This version of the form is not currently in use and is provided for reference only. Download this version of

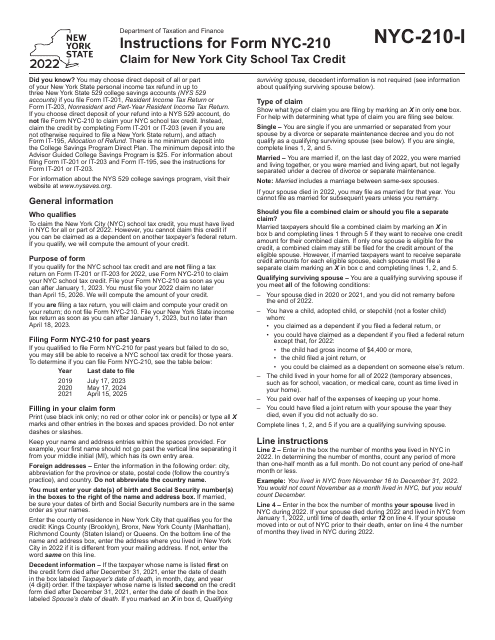

Instructions for Form NYC-210

for the current year.

Instructions for Form NYC-210 Claim for New York City School Tax Credit - New York

This document contains official instructions for Form NYC-210 , Claim for New York City School Tax Credit - a form released and collected by the New York State Department of Taxation and Finance.

FAQ

Q: What is Form NYC-210?

A: Form NYC-210 is a form used to claim the New York City School Tax Credit.

Q: Who can claim the New York City School Tax Credit?

A: The New York City School Tax Credit can be claimed by New York City residents who meet certain income requirements.

Q: What is the purpose of the New York City School Tax Credit?

A: The purpose of the New York City School Tax Credit is to provide financial relief to qualifying residents for school-related expenses.

Q: How do I qualify for the New York City School Tax Credit?

A: To qualify for the New York City School Tax Credit, you must meet income requirements and have paid eligible school-related expenses.

Q: What are eligible school-related expenses?

A: Eligible school-related expenses include tuition, fees, and supplies for kindergarten through 12th grade.

Q: When is the deadline for filing the Form NYC-210?

A: The deadline for filing the Form NYC-210 is April 15th of the following year.

Q: Can I claim the New York City School Tax Credit if I am not a resident of New York City?

A: No, the New York City School Tax Credit can only be claimed by New York City residents.

Q: Is the New York City School Tax Credit refundable?

A: Yes, the New York City School Tax Credit is refundable, meaning you may receive a refund if the credit exceeds your tax liability.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.