This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 990 Schedule J

for the current year.

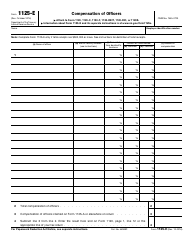

Instructions for IRS Form 990 Schedule J Compensation Information

This document contains official instructions for IRS Form 990 Schedule J, Compensation Information - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 990 Schedule J is available for download through this link.

FAQ

Q: What is IRS Form 990?

A: IRS Form 990 is a tax return form that tax-exempt organizations in the United States are required to file each year.

Q: What is Schedule J of IRS Form 990?

A: Schedule J is a section of IRS Form 990 that provides information about compensation of certain individuals in tax-exempt organizations.

Q: Who needs to file IRS Form 990?

A: Tax-exempt organizations, such as nonprofits and charities, need to file IRS Form 990.

Q: What information does Schedule J of IRS Form 990 require?

A: Schedule J requires information about compensation of key employees, highest paid employees, and other employees receiving over $150,000 in compensation.

Q: What is considered compensation on Schedule J?

A: Compensation includes salaries, bonuses, severance payments, and other forms of compensation.

Q: Are there any reporting thresholds for compensation on Schedule J?

A: Yes, compensation of key employees and highest paid employees exceeding $150,000 must be reported on Schedule J.

Q: What is the deadline for filing IRS Form 990?

A: The deadline for filing IRS Form 990 varies depending on the tax year of the organization, but it is generally due on the 15th day of the 5th month after the end of the organization's fiscal year.

Q: Can I file IRS Form 990 electronically?

A: Yes, tax-exempt organizations can file IRS Form 990 electronically using the IRS's e-file system.

Q: What happens if a tax-exempt organization fails to file IRS Form 990?

A: Failure to file IRS Form 990 can result in penalties and the loss of tax-exempt status for the organization.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.