This version of the form is not currently in use and is provided for reference only. Download this version of

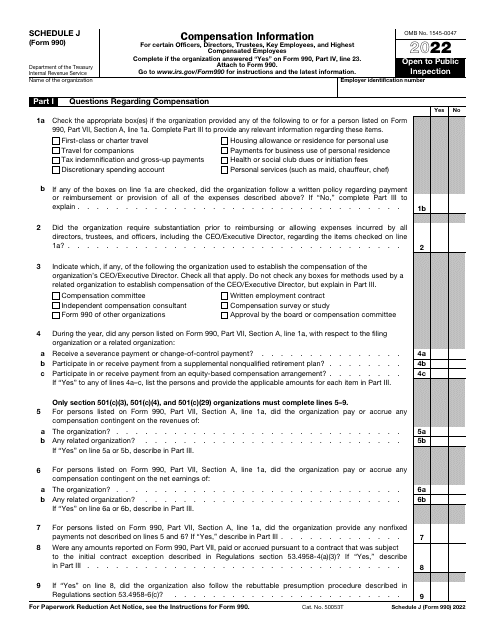

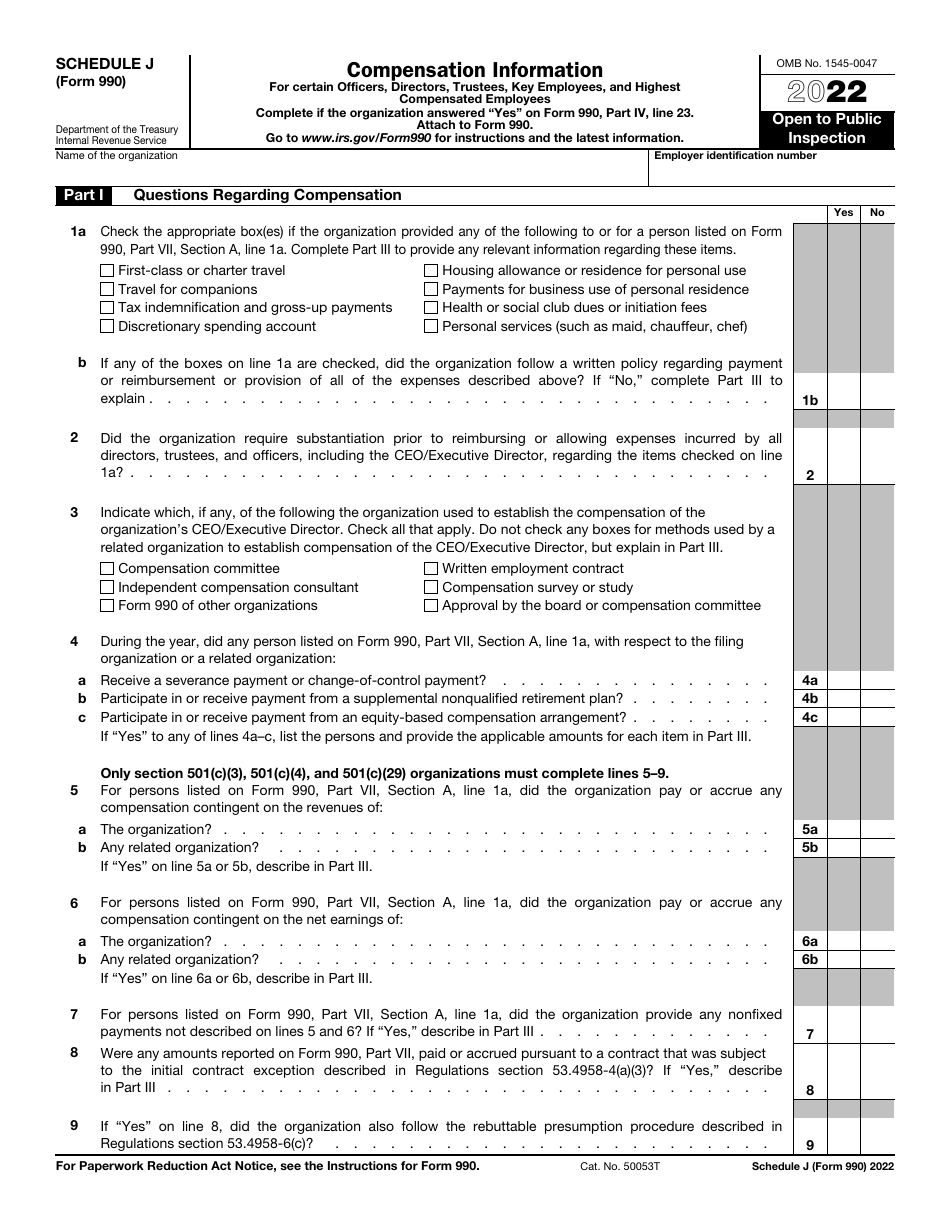

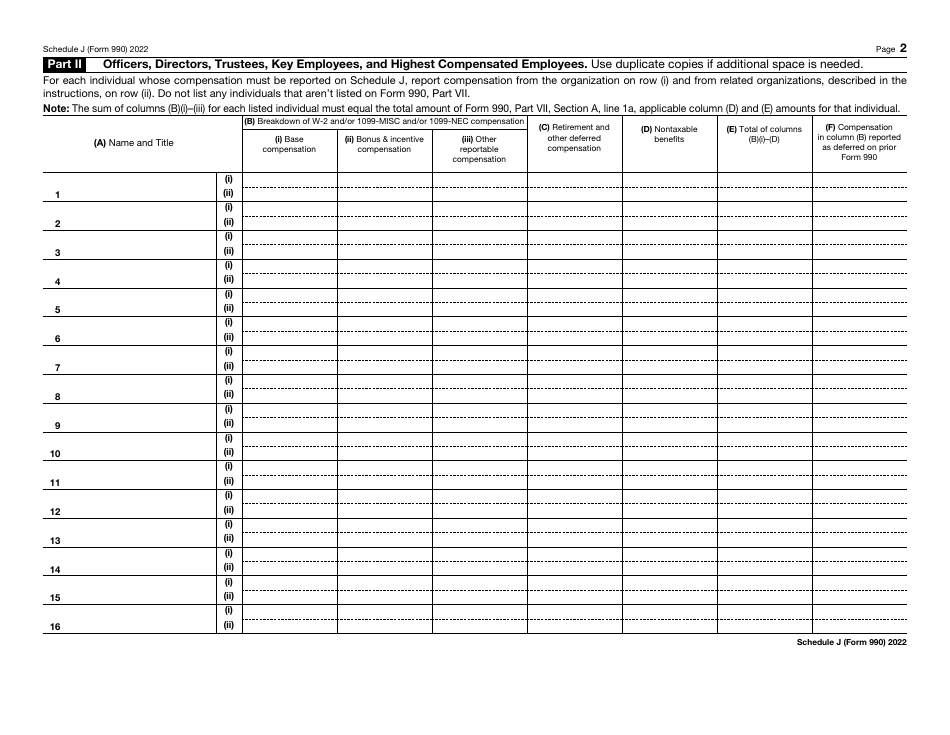

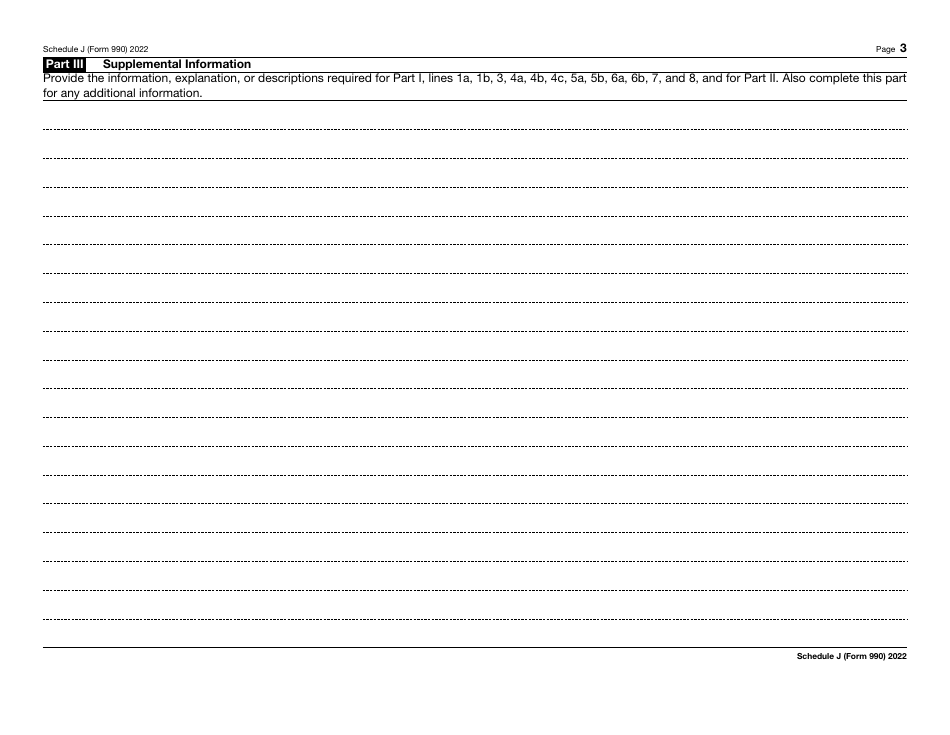

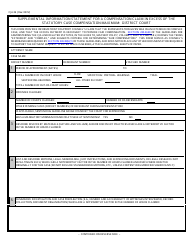

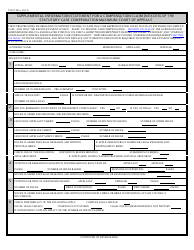

IRS Form 990 Schedule J

for the current year.

IRS Form 990 Schedule J Compensation Information

What Is IRS Form 990 Schedule J?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 990, Return of Organization Exempt From Income Tax. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 990 Schedule J?

