This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8853

for the current year.

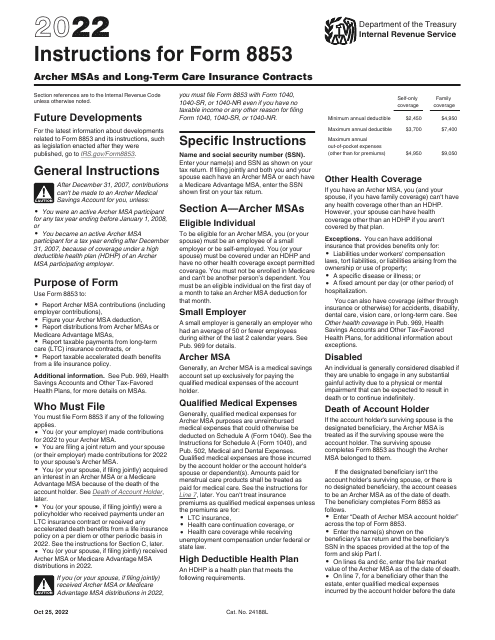

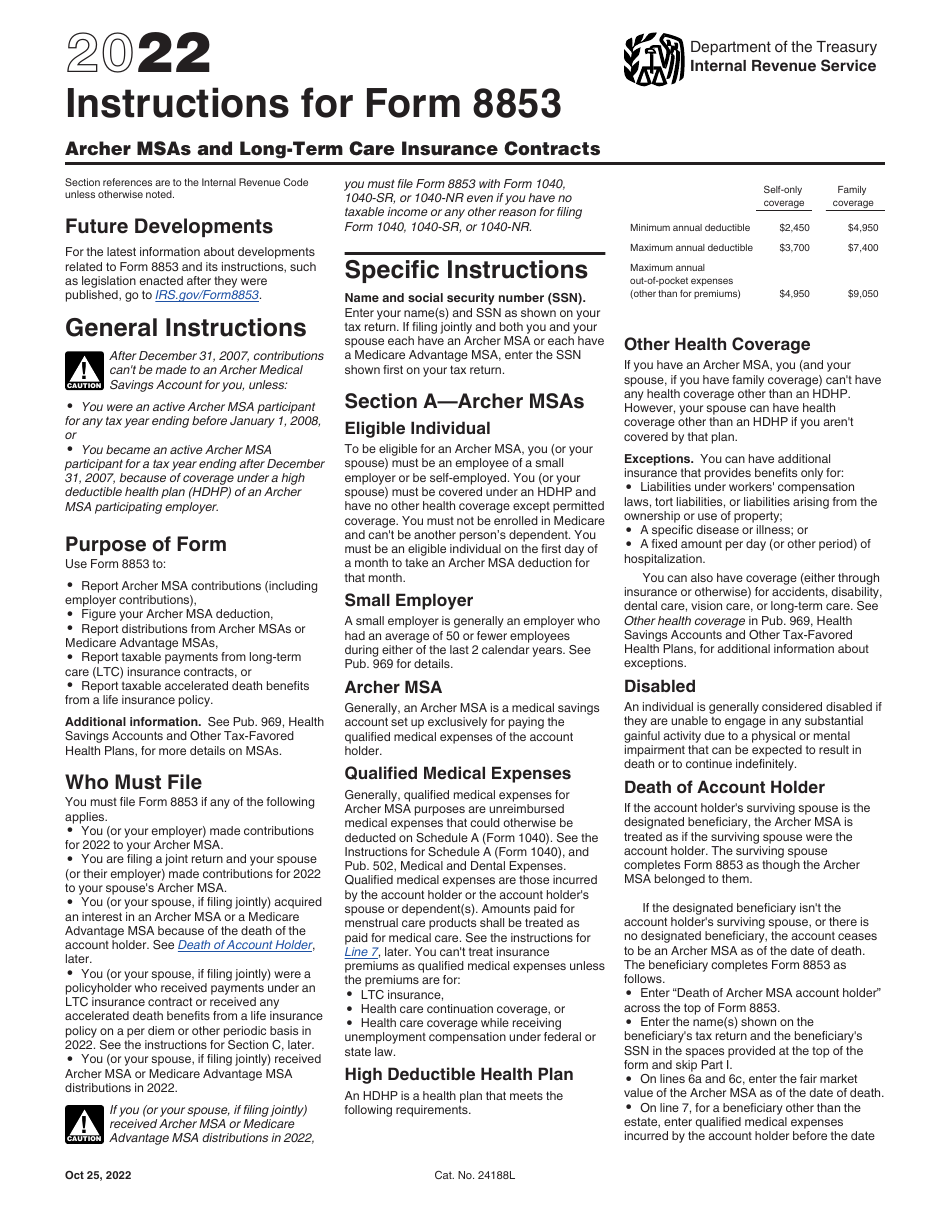

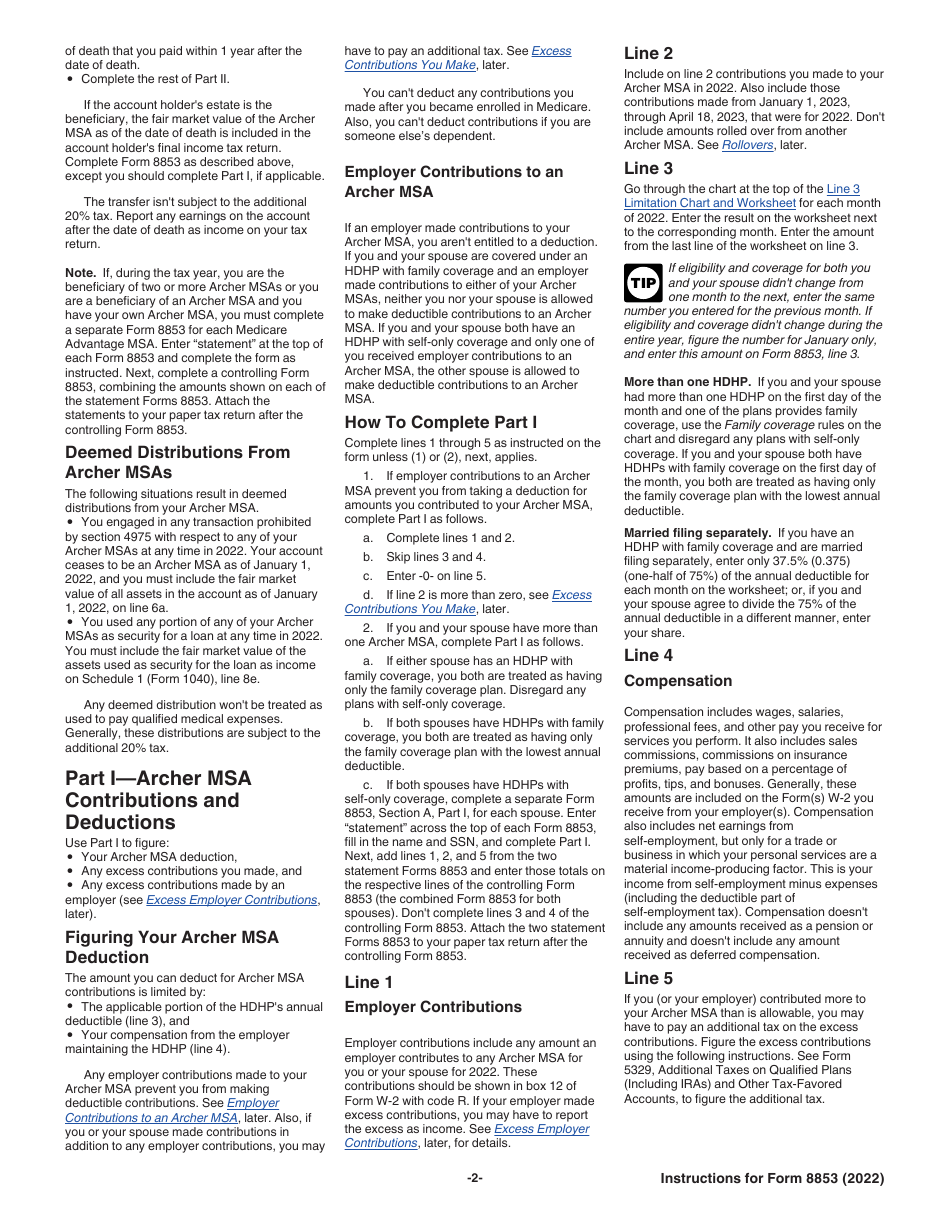

Instructions for IRS Form 8853 Archer Msas and Long-Term Care Insurance Contracts

This document contains official instructions for IRS Form 8853 , Archer Msas and Long-Term Care Insurance Contracts - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8853 is available for download through this link.

FAQ

Q: What is IRS Form 8853?

A: IRS Form 8853 is a tax form used to report contributions to Archer MSAs and to provide information on long-term care insurance contracts.

Q: What are Archer MSAs?

A: Archer MSAs, or Medical Savings Accounts, are tax-exempt accounts that individuals who have high-deductible health plans can use to save for medical expenses.

Q: What information do I need to provide on Form 8853 for Archer MSAs?

A: You need to report your Archer MSA contributions, distributions, and any excess contributions you made.

Q: What is a long-term care insurance contract?

A: A long-term care insurance contract is an insurance policy that helps cover the costs of long-term care services, such as nursing home care or in-home care.

Q: Do I need to report my long-term care insurance contract on Form 8853?

A: No, you do not need to report your long-term care insurance contract on Form 8853. The form is only for reporting Archer MSA contributions and distributions.

Q: Are there any penalties for not filing Form 8853?

A: Yes, there may be penalties for not filing Form 8853 or for incorrectly reporting Archer MSA contributions, distributions, or excess contributions.

Q: Can I file Form 8853 electronically?

A: Yes, you can file Form 8853 electronically if you are using tax software or if you are e-filing your tax return.

Q: Can I make changes to Form 8853 after it has been submitted?

A: If you need to make changes to Form 8853 after it has been submitted, you will need to file an amended tax return using Form 1040X.

Q: Is Form 8853 specific to the United States or Canada?

A: Form 8853 is specific to the United States. If you are a resident of Canada, you will need to consult the Canadian tax authorities for the appropriate forms and instructions.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.