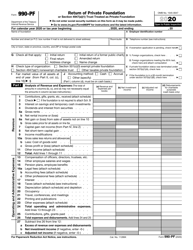

This version of the form is not currently in use and is provided for reference only. Download this version of

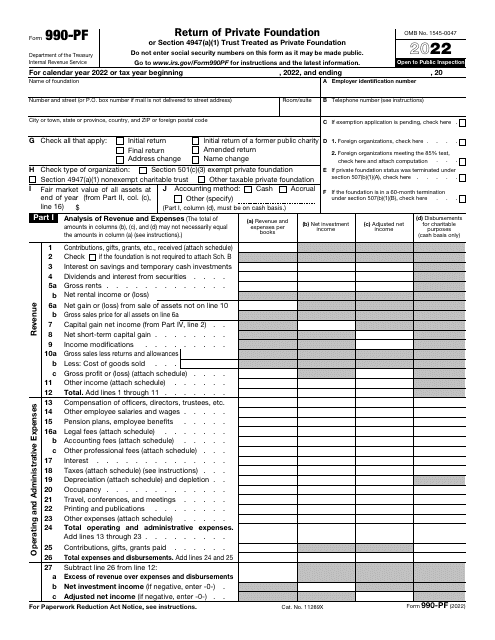

IRS Form 990-PF

for the current year.

