This version of the form is not currently in use and is provided for reference only. Download this version of

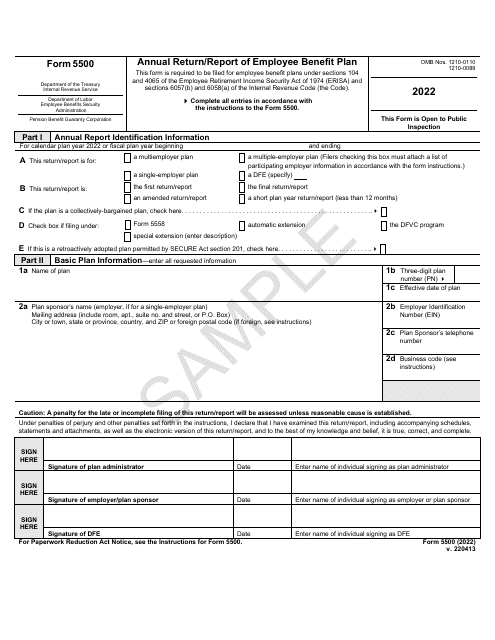

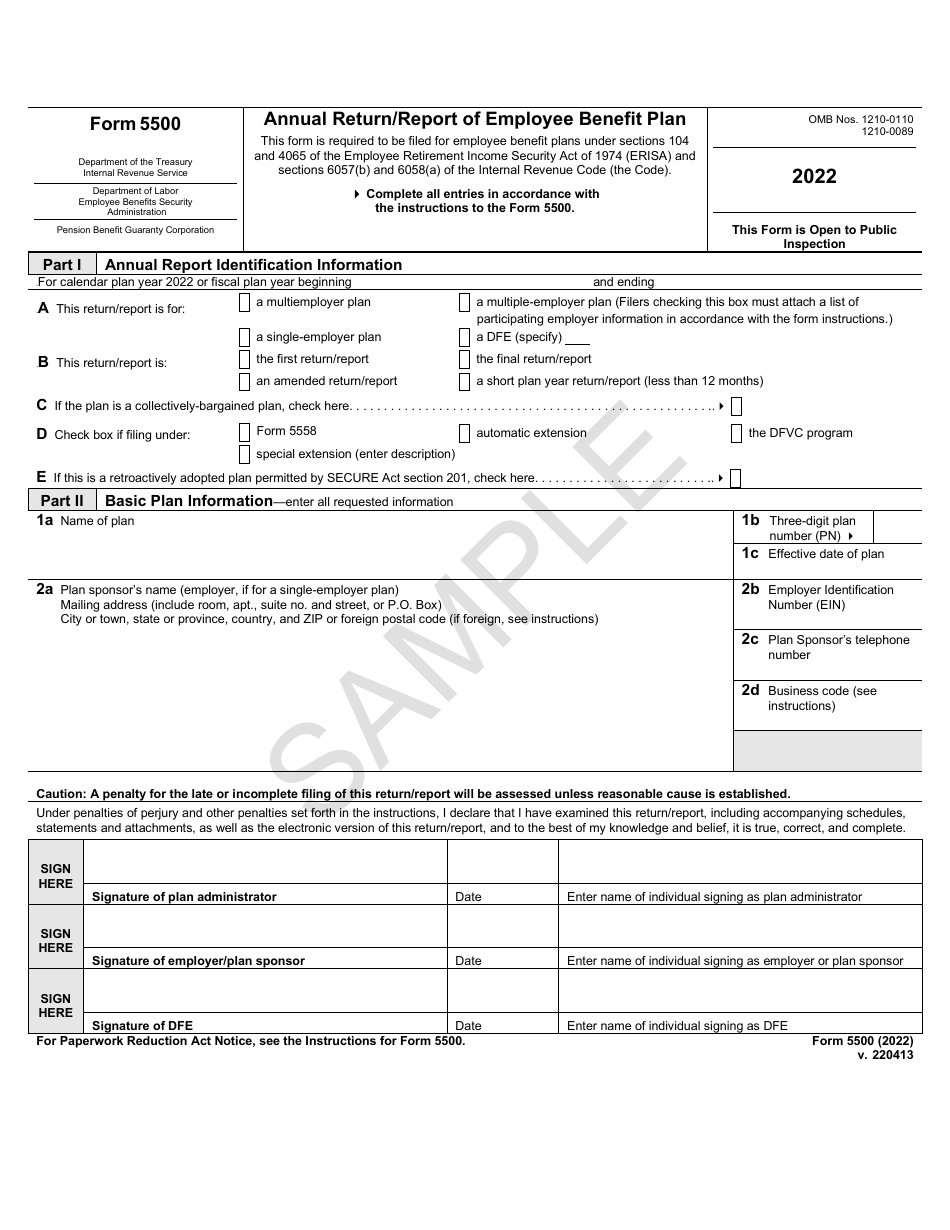

Form 5500

for the current year.

