This version of the form is not currently in use and is provided for reference only. Download this version of

Form IT-649

for the current year.

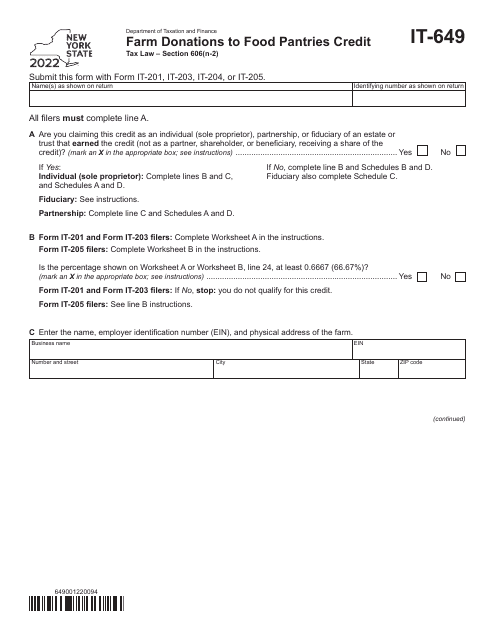

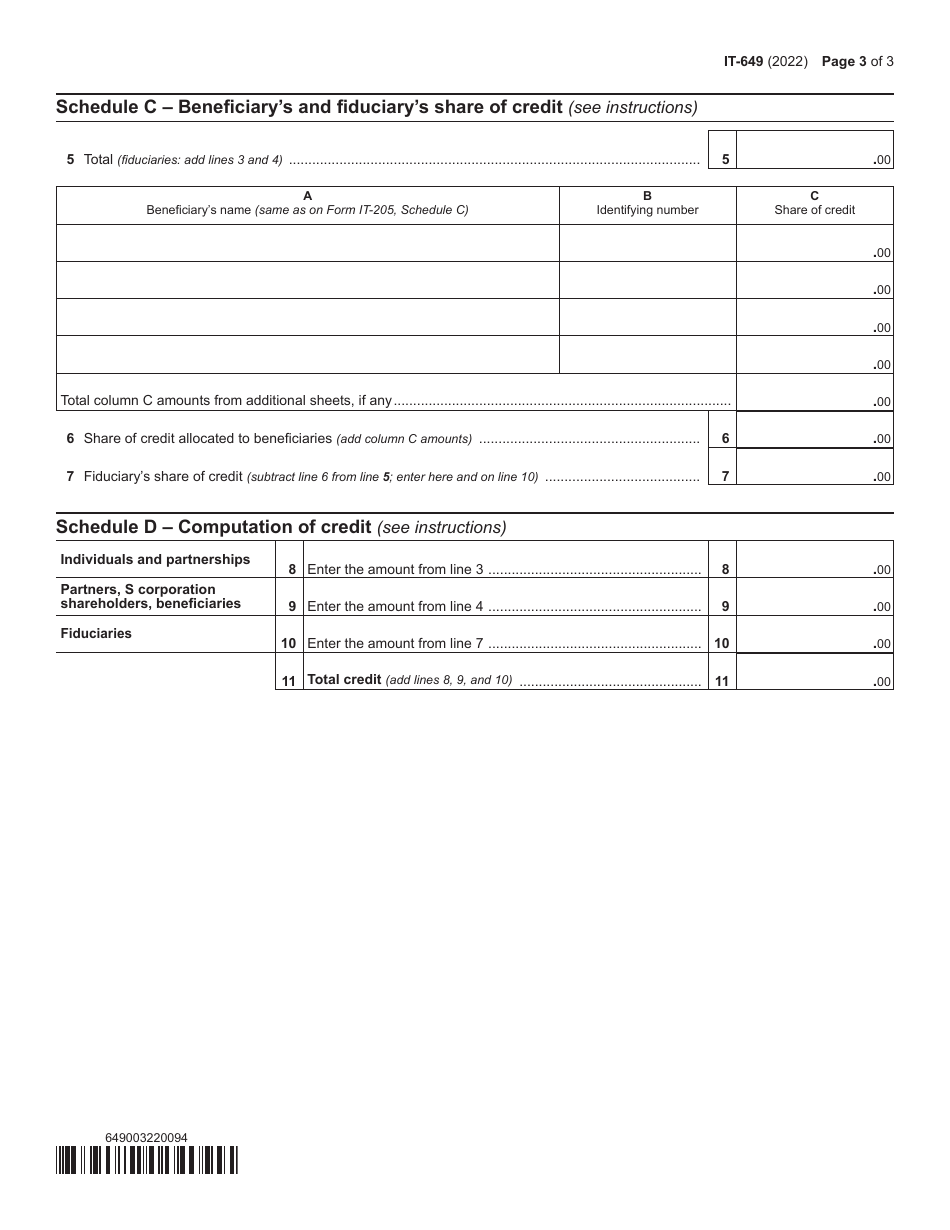

Form IT-649 Farm Donations to Food Pantries Credit - New York

What Is Form IT-649?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-649?

