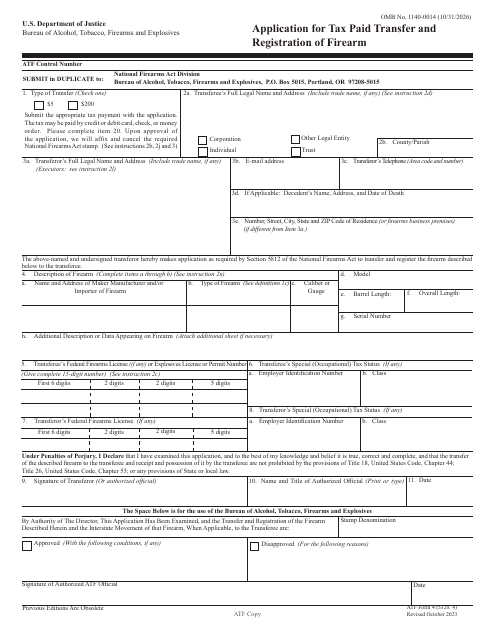

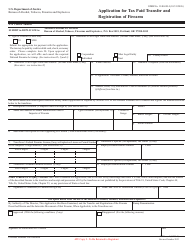

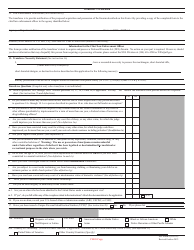

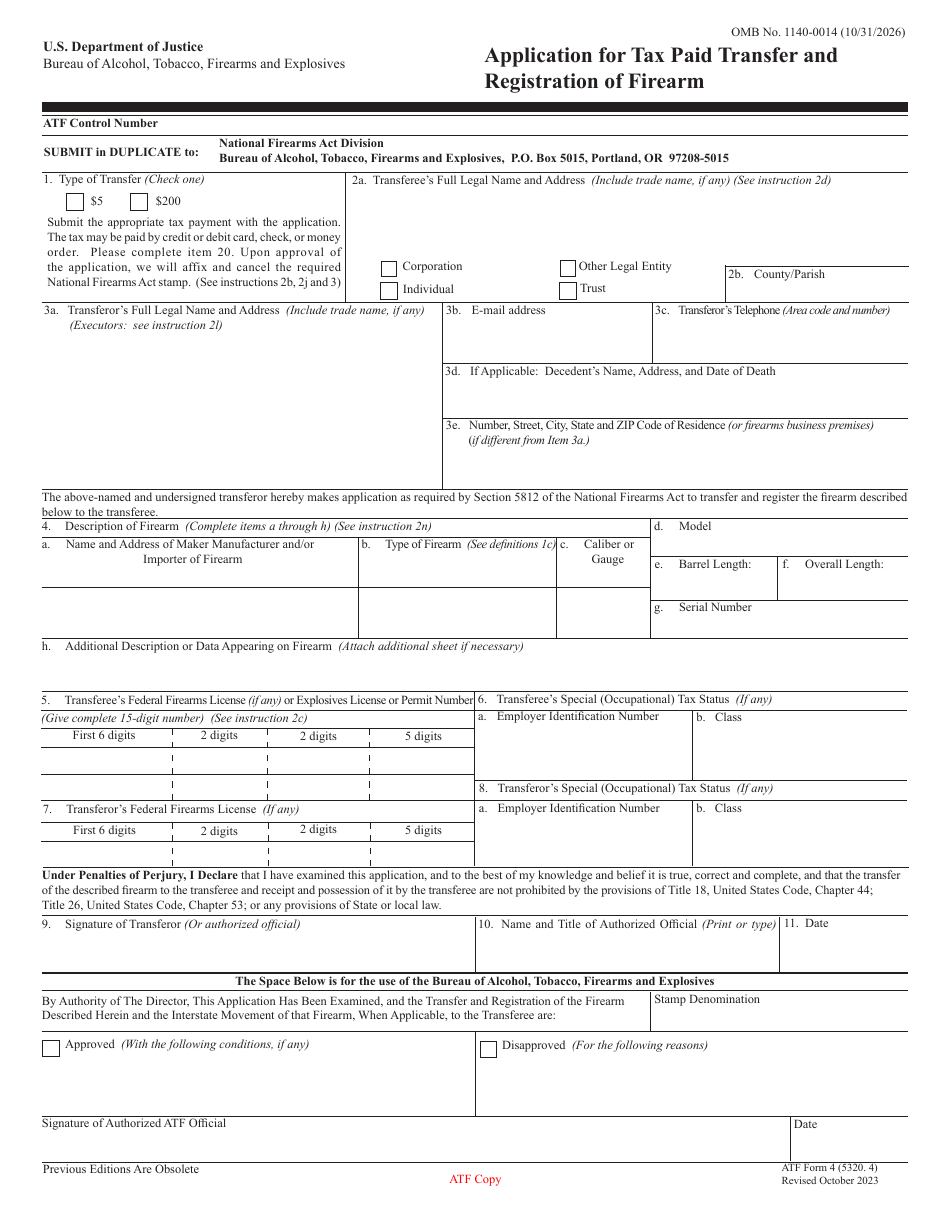