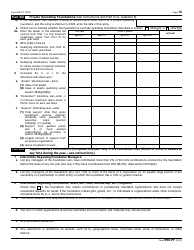

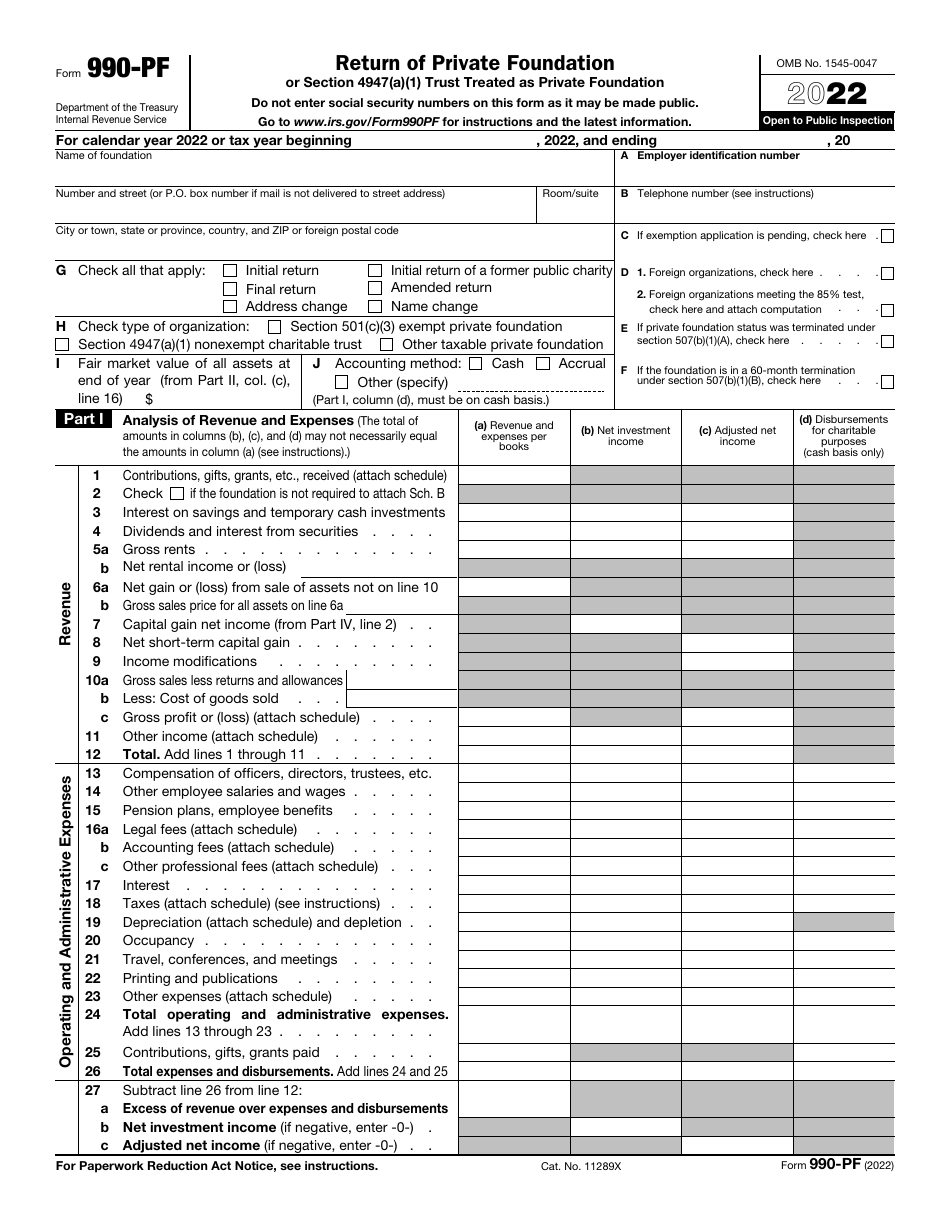

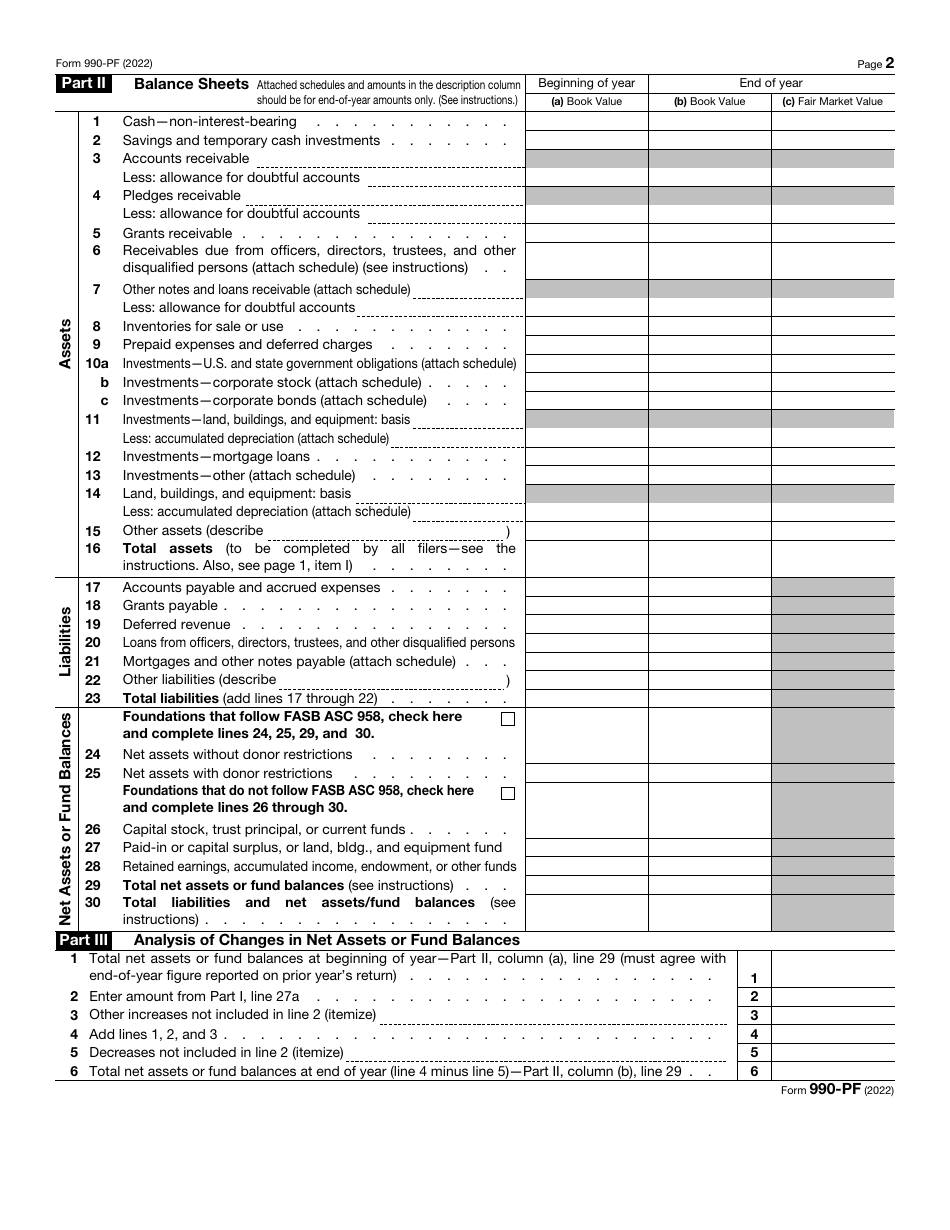

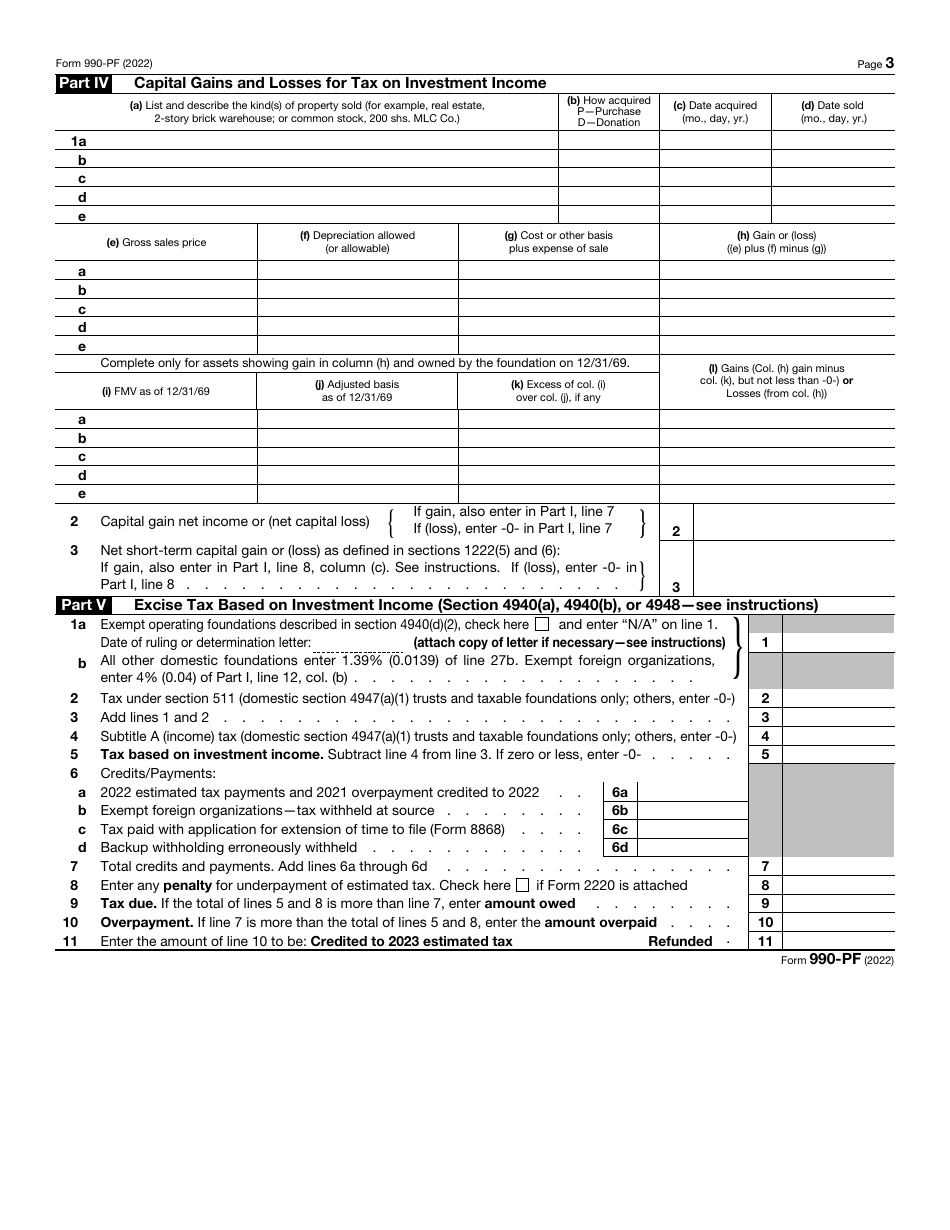

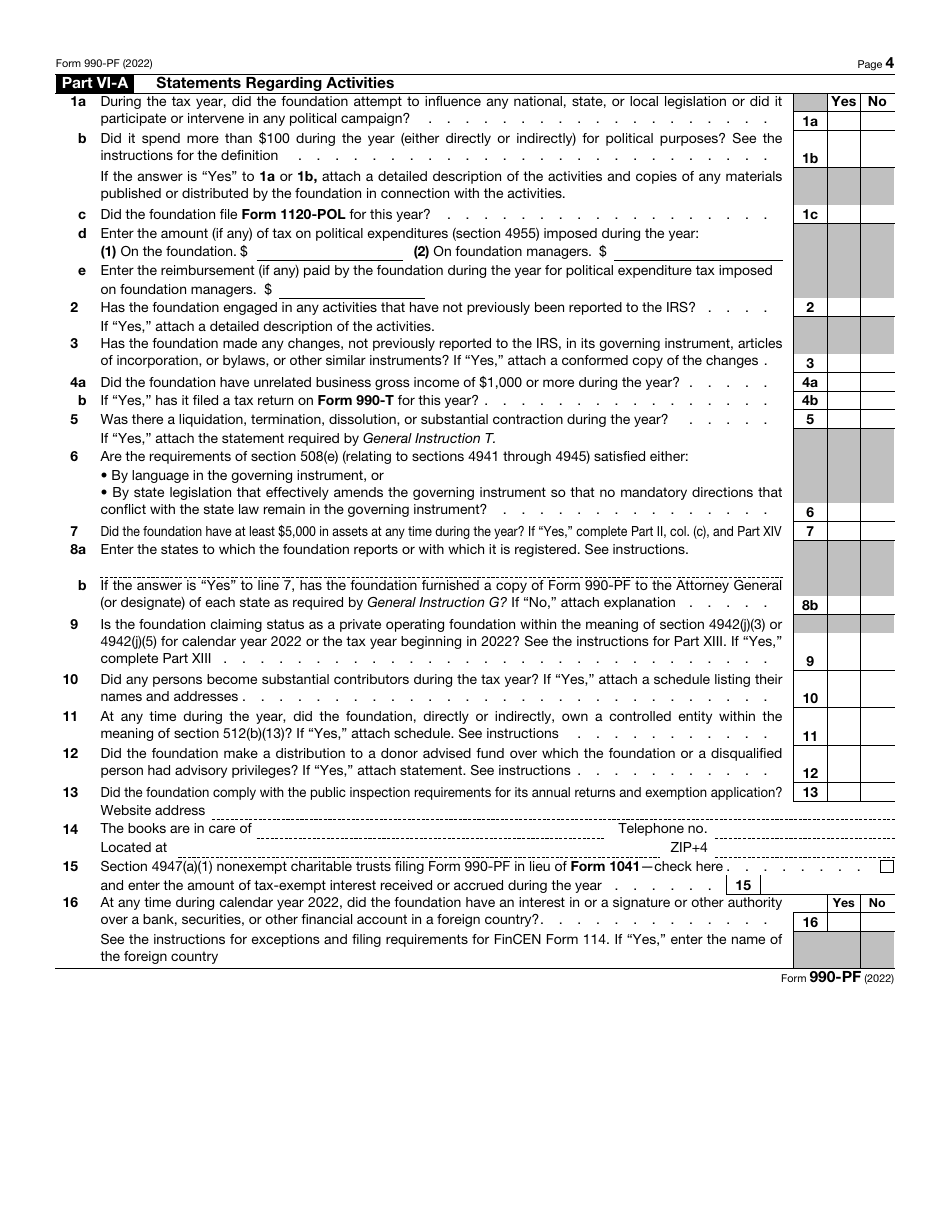

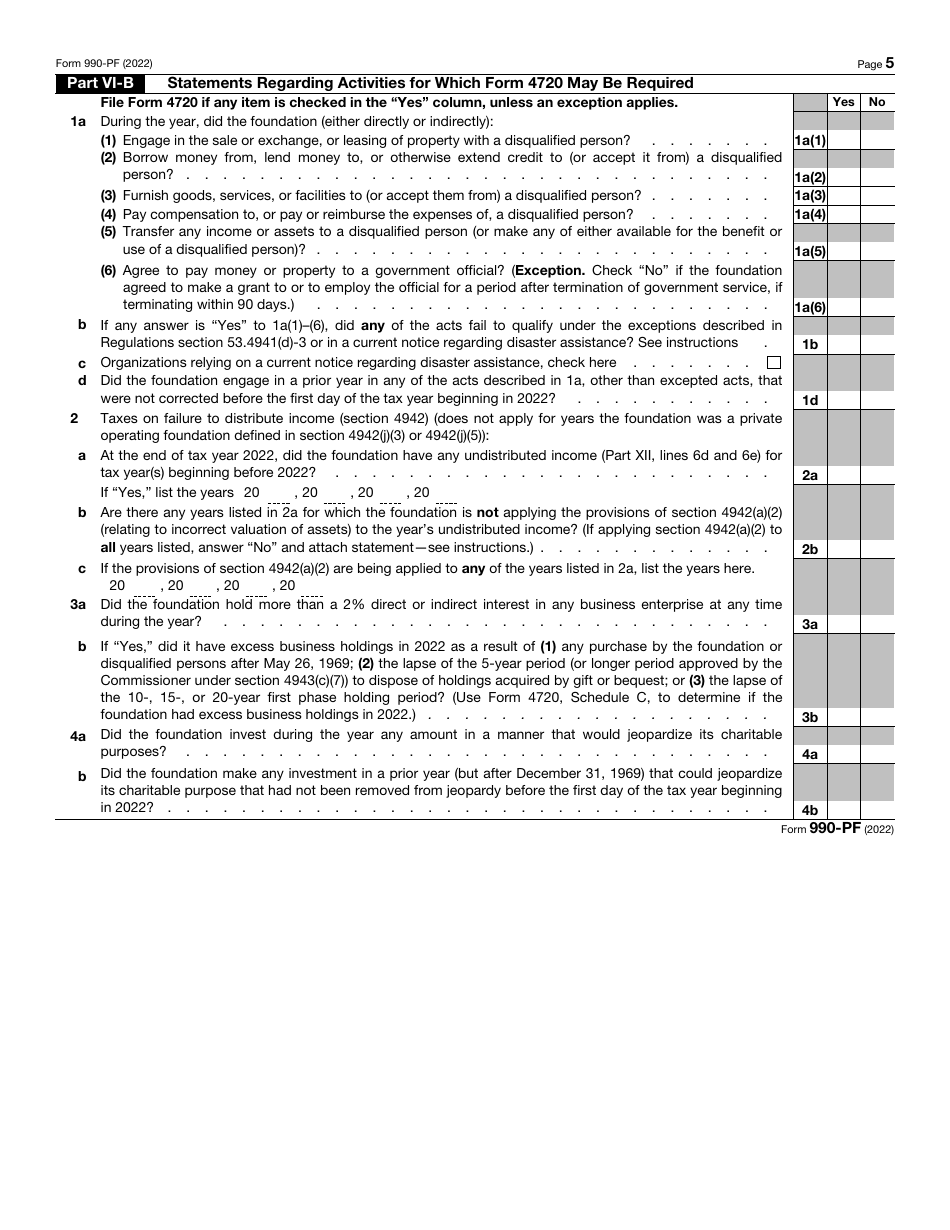

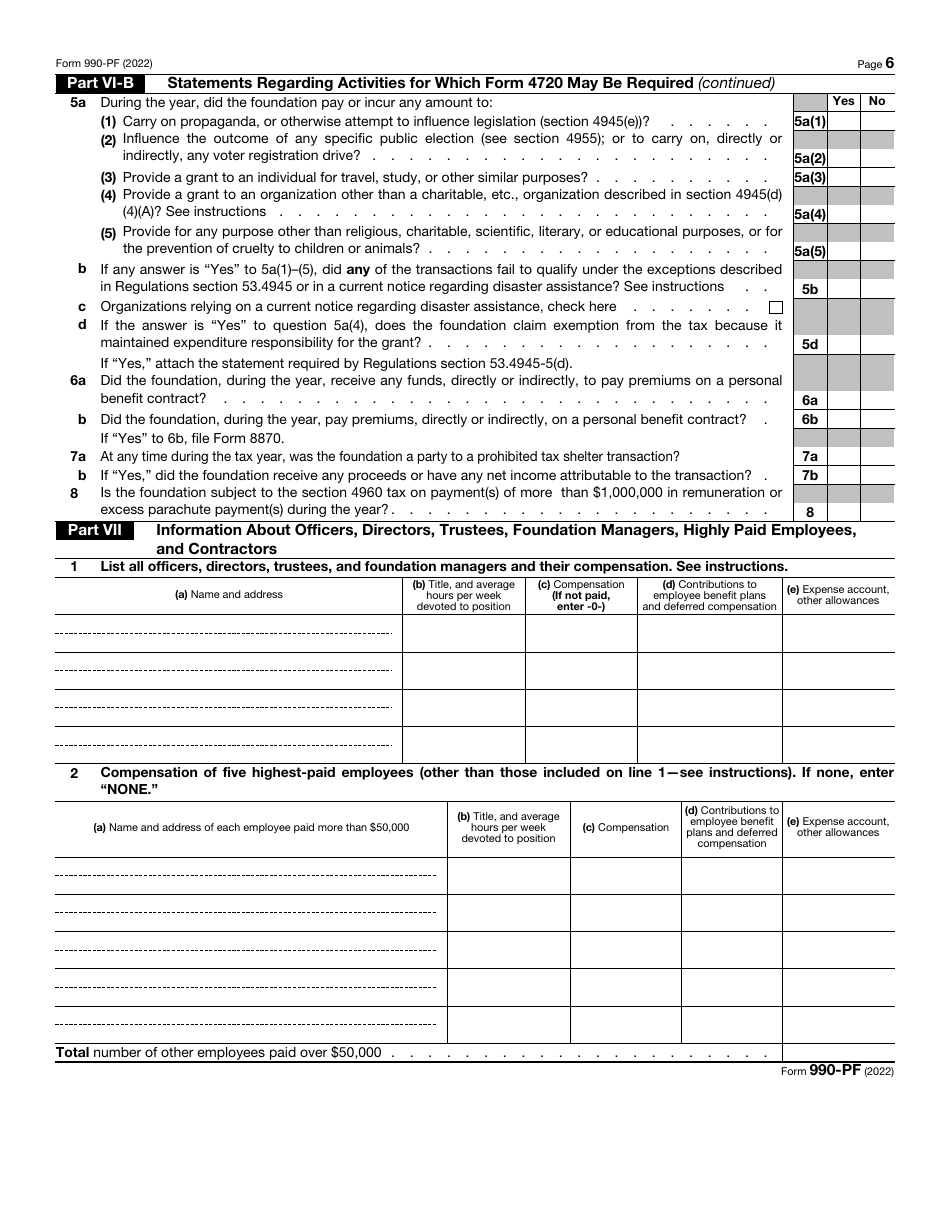

