This version of the form is not currently in use and is provided for reference only. Download this version of

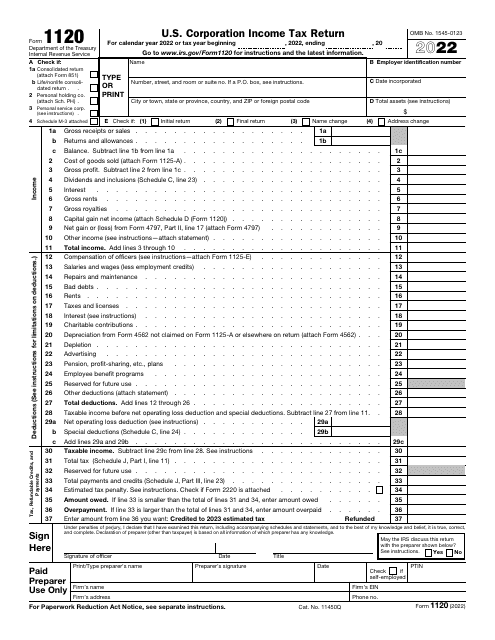

IRS Form 1120

for the current year.

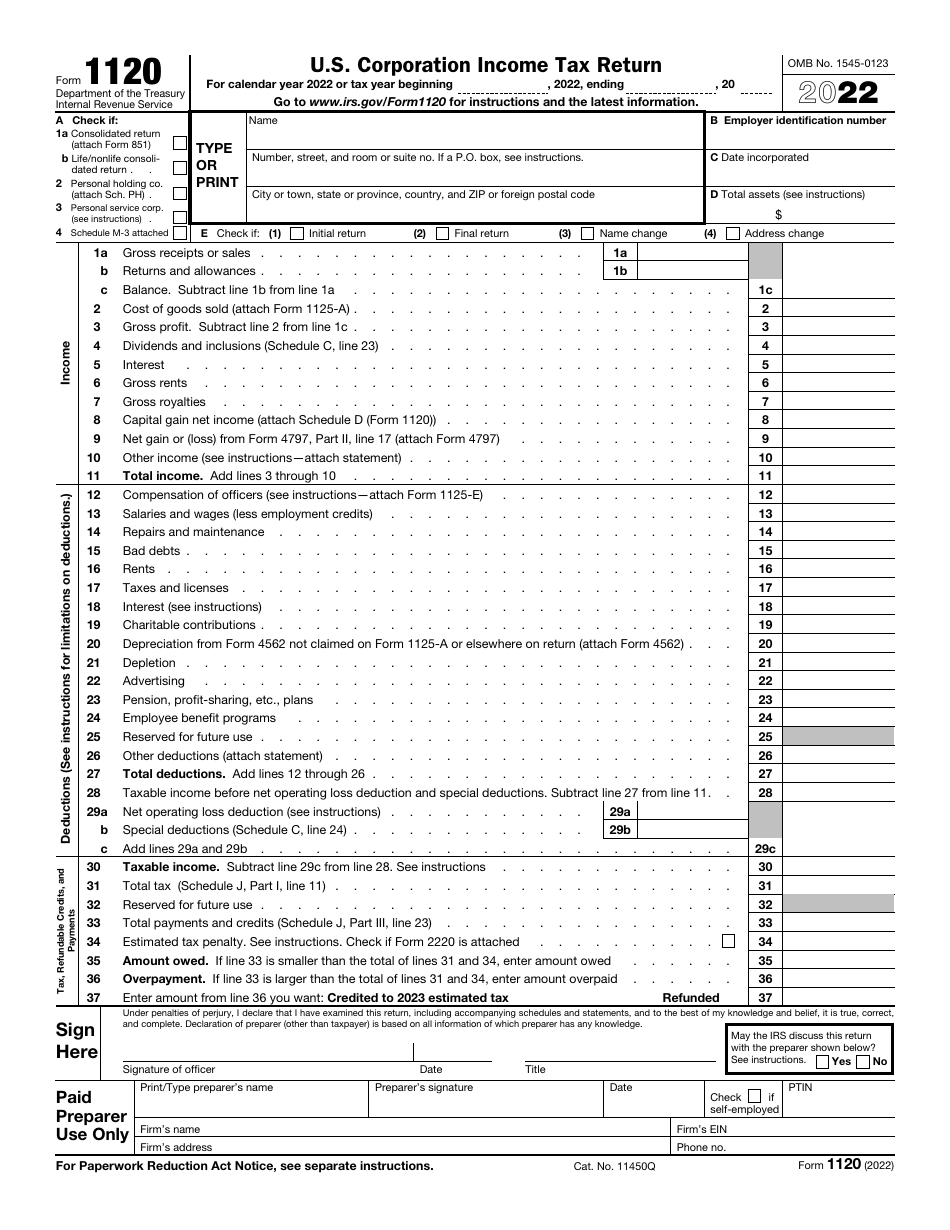

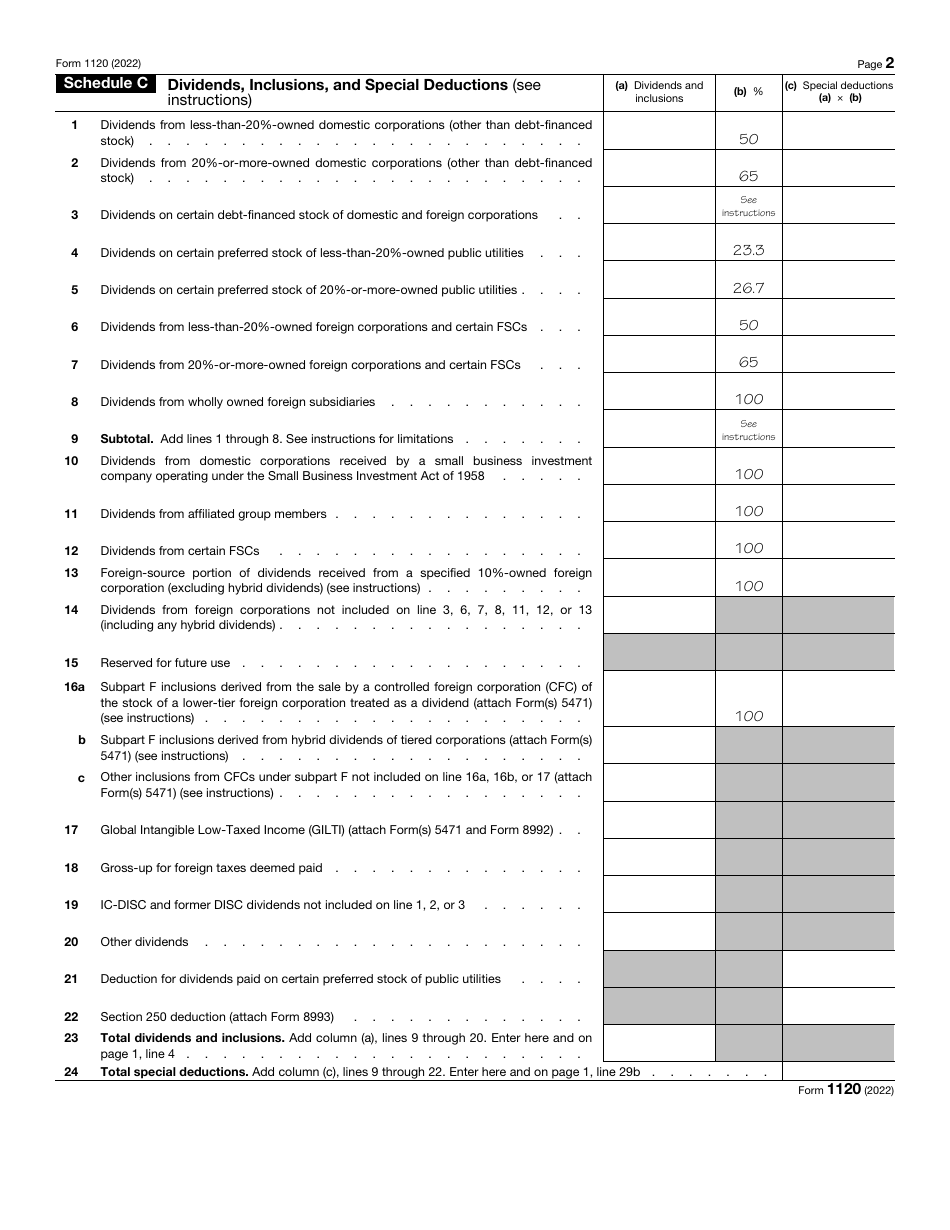

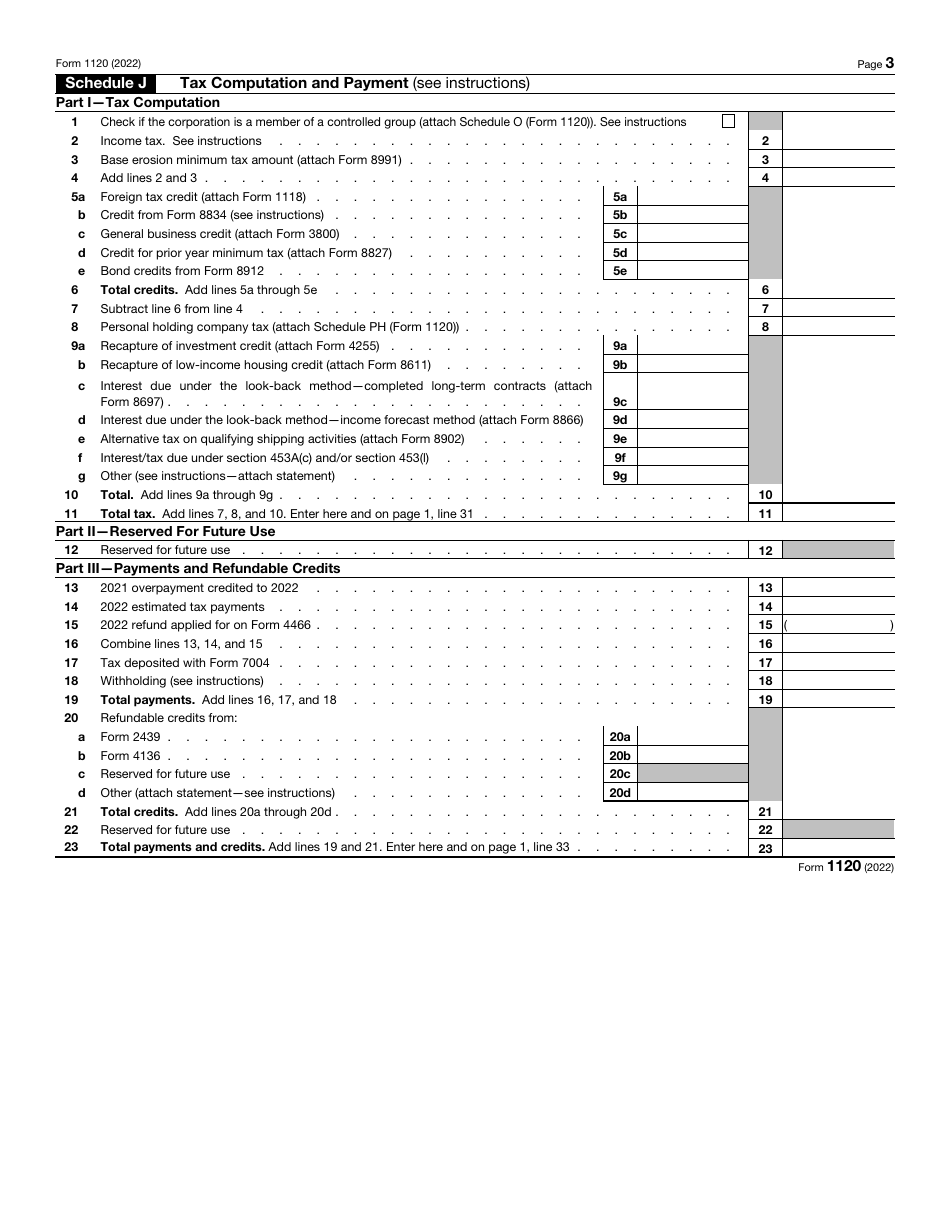

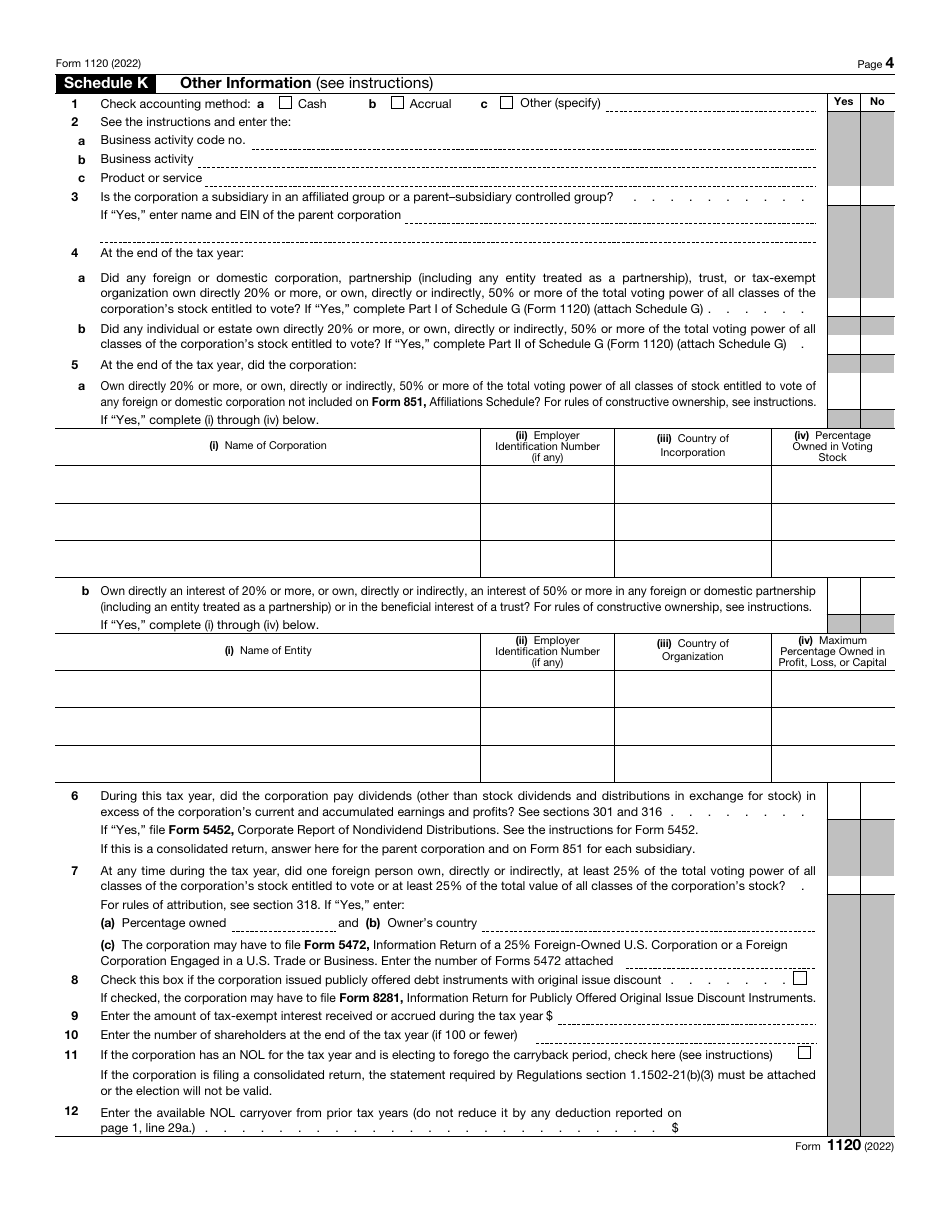

