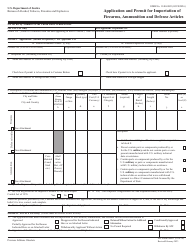

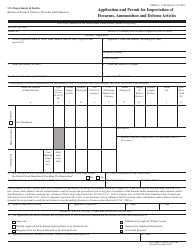

This version of the form is not currently in use and is provided for reference only. Download this version of

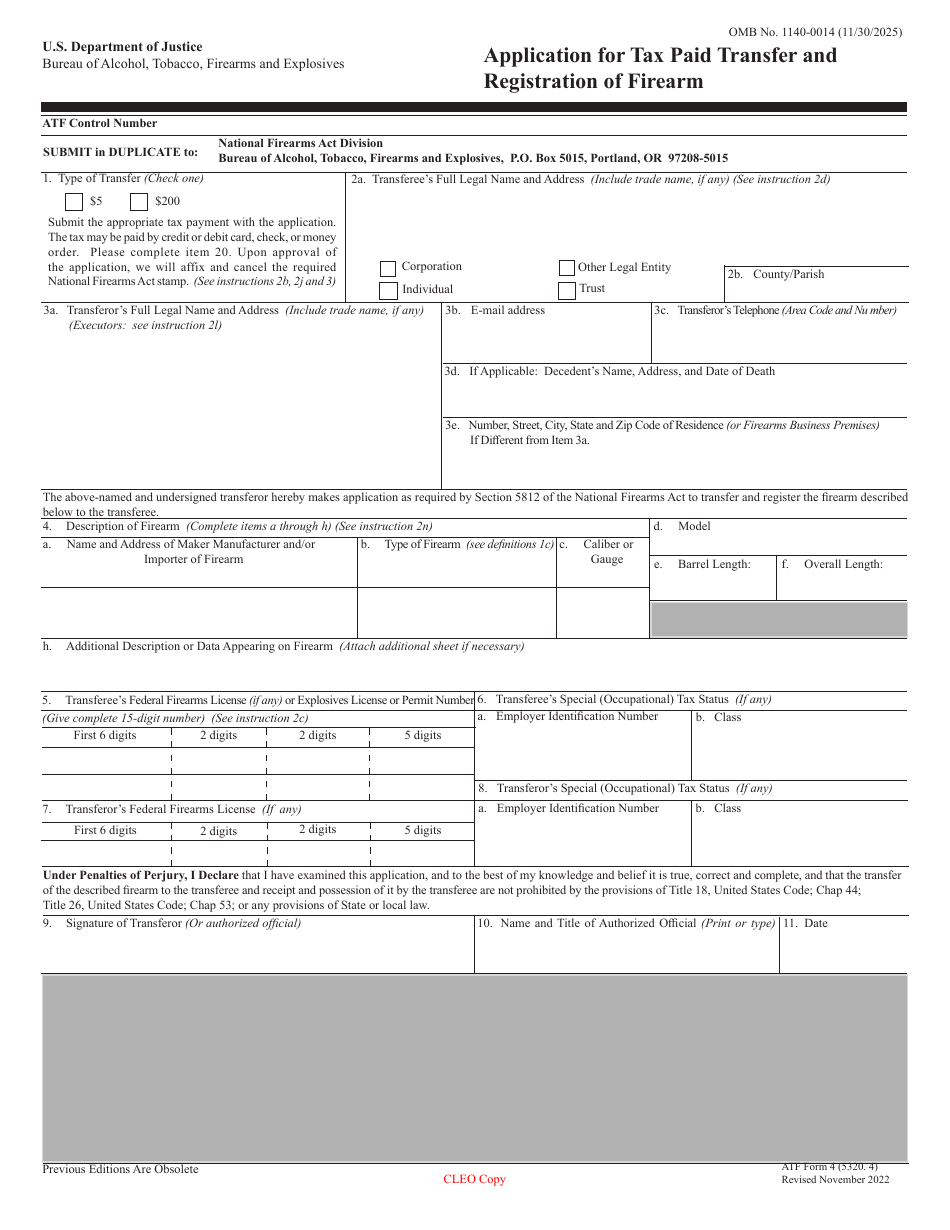

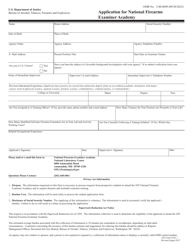

ATF Form 4 (5320.4)

for the current year.

