This version of the form is not currently in use and is provided for reference only. Download this version of

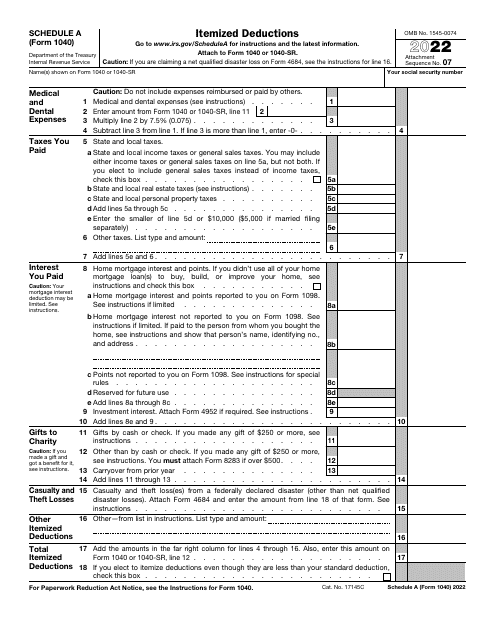

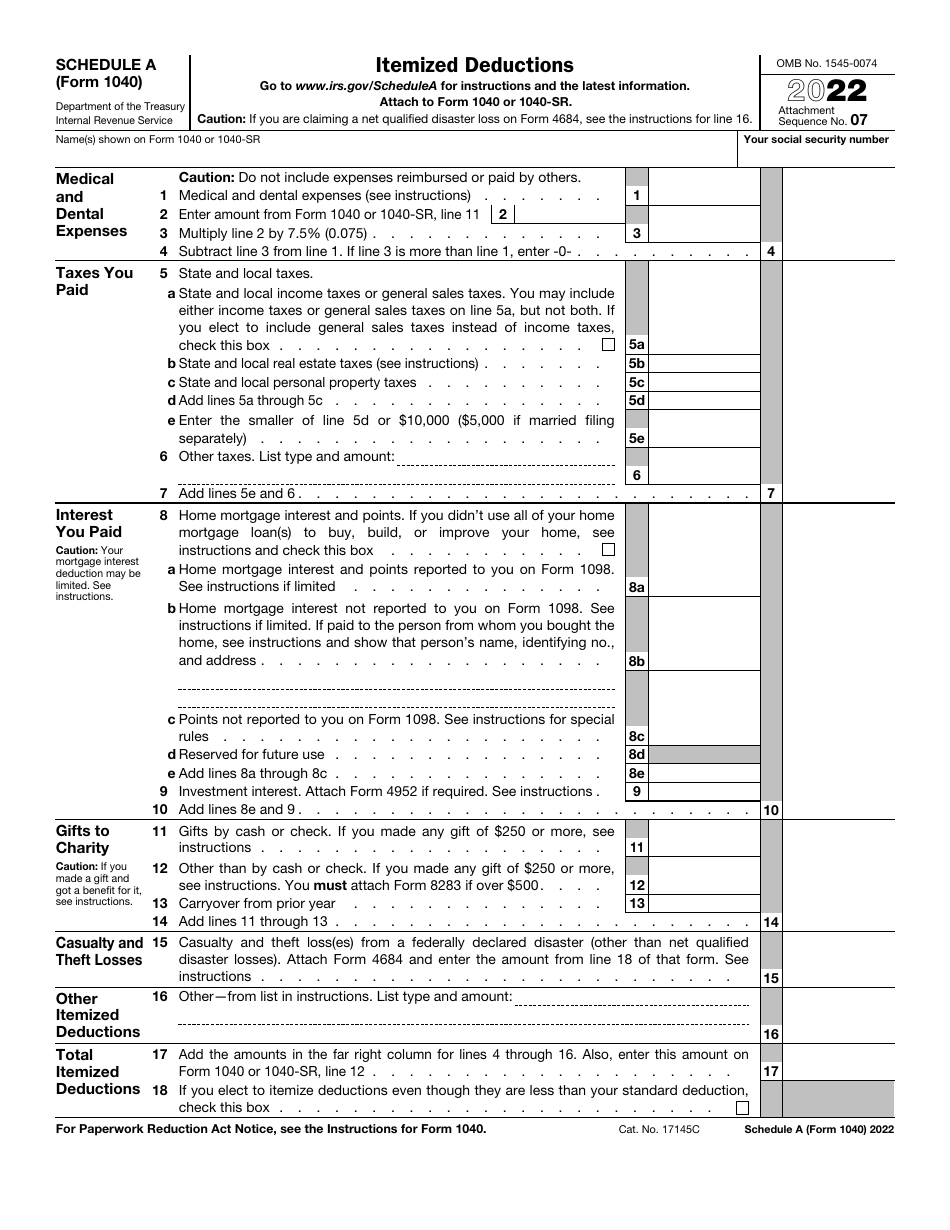

IRS Form 1040 Schedule A

for the current year.

IRS Form 1040 Schedule A Itemized Deductions

What Is IRS Form 1040 Schedule A?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1040, U.S. Individual Income Tax Return. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1040 Schedule A?

A: IRS Form 1040 Schedule A is a tax form used to report itemized deductions.

Q: What are itemized deductions?

A: Itemized deductions are expenses that taxpayers can deduct from their taxable income to reduce their overall tax liability.

Q: What types of expenses can be deducted on Schedule A?

A: Some common expenses that can be deducted on Schedule A include medical expenses, state and local taxes, mortgage interest, charitable contributions, and miscellaneous deductions.

Q: Do I have to use Schedule A to deduct expenses?

A: No, taxpayers have the option to either take the standard deduction or to itemize their deductions using Schedule A.

Q: Who is eligible to use Schedule A?

A: Taxpayers who have qualifying expenses that exceed the standard deduction amount are eligible to use Schedule A to itemize their deductions.

Q: Is there a limit to how much I can deduct on Schedule A?

A: Yes, some deductions on Schedule A are subject to limitations and thresholds. For example, there are limitations on the deduction for state and local taxes, as well as a threshold for medical expenses.

Q: When is the deadline to file Schedule A?

A: Schedule A must be filed along with your annual tax return by the tax filing deadline, which is typically April 15th.

Q: Can I e-file Schedule A?

A: Yes, taxpayers can e-file Schedule A along with their tax return using approved tax software or through a tax professional.

Q: What if I made a mistake on my Schedule A?

A: If you made a mistake on your Schedule A, you may need to file an amended tax return using Form 1040X to correct the error.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1040 Schedule A through the link below or browse more documents in our library of IRS Forms.