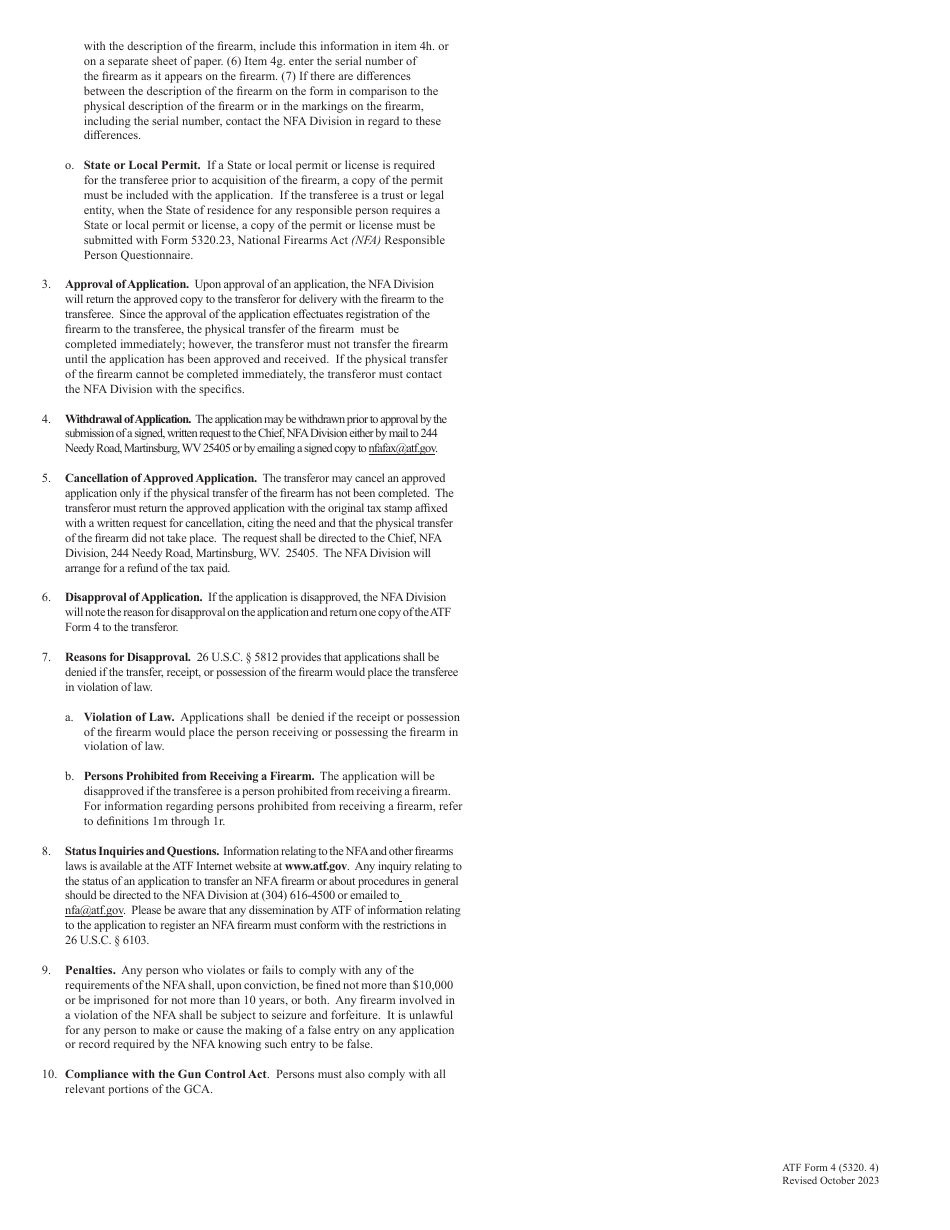

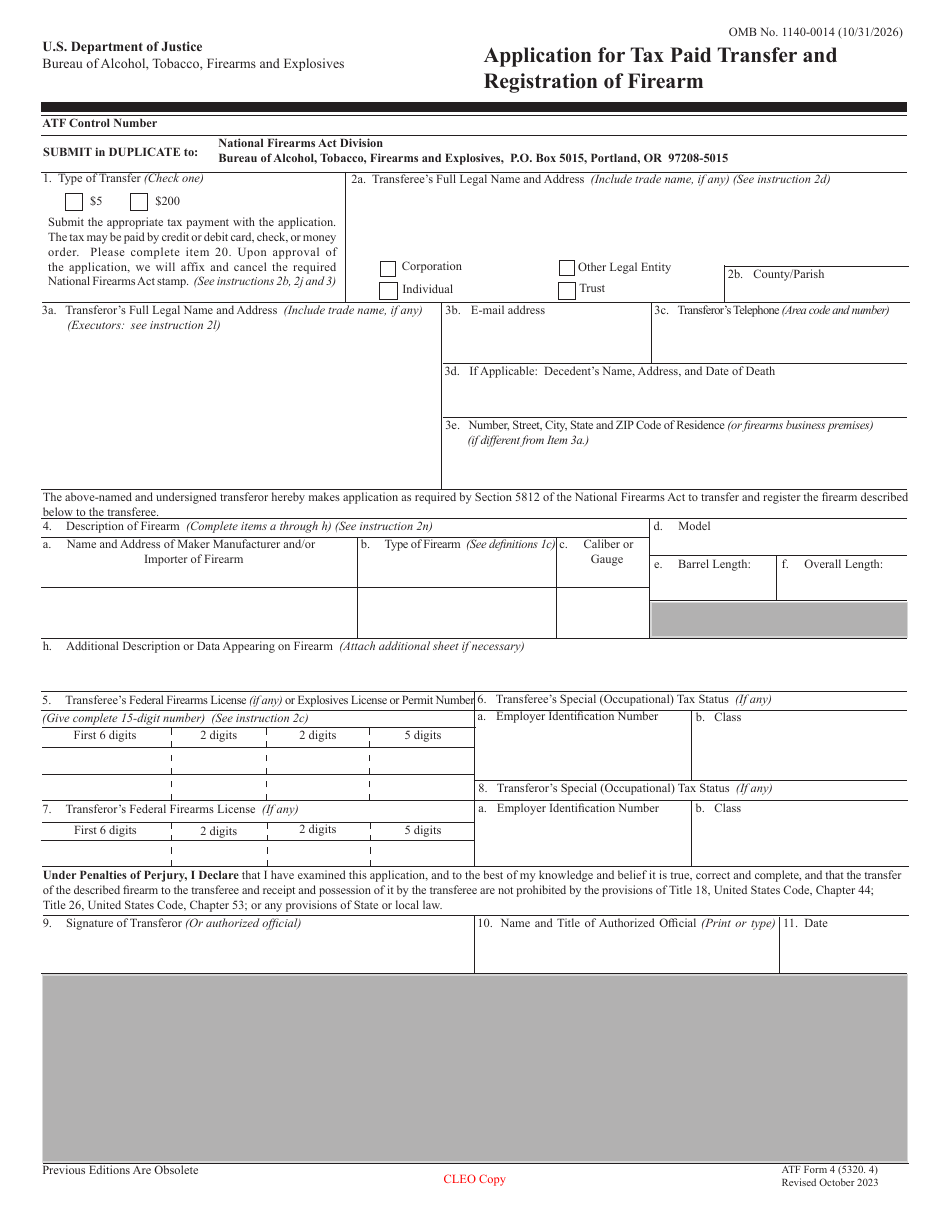

ATF Form 4 (5320.4) Application for Tax Paid Transfer and Registration of Firearm

What Is ATF Form 4?