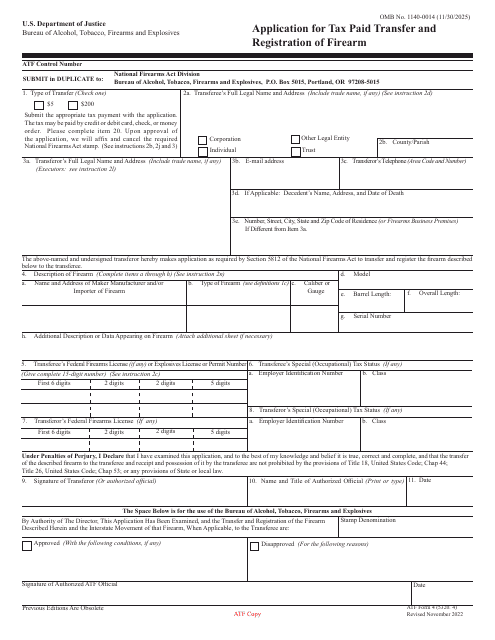

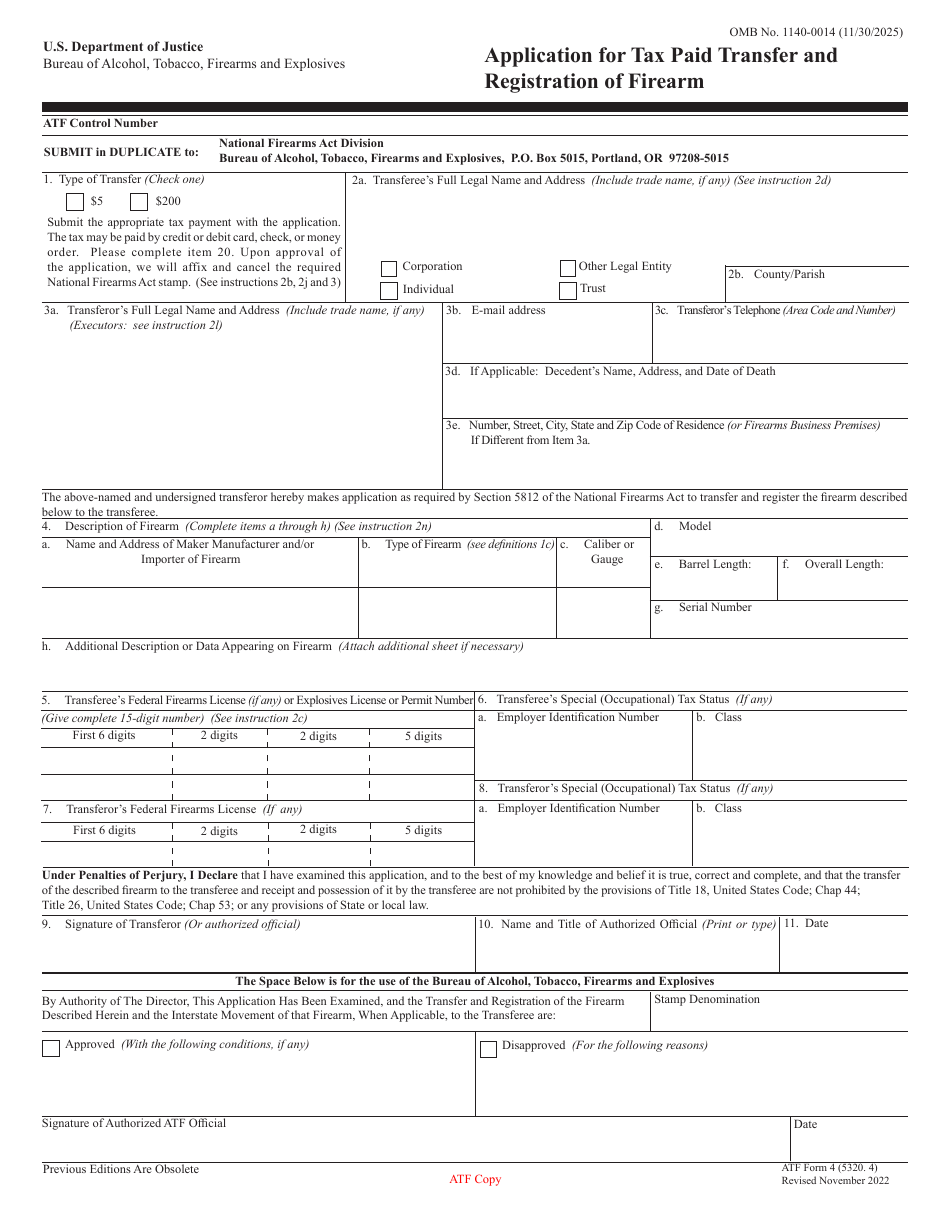

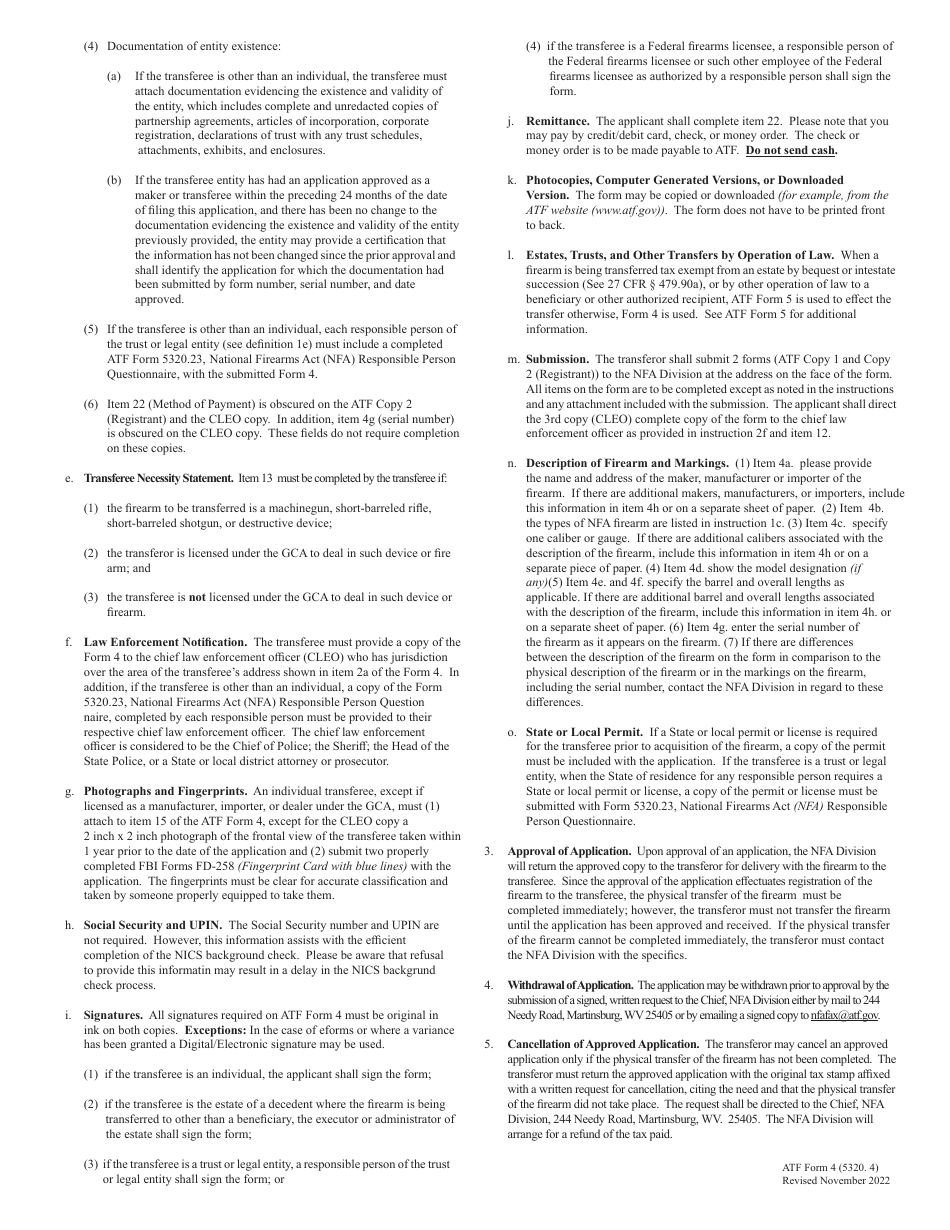

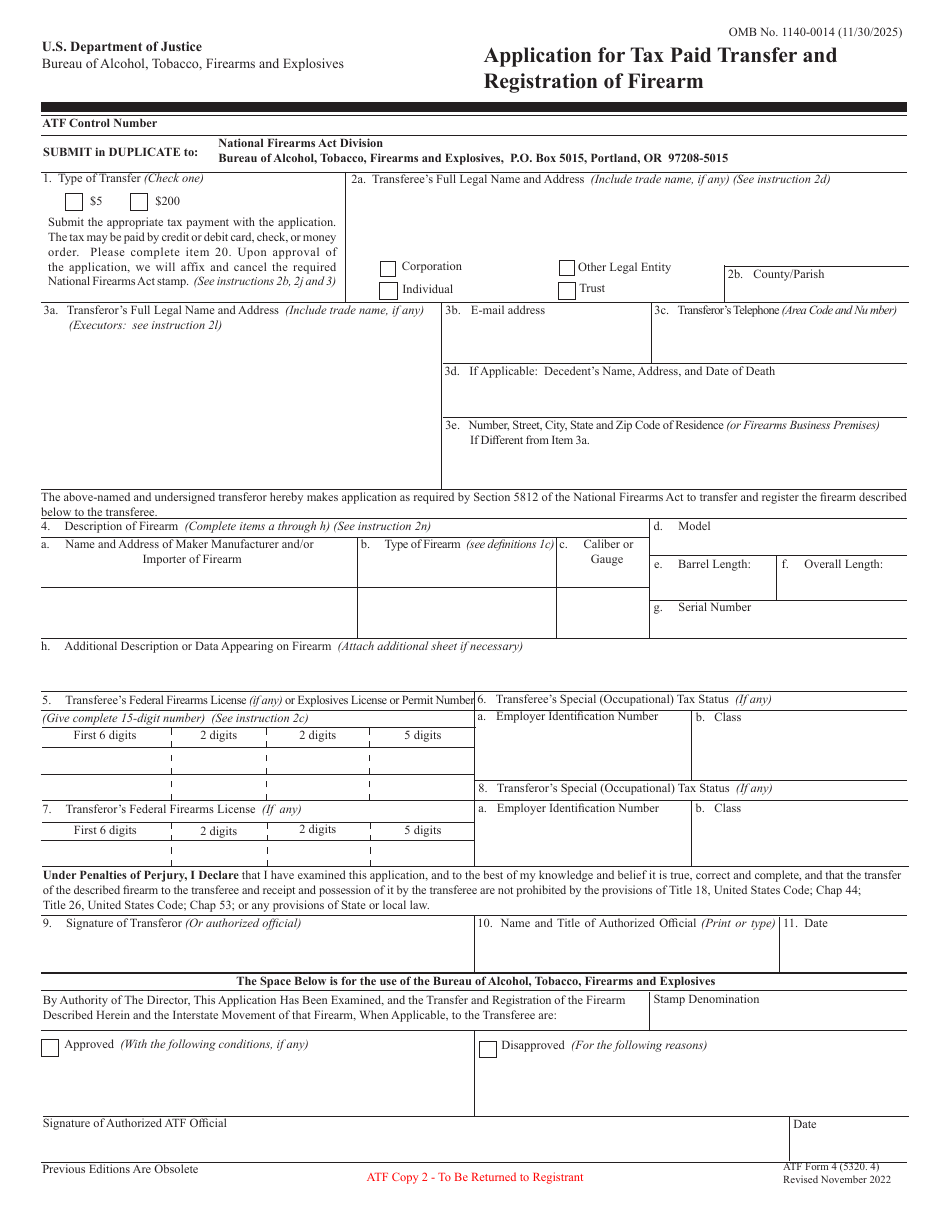

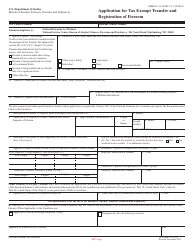

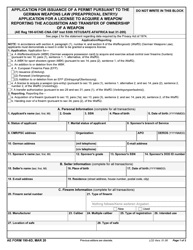

ATF Form 4 (5320.4) Application for Tax Paid Transfer and Registration of Firearm

What Is ATF Form 4 (5320.4)?

