This version of the form is not currently in use and is provided for reference only. Download this version of

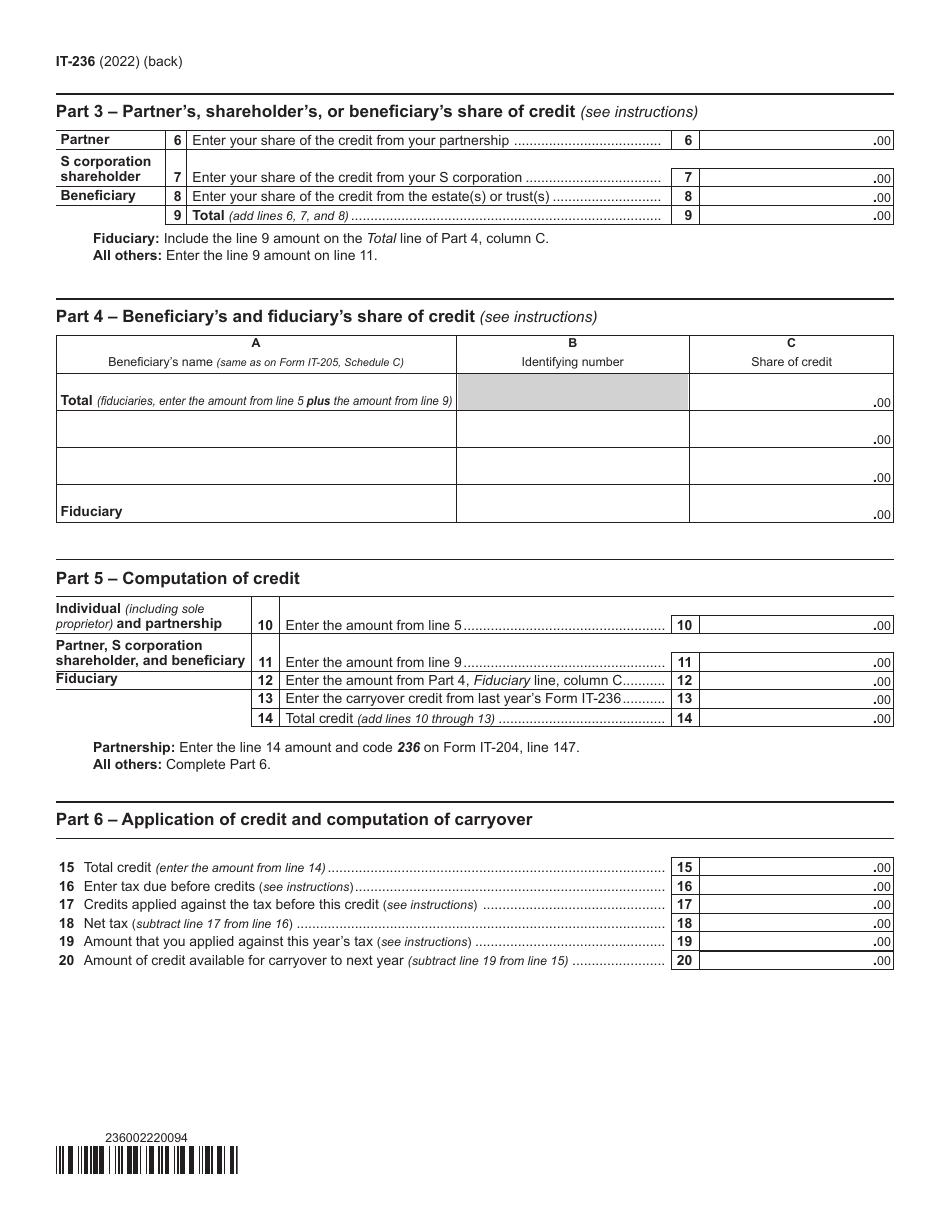

Form IT-236

for the current year.