Form 5500 Annual Return / Report of Employee Benefit Plan - Sample

What Is Form 5500?

This is a legal form that was released by the U.S. Department of Labor - Employee Benefits Security Administration on April 13, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5500?

A: Form 5500 is an annual return/report filed by employee benefit plans to provide information to the IRS and the Department of Labor.

Q: Who needs to file Form 5500?

A: Employee benefit plans, such as retirement plans and health plans, generally need to file Form 5500.

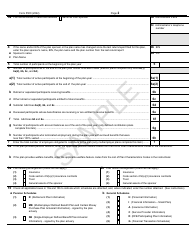

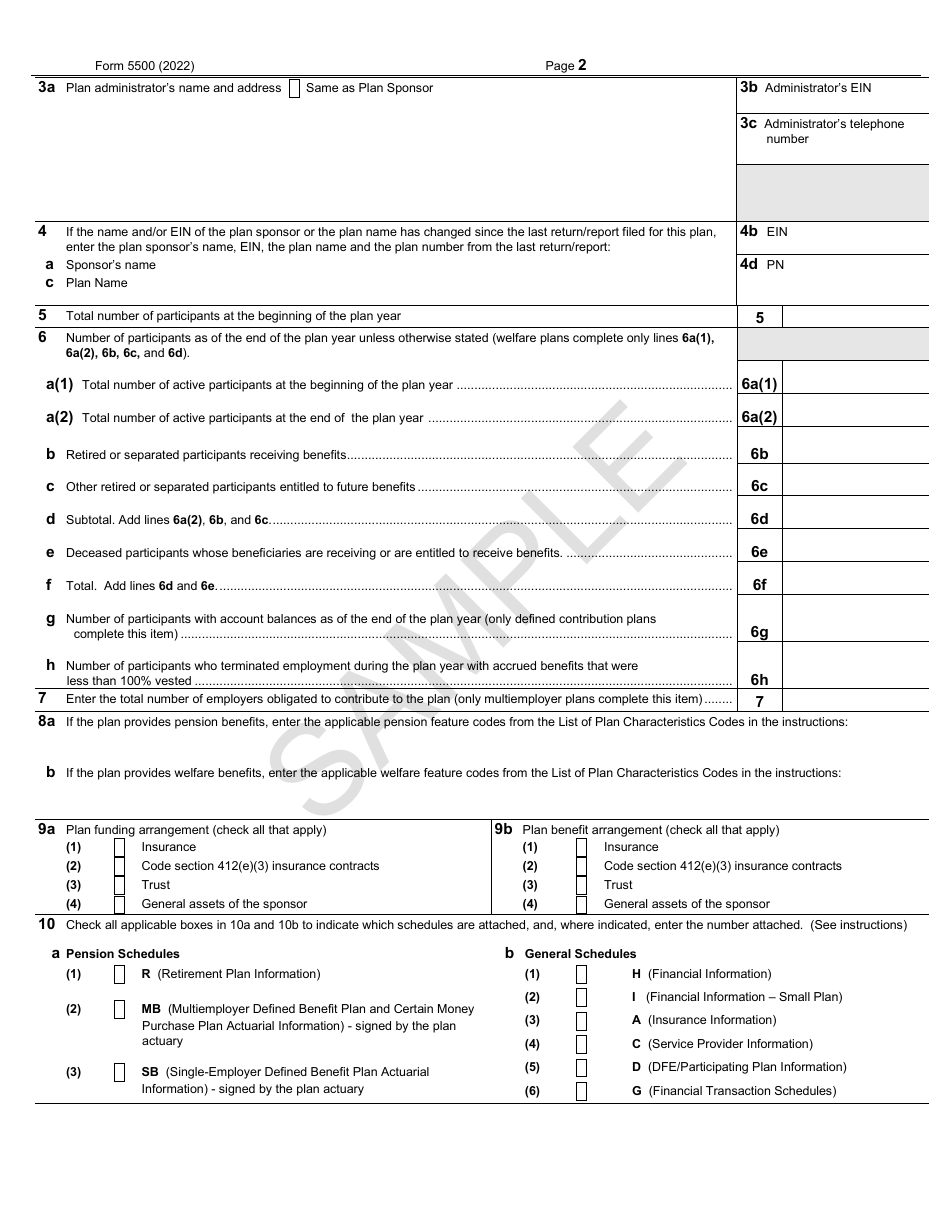

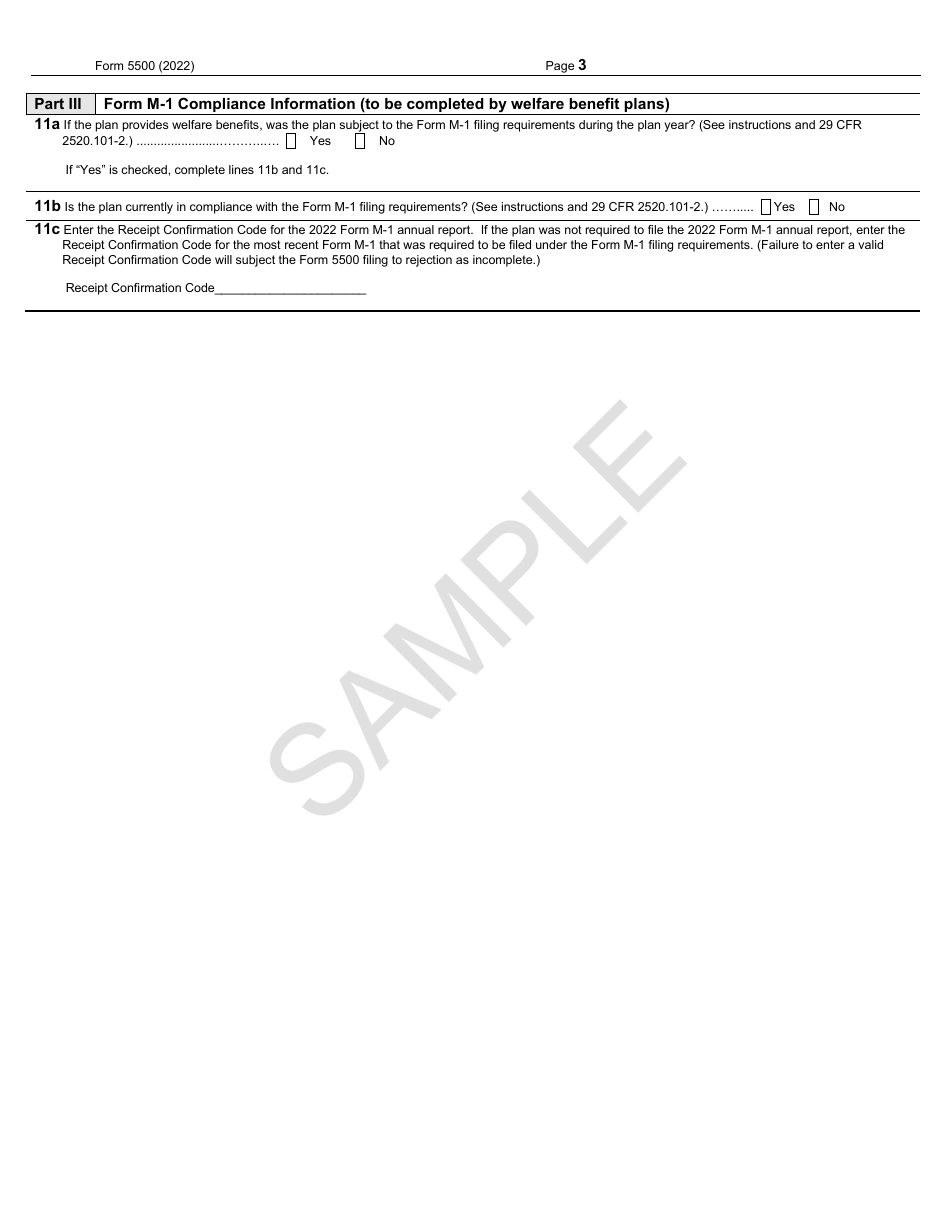

Q: What information is required on Form 5500?

A: Form 5500 requires information about the plan's financial condition, operations, and compliance with certain rules and regulations.

Q: When is Form 5500 due?

A: Form 5500 is generally due on the last day of the seventh month after the plan year ends. For calendar year plans, the due date is July 31st.

Q: Are there any extensions for filing Form 5500?

A: Yes, extensions of up to 2.5 months can be requested by filing Form 5558 before the original due date of Form 5500.

Q: What are the penalties for not filing Form 5500?

A: Penalties for not filing Form 5500 can be significant, ranging from $2,194 per day to $1,100 per day, depending on the size of the plan.

Q: Can Form 5500 be filed electronically?

A: Yes, Form 5500 can be filed electronically through the Department of Labor's EFAST2 system.

Q: Do all employee benefit plans need to file Form 5500?

A: No, some small plans may be exempt from filing Form 5500. It is important to consult with a tax professional or the IRS to determine if your plan is exempt.

Q: What is the purpose of filing Form 5500?

A: The purpose of filing Form 5500 is to provide transparency and ensure compliance with reporting requirements for employee benefit plans.

Form Details:

- Released on April 13, 2022;

- The latest available edition released by the U.S. Department of Labor - Employee Benefits Security Administration;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5500 by clicking the link below or browse more documents and templates provided by the U.S. Department of Labor - Employee Benefits Security Administration.