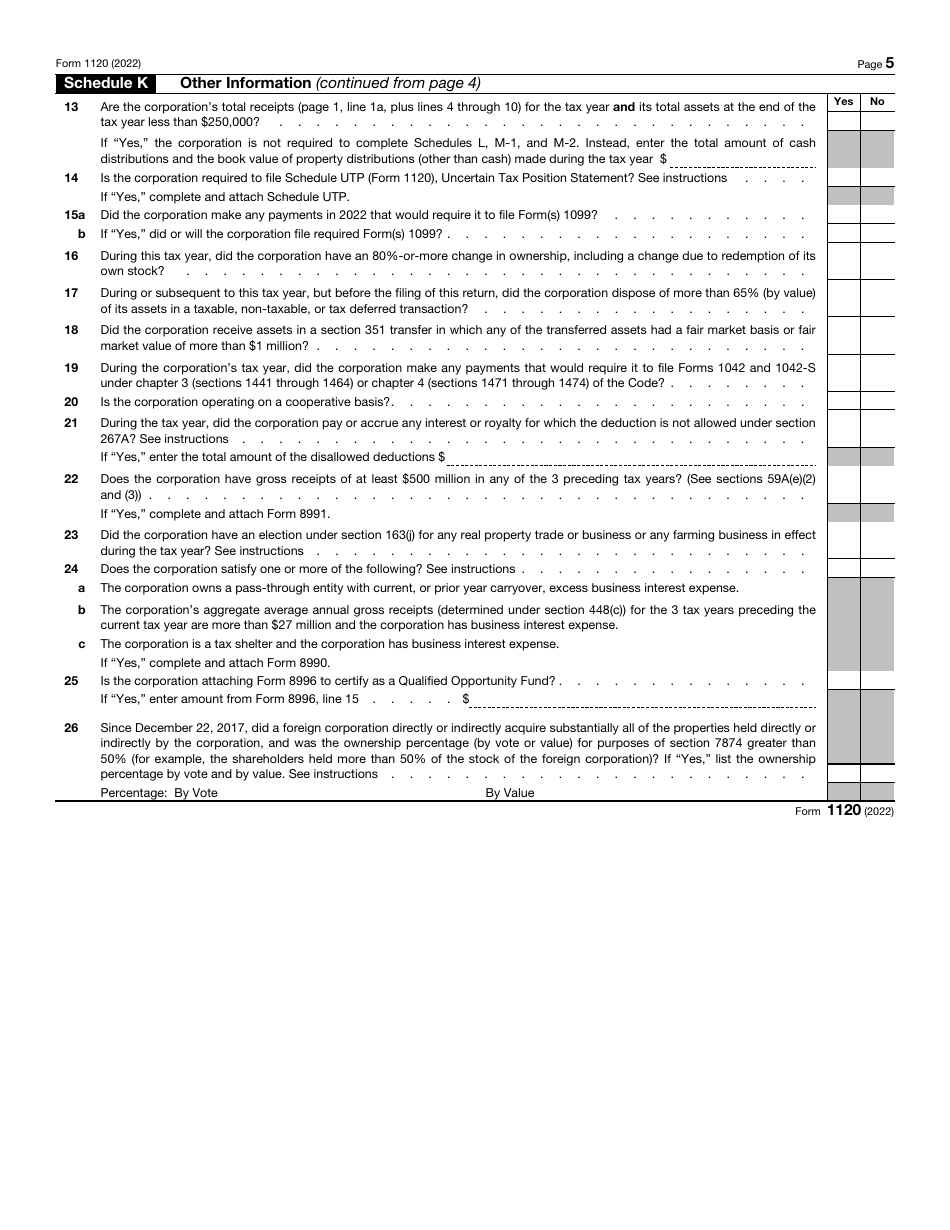

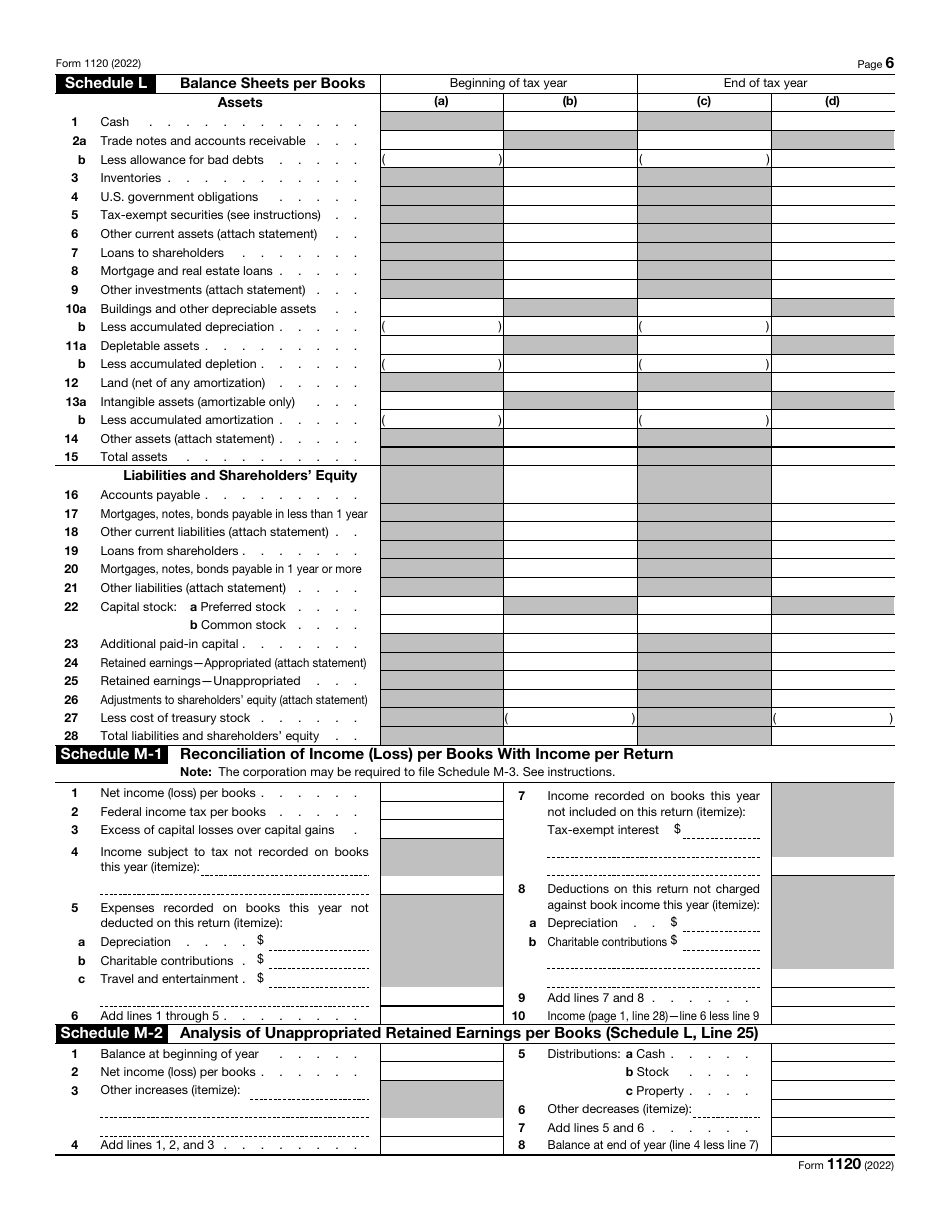

IRS Form 1120 U.S. Corporation Income Tax Return

What Is IRS Form 1120?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120?

A: IRS Form 1120 is the U.S. Corporation Income Tax Return.

Q: Who needs to file IRS Form 1120?

A: All domestic corporations (including S corporations), and certain foreign corporations, must file IRS Form 1120.

Q: When is the deadline to file IRS Form 1120?

A: The deadline to file IRS Form 1120 is typically the 15th day of the 4th month following the end of the corporation's tax year.

Q: Are there any extensions available for filing IRS Form 1120?

A: Yes, extensions are available by filing IRS Form 7004. This can provide an additional 6 months to file.

Q: What information is required to complete IRS Form 1120?

A: Some of the information required includes the corporation's income, deductions, credits, and tax liability.

Q: Are there any penalties for late or incorrect filing of IRS Form 1120?

A: Yes, penalties may be imposed for late filing, late payment, and inaccuracies on IRS Form 1120.

Q: Can I e-file IRS Form 1120?

A: Yes, most corporations are required to e-file IRS Form 1120, unless specifically granted a waiver.

Q: Can I get a refund if I overpay my taxes on IRS Form 1120?

A: Yes, corporations can receive a refund if they overpay their taxes on IRS Form 1120.

Q: Is IRS Form 1120 used for state income taxes as well?

A: No, IRS Form 1120 is only for reporting federal income taxes. State income taxes have their own separate forms.

Form Details:

- A 6-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120 through the link below or browse more documents in our library of IRS Forms.