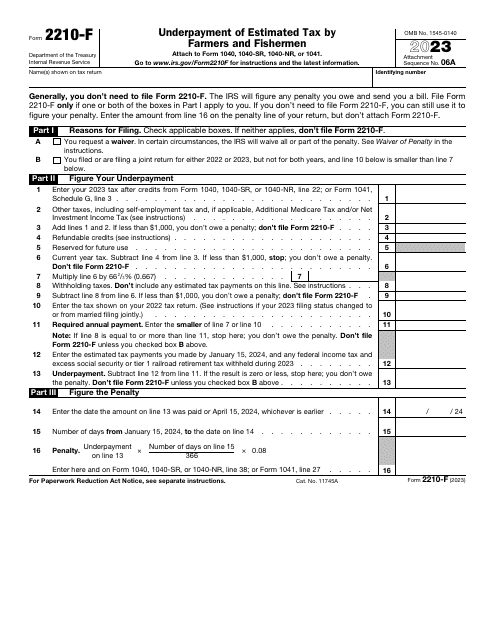

IRS Form 2210-F Underpayment of Estimated Tax by Farmers and Fishermen

What Is IRS Form 2210-F?

IRS Form 2210-F, Underpayment of Estimated Tax by Farmers and Fishermen , is a fiscal document completed by individuals, trusts, and estates to figure out whether they owe tax authorities a penalty after making an error in estimated tax calculations. Only taxpayers that generate two-thirds of their income through fishing and farming are obliged to fill out this instrument. While generally fiscal organs contact a taxpayer in the first place, it is possible you have noticed an underpayment on your own or during the last two years you filed a joint return - in either of these cases, you have to file Form 2210-F to determine the amount of underpayment and potential sanctions.

This worksheet was issued by the Internal Revenue Service (IRS) in 2023 - older editions of the instrument are now outdated. You can find an IRS Form 2210-F fillable version below.

Put a tick in the box that describes your situation and specifies why you have to prepare the paperwork, use guidelines and formulas put in writing to learn the total amount of tax you owe (if the result is zero or less, you will not be required to submit the form), and record the amount of penalty you owe. The numbers you include in this form have to be replicated on your main income statement - make sure the results match otherwise the penalty you are charged with will be even bigger in the future.

Check the official IRS-issued instructions before completing and submitting the form.