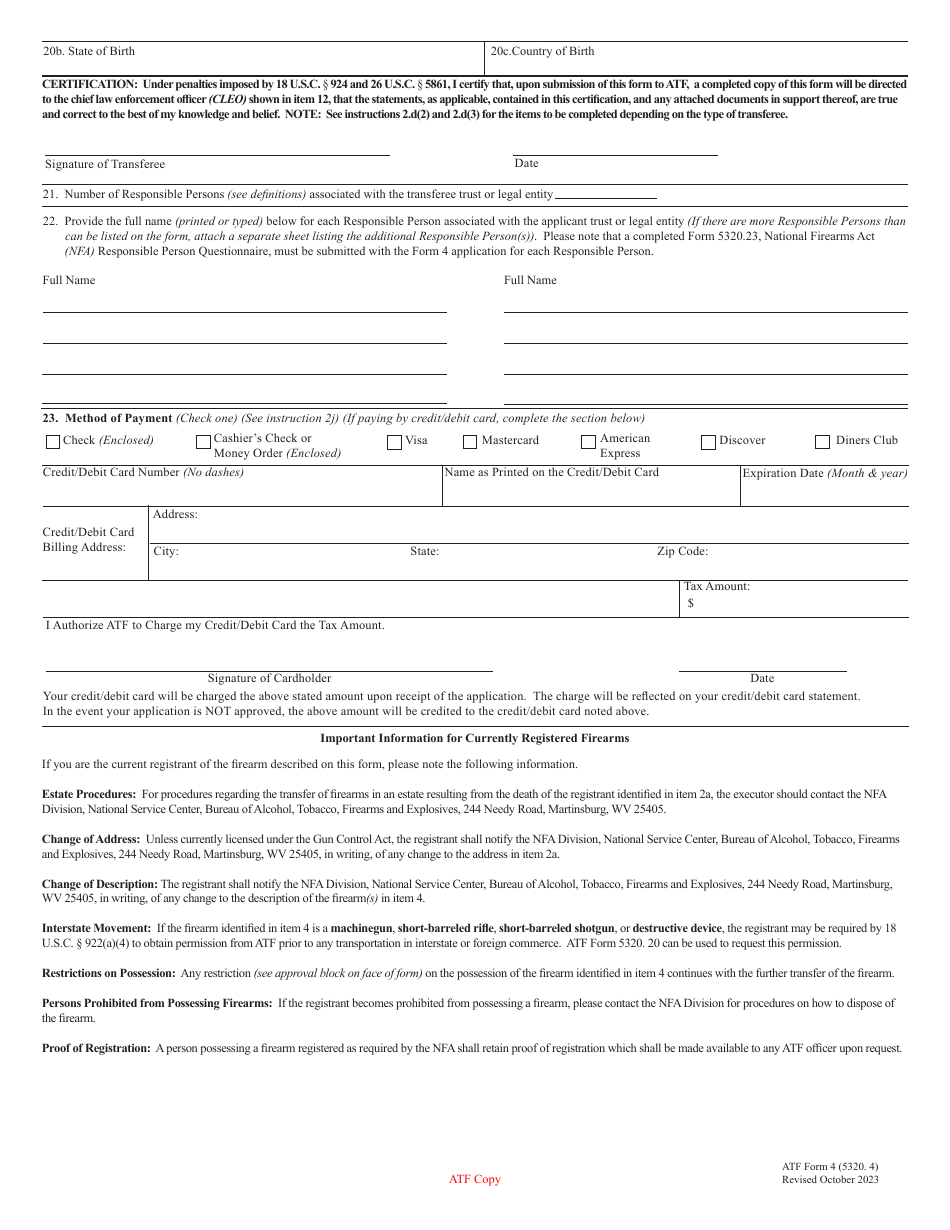

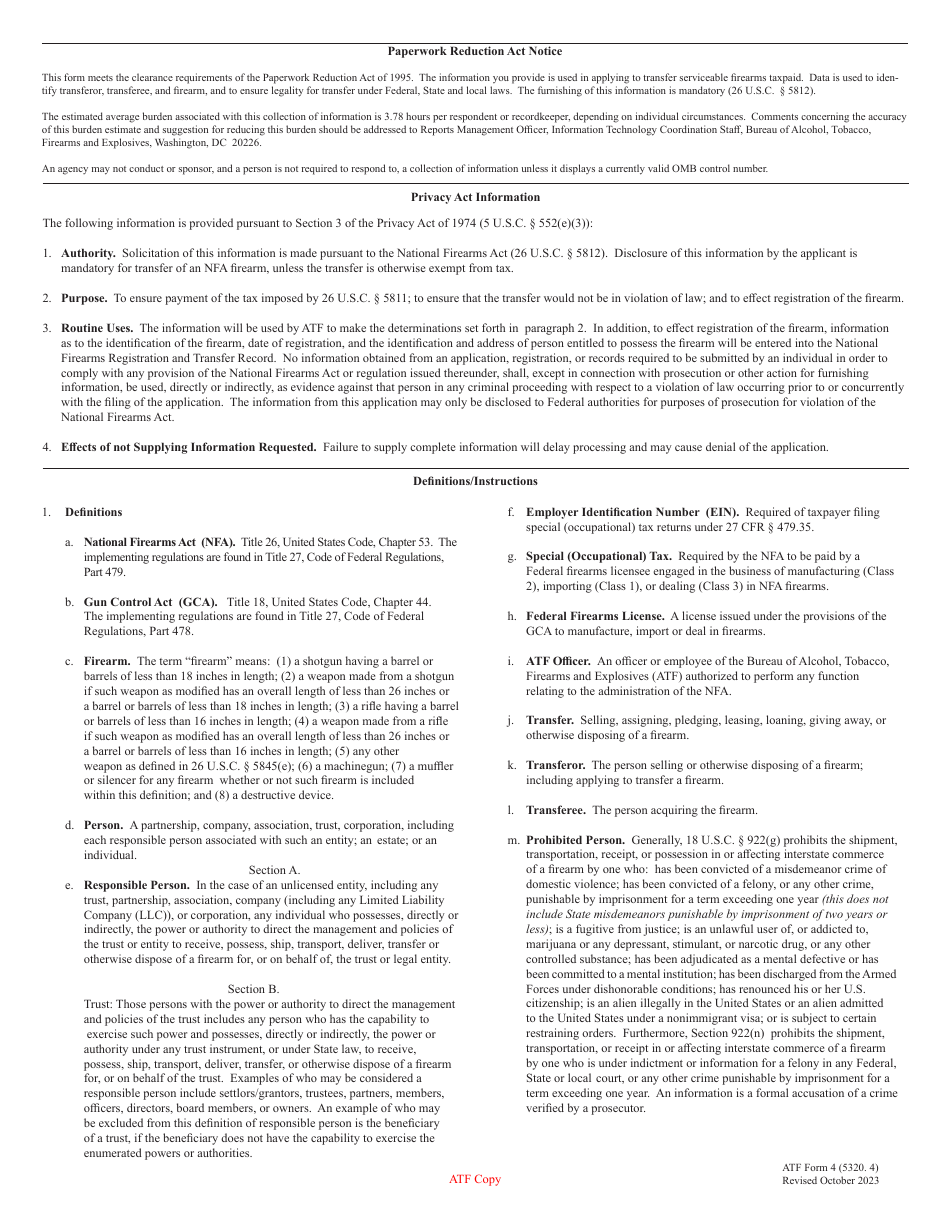

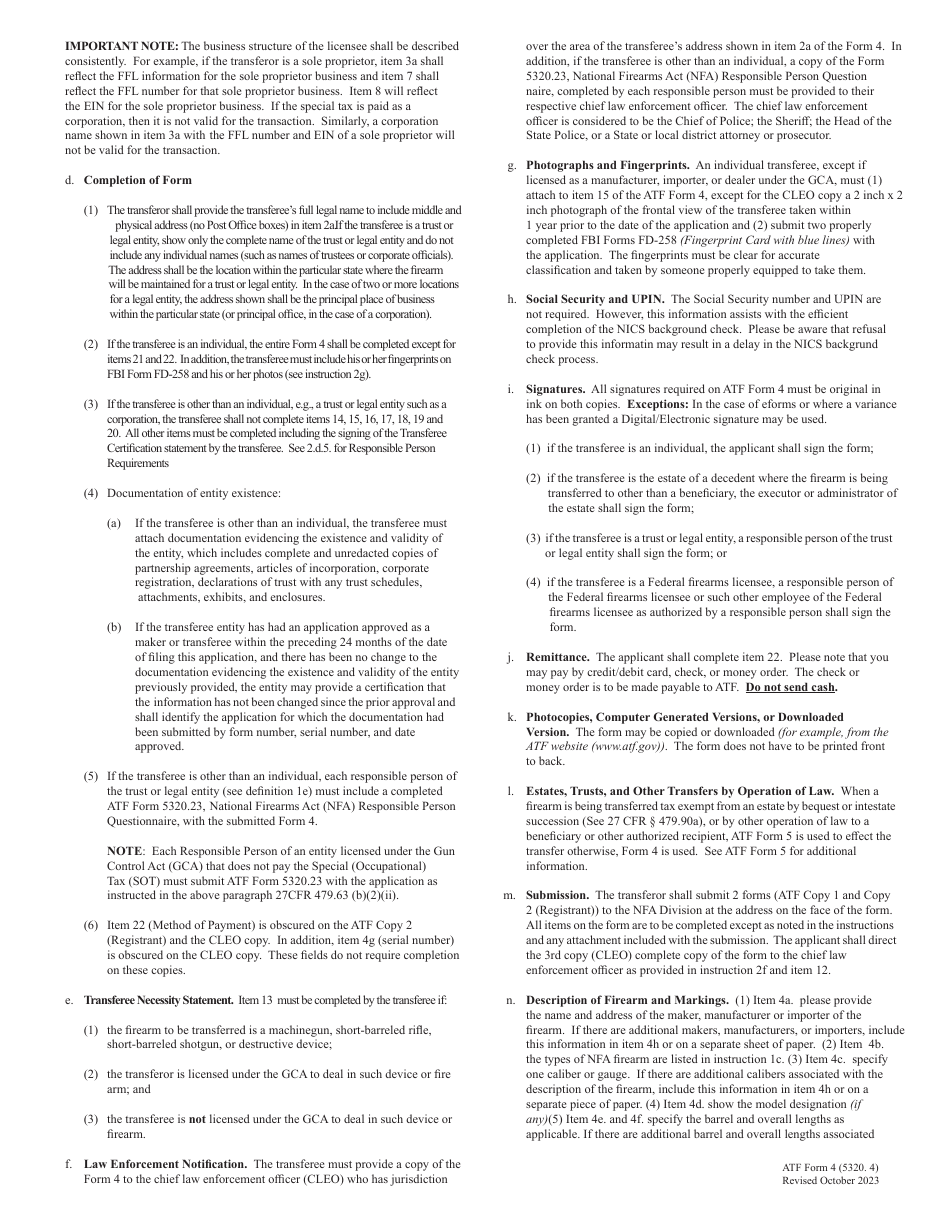

ATF Form 4, Application for Tax Paid Transfer and Registration of Firearm - also known as the ATF E-Form 4 or the ATF Form 5320.4 - is a document used to request approval of a tax-paid transfer of a serviceable firearm from one owner to another. The form is mandatory. The Bureau of Alcohol, Tobacco, Firearms, and Explosives (ATF) uses the provided information to identify the transferred firearm, both parties of transfer, and to ensure the transfer complies with Federal, State, and local laws.

The form was last revised by the ATF on October 1, 2023 . Download the latest fillable ATF Form 4 through the link below.

ATF Form 3 Vs. Form 4

The ATF recognizes ATF Form 3 and ATF Form 4 as the main firearm transfer forms. ATF Form 3 is used to transfer firearms from one Special Occupational Taxpayer (SOT) to another. The transfer documented via this form does not require paying a transfer tax. ATF Form 4 is used when any party of the transfer process is an individual even if the other one is a SOT and requires paying a transfer tax. You can also complete this form to document a person-to-person transfer.