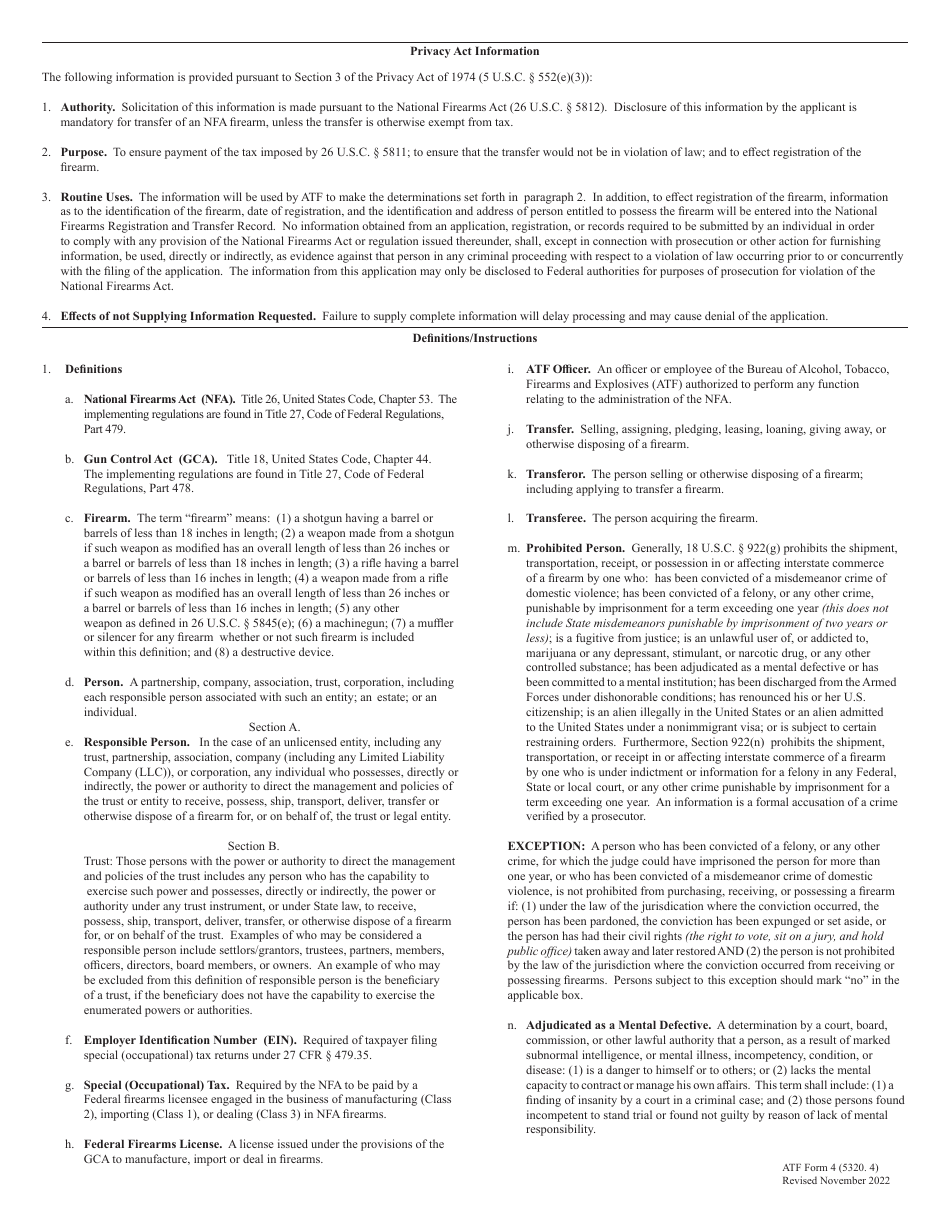

This is a legal form that was released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives on November 1, 2022 and used country-wide. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is ATF Form 4?

A: ATF Form 4 is an application used for the tax paid transfer and registration of firearms.

Q: What is the purpose of ATF Form 4?

A: The purpose of ATF Form 4 is to apply for the transfer and registration of a firearm that requires a tax payment.

