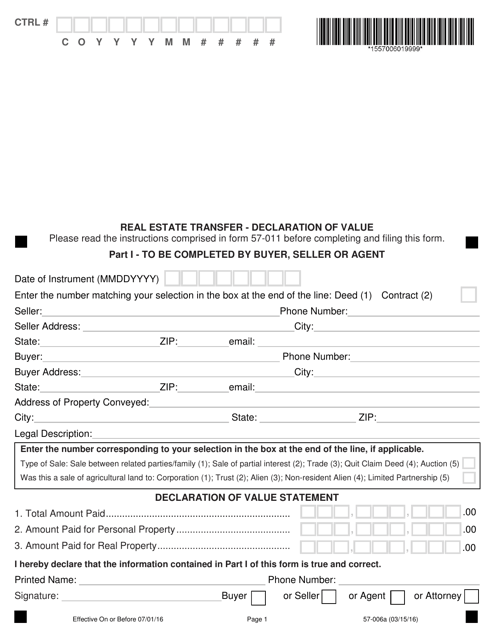

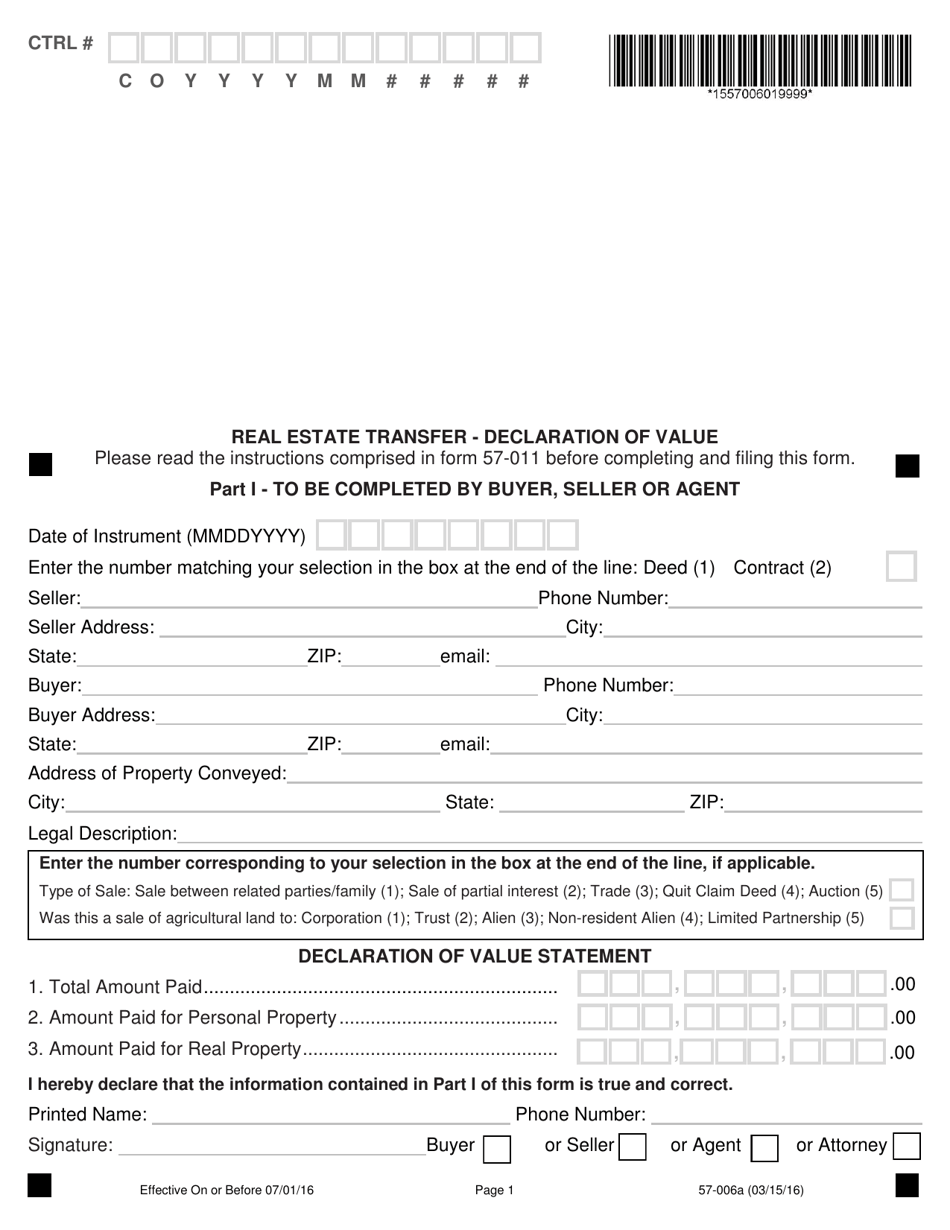

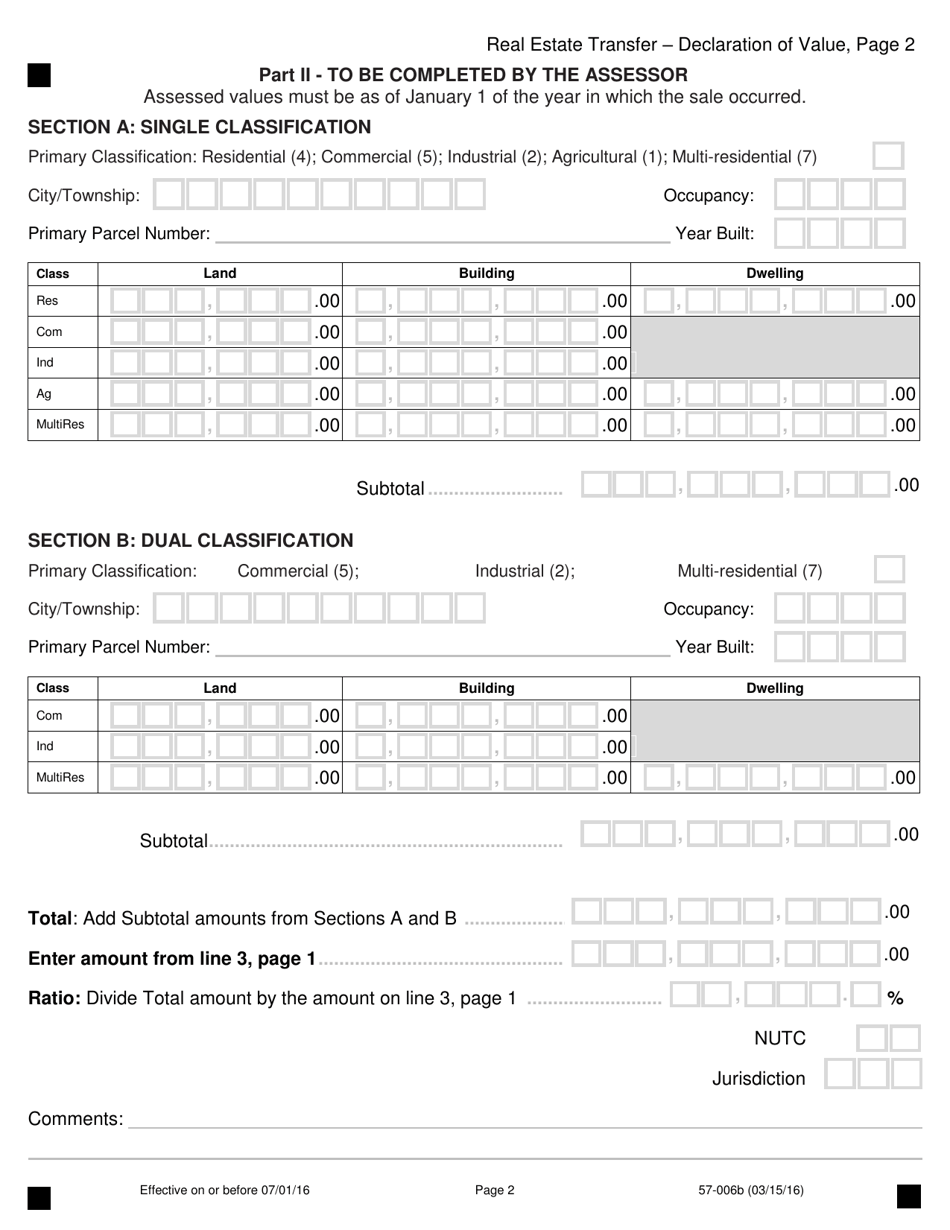

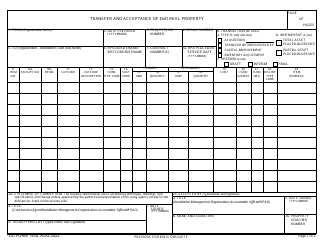

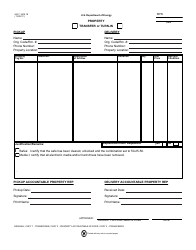

Form 57-006 Real Estate Transfer - Declaration of Value - Iowa

What Is Form 57-006?

This is a legal form that was released by the Iowa Department of Revenue - a government authority operating within Iowa. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form 57-006?

A: Form 57-006 is the Real Estate Transfer - Declaration of Value form in Iowa.

Q: What is the purpose of form 57-006?

A: The purpose of form 57-006 is to declare the value of real estate being transferred in Iowa.

Q: When is form 57-006 required?

A: Form 57-006 is required whenever there is a transfer of real estate in Iowa.

Q: Who needs to fill out form 57-006?

A: The buyer or the buyer's representative usually fills out form 57-006.

Q: Are there any fees associated with form 57-006?

A: Yes, there is a $5 fee for filing form 57-006.

Q: What information is required on form 57-006?

A: Form 57-006 requires information such as the names of the buyer and seller, the property description, and the sale price.

Q: Are there any penalties for not filing form 57-006?

A: Yes, there can be penalties for not filing form 57-006, including late fees and potential legal consequences.

Form Details:

- Released on March 15, 2016;

- The latest edition provided by the Iowa Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 57-006 by clicking the link below or browse more documents and templates provided by the Iowa Department of Revenue.