This version of the form is not currently in use and is provided for reference only. Download this version of

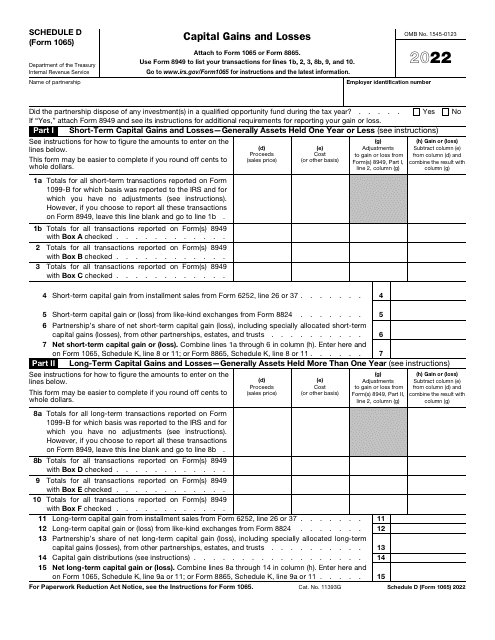

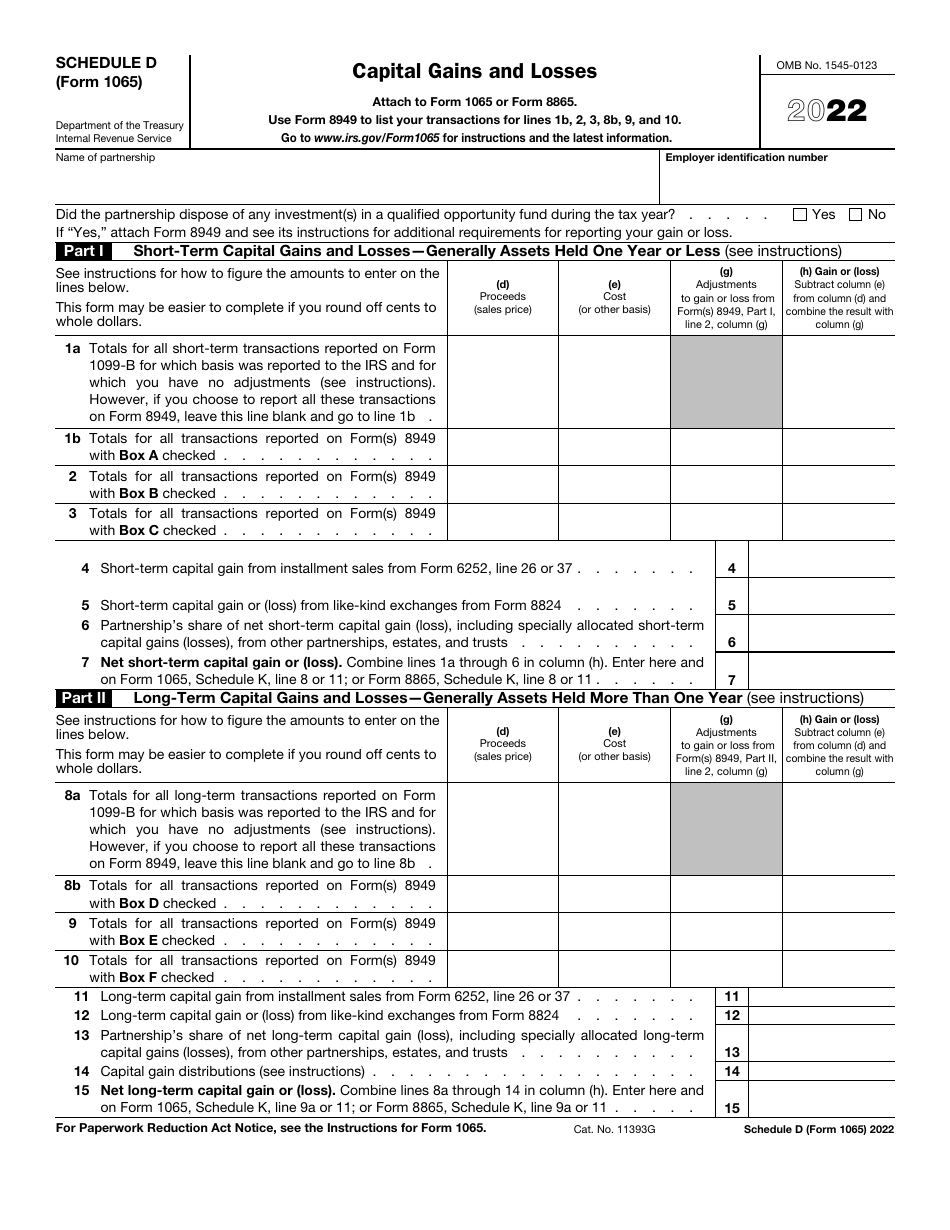

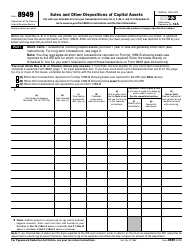

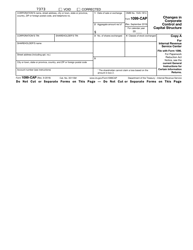

IRS Form 1065 Schedule D

for the current year.

IRS Form 1065 Schedule D Capital Gains and Losses

What Is IRS Form 1065?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1065?

A: IRS Form 1065 is the tax return form used by partnerships to report their income, deductions, gains, losses, and other tax information.

Q: What are capital gains and losses?

A: Capital gains are the profits made from the sale of assets like stocks or real estate. Capital losses are the losses incurred from selling these assets.

Q: How do I report capital gains and losses on IRS Form 1065?

A: Capital gains and losses are reported on Schedule D of IRS Form 1065. You need to calculate your net capital gain or loss and enter the amount on the appropriate line.

Q: What is the capital gains tax rate for partnerships?

A: The capital gains tax rate for partnerships is generally the same as the ordinary income tax rate, which can vary depending on the partnership's total taxable income.

Q: Do partnerships have to report capital gains and losses?

A: Yes, partnerships are required to report capital gains and losses on their tax return using IRS Form 1065.

Q: Are there any exceptions or special rules for reporting capital gains and losses on IRS Form 1065?

A: Yes, there are certain exceptions and special rules that may apply for reporting capital gains and losses on IRS Form 1065. It is advisable to consult a tax professional or refer to the official IRS instructions for specific details.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1065 through the link below or browse more documents in our library of IRS Forms.