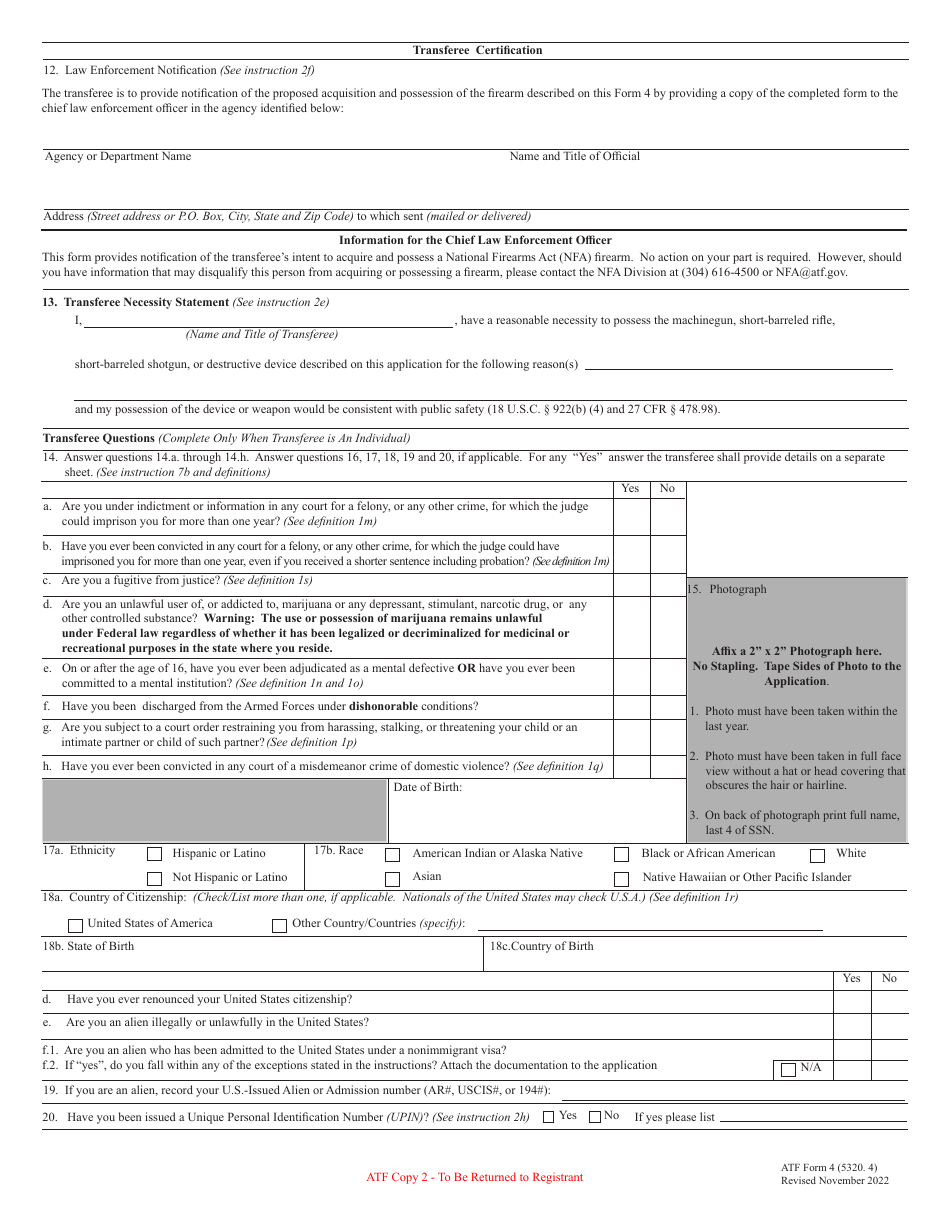

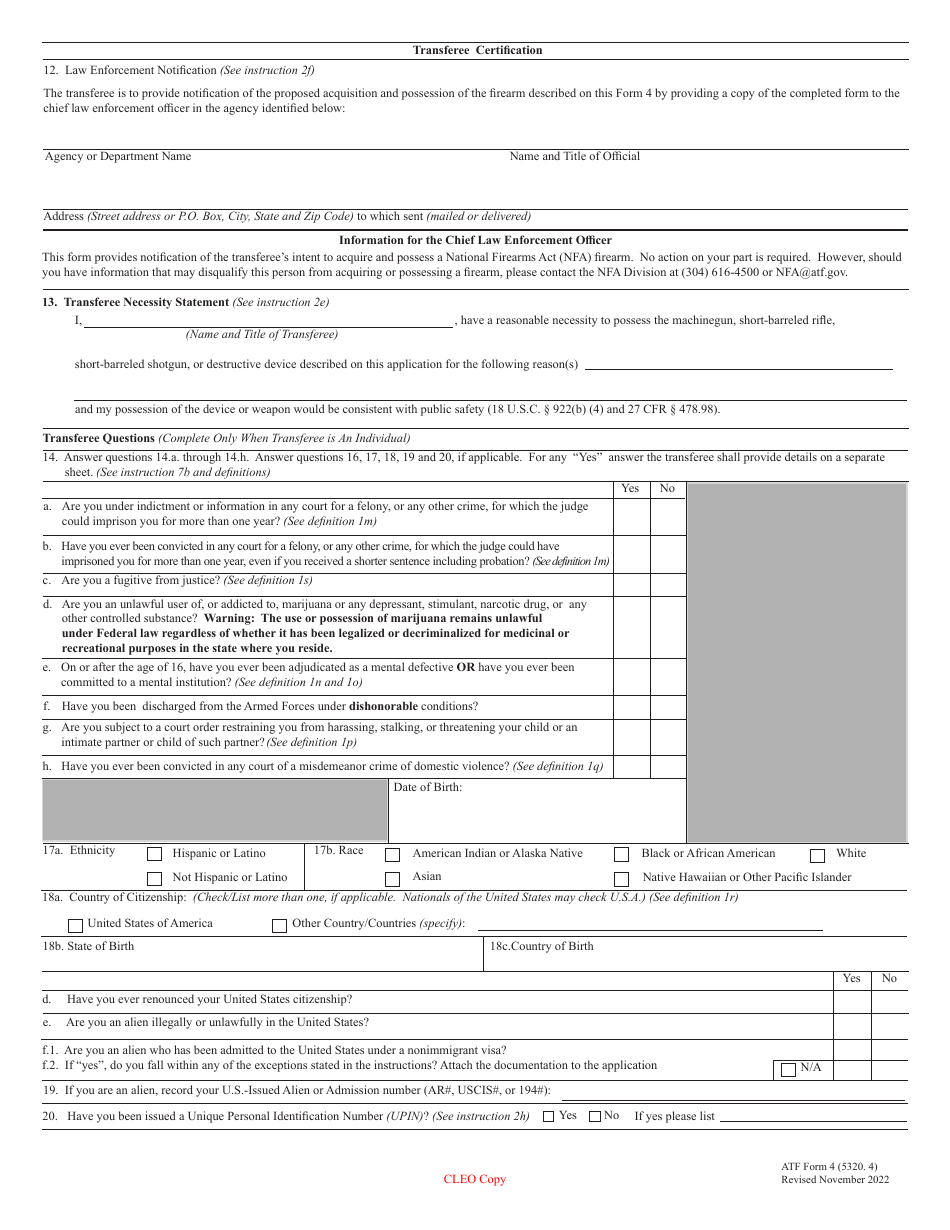