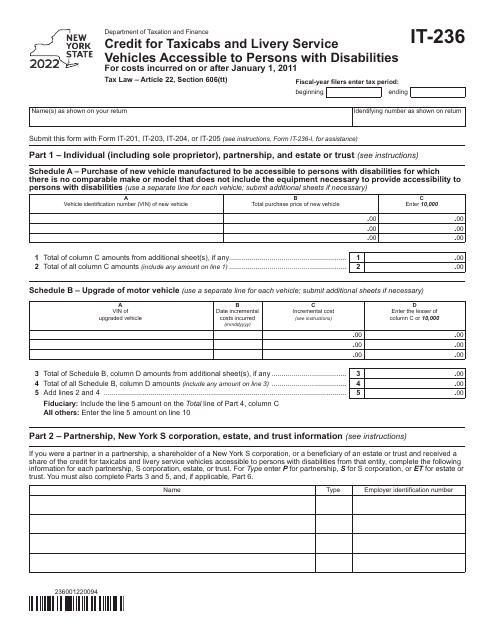

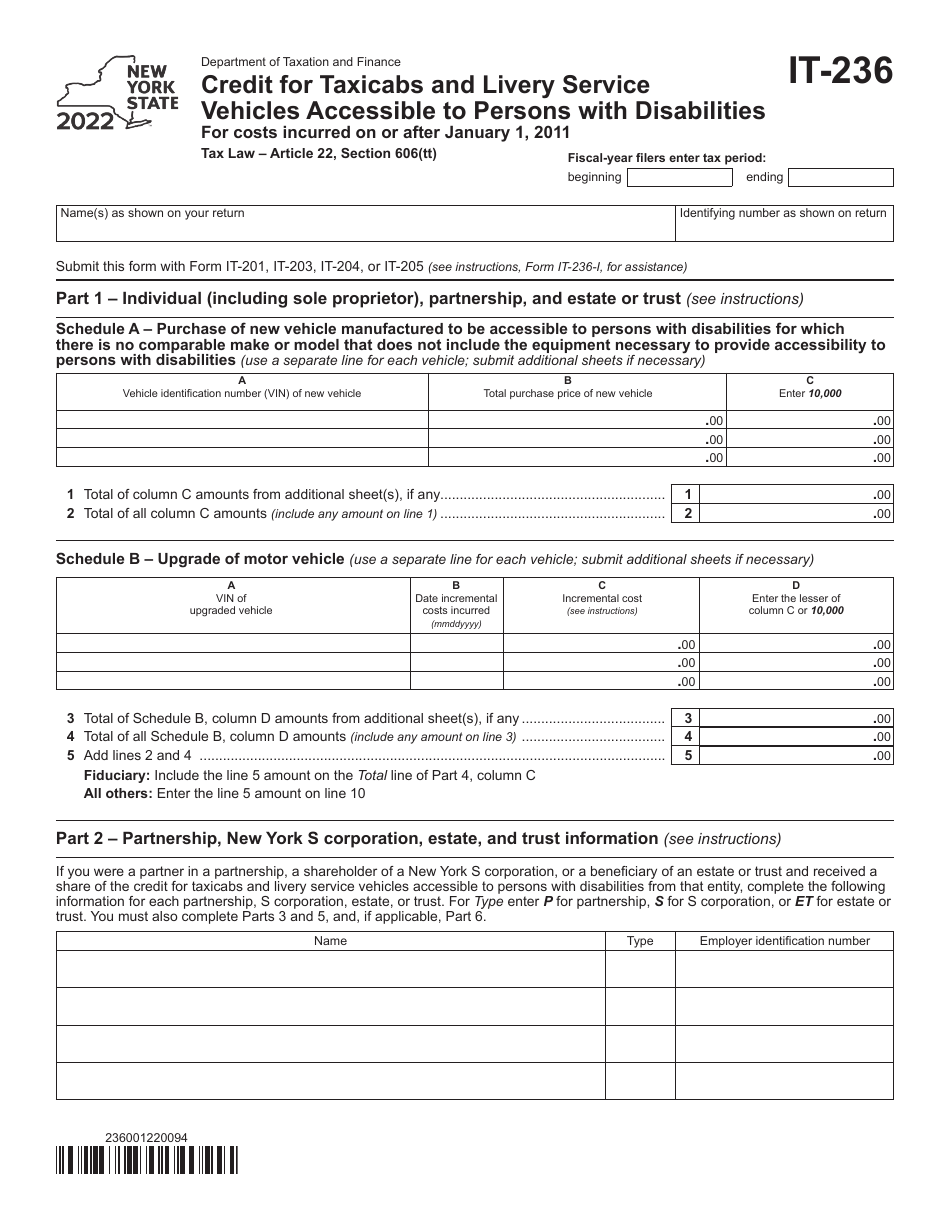

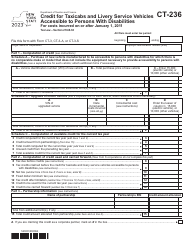

Form IT-236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities for Costs Incurred on or After January 1, 2011 - New York

What Is Form IT-236?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IT-236?

A: Form IT-236 is a tax form used in New York for claiming the Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities.

Q: Who can claim the Credit for Taxicabs and Livery Service Vehicles Accessible to Persons with Disabilities?

A: Individuals or businesses who own or lease taxicabs or livery service vehicles that are accessible to persons with disabilities can claim this credit.

Q: What expenses can be claimed for this credit?

A: Expenses related to the purchase or modification of taxicabs or livery service vehicles to make them accessible to persons with disabilities can be claimed for this credit.

Q: What is the tax credit amount?

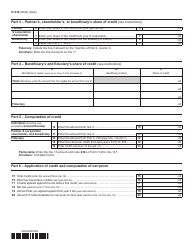

A: The tax credit amount can be up to 50% of the eligible expenses incurred.

Q: When can the credit be claimed?

A: The credit can be claimed for costs incurred on or after January 1, 2011.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-236 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.