A: IRS Form 990 Schedule J is a section of the Form 990 that provides information on the compensation of certain individuals in tax-exempt organizations.

Q: Who needs to fill out IRS Form 990 Schedule J?

A: Tax-exempt organizations that pay certain individuals above a certain threshold of compensation are required to fill out IRS Form 990 Schedule J.

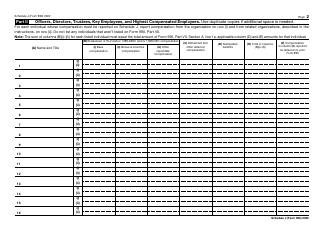

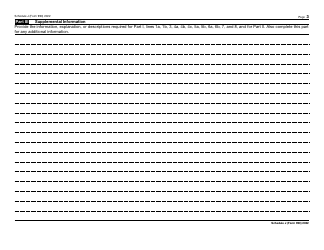

Q: What information does IRS Form 990 Schedule J require?

A: IRS Form 990 Schedule J requires organizations to provide information on the compensation of their top officials and highest compensated employees.

Q: Why is IRS Form 990 Schedule J important?

A: IRS Form 990 Schedule J helps promote transparency and accountability in the compensation practices of tax-exempt organizations.

Q: Are there any penalties for not filing IRS Form 990 Schedule J?

A: Yes, tax-exempt organizations that fail to file IRS Form 990 Schedule J or provide inaccurate information may face penalties or loss of their tax-exempt status.

Form Details:

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 990 Schedule J through the link below or browse more documents in our library of IRS Forms.