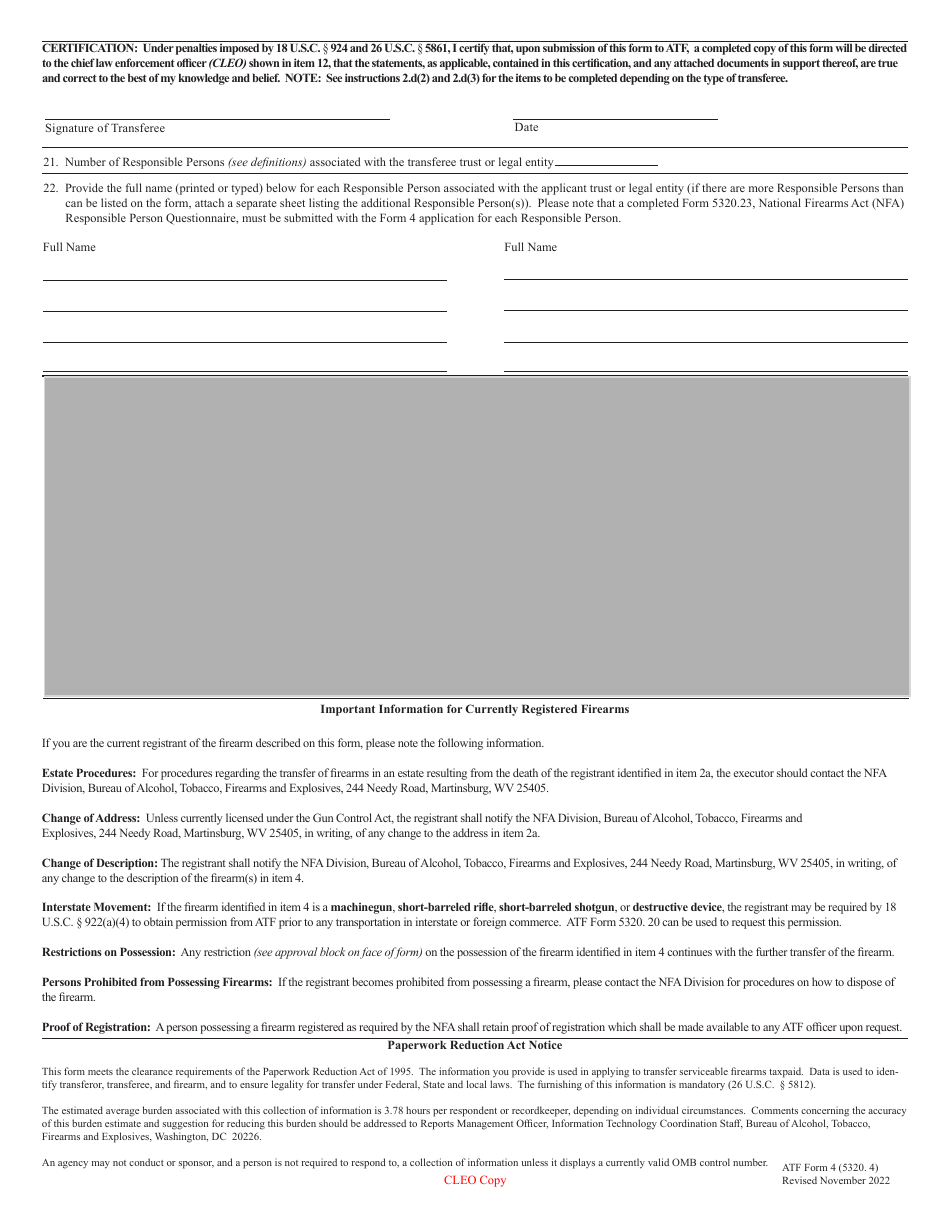

Q: What information is required on ATF Form 4?

