This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form IT-236

for the current year.

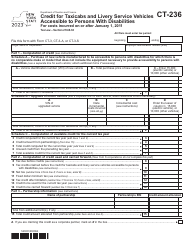

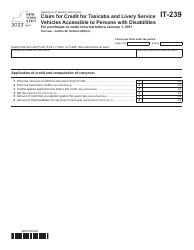

Instructions for Form IT-236 Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities for Costs Incurred on or After January 1, 2011 - New York

This document contains official instructions for Form IT-236 , Credit for Taxicabs and Livery Service Vehicles Accessible to Costs Incurred on or After January 1, 2011 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form IT-236 is available for download through this link.

FAQ

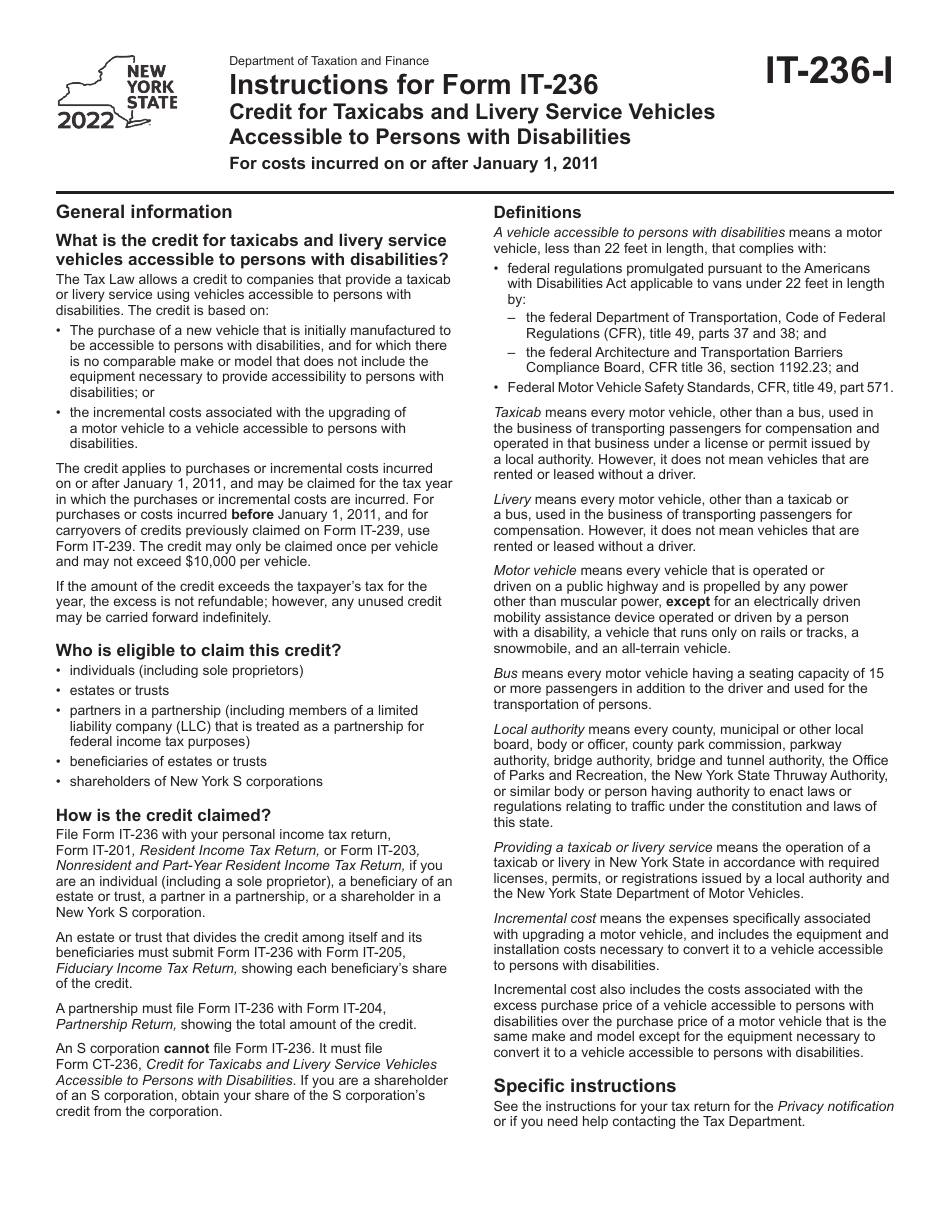

Q: What is Form IT-236?

A: Form IT-236 is a tax form in New York for claiming the Credit for Taxicabs and Livery Service Vehicles Accessible to Persons With Disabilities.

Q: What is the purpose of Form IT-236?

A: The purpose of Form IT-236 is to allow individuals or businesses to claim a tax credit for costs incurred related to taxicabs and livery service vehicles accessible to persons with disabilities.

