This version of the form is not currently in use and is provided for reference only. Download this version of

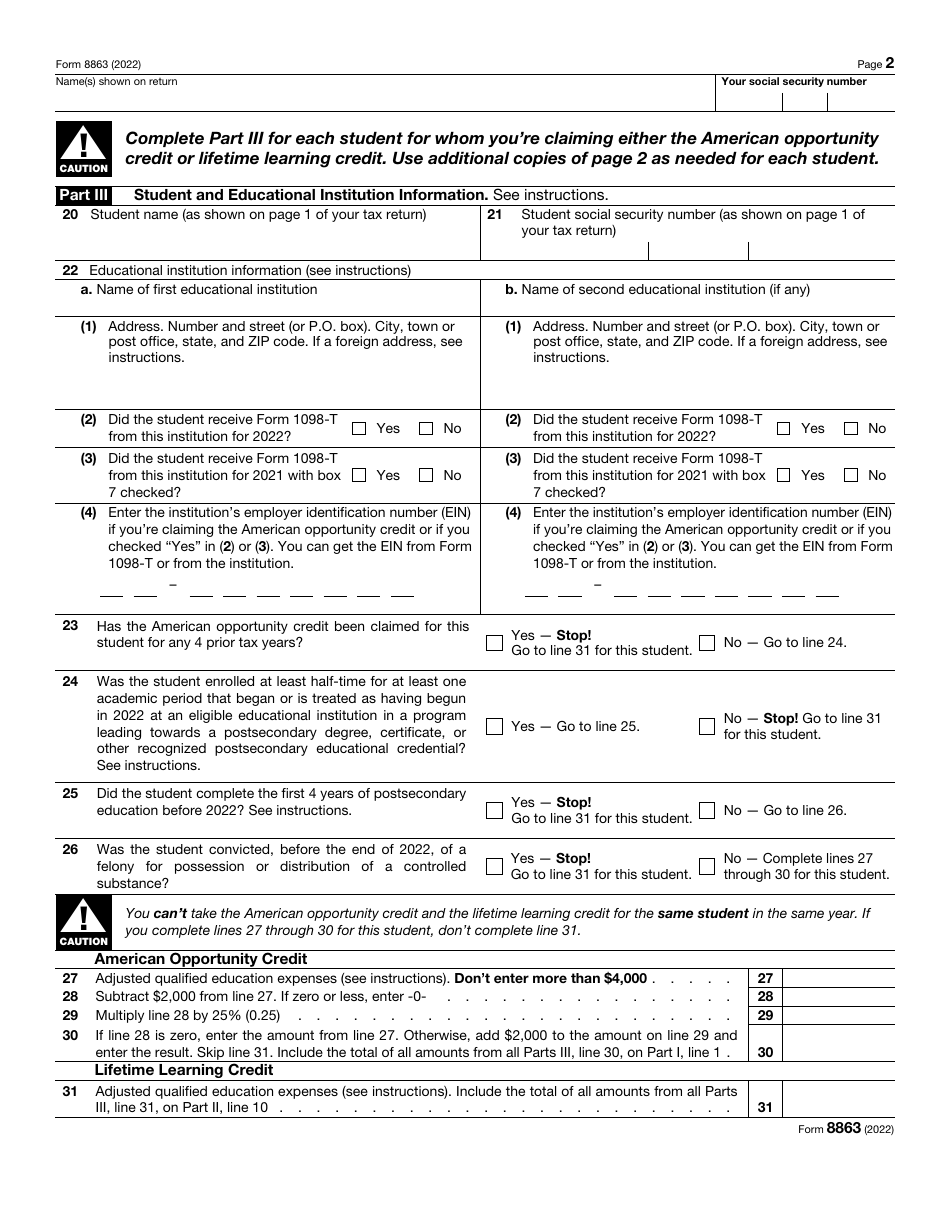

IRS Form 8863

for the current year.

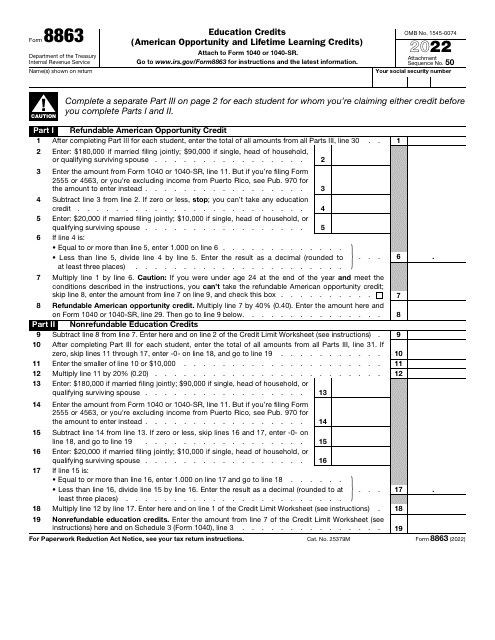

IRS Form 8863 Education Credits (American Opportunity and Lifetime Learning Credits)

What Is IRS Form 8863?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8863?