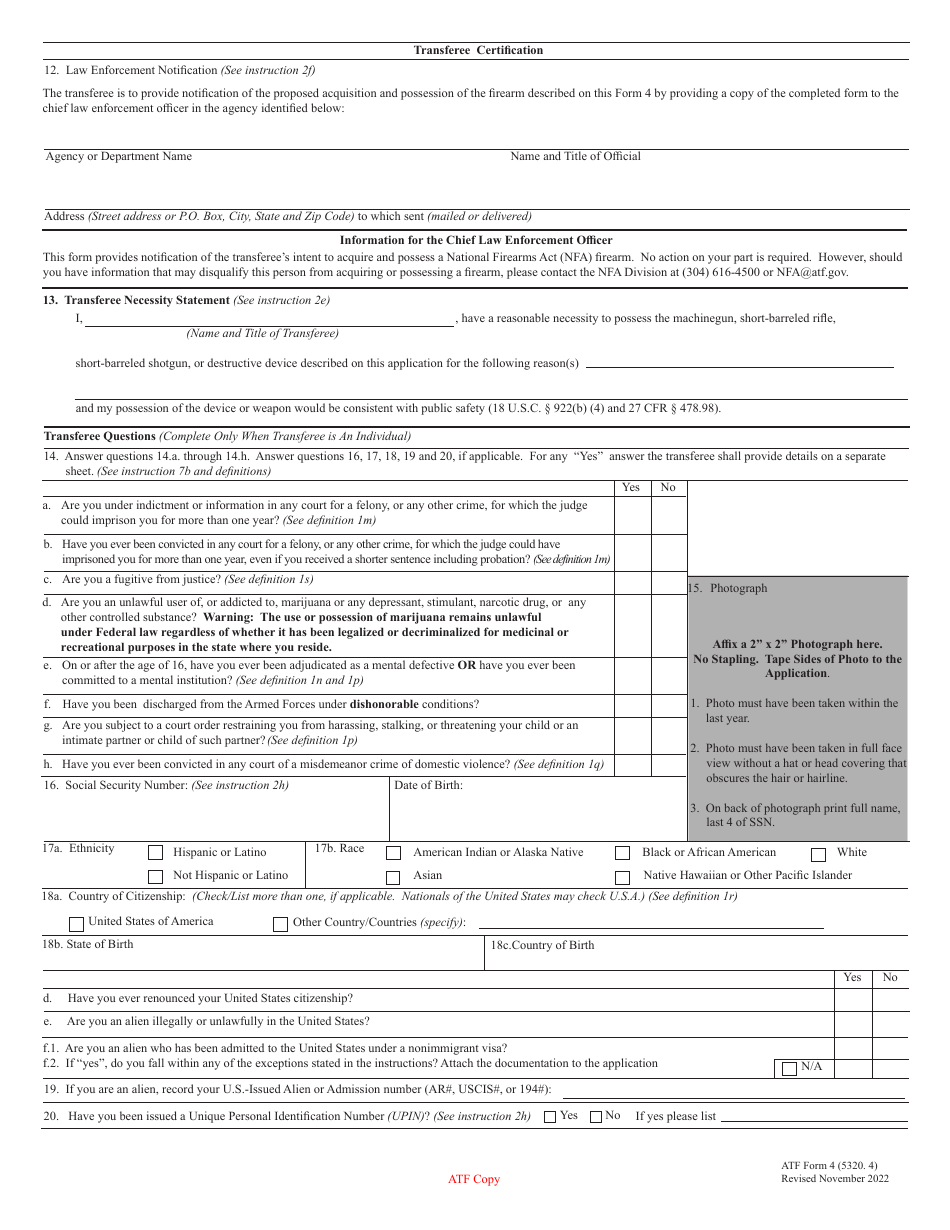

A: ATF Form 4 requires information about the firearm, the transferee, and the transferor, as well as fingerprints and a photograph.

Q: Are there any fees associated with submitting ATF Form 4?

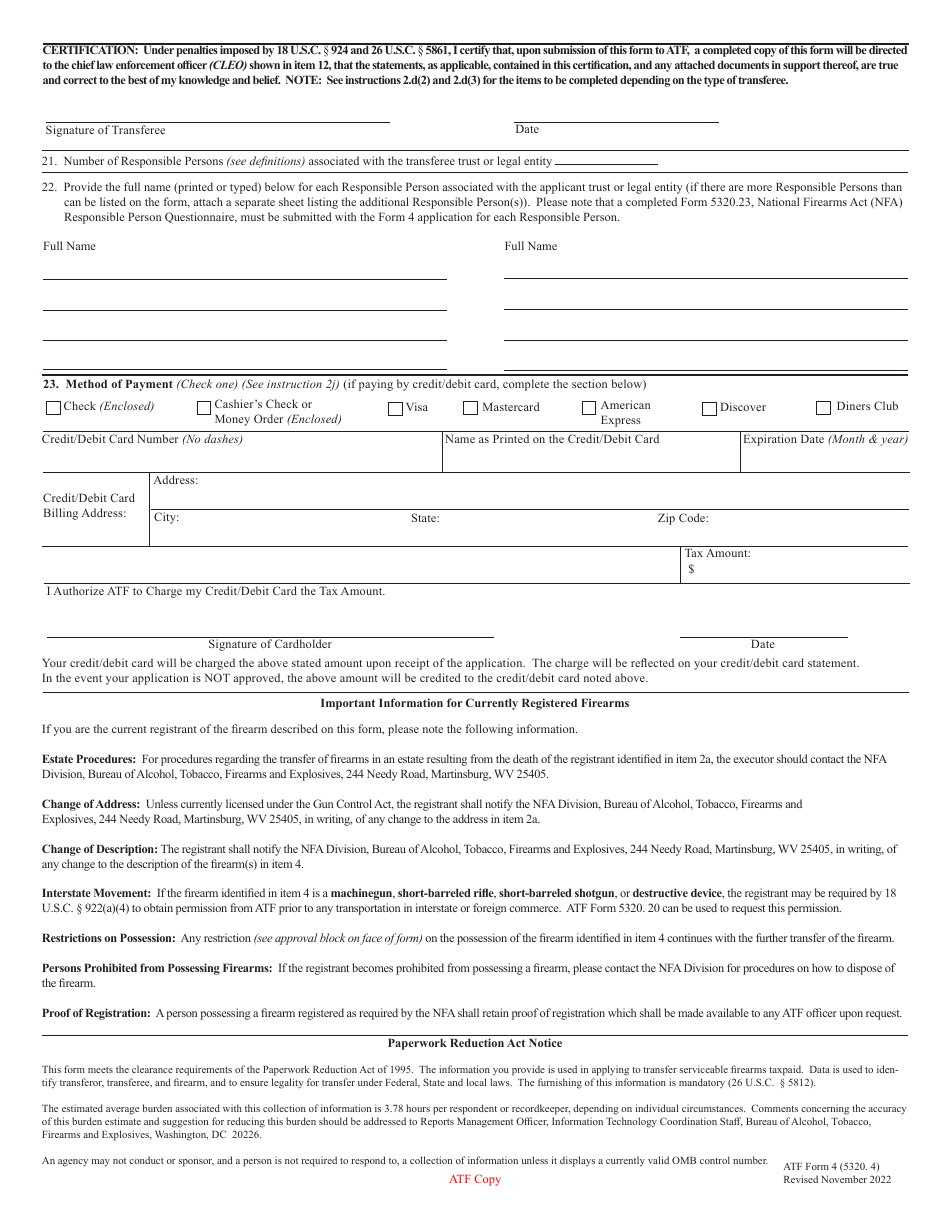

A: Yes, there is a $200 tax payment required for each transfer specified on ATF Form 4.

