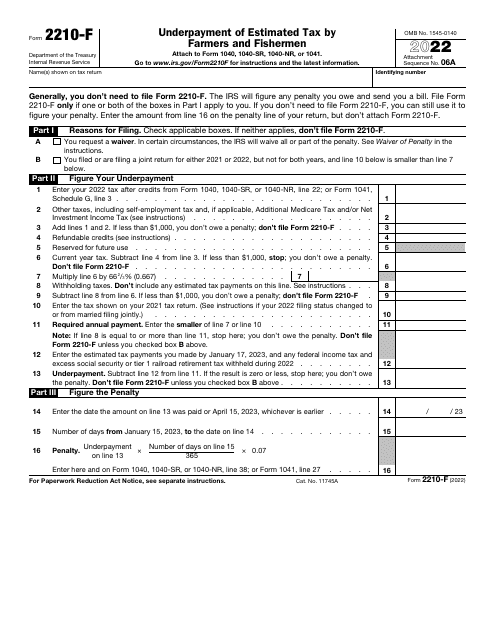

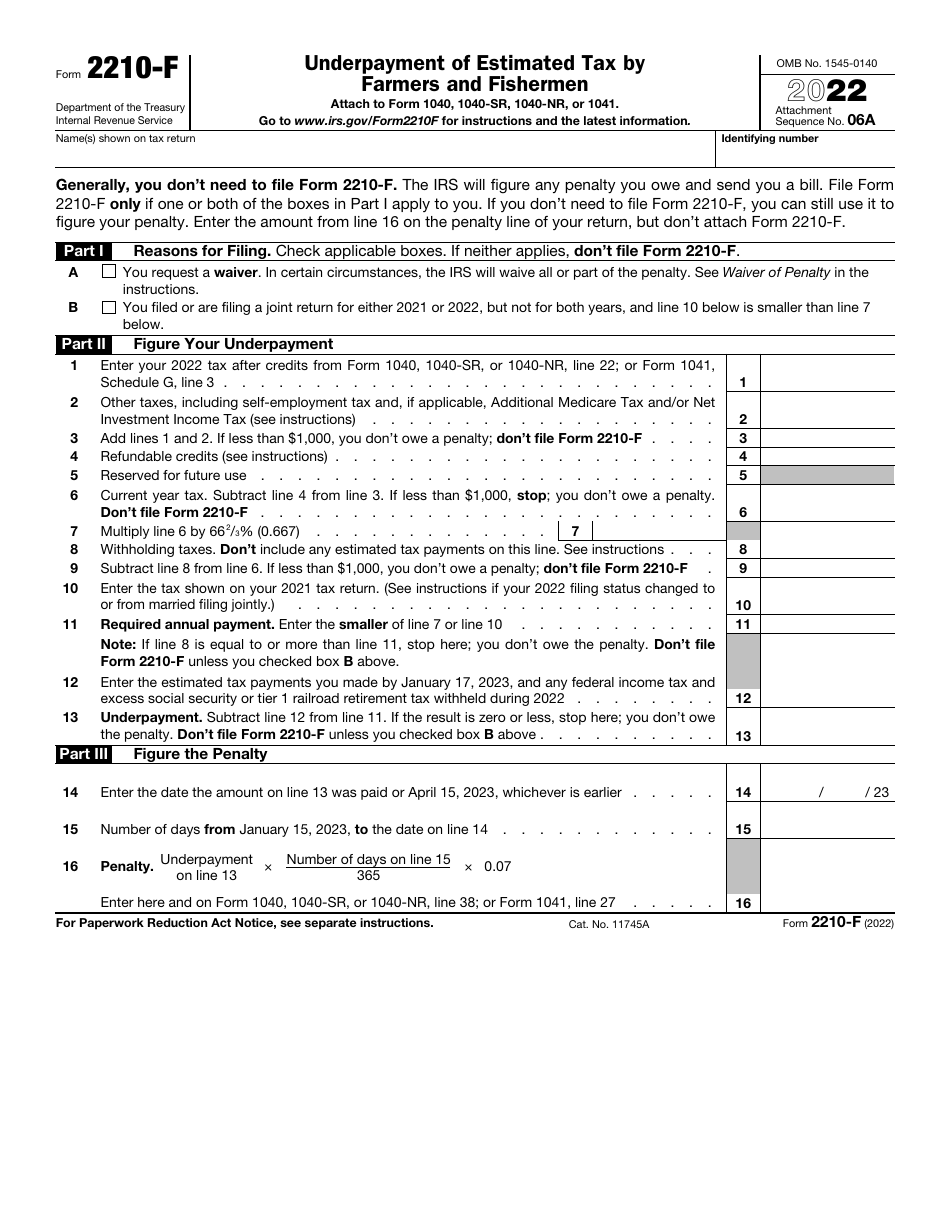

This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 2210-F

for the current year.

IRS Form 2210-F Underpayment of Estimated Tax by Farmers and Fishermen

What Is IRS Form 2210-F?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 2210-F?

A: IRS Form 2210-F is a form used by farmers and fishermen to calculate and report any underpayment of estimated tax.

Q: Who should use IRS Form 2210-F?

A: IRS Form 2210-F should be used by farmers and fishermen who have not made required estimated tax payments throughout the year.

Q: What is the purpose of IRS Form 2210-F?

A: The purpose of IRS Form 2210-F is to calculate any underpayment penalties for farmers and fishermen who did not pay enough estimated tax during the year.

Q: How does IRS Form 2210-F work?

A: IRS Form 2210-F calculates the underpayment penalty based on the difference between the amount of estimated tax paid and the required annual payment.

Q: When is IRS Form 2210-F due?

A: IRS Form 2210-F is due with the taxpayer's annual income tax return, typically by April 15th.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 2210-F through the link below or browse more documents in our library of IRS Forms.