This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 14446 (PL)

for the current year.

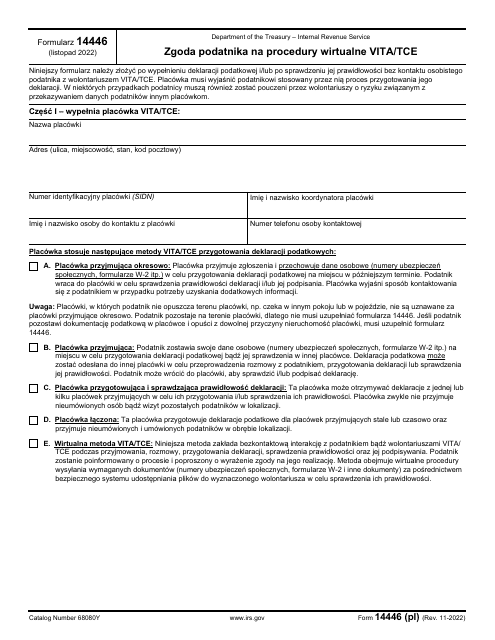

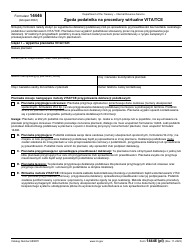

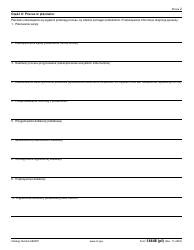

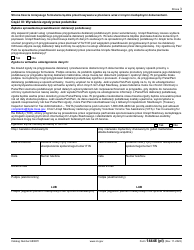

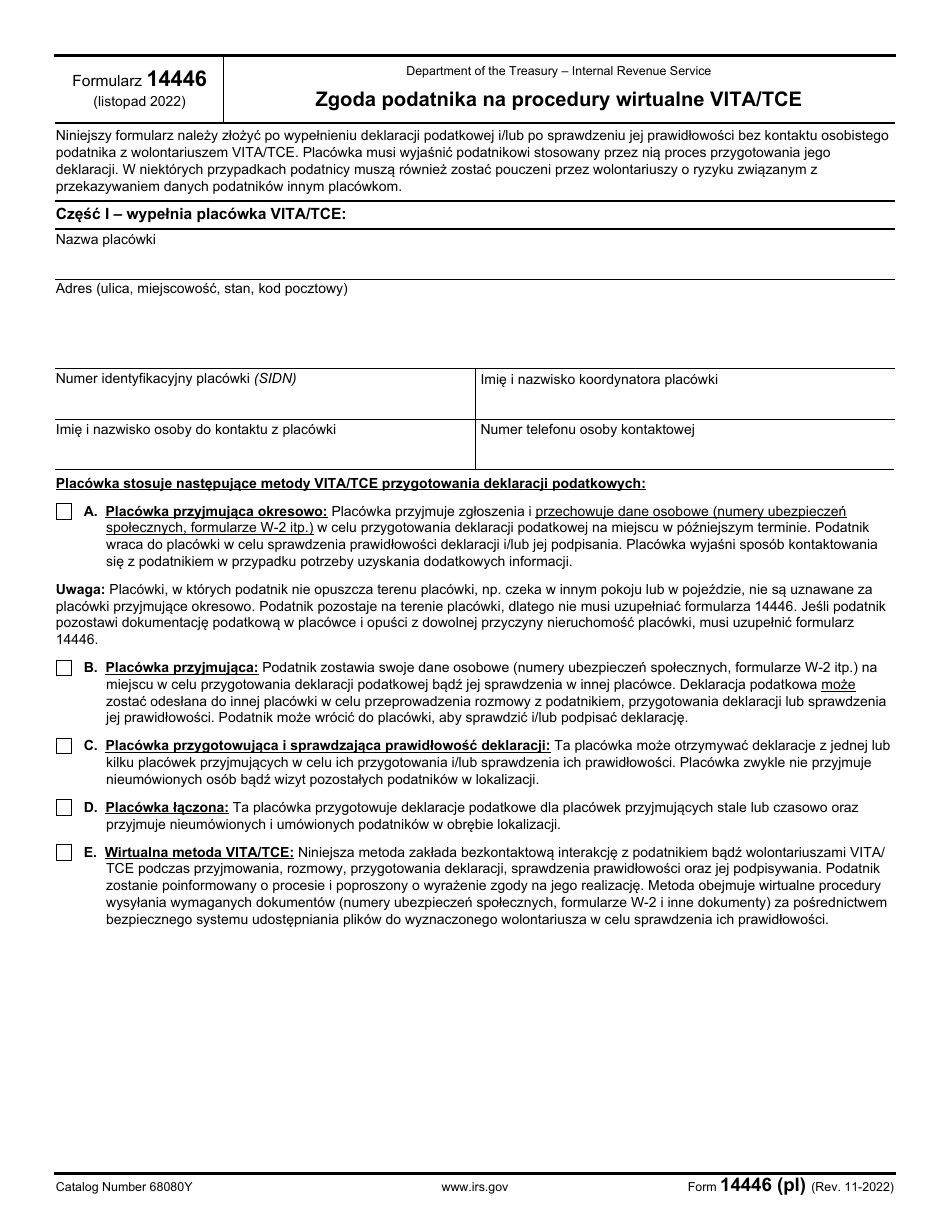

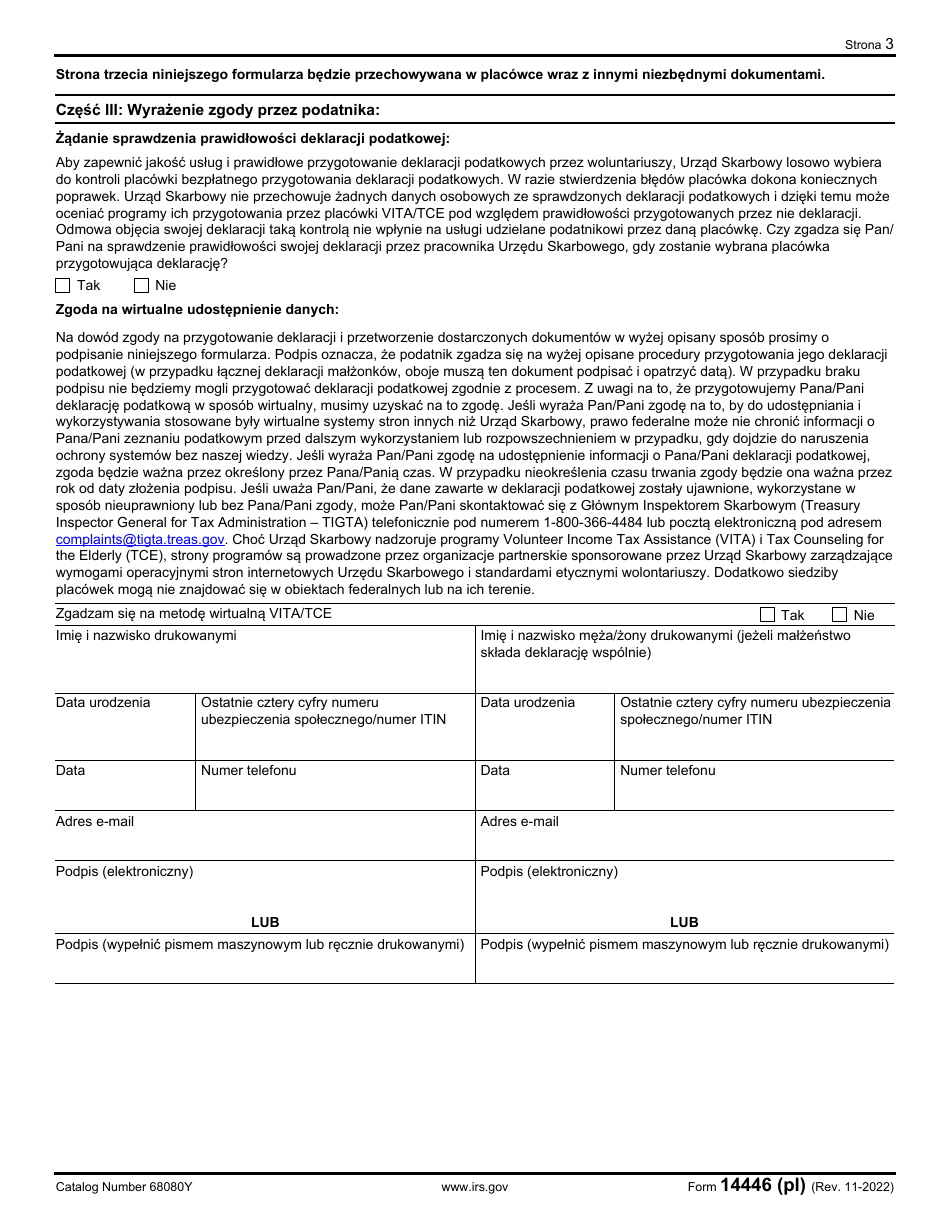

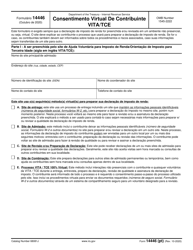

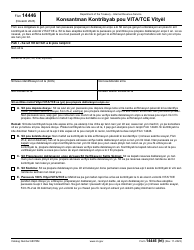

IRS Form 14446 (PL) Virtual Vita / Tce Taxpayer Consent (Polish)

IRS Form 14446 (PL), Virtual VITA/TCE Taxpayer Consent (Polish), is used to obtain the taxpayer's consent to participate in the Virtual VITA/TCE program and receive tax assistance services in Polish.

FAQ

Q: What is IRS Form 14446 (PL)?

A: IRS Form 14446 (PL) is the Virtual Vita/Tce Taxpayer Consent form for Polish taxpayers.

Q: What is the purpose of IRS Form 14446 (PL)?

A: The purpose of IRS Form 14446 (PL) is to provide consent from Polish taxpayers to receive virtual tax assistance.

Q: Who needs to use IRS Form 14446 (PL)?

A: Polish taxpayers who want to participate in the Virtual Vita/Tce tax assistance program need to use IRS Form 14446 (PL).

Q: Can I use IRS Form 14446 (PL) if I am not a Polish taxpayer?

A: No, IRS Form 14446 (PL) is specifically for Polish taxpayers.

Q: Is IRS Form 14446 (PL) available in English?

A: No, IRS Form 14446 (PL) is specifically for Polish taxpayers and is available in Polish language.