This version of the form is not currently in use and is provided for reference only. Download this version of

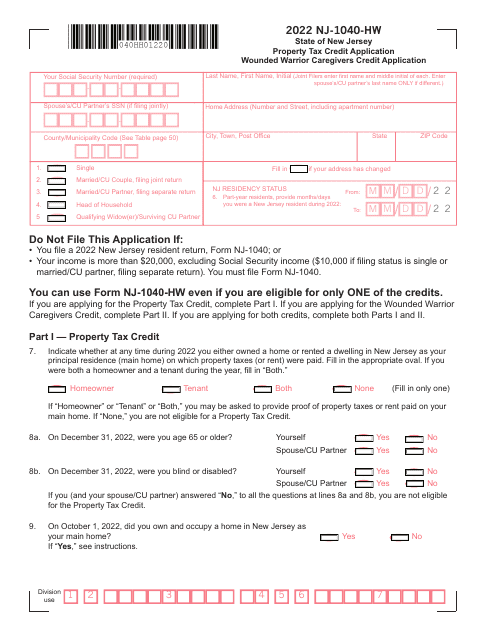

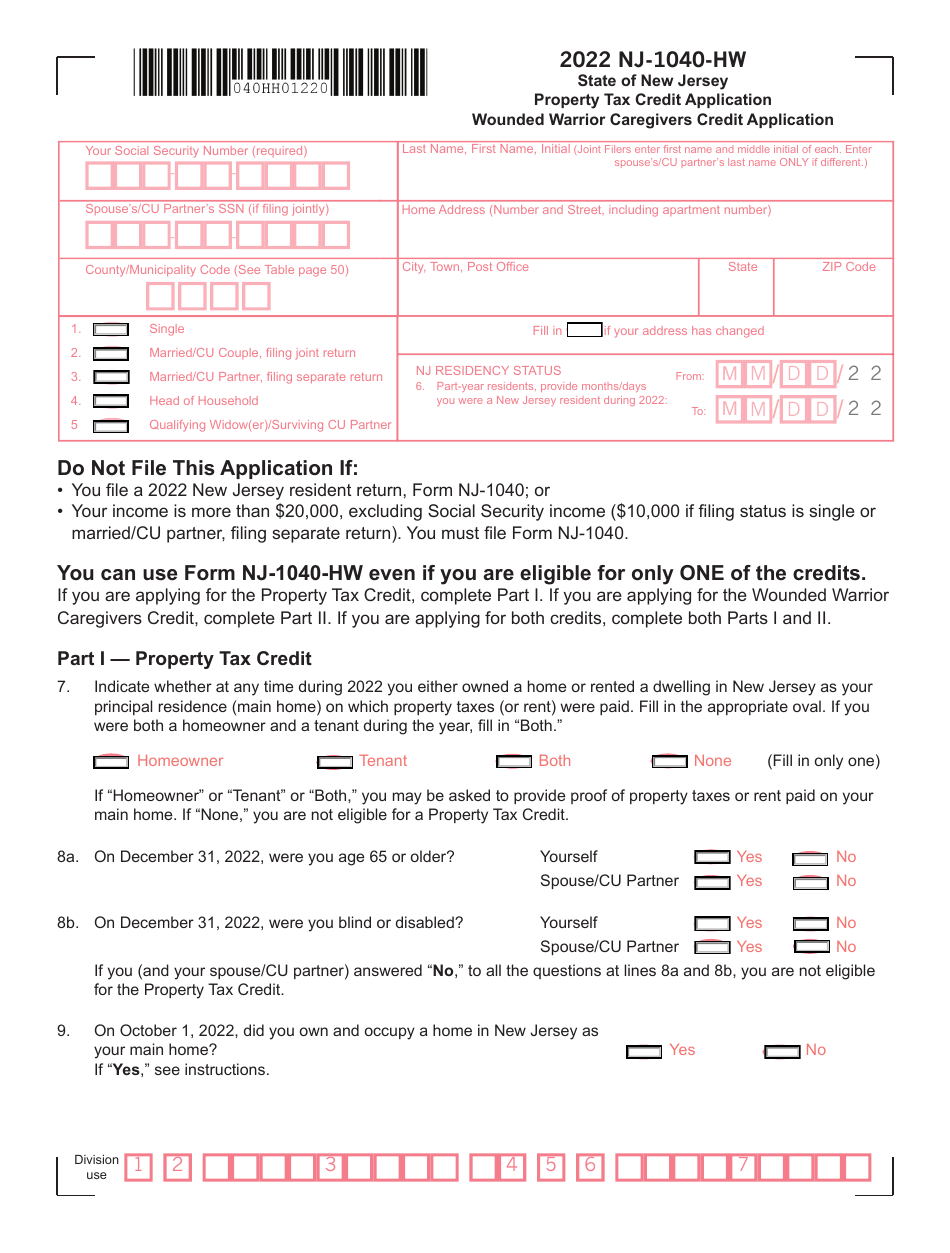

Form NJ-1040-HW

for the current year.

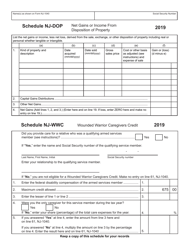

Form NJ-1040-HW Property Tax Credit Application and Wounded Warrior Caregivers Credit Application - New Jersey

What Is Form NJ-1040-HW?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is form NJ-1040-HW?

