This version of the form is not currently in use and is provided for reference only. Download this version of

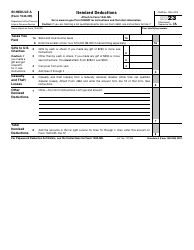

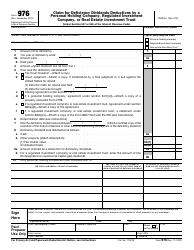

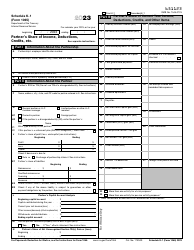

Instructions for IRS Form 1040 Schedule A

for the current year.

Instructions for IRS Form 1040 Schedule A Itemized Deductions

This document contains official instructions for IRS Form 1040 Schedule A, Itemized Deductions - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1040 Schedule A is available for download through this link.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a form that allows you to itemize your deductions rather than taking the standard deduction.

Q: What are itemized deductions?

A: Itemized deductions are expenses that you can subtract from your adjusted gross income (AGI) to reduce your taxable income.

Q: What expenses can I claim as itemized deductions?

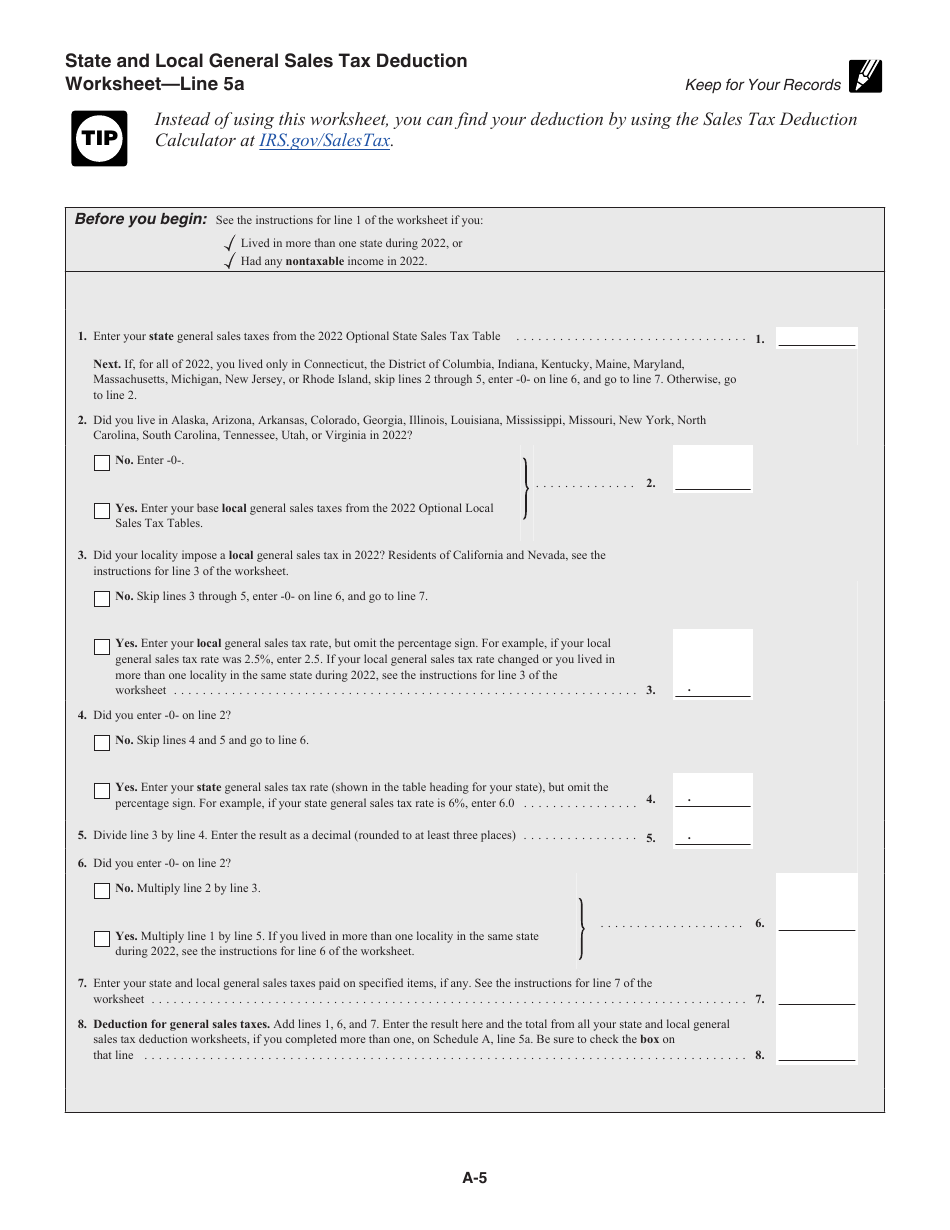

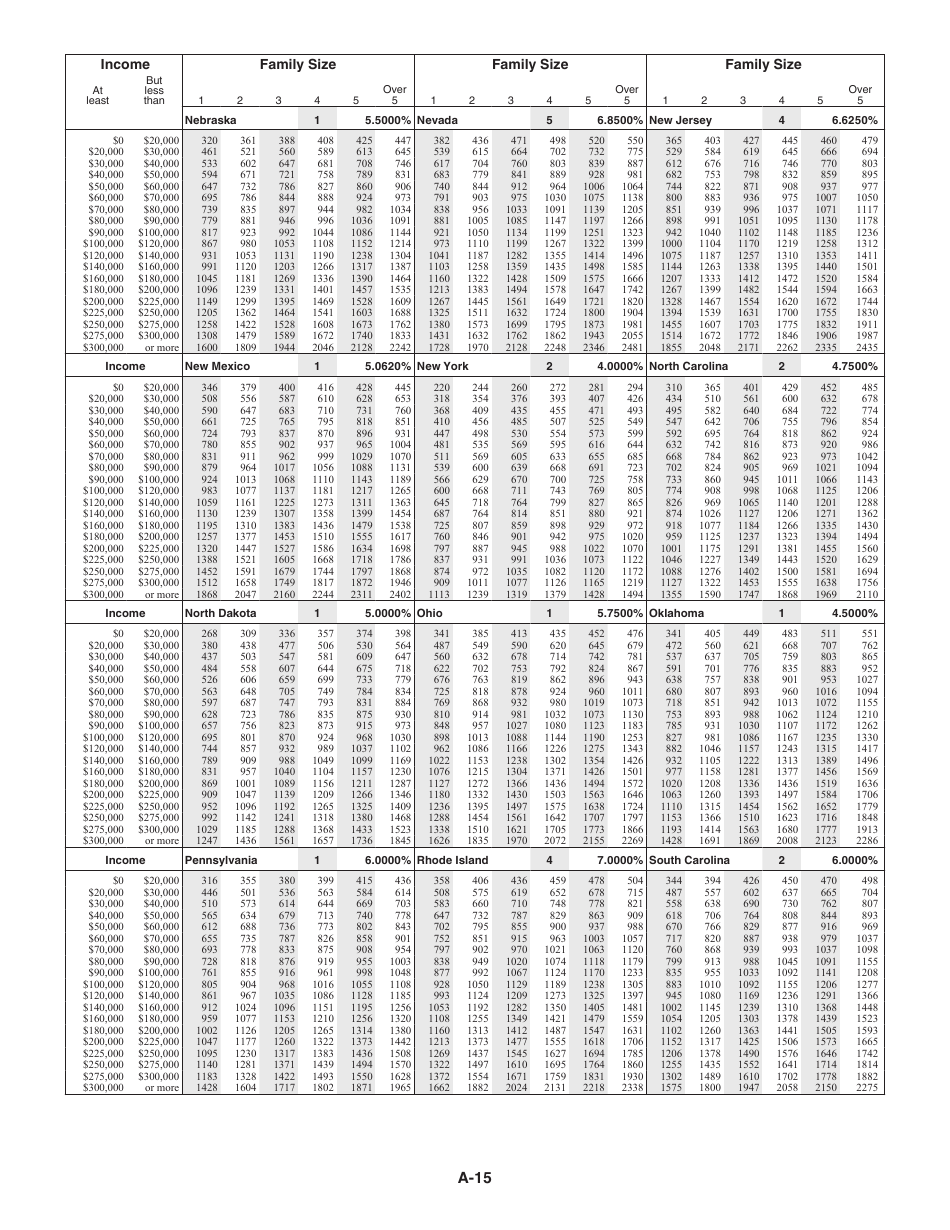

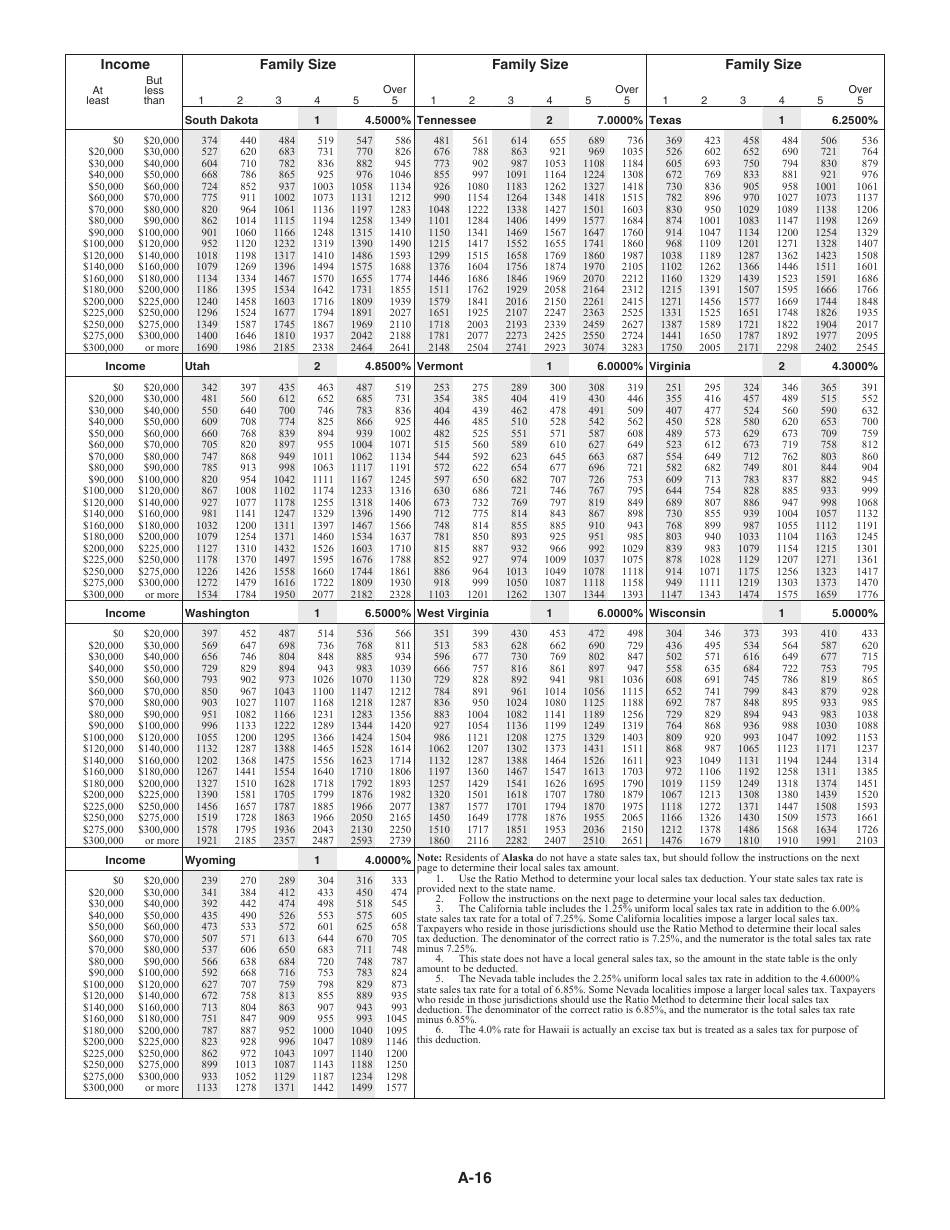

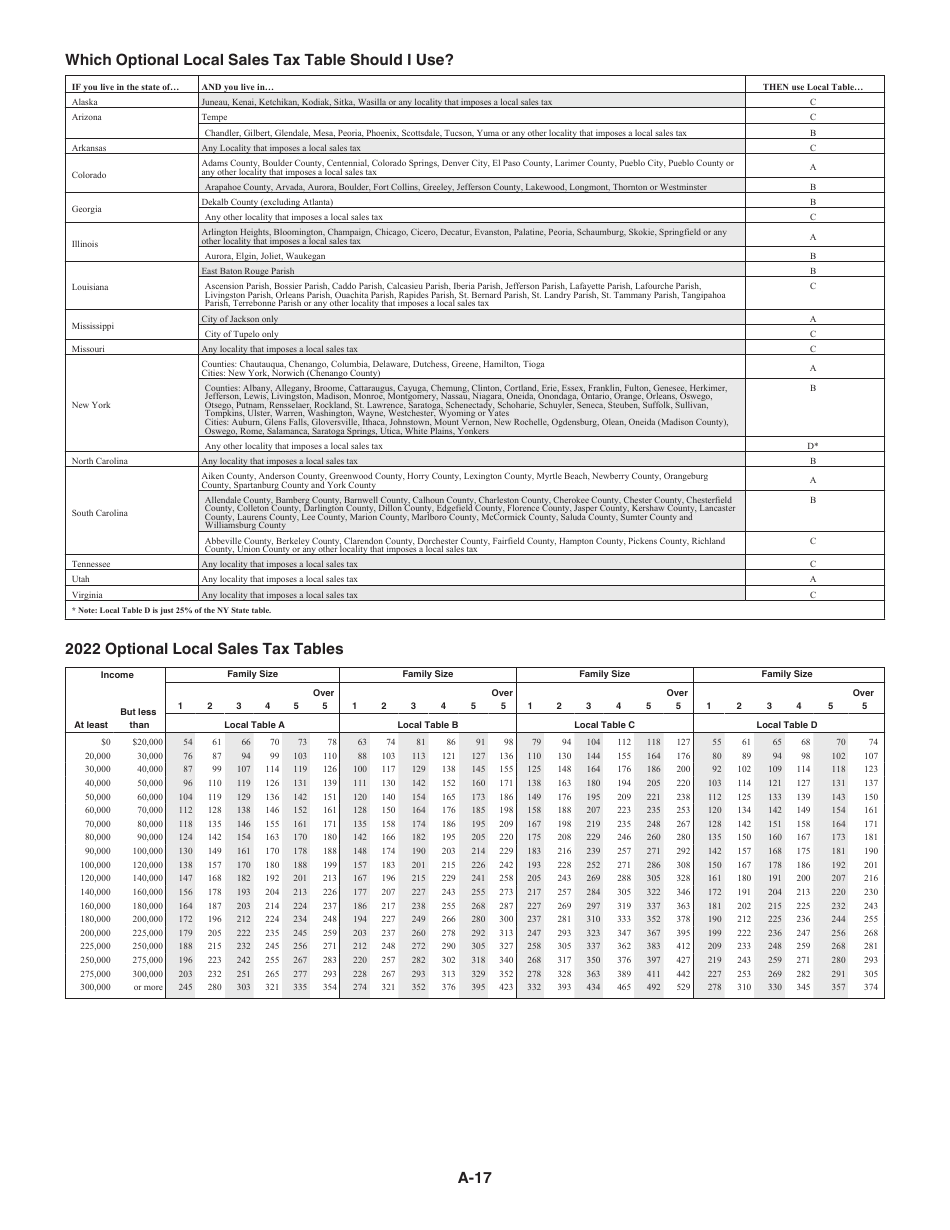

A: Common itemized deductions include medical expenses, state and local taxes, mortgage interest, charitable contributions, and certain unreimbursed employee expenses.

Q: How do I know if I should itemize deductions or take the standard deduction?

A: You should compare your potential itemized deductions to the standard deduction amount for your filing status. If your itemized deductions are higher, it might be beneficial to itemize.

Q: Do I need to include proof or receipts for my itemized deductions?

A: You should keep records and receipts to support your claimed expenses, but you do not need to attach them to your tax return. However, you must have them available in case the IRS asks for verification.

Q: Is there a limit to how much I can deduct for itemized deductions?

A: Certain itemized deductions may be subject to limitations. For example, there is a limit on the amount of state and local taxes you can deduct.

Q: Can I amend my tax return to switch from itemized deductions to the standard deduction?

A: No, once you have filed your tax return, you generally cannot switch from itemized deductions to the standard deduction or vice versa.

Instruction Details:

- This 17-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.