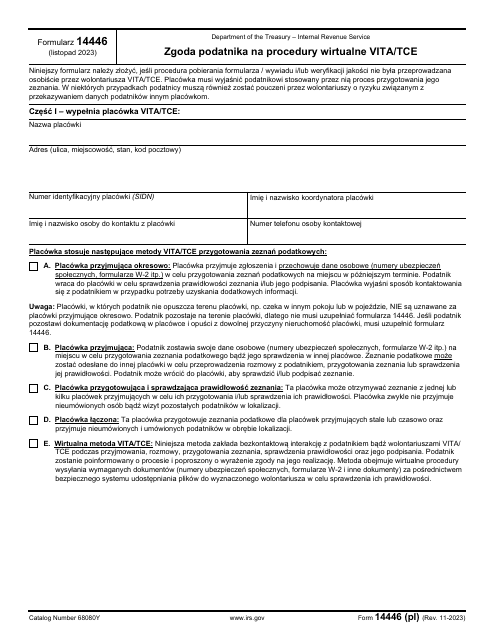

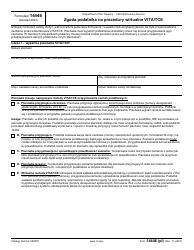

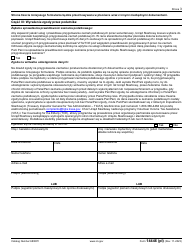

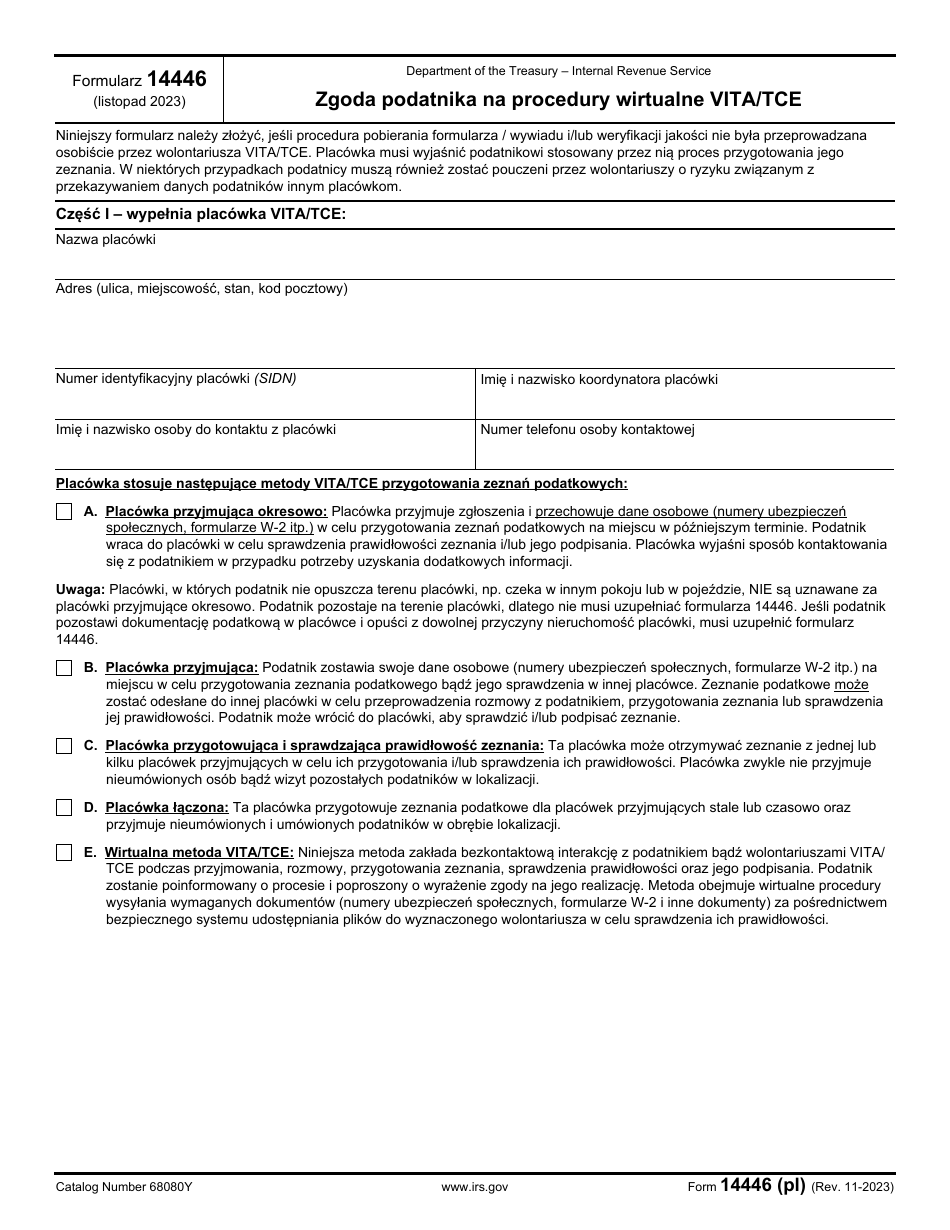

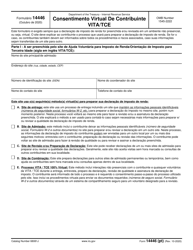

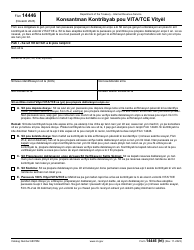

IRS Form 14446 (PL) Virtual Vita / Tce Taxpayer Consent (Polish)

