This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form NJ-1040-HW

for the current year.

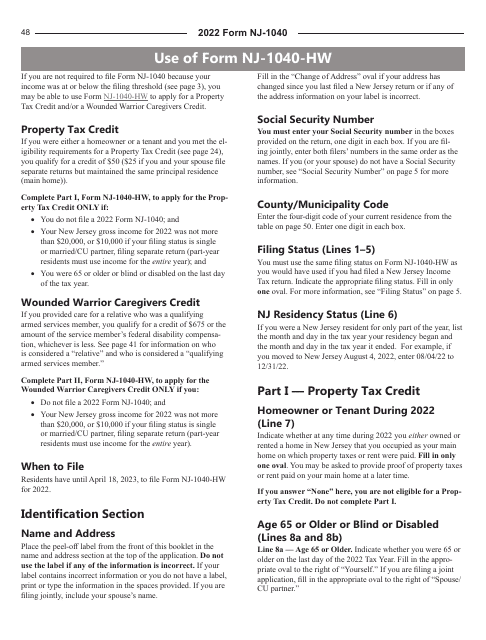

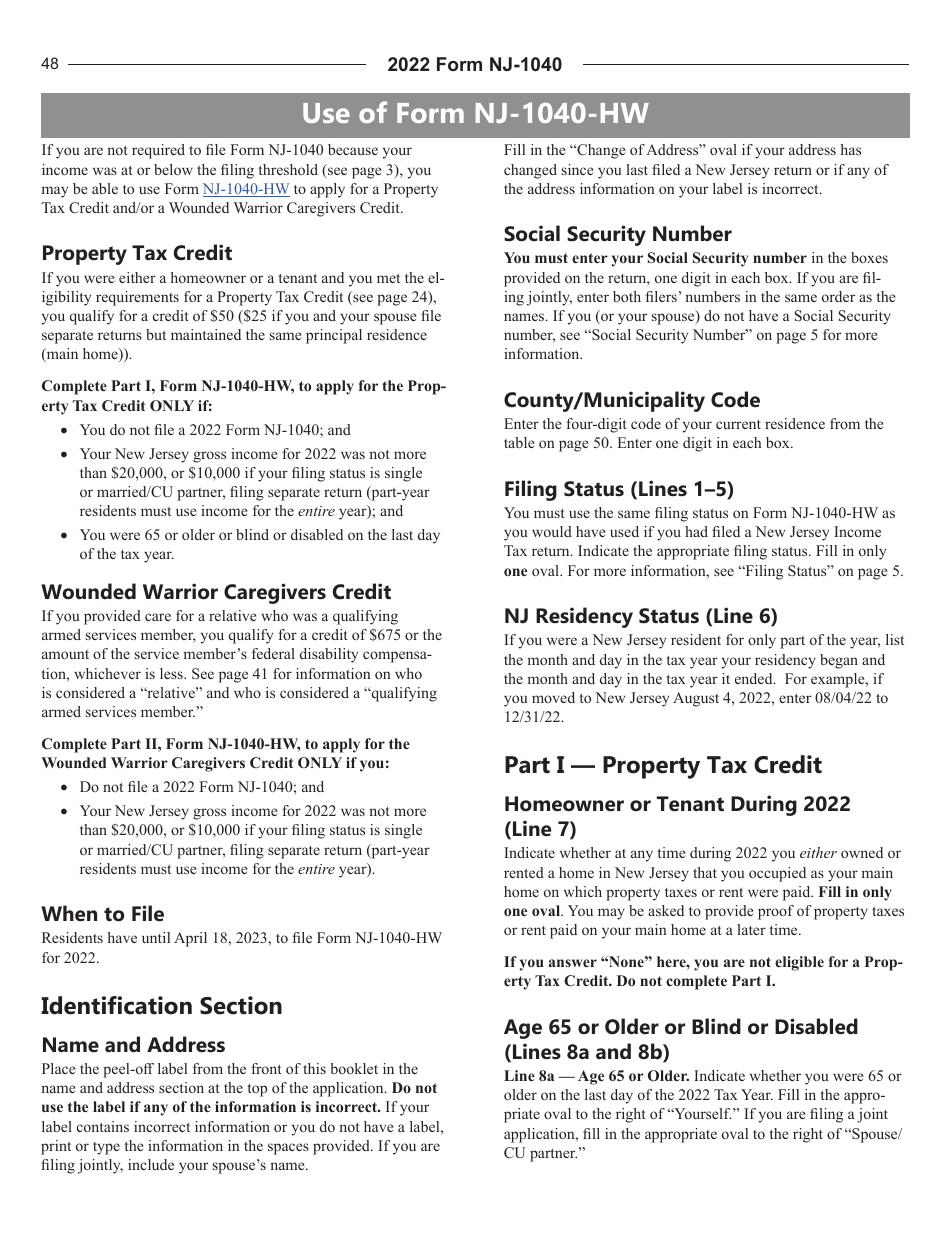

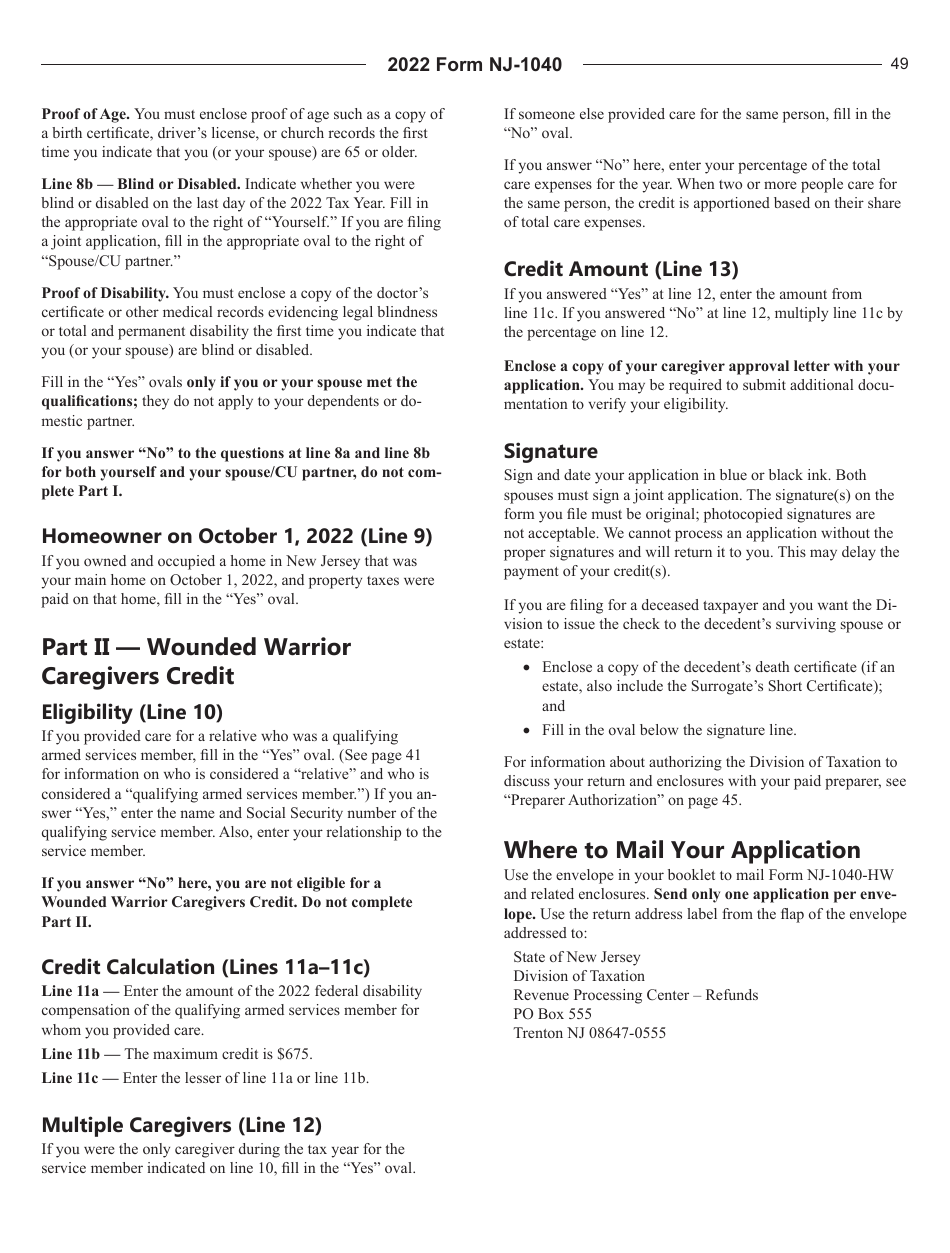

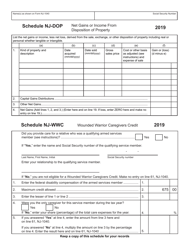

Instructions for Form NJ-1040-HW Property Tax Credit Application and Wounded Warrior Caregivers Credit Application - New Jersey

This document contains official instructions for Form NJ-1040-HW , Property Wounded Warrior Caregivers Credit Application - a form released and collected by the New Jersey Department of the Treasury. An up-to-date fillable Form NJ-1040-HW is available for download through this link.

FAQ

Q: What is Form NJ-1040-HW?

A: Form NJ-1040-HW is an application for the Property Tax Credit and Wounded Warrior Caregivers Credit in New Jersey.

Q: What is the Property Tax Credit in New Jersey?

A: The Property Tax Credit is a credit that can be claimed by eligible taxpayers to help offset the cost of property taxes.

Q: Who is eligible for the Property Tax Credit?

A: To be eligible for the Property Tax Credit in New Jersey, you must meet certain income and residency requirements.

Q: What is the Wounded Warrior Caregivers Credit?

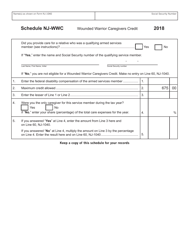

A: The Wounded Warrior Caregivers Credit is a credit that can be claimed by eligible caregivers of wounded military personnel in New Jersey.

Q: Who is eligible for the Wounded Warrior Caregivers Credit?

A: To be eligible for the Wounded Warrior Caregivers Credit in New Jersey, you must meet certain criteria as outlined in the form instructions.

Q: What documents do I need to include with Form NJ-1040-HW?

A: You may need to include documents such as proof of income, proof of property taxes paid, and documentation related to the Wounded Warrior Caregiver credit.

Q: Can I e-file Form NJ-1040-HW?

A: Yes, you can e-file Form NJ-1040-HW if you meet certain requirements. The instructions provide more information on e-filing options.

Q: What should I do if I need help with Form NJ-1040-HW?

A: If you need help with Form NJ-1040-HW or have questions, you can contact the New Jersey Division of Taxation for assistance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.