ATF Form 4 Instructions

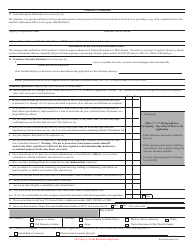

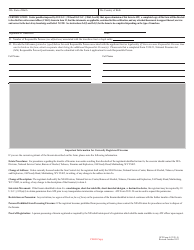

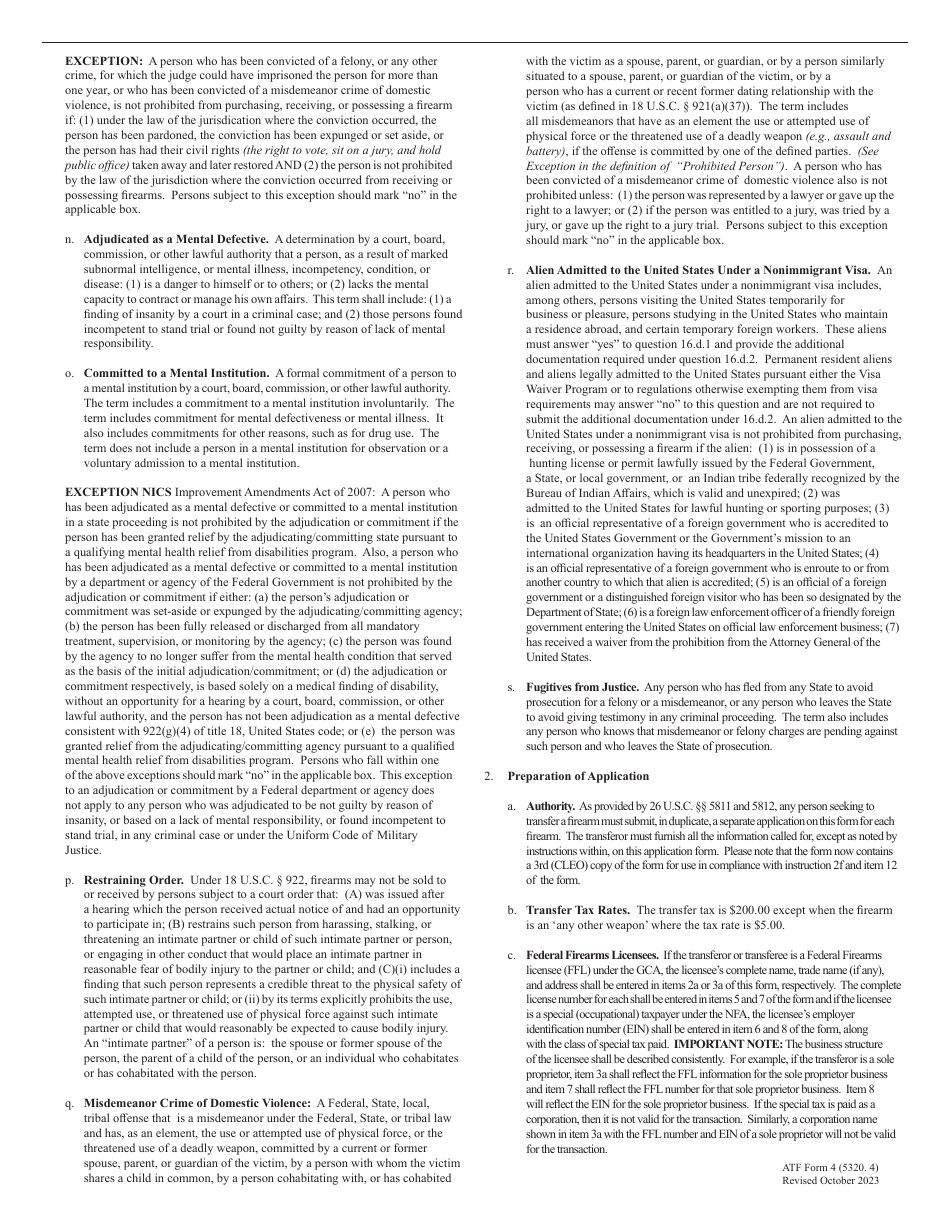

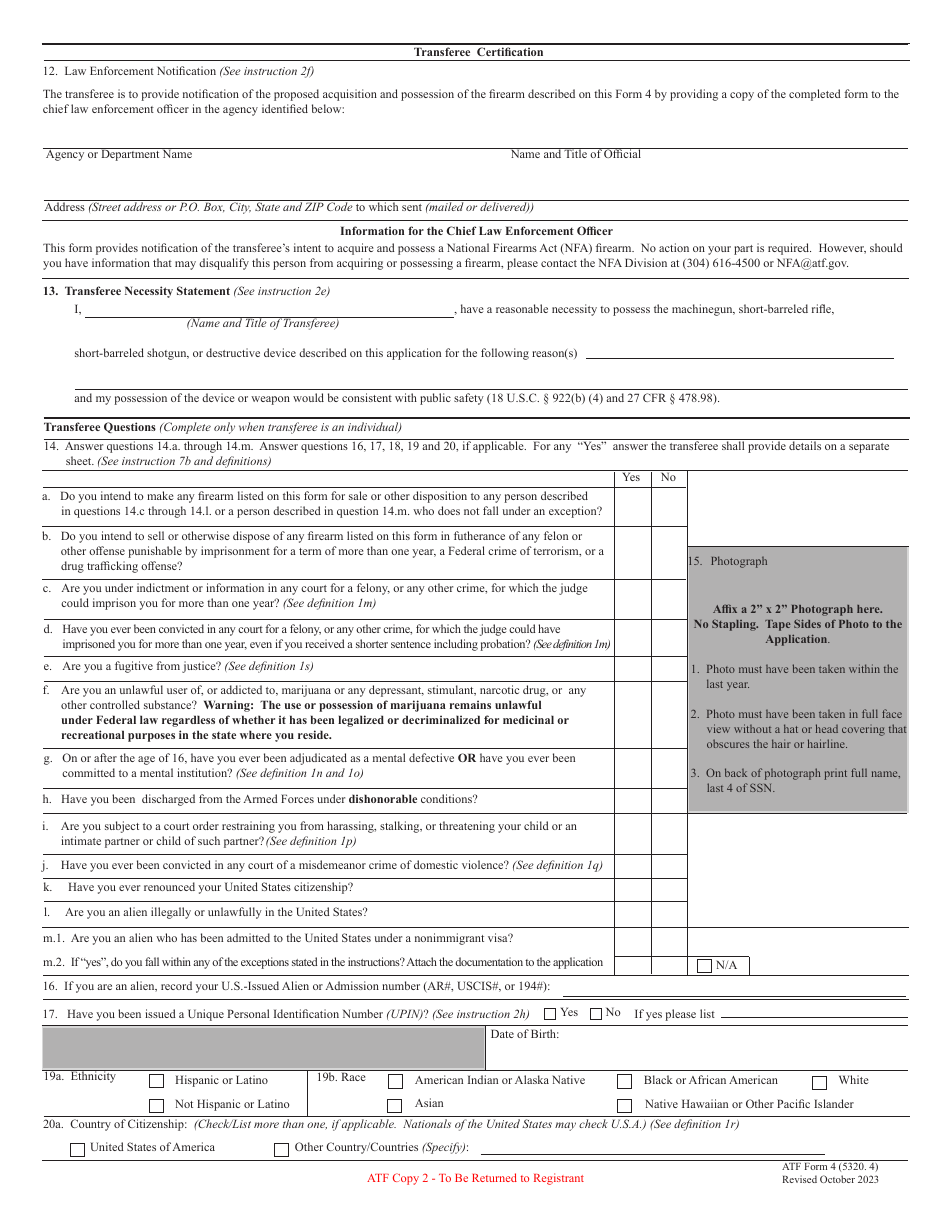

- If the transferee is an individual, complete the whole form except for Items 18 and 19;

- If the transferee is a trust or legal entity, skip Items 14 through 17;

- If the transferee is an individual not licensed under the Gun Control Act as an importer, dealer, or manufacturer, attach 15 a 2-inch x 2-inch frontal view photo of the transferee taken within a year before the application date to Item 15. Do not attach your photo to the CLEO copy;

- If the transferee is an individual, submit two FBI FD-258 forms with the application. The fingerprints must be taken by someone who has the proper equipment for an accurate identification;

- If the transferee is an entity, attach documentation to prove the existence and validity of the entity, e.g., corporate registration, articles of incorporation, declarations of trust, or partnership agreements;

- If the transferee is a trust or legal entity, include a completed ATF Form 5320.23, National Firearms Act (NFA) Responsible Person Questionnaire for each responsible person;

- Before the acquisition of a firearm, the transferee must obtain a state or local permit or license. Attach a copy of this license when submitting your application;

- The ATF will send the approved ATF copy 2 to the transferor. The transferor is prohibited to transfer the firearm before the approval goes through. At the same time, the transferor is obliged to transfer the firearm and the approved application to the transferee immediately upon receipt.

How to Fill out Application for Tax Paid Transfer and Registration of Firearm?