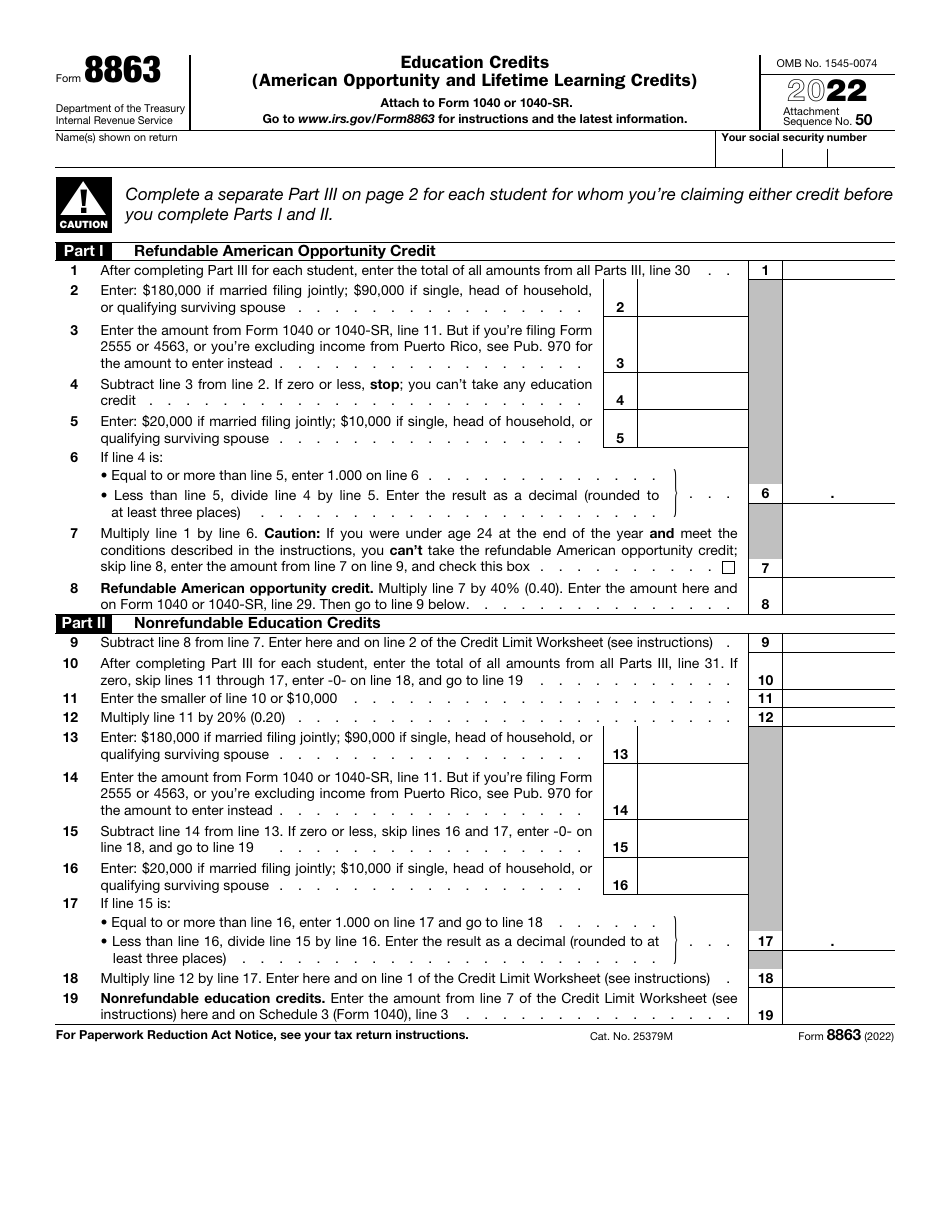

A: IRS Form 8863 is a form used to claim education credits, such as the American Opportunity Credit and the Lifetime Learning Credit.

Q: What is the American Opportunity Credit?

A: The American Opportunity Credit is a tax credit that can be claimed for qualified education expenses incurred by an eligible student.

Q: What is the Lifetime Learning Credit?

A: The Lifetime Learning Credit is a tax credit that can be claimed for qualified education expenses incurred by the taxpayer, their spouse, or their dependents.

Q: Who is eligible to claim the education credits?

A: Eligibility for the education credits varies, but generally, the credits can be claimed by taxpayers who paid qualified education expenses for themselves, their spouse, or their dependents.

Q: What are qualified education expenses?

A: Qualified education expenses include tuition, fees, and other related expenses required for enrollment or attendance at an eligible educational institution.

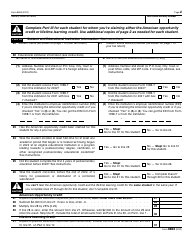

Q: How do I fill out Form 8863?

A: To fill out Form 8863, you will need to provide information about the student, education institution, and qualified education expenses. The form requires you to calculate the amount of credit you are eligible for.

Q: Is there an income limit for claiming the education credits?

A: Yes, there are income limits for claiming the education credits. These limits vary depending on the credit and the taxpayer's filing status.

Q: Are there any restrictions on claiming both the American Opportunity Credit and the Lifetime Learning Credit?

A: Yes, you cannot claim both credits for the same student in the same year. You must choose one credit that provides the most benefit.

Q: When should I file Form 8863?

A: Form 8863 should be filed along with your individual income tax return. The deadline for filing depends on the tax year.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8863 through the link below or browse more documents in our library of IRS Forms.