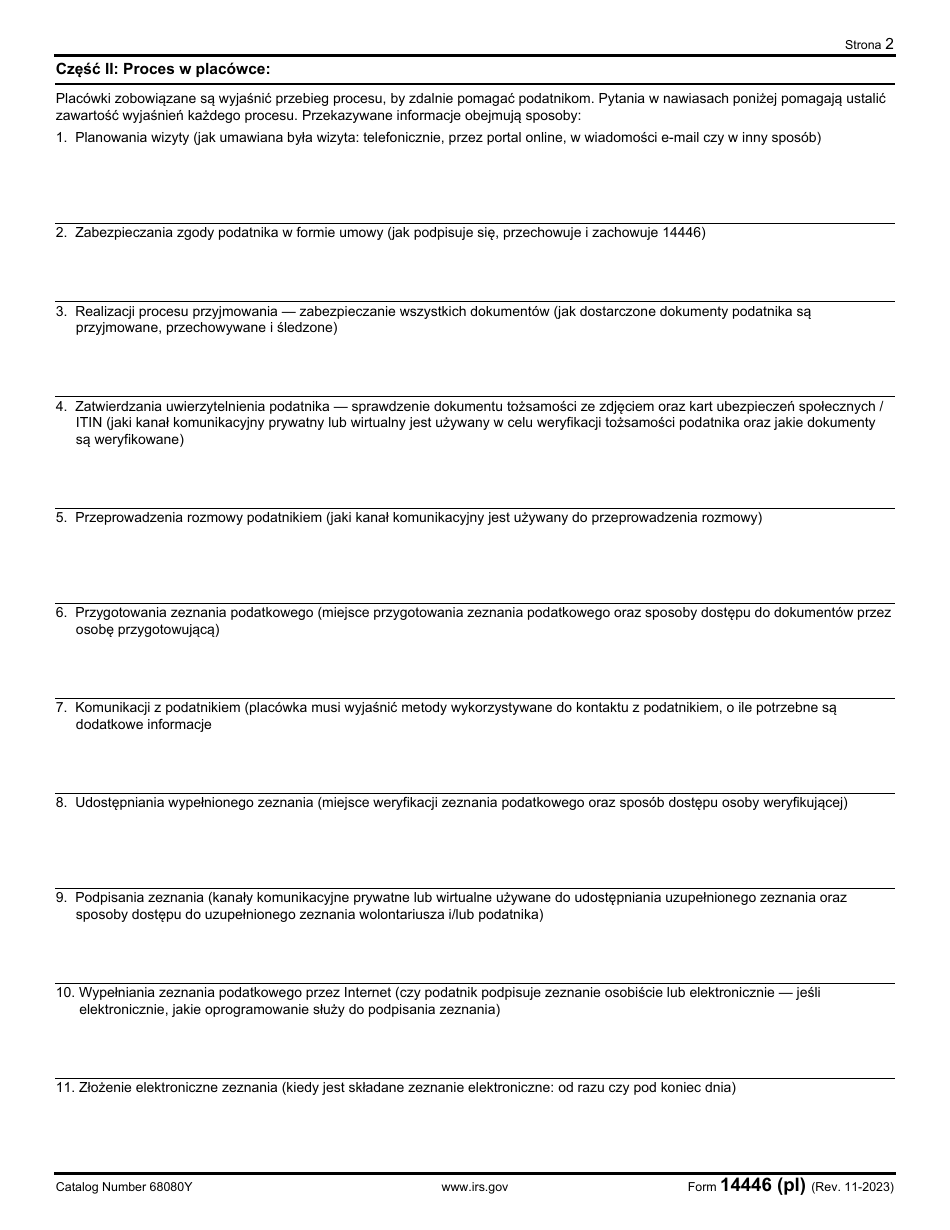

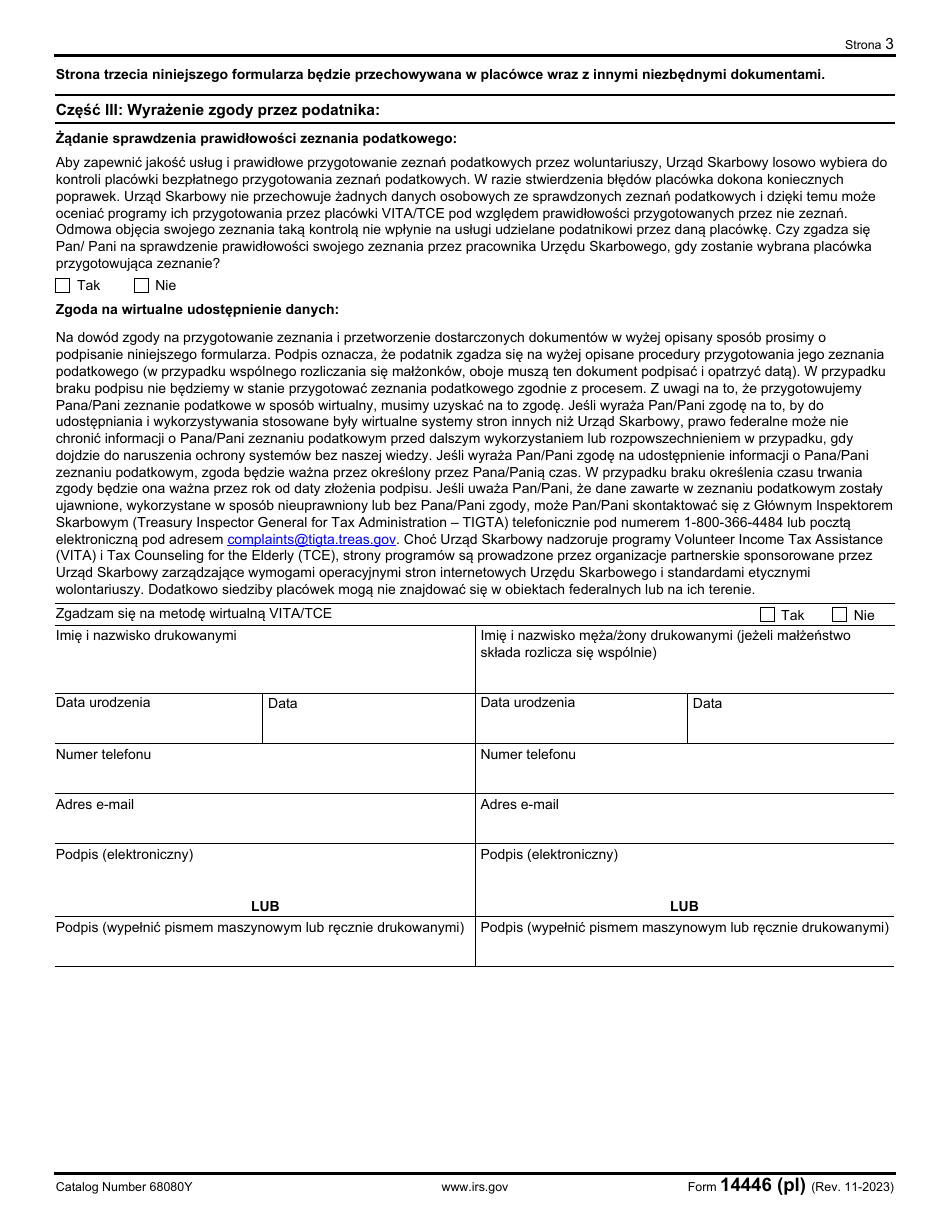

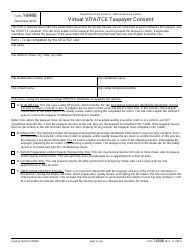

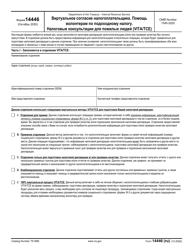

IRS Form 14446 (PL), Virtual VITA/TCE Taxpayer Consent (Polish), is used to obtain the taxpayer's consent to participate in the Virtual VITA/TCE program and receive tax assistance services in Polish.

IRS Form 14446 (PL) Virtual Vita/Tce Taxpayer Consent (Polish) - Frequently Asked Questions (FAQ)

Q: What is IRS Form 14446 (PL)?

A: IRS Form 14446 (PL) is the Virtual Vita/Tce Taxpayer Consent form for Polish taxpayers.

Q: What is the purpose of IRS Form 14446 (PL)?

A: The purpose of IRS Form 14446 (PL) is to provide consent from Polish taxpayers to receive virtual tax assistance.

Q: Who needs to use IRS Form 14446 (PL)?

A: Polish taxpayers who want to participate in the Virtual Vita/Tce tax assistance program need to use IRS Form 14446 (PL).

Q: Can I use IRS Form 14446 (PL) if I am not a Polish taxpayer?

A: No, IRS Form 14446 (PL) is specifically for Polish taxpayers.

Q: Is IRS Form 14446 (PL) available in English?

A: No, IRS Form 14446 (PL) is specifically for Polish taxpayers and is available in Polish language.