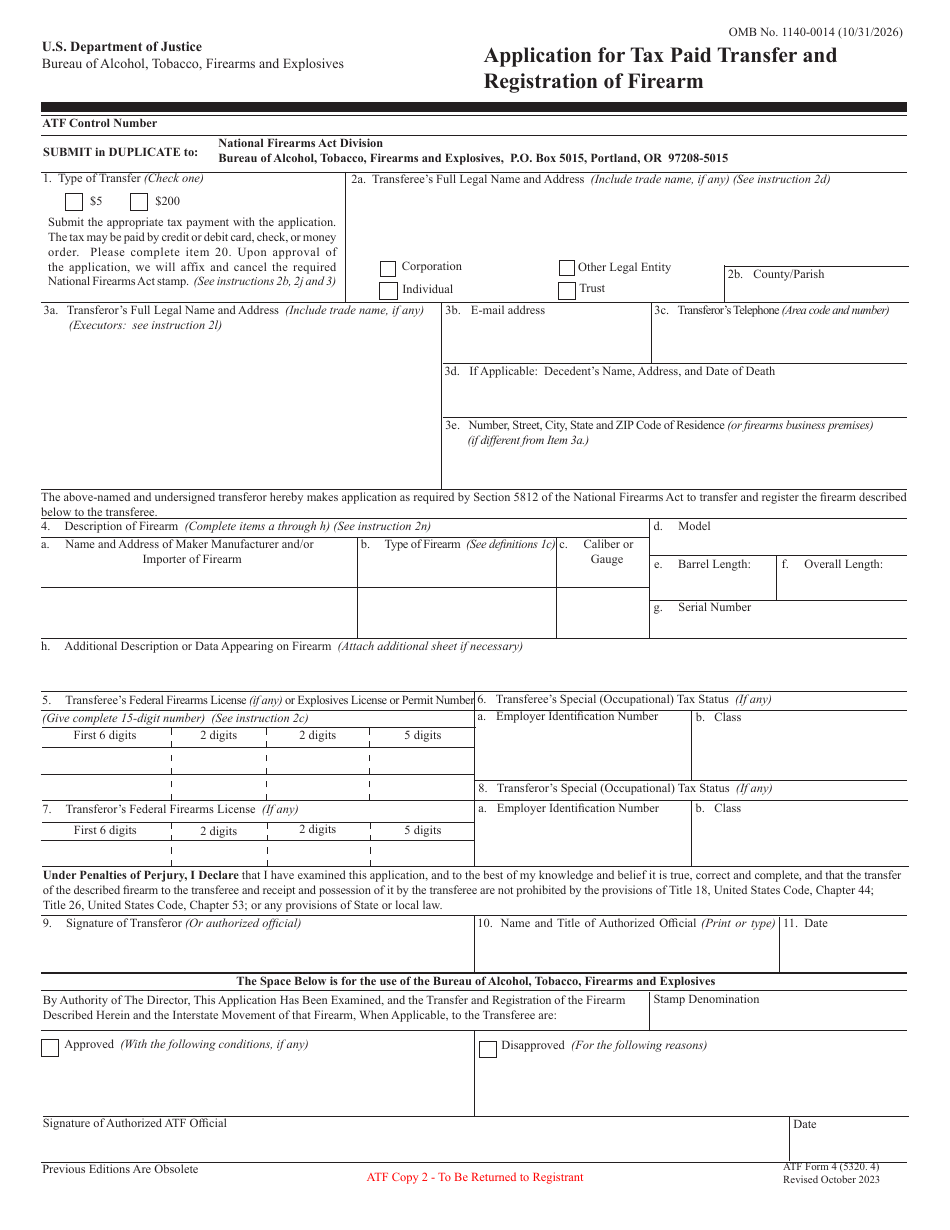

Complete the ATF Form 4 as follows:

- Item 1. Type of Transfer. The tax for a firearm transfer is $200. If "any other weapon" is transferred, the transfer tax will be $5. Find the explanation of the terms in the attached instructions;

- Item 2A. Transferee's Name and Address. Provide the complete name and physical address of the transferee. P.O. Box numbers will not be accepted. If the transferee is a trust or legal entity, enter only the name of the trust or legal entity without including any individual names;

- Item 2B. County. Self-explanatory;

- Items 3A - 3C. Transferor's Name and Address/E-mail Address/Transferor's Telephone. Self-explanatory;

- Item 3D. Decedent's Name, Address, and Date of Death. Fill it out only if you have inherited the firearm and are transferring it to your gun trust;

- Item 3E. Number, Street, City, State and Zip Code of Residence. Complete only if different from the address indicated in the Item 3A;

- Items 4A - 4H. Description of Firearm. Use the fields provided for an accurate description of the firearm you are going to transfer. Do not use any slang terms in your description. Attach additional sheets if needed;

- Item 5. Transferee's Federal Firearms License. If the transferee is a Federal Firearms Licensee, provide a 15-digit license number in this item;

- Item 6. Transferee's Special (Occupational) Tax Status. Fill out this item if the transferee is a SOT;

- Items 7 - 8. Transferor's Federal Firearms License/ Transferor's Special (Occupational) Tax Status. Use the same instructions as applicable for Items 5 - 6;

- Items 9 - 11. Signature of Transferor/ Name and Title of Authorized Official/Date. Self-explanatory;

