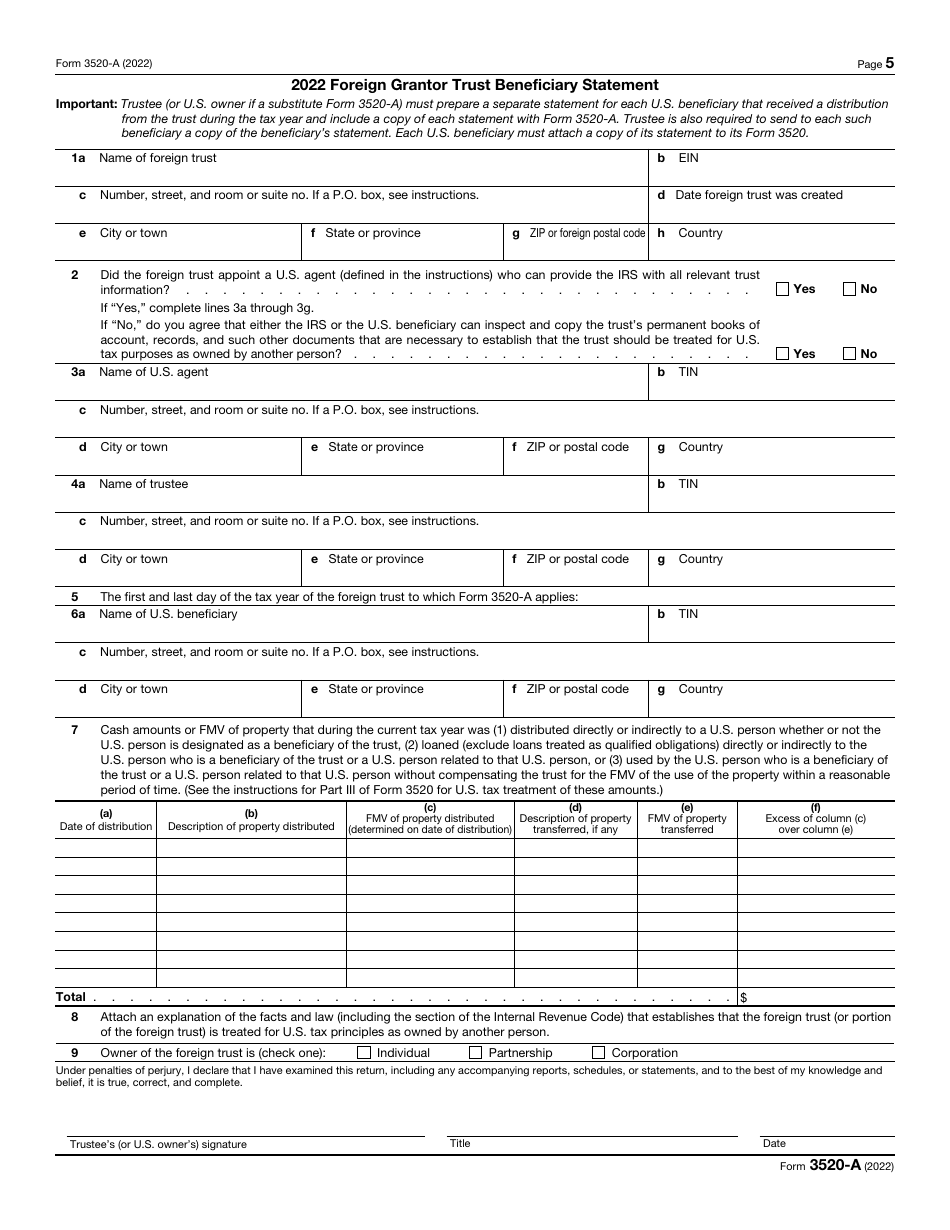

IRS Form 3520-A Annual Information Return of Foreign Trust With a U.S. Owner

What Is IRS Form 3520-A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 3520-A?

A: IRS Form 3520-A is an Annual Information Return of Foreign Trust With a U.S. Owner.

Q: Who needs to file IRS Form 3520-A?

A: Any U.S. person who is treated as the owner of a foreign trust must file IRS Form 3520-A.

Q: What is a foreign trust?

A: A foreign trust is a trust that is formed under the laws of a country other than the United States.

