This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 57-006

for the current year.

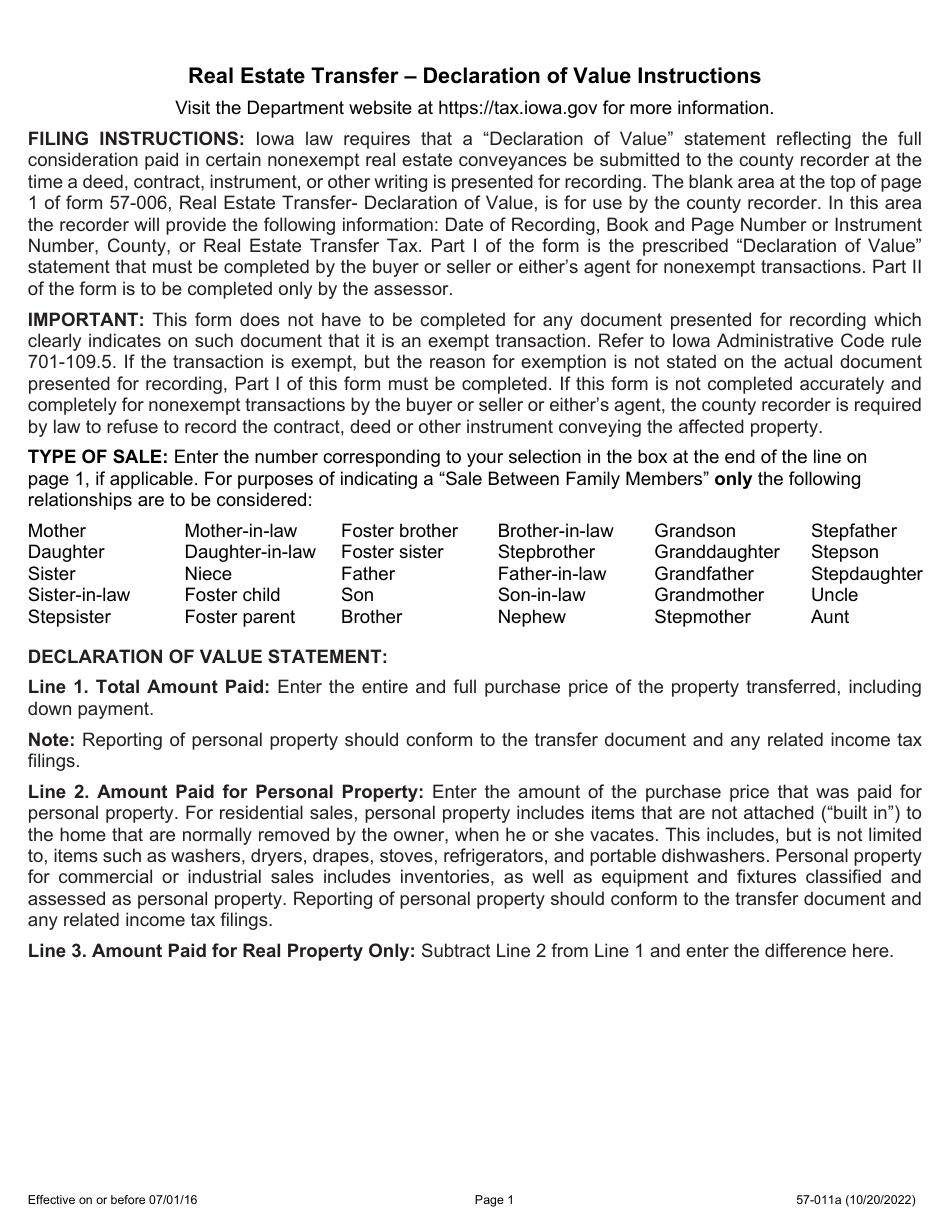

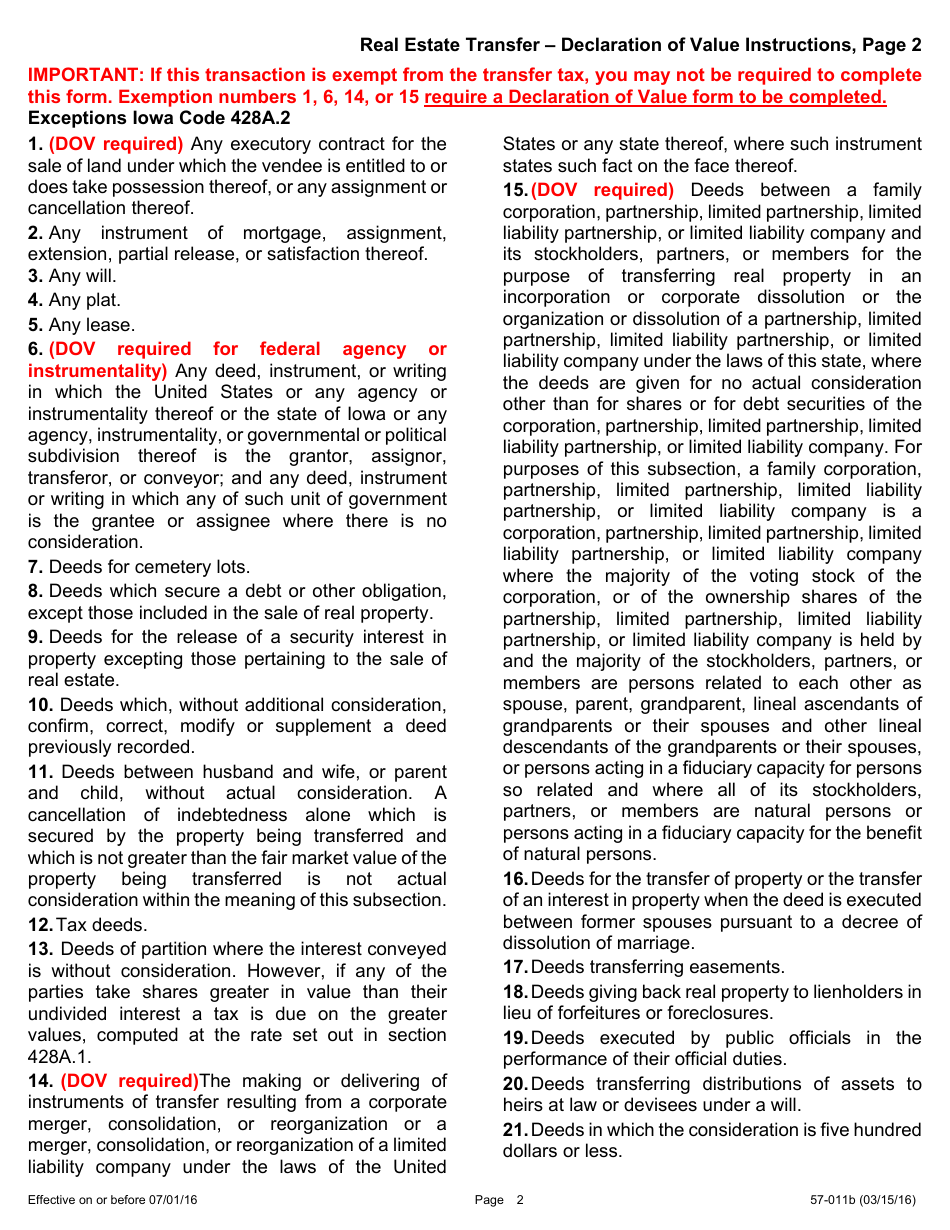

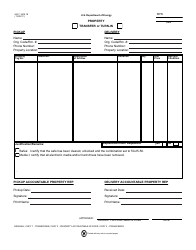

Instructions for Form 57-006 Real Estate Transfer - Declaration of Value - Iowa

This document contains official instructions for Form 57-006 , Real Estate Transfer - Declaration of Value - a form released and collected by the Iowa Department of Revenue. An up-to-date fillable Form 57-006 is available for download through this link.

FAQ

Q: What is Form 57-006?

A: Form 57-006 is the Real Estate Transfer - Declaration of Value form used in Iowa.

Q: What is the purpose of Form 57-006?

A: The purpose of Form 57-006 is to document the sale or transfer of real estate in Iowa and declare its value.

Q: Who needs to fill out Form 57-006?

A: Both the buyer and seller of the real estate need to fill out Form 57-006.

Q: What information is required on Form 57-006?

A: Form 57-006 requires information such as the property address, names of the buyer and seller, purchase price, and property description.

Q: Are there any filing fees for Form 57-006?

A: Yes, there is a filing fee for Form 57-006, which varies depending on the county.

Q: When should Form 57-006 be filed?

A: Form 57-006 should be filed at the time of the real estate transfer or within 30 days of the transfer.

Q: What happens after Form 57-006 is filed?

A: After Form 57-006 is filed, it is reviewed by the county recorder's office and the appropriate taxes and fees are assessed.

Q: Can Form 57-006 be amended?

A: Yes, if there is a mistake or if additional information needs to be provided, Form 57-006 can be amended by filing a corrected form.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Iowa Department of Revenue.