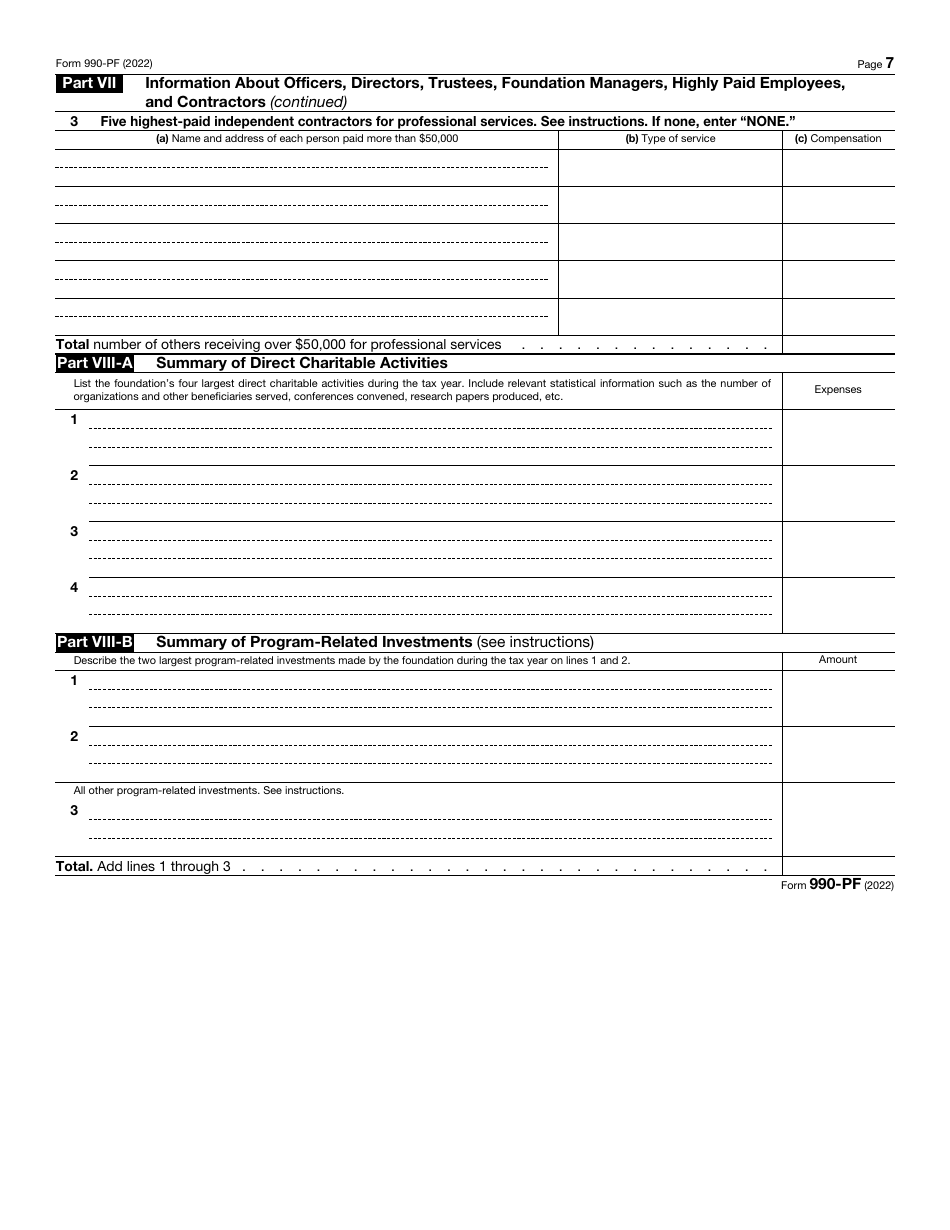

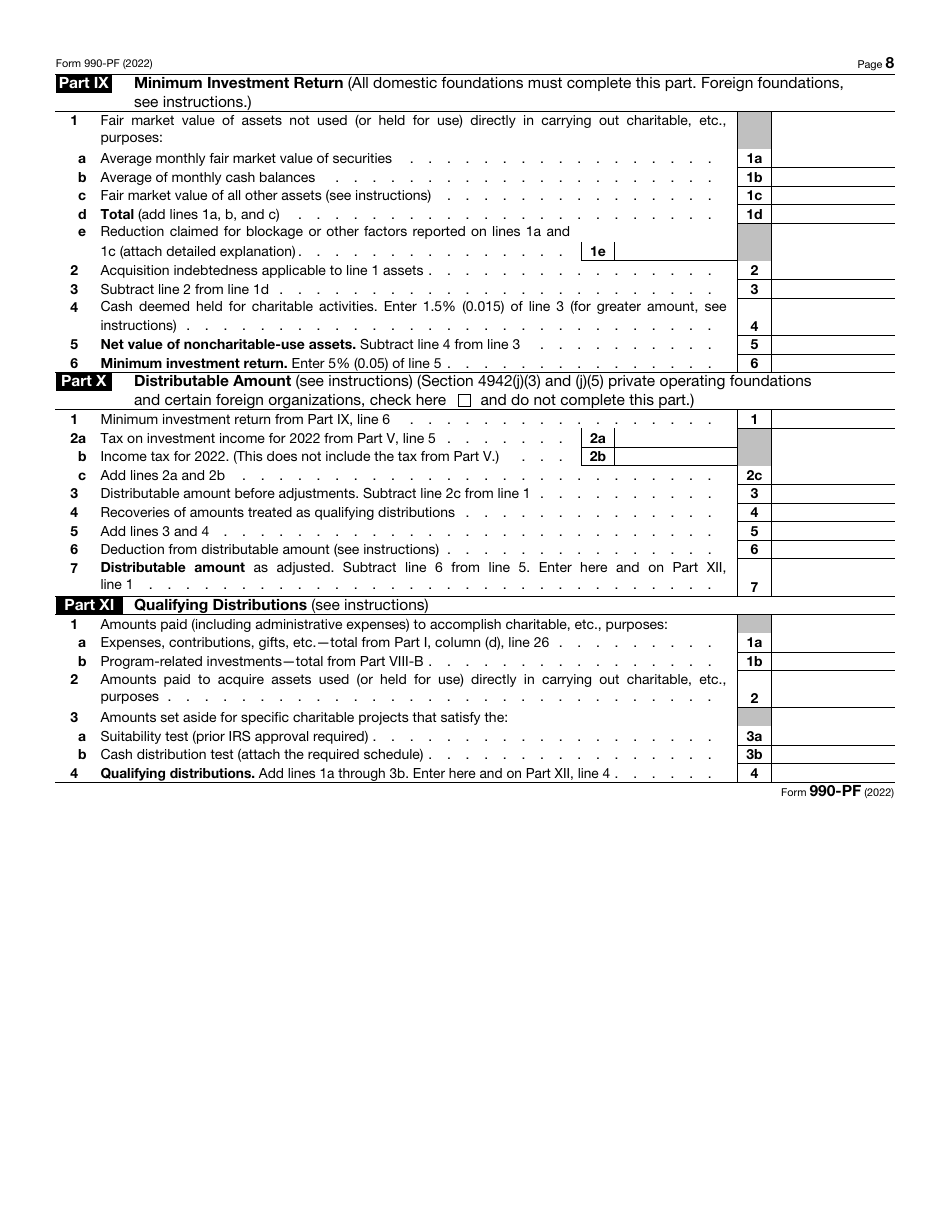

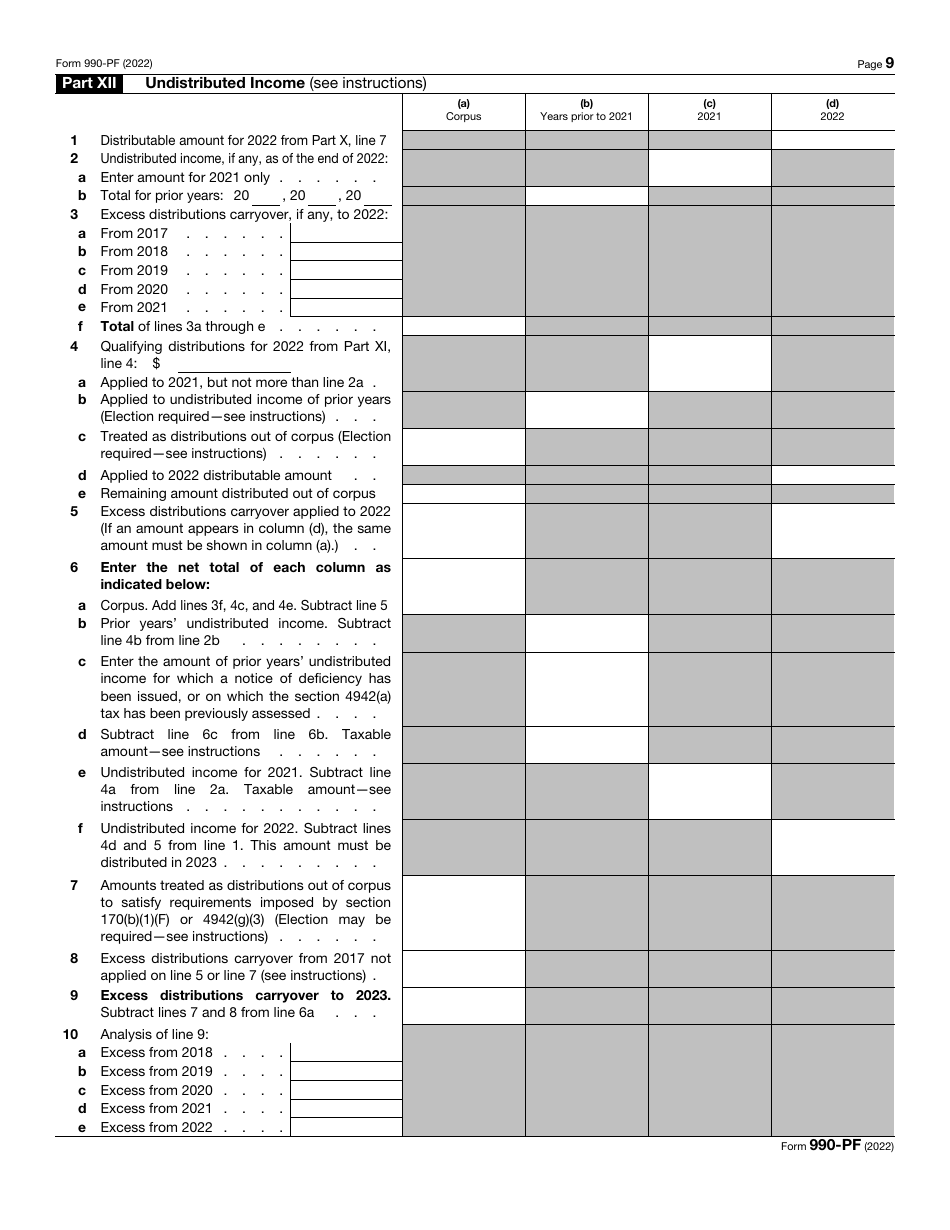

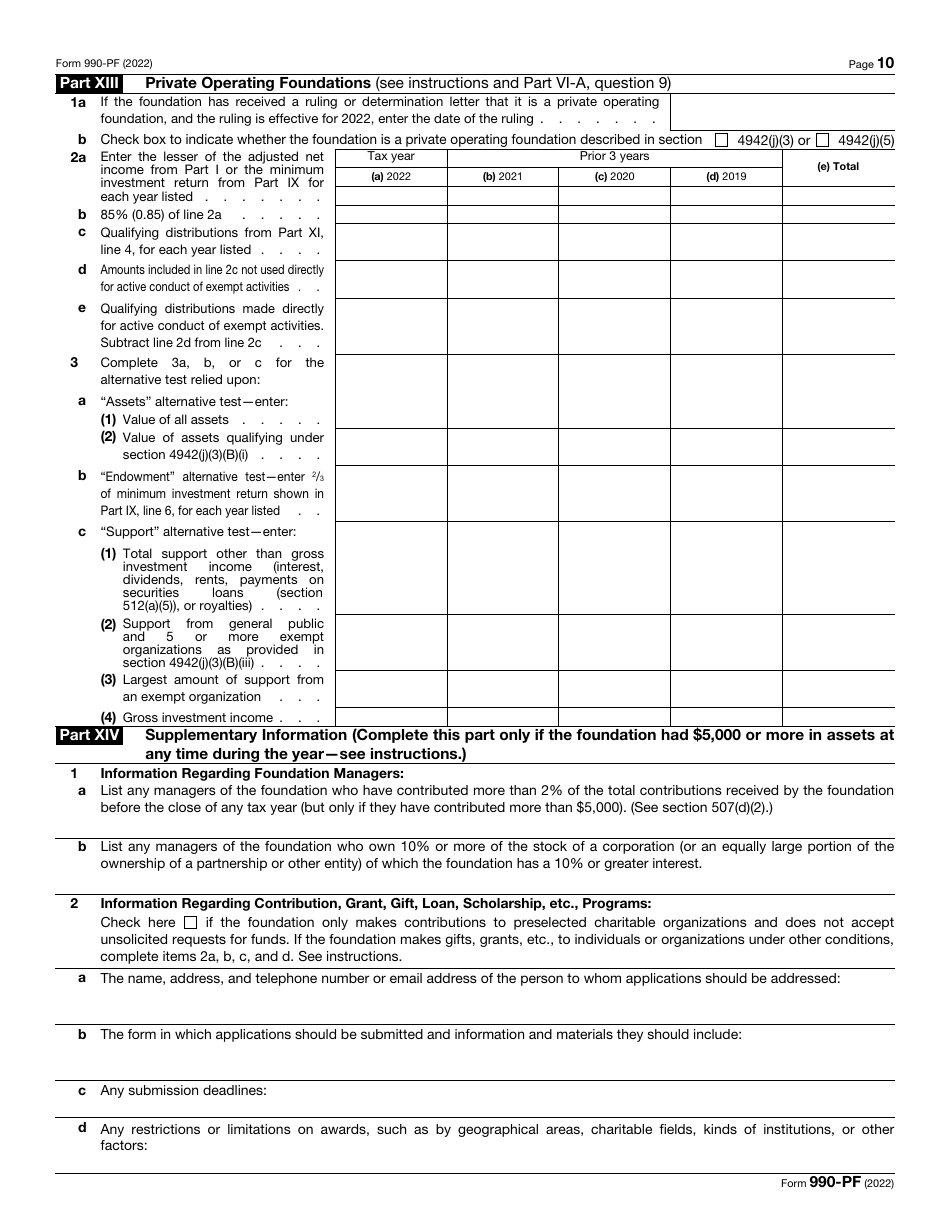

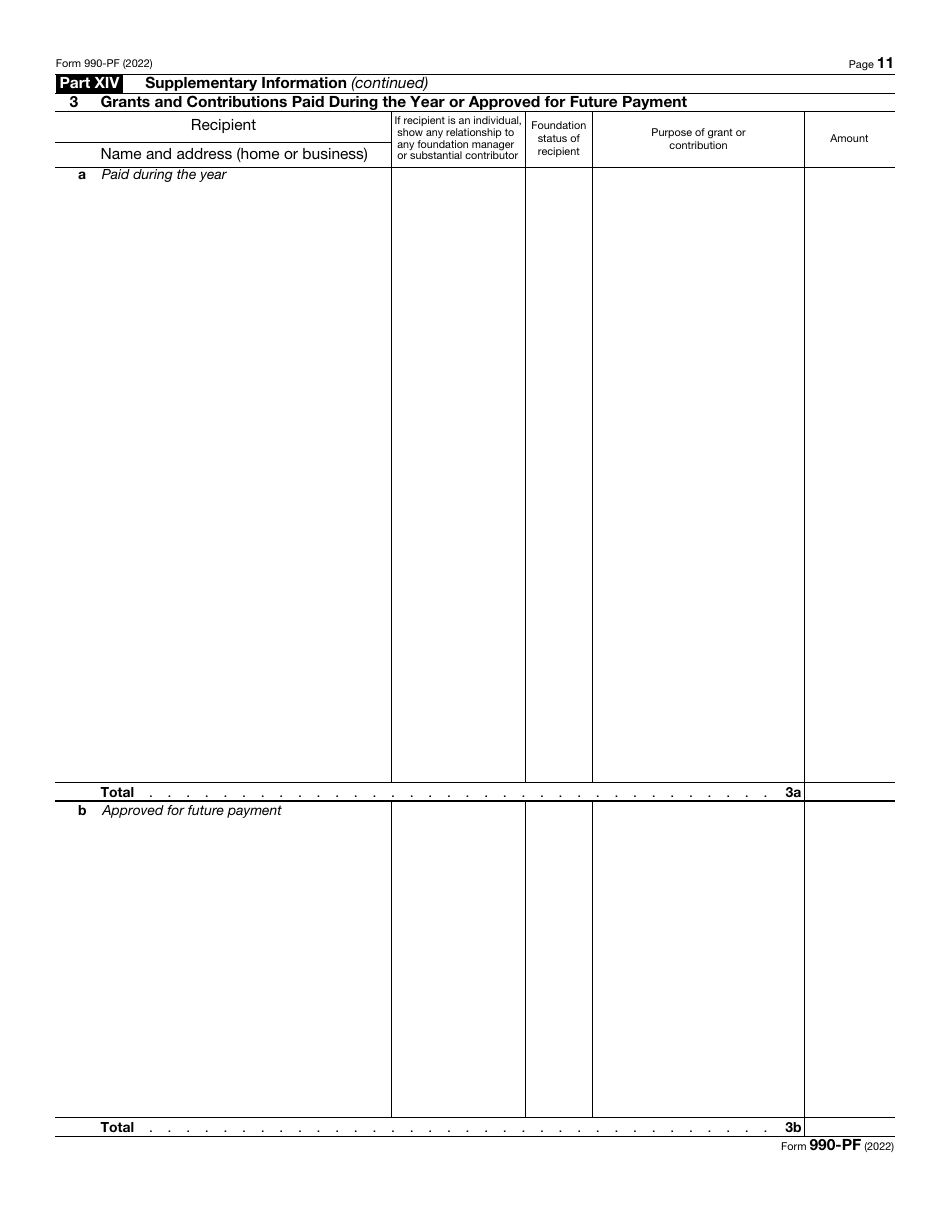

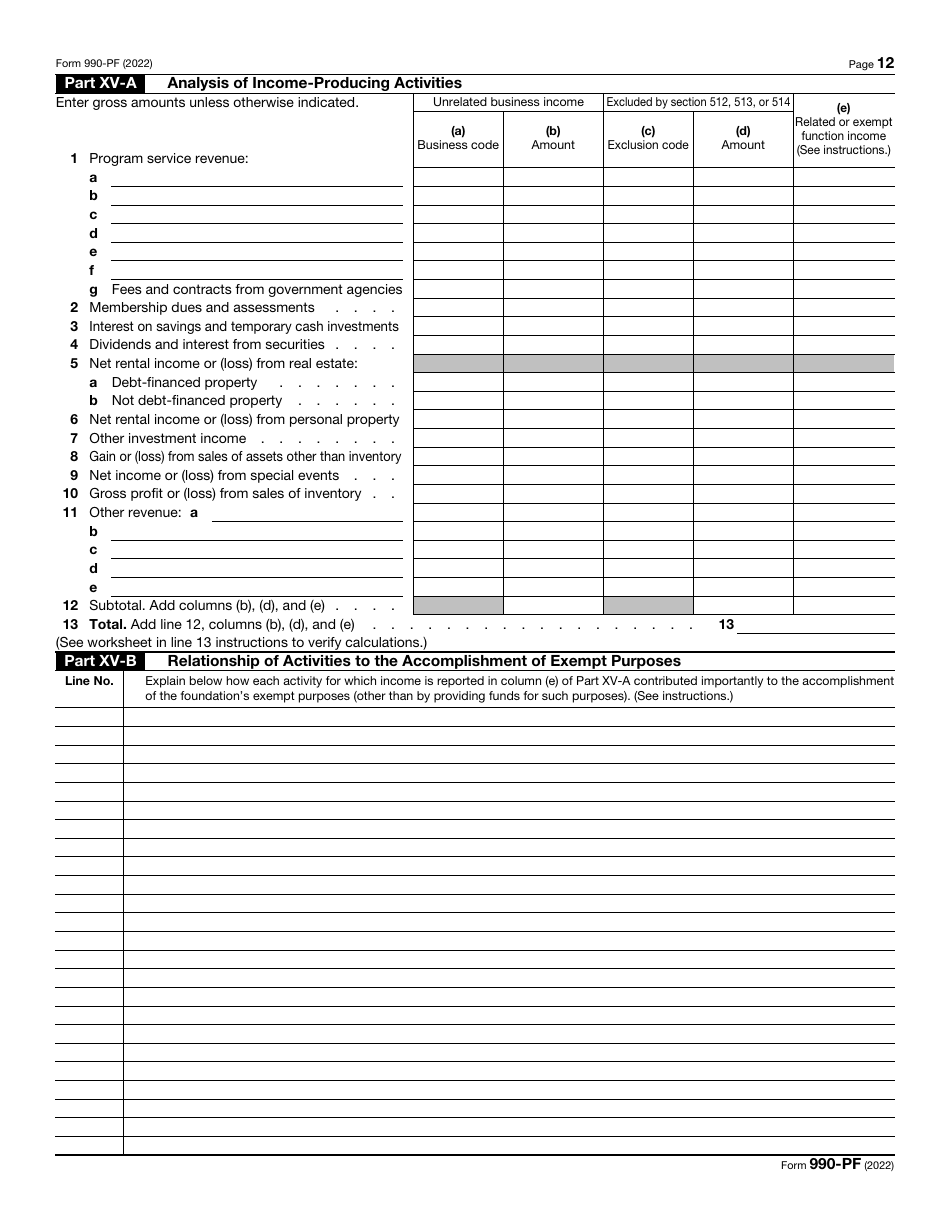

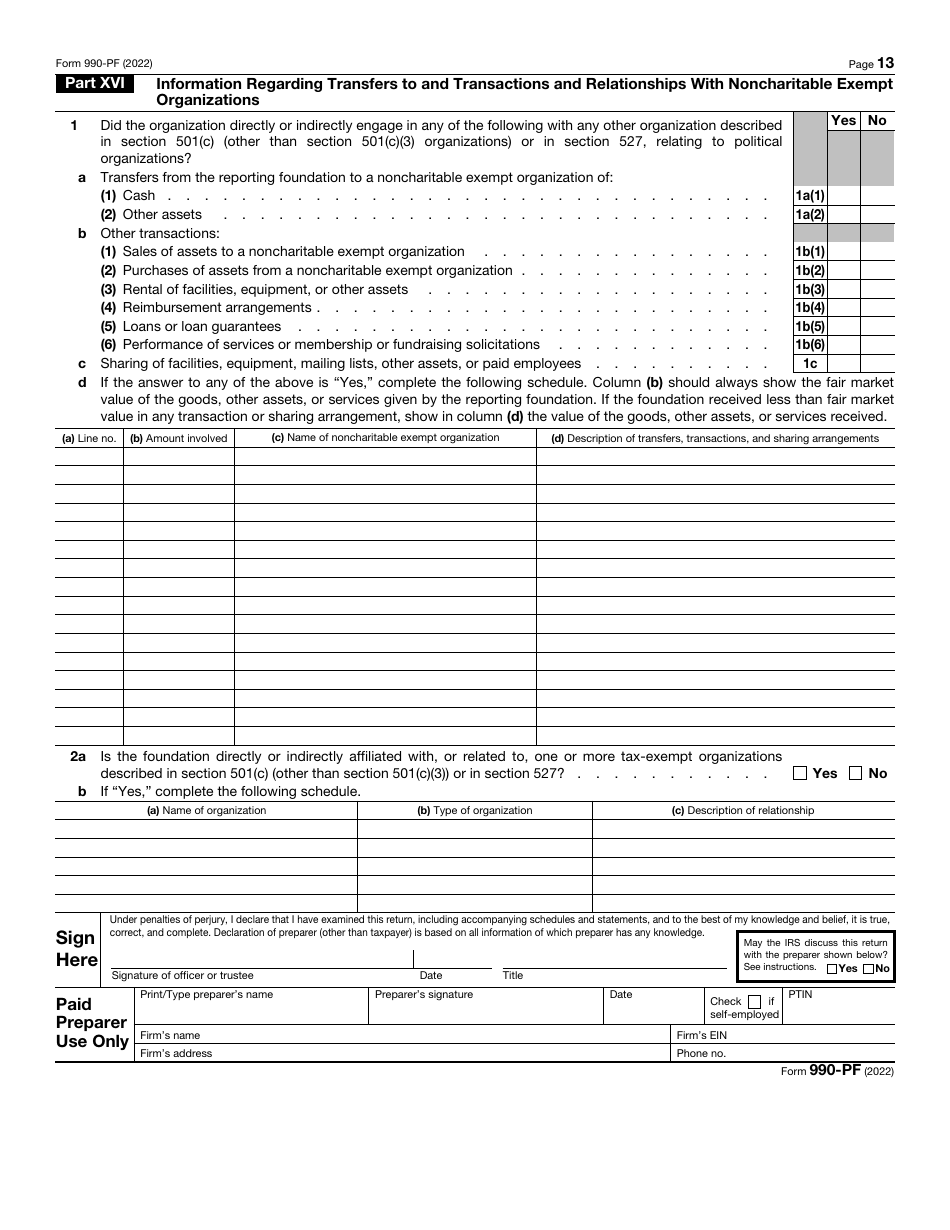