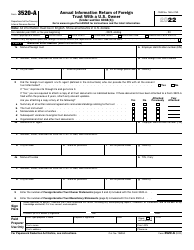

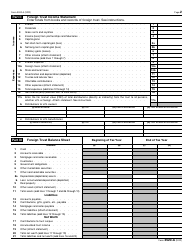

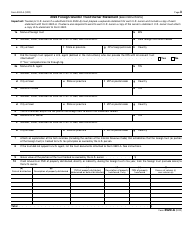

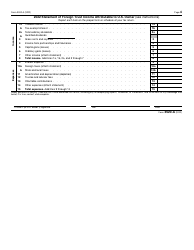

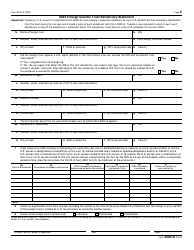

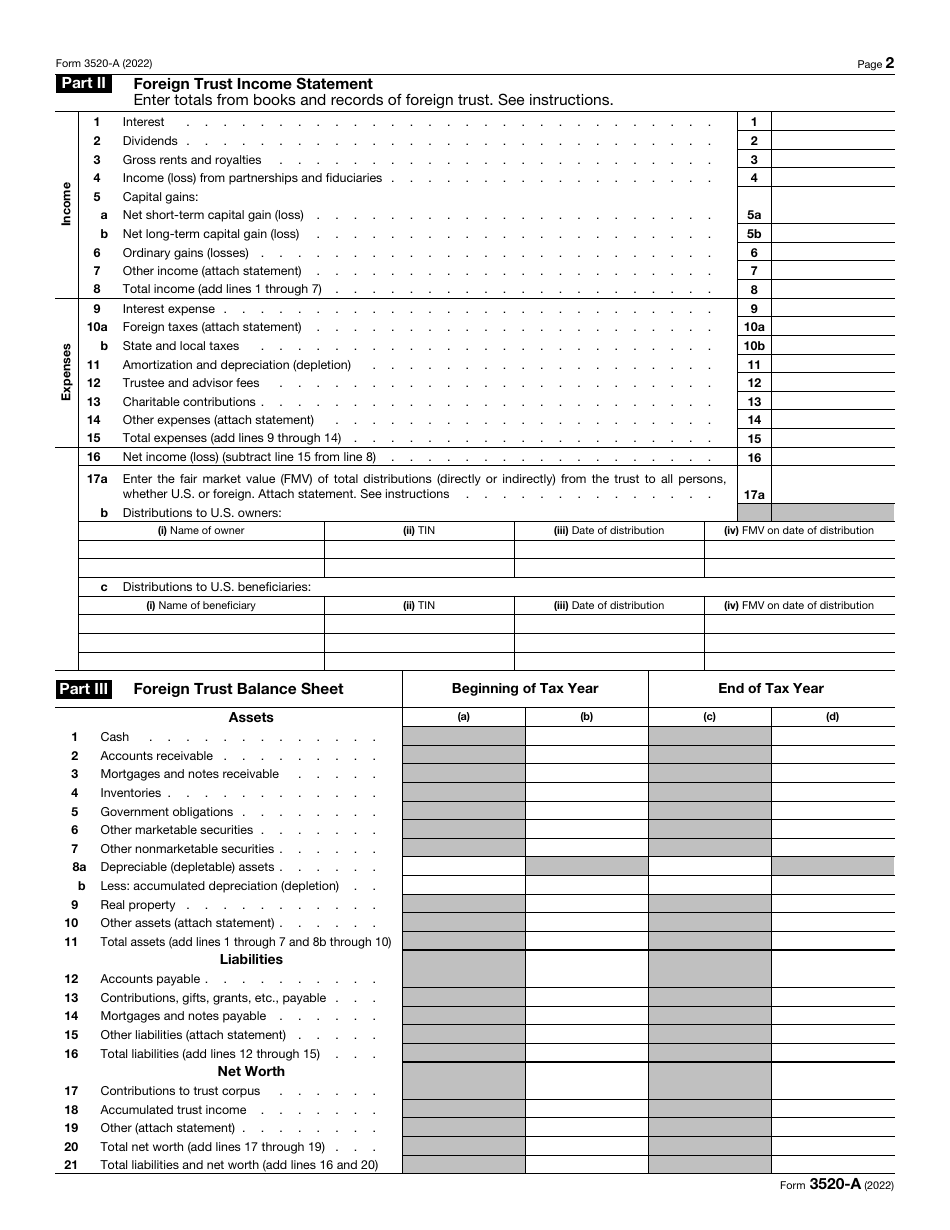

Q: What information is reported on IRS Form 3520-A?

A: IRS Form 3520-A is used to report various information about the foreign trust, including its income, distributions, and beneficiaries.

Q: When is IRS Form 3520-A due?

A: IRS Form 3520-A is generally due on the 15th day of the 3rd month after the end of the trust's taxable year.

Q: What are the penalties for not filing IRS Form 3520-A?

A: The penalties for not filing IRS Form 3520-A can be significant, including monetary penalties and potential criminal penalties.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 3520-A through the link below or browse more documents in our library of IRS Forms.