This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1065 Schedule D

for the current year.

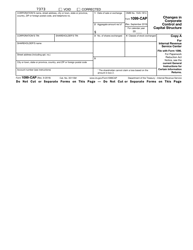

Instructions for IRS Form 1065 Schedule D Capital Gains and Losses

This document contains official instructions for IRS Form 1065 Schedule D, Capital Gains and Losses - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1065 Schedule D?

A: IRS Form 1065 Schedule D is a tax form used by partnerships to report capital gains and losses.

Q: What are capital gains and losses?

A: Capital gains are profits made from the sale of investments or assets, while capital losses are the opposite - losses incurred from the sale of investments or assets.

Q: Why do partnerships need to report capital gains and losses?

A: Partnerships are required to report their capital gains and losses to the IRS in order to accurately calculate their tax liability.

Q: What information is required on Schedule D?

A: Schedule D requires partnerships to provide details of their capital transactions, including the date of sale, purchase price, selling price, and any associated gains or losses.

Q: Are there any special rules or considerations when reporting capital gains and losses on Schedule D?

A: Yes, there are specific rules and considerations for reporting capital gains and losses on Schedule D. It is important to consult the instructions or seek professional tax advice for guidance.

Q: When is the deadline for filing Form 1065 Schedule D?

A: The deadline for filing Form 1065 Schedule D is typically the same as the deadline for filing the partnership's annual tax return, which is usually April 15th of the following year.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.