IRS Form 990-PF Return of Private Foundation or Section 4947(A)(1) Trust Treated as Private Foundation

What Is IRS Form 990-PF?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990-PF?

A: IRS Form 990-PF is a tax return filed by private foundations or trusts treated as private foundations.

Q: Who needs to file Form 990-PF?

A: Private foundations and trusts treated as private foundations are required to file Form 990-PF.

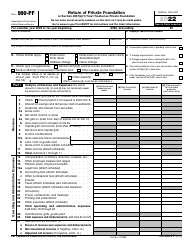

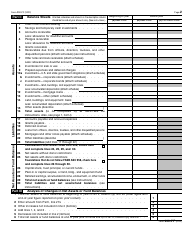

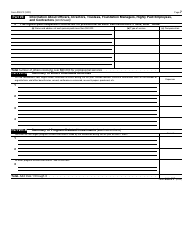

Q: What information is required on Form 990-PF?

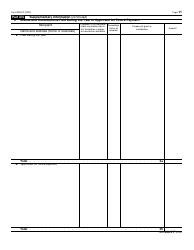

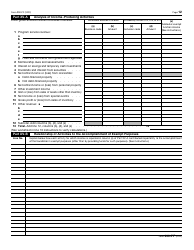

A: Form 990-PF requires information about the foundation's financial activities, grants, investments, and other relevant details.

Q: When is Form 990-PF due?

A: Form 990-PF is generally due on the 15th day of the 5th month following the close of the foundation's taxable year.

Q: What are the consequences of not filing Form 990-PF?

A: Failure to file Form 990-PF may result in penalties and potential loss of tax-exempt status for the foundation.

Q: Are there any exceptions to filing Form 990-PF?

A: Certain small private foundations may be exempt from filing Form 990-PF. Check IRS guidelines for specific requirements.

Form Details:

- A 13-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990-PF through the link below or browse more documents in our library of IRS Forms.