This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-649

for the current year.

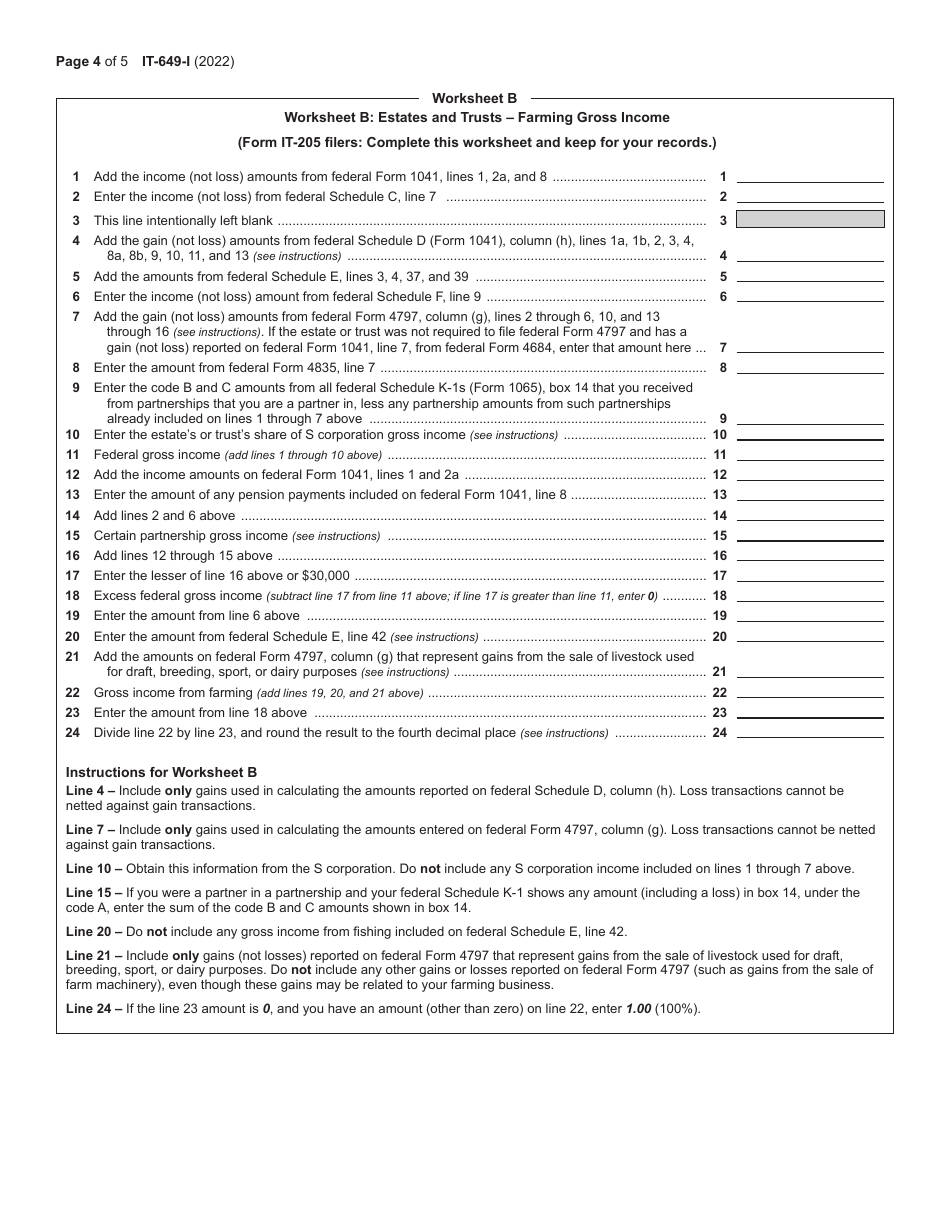

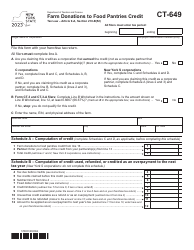

Instructions for Form IT-649 Farm Donations to Food Pantries Credit - New York

This document contains official instructions for Form IT-649 , Farm Donations to Food Pantries Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-649 is available for download through this link.

FAQ

Q: What is Form IT-649?