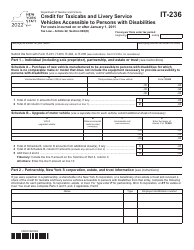

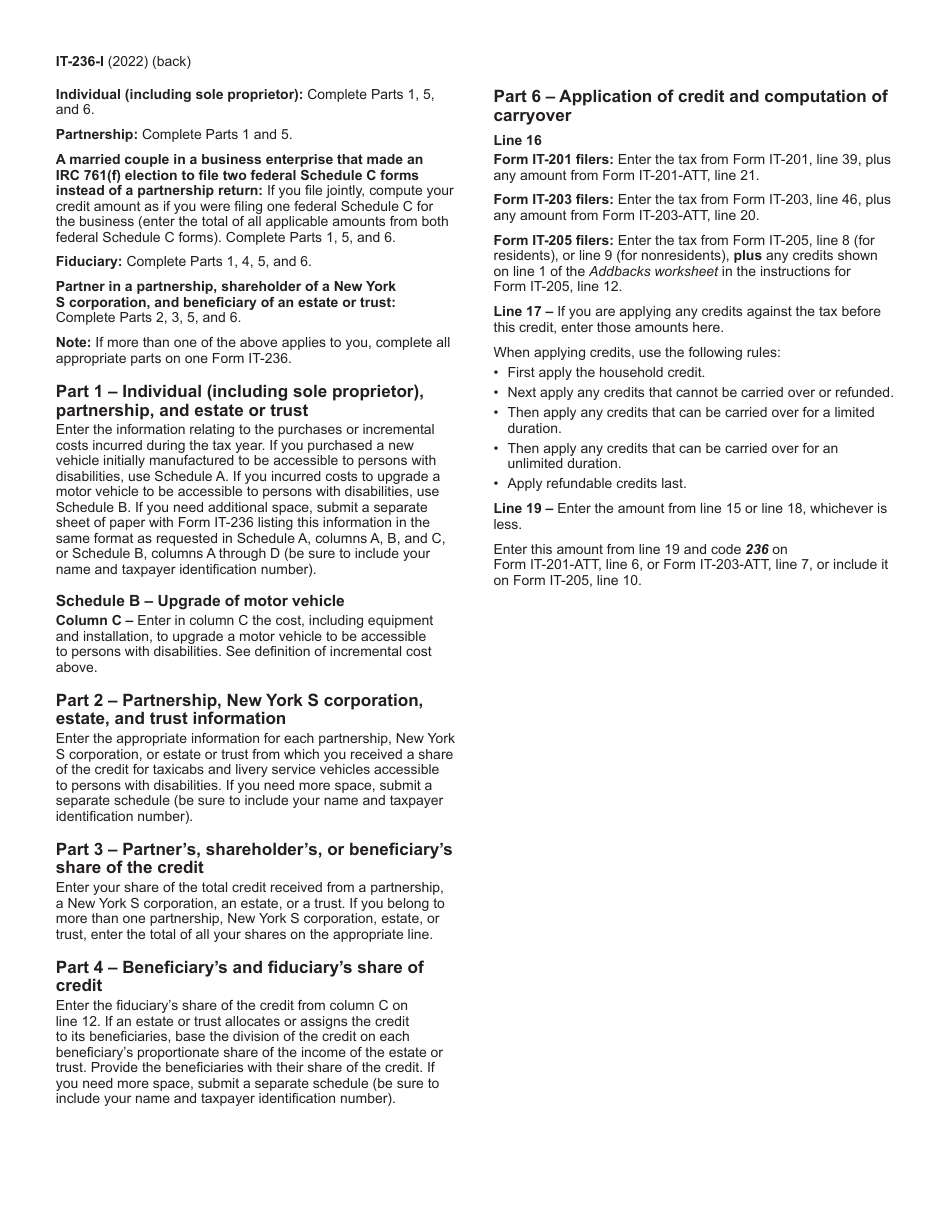

Q: What expenses can be claimed on Form IT-236?

A: Expenses related to the purchase or modification of taxicabs and livery service vehicles to make them accessible to persons with disabilities can be claimed on Form IT-236.

Q: What is the tax credit amount for Form IT-236?

A: The tax credit amount for Form IT-236 is equal to 50% of the eligible expenses, up to a maximum of $10,000 per taxicab or livery service vehicle.

Q: What are the eligibility requirements for claiming the credit?

A: To claim the credit, the taxicabs or livery service vehicles must be used primarily in New York State for transporting persons with disabilities, and must meet certain accessibility standards.

Q: When should Form IT-236 be filed?

A: Form IT-236 should be filed with your New York State tax return for the tax year in which the expenses were incurred.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.