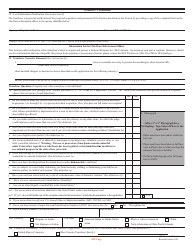

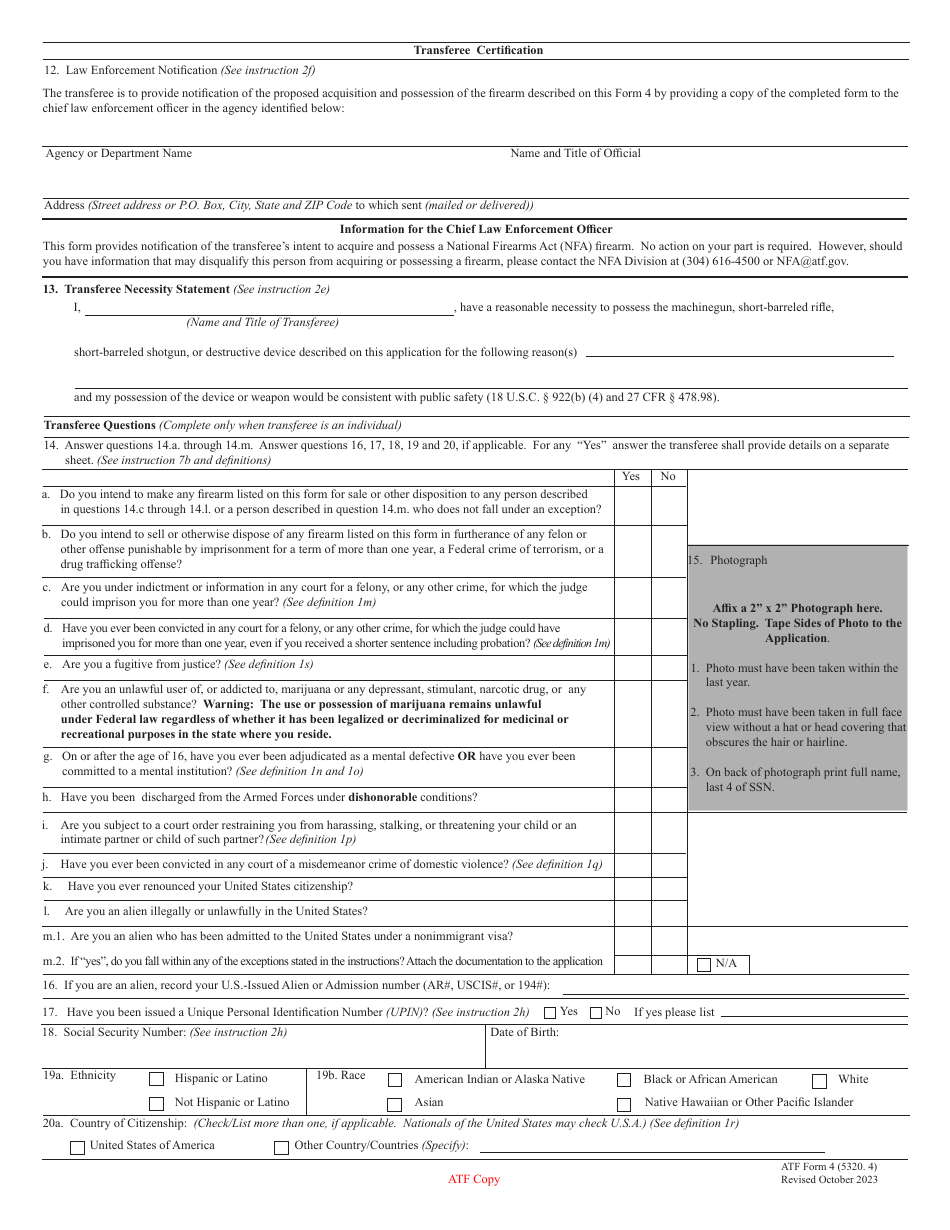

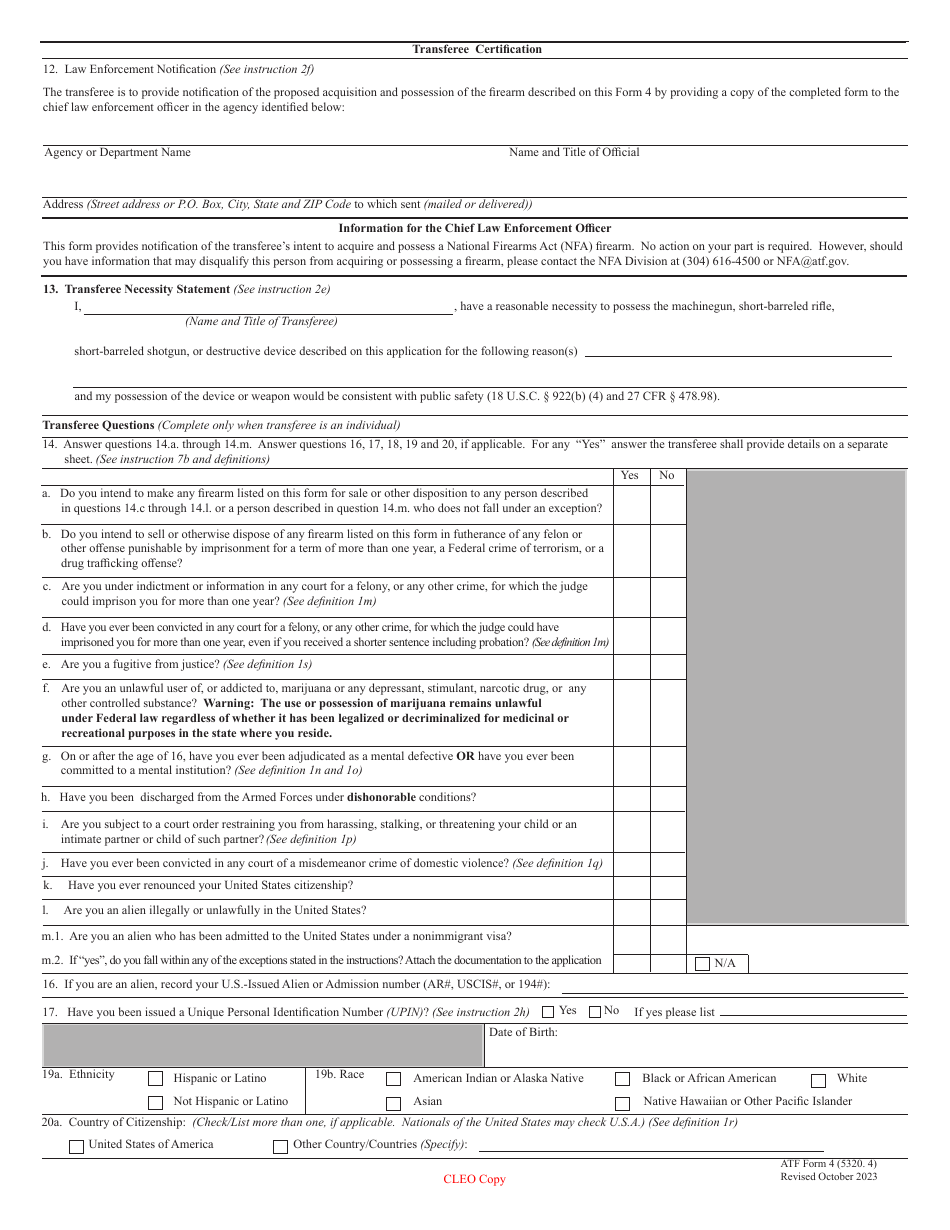

- Item 12. Law Enforcement Notification. Provide here the name of the agency, name, and title of the official, and address where CLEO notification was sent to;

- Item 13. Transferee Necessity Statement. Fill out this item if the firearm to be transferred is a short-barreled rifle or shotgun, machinegun, or destructive device;

- Item 14. Answer the questions provided only if the transferee is an individual. Provide additional details for any "Yes" answer on a separate sheet;

- Item 15. Photograph. Self-explanatory;

- Items 16A - 16D, and 17. Self-explanatory;

- Item 18. The Number of Responsible Persons. It is applicable if a transferee is a trust or legal entity;

- Item 19. If the space provided in this item is not enough, continue listing on a separate sheet;

- Item 20. Method of Payment. Check the method used to pay the transfer tax. If paying by check or money order, submit it with the form.