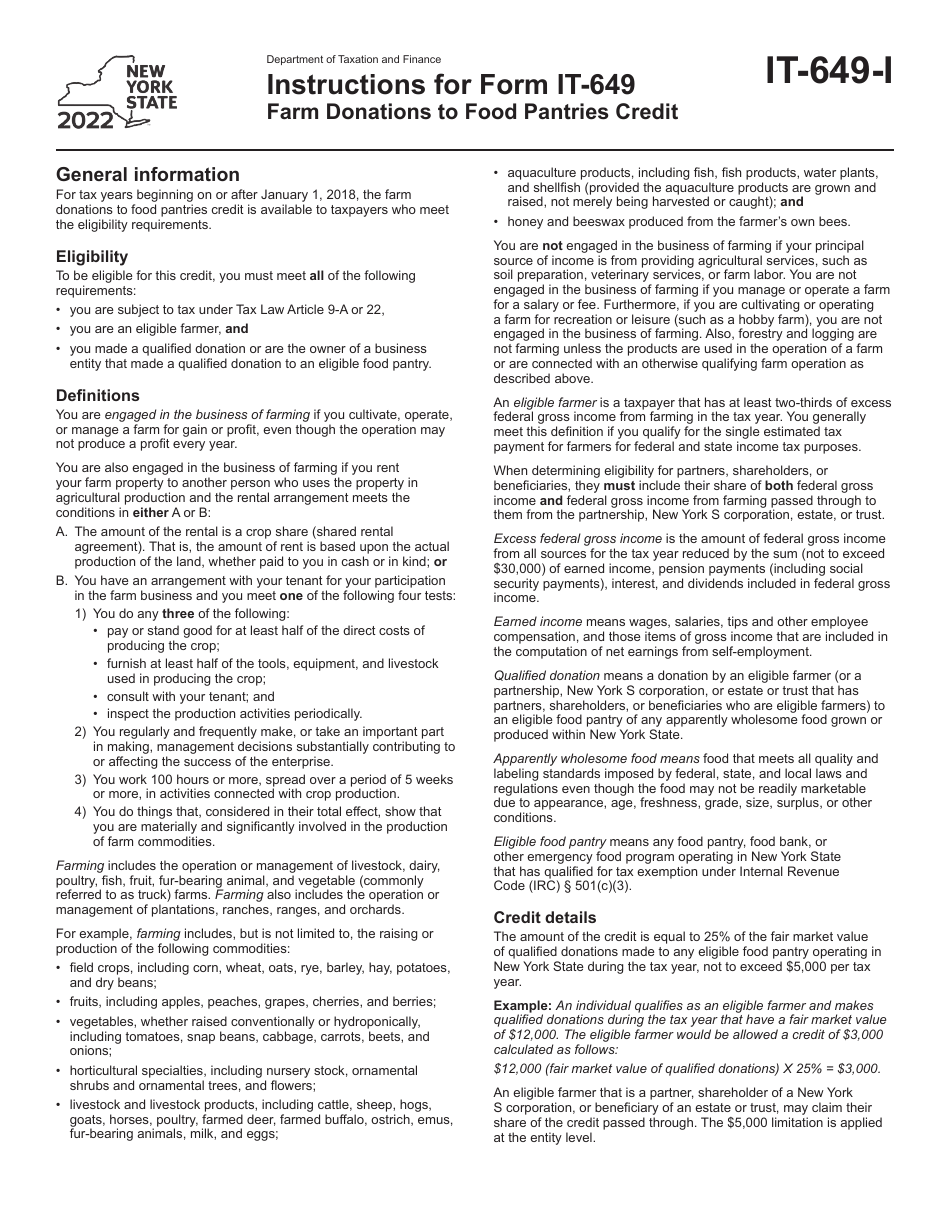

A: Form IT-649 is a tax form in New York used to claim the Farm Donations to Food Pantries Credit.

Q: Who can claim the Farm Donations to Food Pantries Credit?

A: Farmers in New York who make qualifying donations to food pantries can claim this credit.

Q: What is the purpose of the Farm Donations to Food Pantries Credit?

A: The purpose of this credit is to incentivize farmers to donate food products to eligible food pantries.

Q: How do I qualify for the Farm Donations to Food Pantries Credit?

A: To qualify, you must be a farmer in New York and make eligible donations of food products to eligible food pantries.

Q: What types of donations are eligible for the credit?

A: Eligible donations include fresh fruits and vegetables, meats, dairy products, and processed farm products.

Q: How much is the Farm Donations to Food Pantries Credit?

