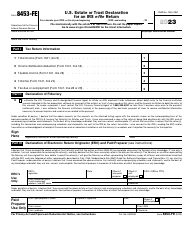

This version of the form is not currently in use and is provided for reference only. Download this version of

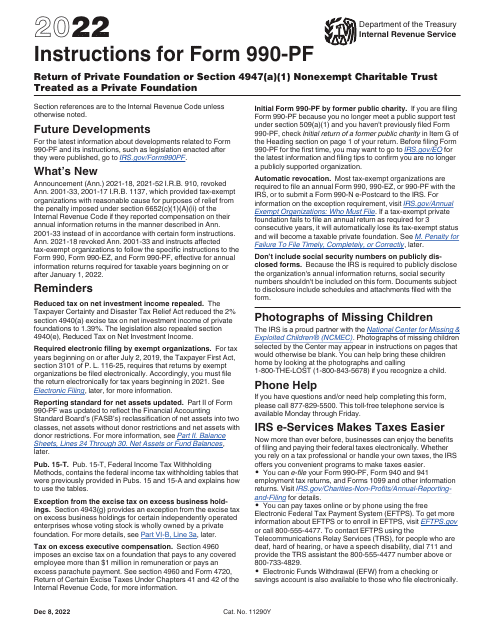

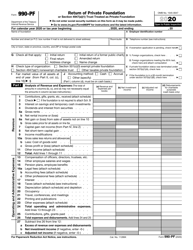

Instructions for IRS Form 990-PF

for the current year.

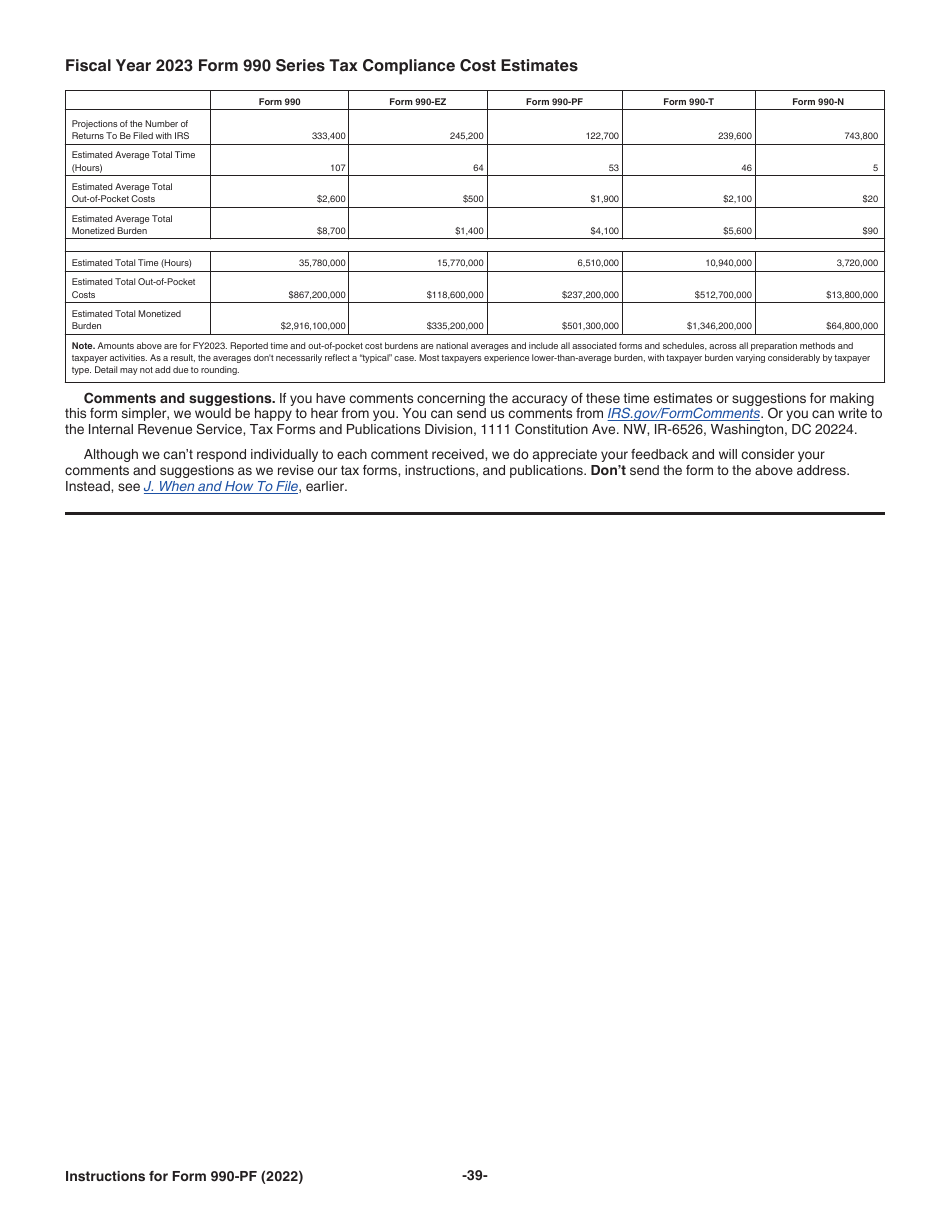

Instructions for IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Nonexempt Charitable Trust Treated as a Private Foundation

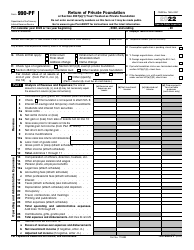

This document contains official instructions for IRS Form 990-PF , Return of Charitable Trust Treated as a Private Foundation - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990-PF is available for download through this link.

FAQ

Q: What information is required for IRS Form 990-PF?

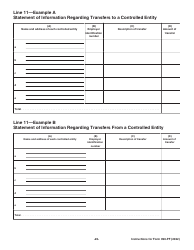

A: IRS Form 990-PF requires information about the foundation's income, expenses, grants, investments, assets, and other financial transactions.

Q: When is IRS Form 990-PF due?

A: IRS Form 990-PF is due by the 15th day of the 5th month after the end of the organization's tax year.

Q: Are there any penalties for not filing IRS Form 990-PF?

A: Yes, there are penalties for not filing IRS Form 990-PF. The penalties can vary depending on the size of the organization and the duration of the noncompliance.

Q: Can I file IRS Form 990-PF electronically?

A: Yes, you can file IRS Form 990-PF electronically using the IRS's e-File system or through approved tax software.

Q: Do I need to include any attachments with IRS Form 990-PF?

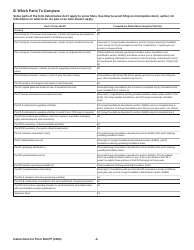

A: Yes, certain attachments may be required depending on the organization's activities and financial transactions. These attachments provide additional details and explanations.

Instruction Details:

- This 41-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.