Q: How long does it take to process ATF Form 4?

A: Processing times for ATF Form 4 can vary, but it typically takes several months to complete.

Q: Who is eligible to submit ATF Form 4?

A: Any individual who is not prohibited from possessing firearms and meets the requirements for transfer and registration can submit ATF Form 4.

Q: Can I submit ATF Form 4 electronically?

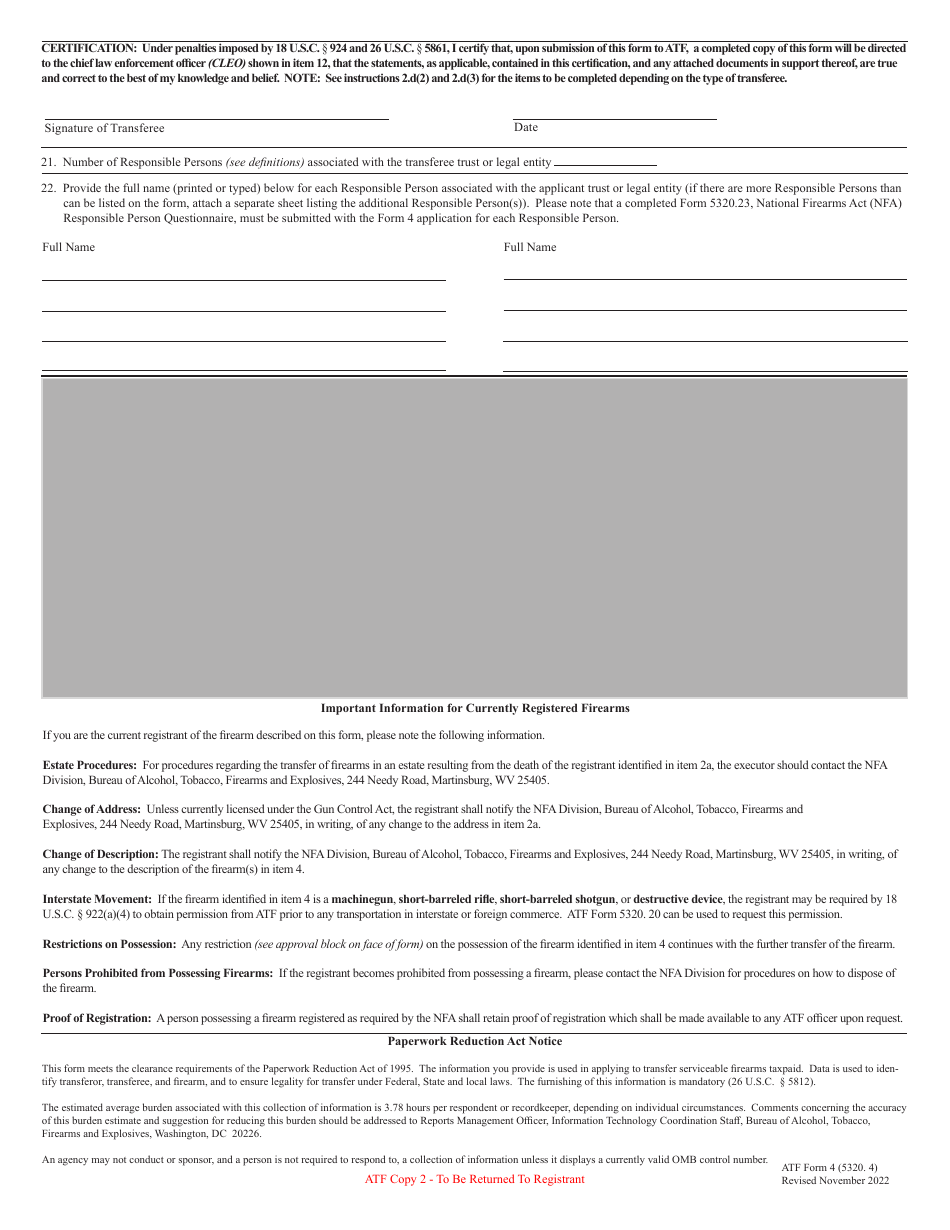

A: No, ATF Form 4 must be submitted in paper format with original signatures.

Q: What happens after ATF Form 4 is approved?

A: Once ATF Form 4 is approved, the transferee can take possession of the firearm.

Q: Are there any restrictions on transferring the firearm after ATF Form 4 approval?

A: After the transfer is approved, the firearm can only be transferred to another eligible individual with the proper approvals and tax payments.

Form Details:

- Released on November 1, 2022;

- The latest available edition released by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives;

- Easy to use and ready to print;

- Yours to fill out and keep for your records;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of ATF Form 4 (5320.4) by clicking the link below or browse more documents and templates provided by the U.S. Department of Justice - Bureau of Alcohol, Tobacco, Firearms and Explosives.