A: Form IT-649 is a tax form in New York specifically for individuals and businesses who have made donations of food or farm products to eligible food pantries.

Q: Who is eligible to claim the Farm Donations to Food Pantries Credit?

A: Individuals and businesses who have made qualified donations of food or farm products to eligible food pantries in New York are eligible to claim this credit.

Q: What is the purpose of the Farm Donations to Food Pantries Credit?

A: The purpose of this credit is to encourage individuals and businesses to donate excess food or farm products to eligible food pantries, thereby helping to address food insecurity in New York.

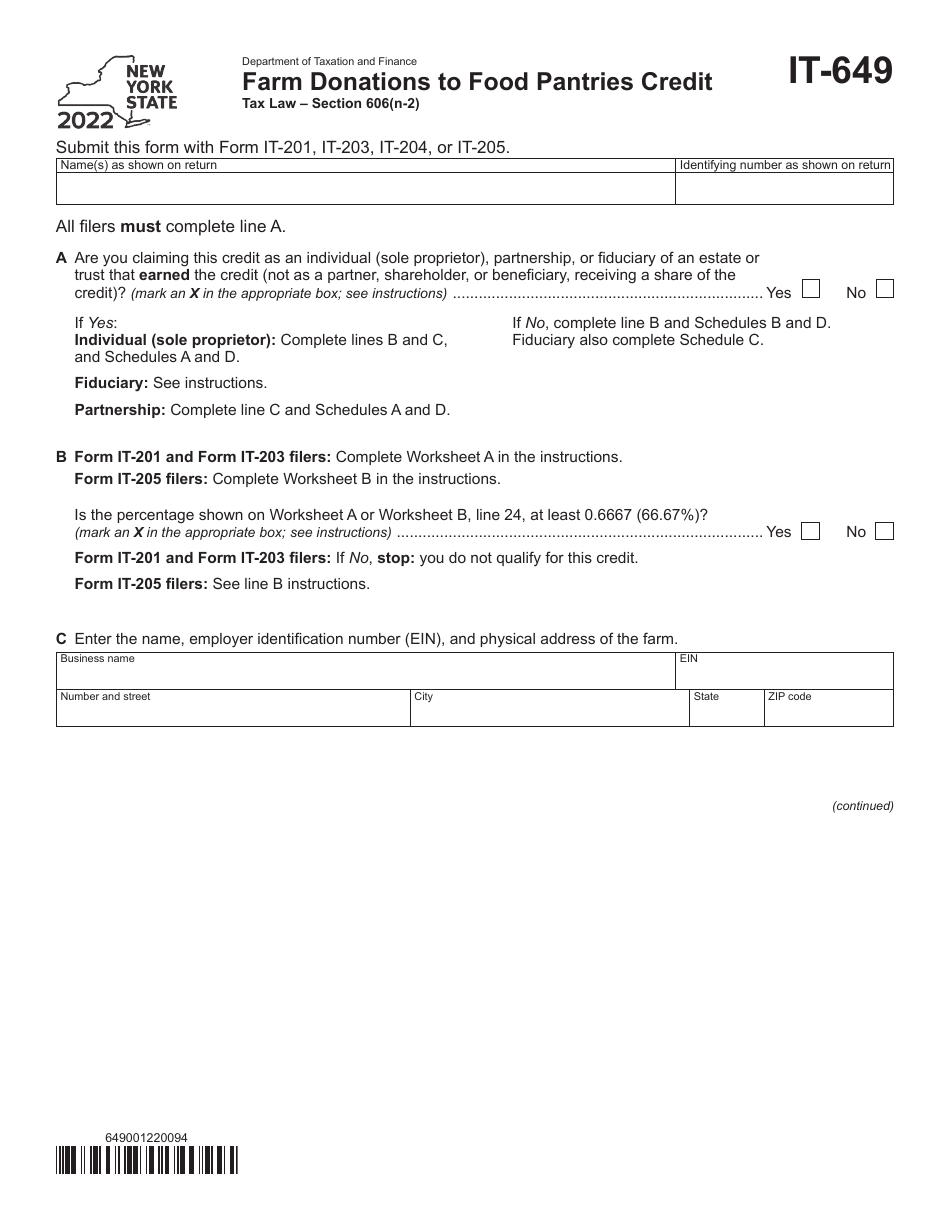

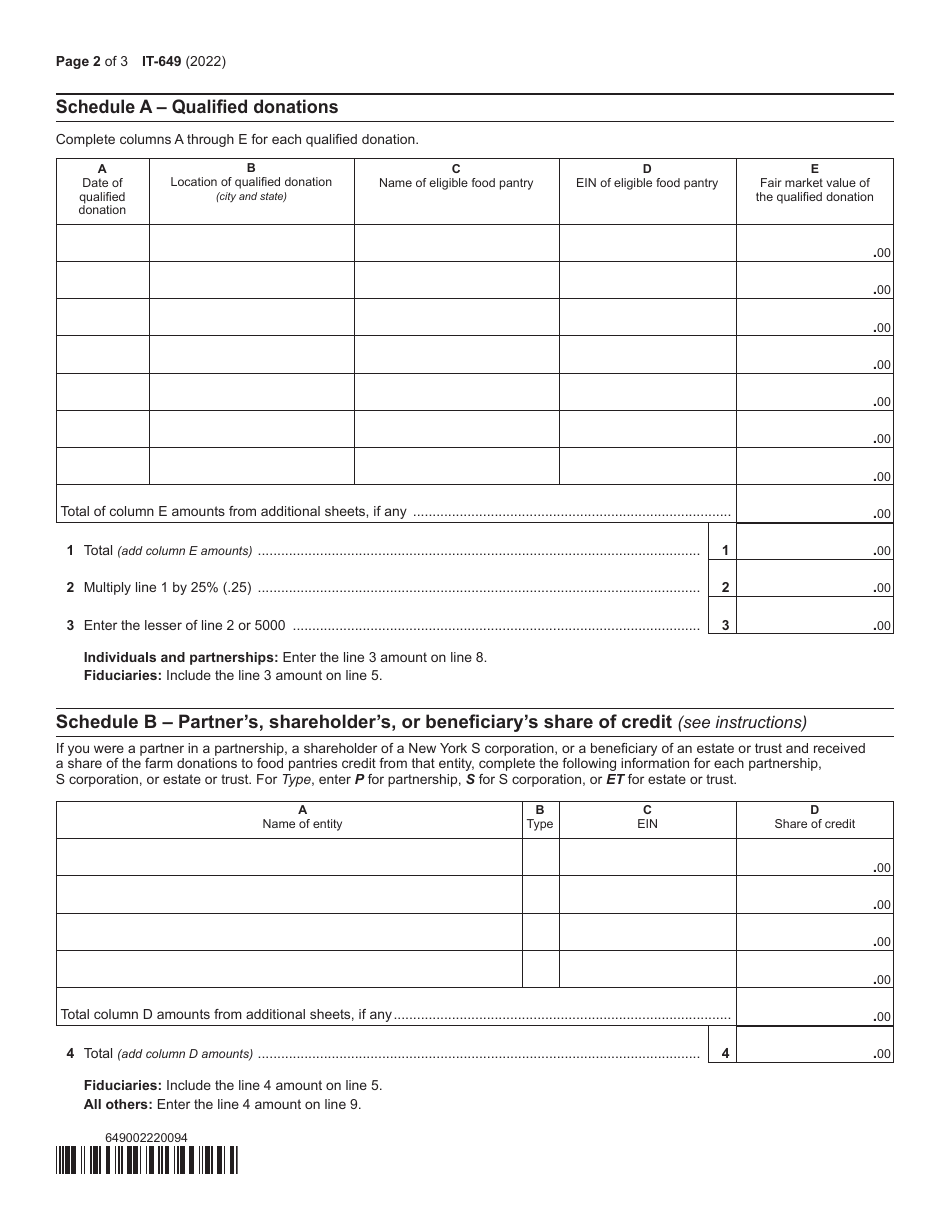

Q: How much is the Farm Donations to Food Pantries Credit?

A: The credit is equal to 25% of the value of qualified donations made during the tax year, up to a maximum credit of $5,000.

Q: What are qualified donations for this credit?

A: Qualified donations include donations of food or farm products that are fit for human consumption and meet certain criteria specified by the New York Department of Taxation and Finance.

Q: How do I claim the Farm Donations to Food Pantries Credit?

A: To claim this credit, individuals and businesses must complete and file Form IT-649 along with their tax return. It is important to keep records and documentation of the donations made.

Q: Are there any limitations or restrictions for claiming this credit?

A: Yes, the credit is nonrefundable and cannot exceed the taxpayer's tax liability for the year. Additionally, the credit cannot be carried forward or transferred.

Q: What is the deadline for claiming this credit?

A: The deadline for claiming the Farm Donations to Food Pantries Credit is the same as the deadline for filing your New York State tax return, which is usually April 15th.

Q: Are there any other credits or incentives related to food donations in New York?

A: Yes, in addition to the Farm Donations to Food Pantries Credit, New York also offers the Food Donation and Conservation EasementTax Credit and the Enhanced Farmers' School Donation Credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-649 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.