A: Form NJ-1040-HW is the Property Tax Credit Application and Wounded Warrior Caregivers Credit Application for New Jersey.

Q: What is the purpose of form NJ-1040-HW?

A: The purpose of form NJ-1040-HW is to apply for property tax credits and wounded warrior caregivers credits in New Jersey.

Q: Who is eligible to use form NJ-1040-HW?

A: Individuals who own or rent a home in New Jersey and meet certain income requirements may be eligible to use form NJ-1040-HW.

Q: What is the Property Tax Credit?

A: The Property Tax Credit is a credit that can help offset the property taxes paid by eligible individuals in New Jersey.

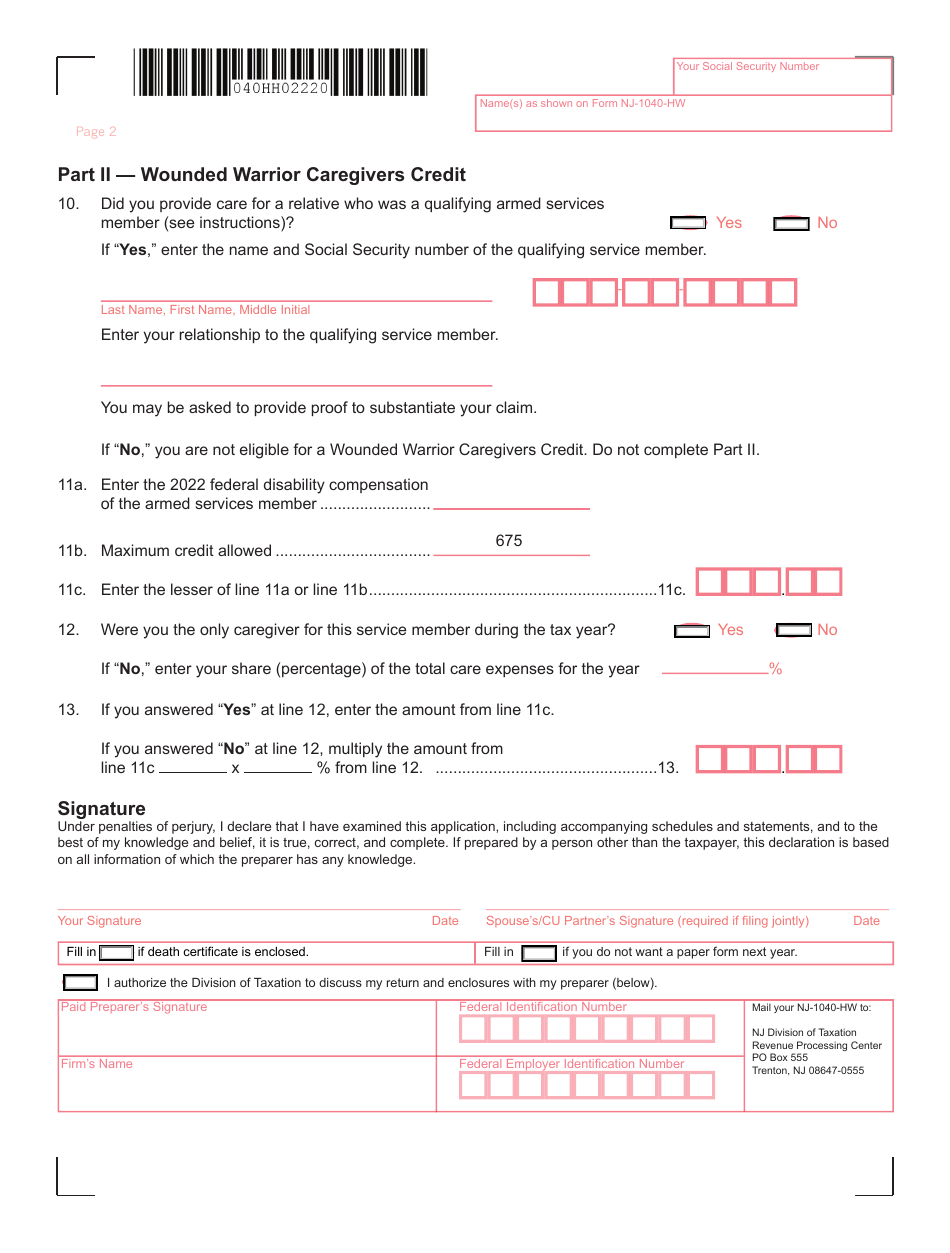

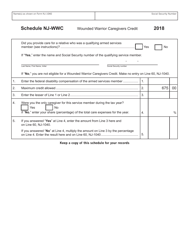

Q: What is the Wounded Warrior Caregivers Credit?

A: The Wounded Warrior Caregivers Credit is a credit available to eligible individuals who are primary caregivers for certain wounded veterans.

Q: What documents do I need to include with form NJ-1040-HW?

A: You may need to include documents such as proof of property taxes paid and proof of eligibility for the Wounded Warrior Caregivers Credit.

Q: When is the deadline for submitting form NJ-1040-HW?

A: The deadline for submitting form NJ-1040-HW is generally April 15th, but it may vary depending on the tax year.

Q: Are there any income limits for the Property Tax Credit and Wounded Warrior Caregivers Credit?

A: Yes, there are income limits to qualify for the Property Tax Credit and Wounded Warrior Caregivers Credit. The specific limits may vary each year.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040-HW by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.