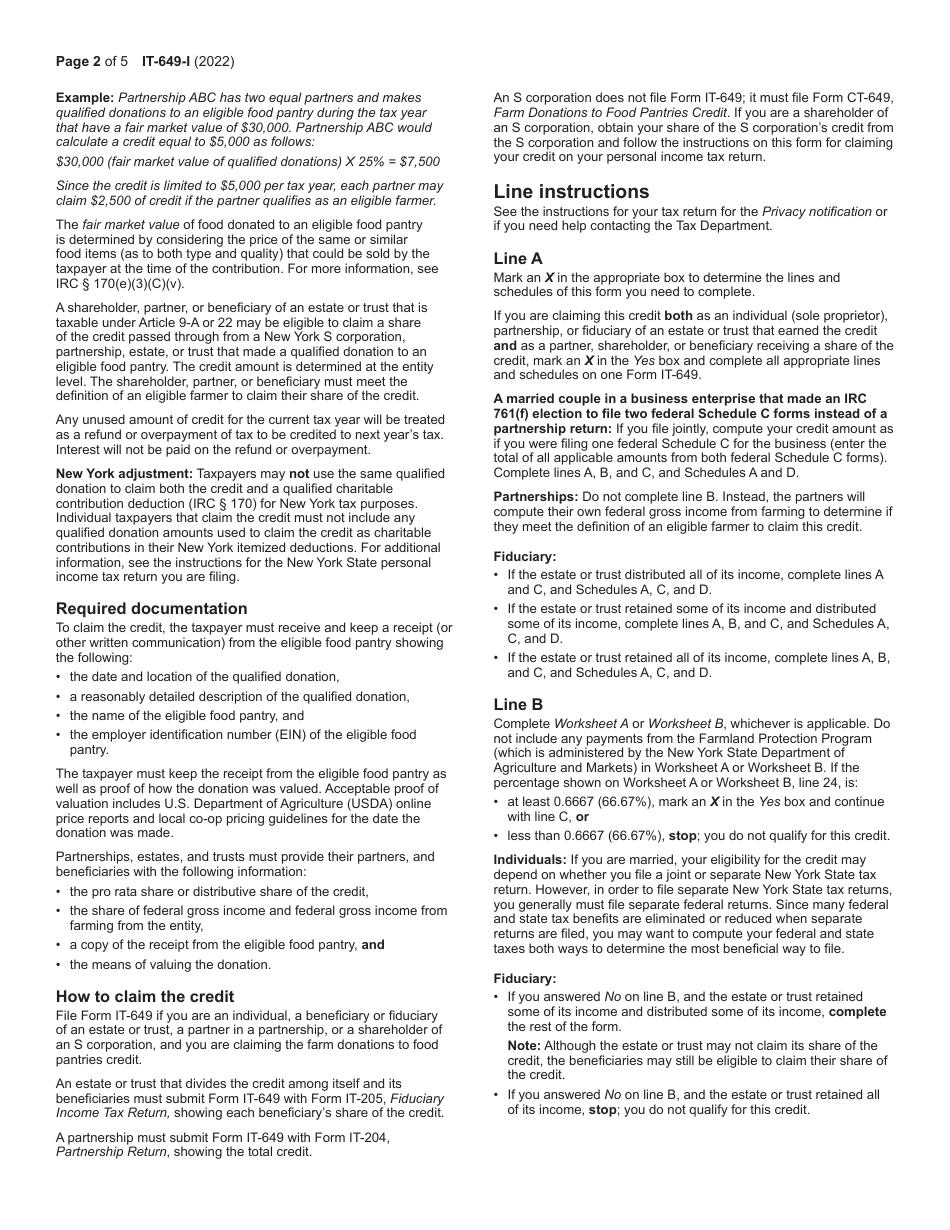

A: The credit is equal to 25% of the fair market value of the total eligible donations made during the tax year, up to a maximum credit of $5,000.

Q: How do I claim the Farm Donations to Food Pantries Credit?

A: You must complete and file Form IT-649 with your New York state tax return, including documentation of your eligible donations.

Q: Is the Farm Donations to Food Pantries Credit refundable?

A: No, the credit is non-refundable, but any unused credit can be carried forward for up to 15 years.

Q: Are there any limitations on claiming the credit?

A: Yes, the credit is subject to certain limitations, including a maximum credit of $5,000 per taxpayer and a total annual statewide cap.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.