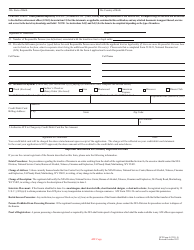

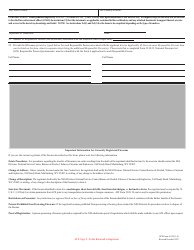

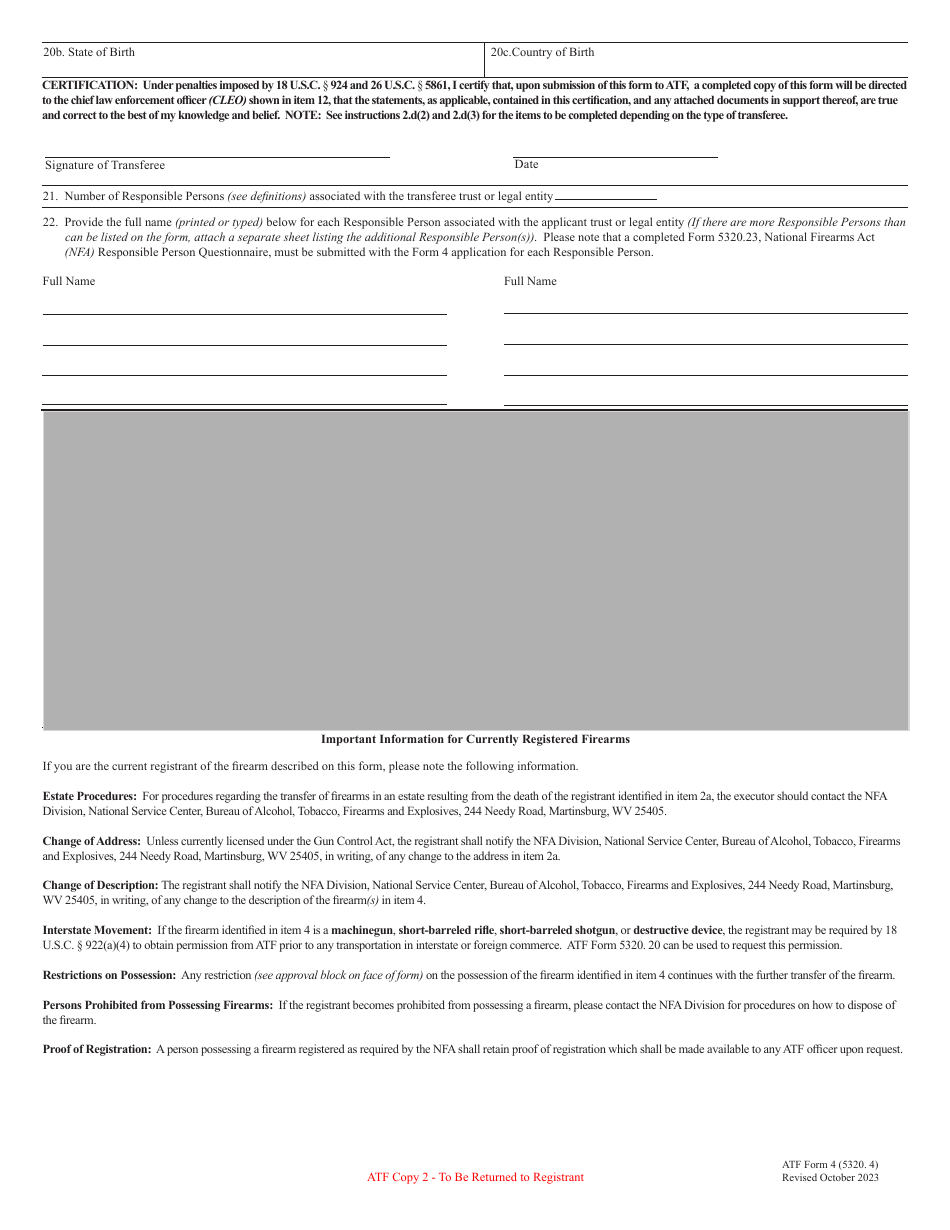

Where to Mail ATF Form 4?

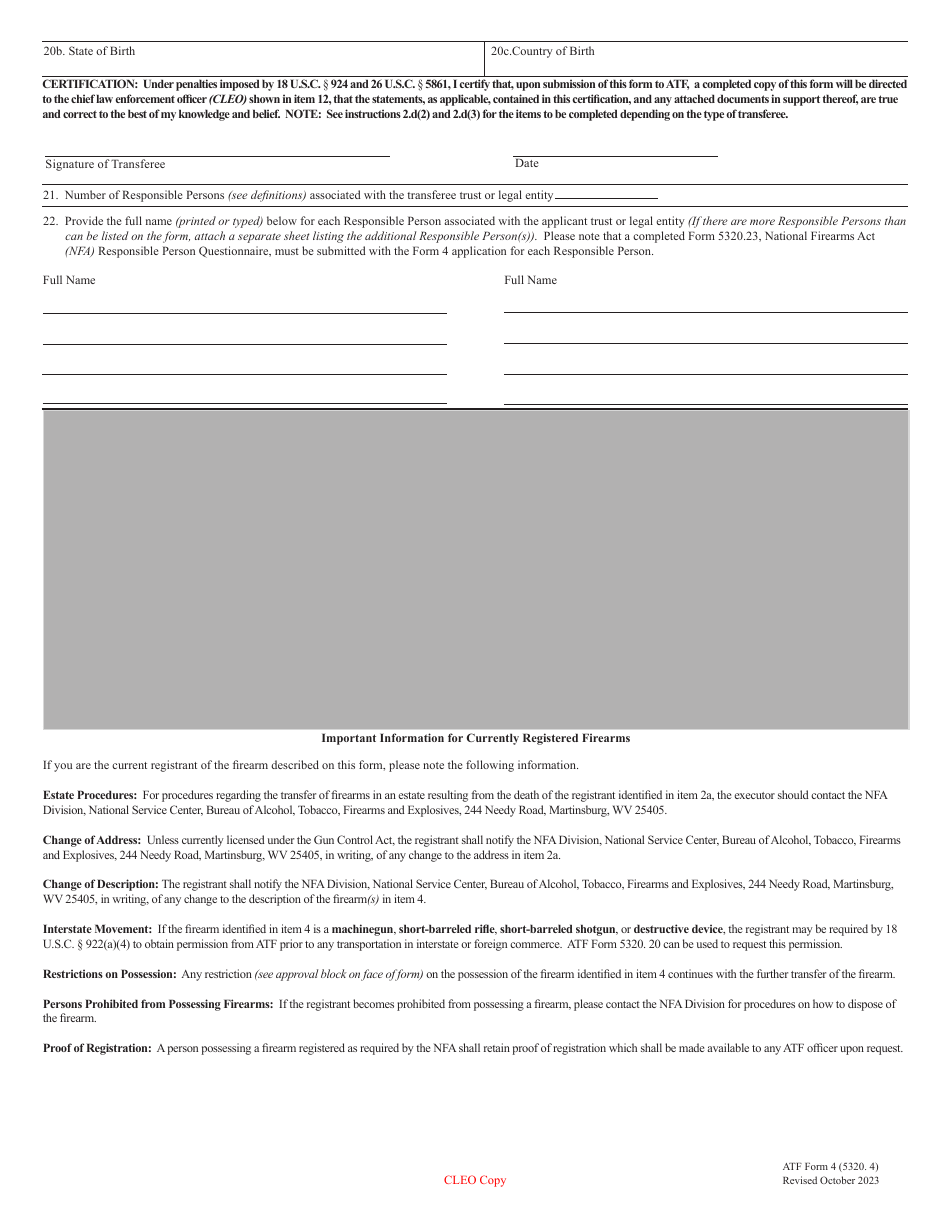

Complete the application for tax paid transfer and registration of firearms in three copies. Submit the ATF Copy and the ATF Copy 2 to the NFA Division. The ATF Form 4 mailing address is provided on the front of the form. Provide the third chief law enforcement officer (CLEO) copy to the officer that has jurisdiction over the area that includes transferee's address indicated in Item 2A. The CLEO can be the sheriff, state or local district attorney, prosecutor, chief of police, or head of the state police.

How Do I Check the Status of My ATF Form 4?

The current wait time is around 4 to 8 months. To stay updated, check your ATF Form 4 status by calling the NFA Division at (304) 616-4500. You can also inquire about the form status via email. The email address for all inquiries is provided on the document.