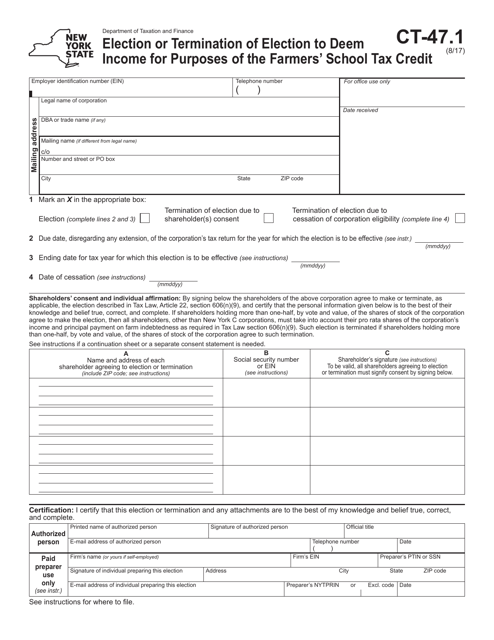

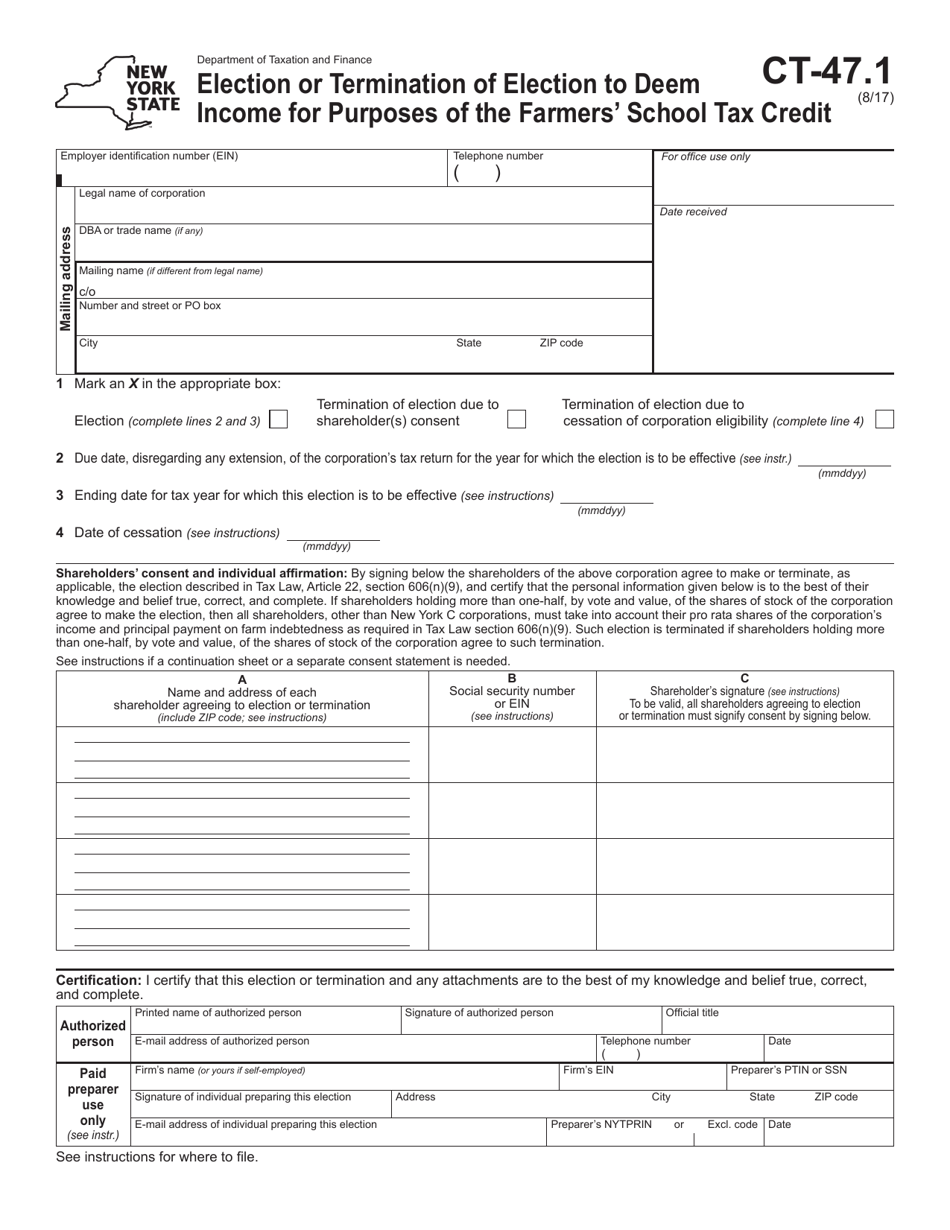

Form CT-47.1 Election or Termination of Election to Deem Income for Purposes of the Farmers' School Tax Credit - New York

What Is Form CT-47.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-47.1?

A: Form CT-47.1 is a form used in New York to elect or terminate the election to deem income for purposes of the Farmers' School Tax Credit.

Q: What is the Farmers' School Tax Credit?

A: The Farmers' School Tax Credit is a tax credit available for farmers in New York.

Q: Who can use Form CT-47.1?

A: Farmers in New York can use Form CT-47.1 to elect or terminate the election to deem income for purposes of the Farmers' School Tax Credit.

Q: What is the purpose of electing to deem income for the Farmers' School Tax Credit?

A: Electing to deem income for the Farmers' School Tax Credit allows farmers to qualify for the tax credit based on a higher income.

Form Details:

- Released on August 1, 2017;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-47.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.