This version of the form is not currently in use and is provided for reference only. Download this version of

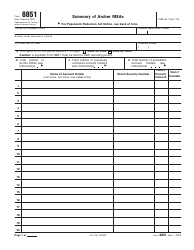

IRS Form 8853

for the current year.

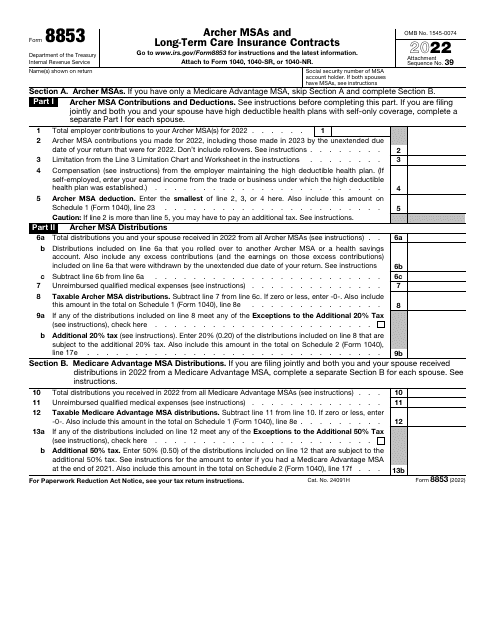

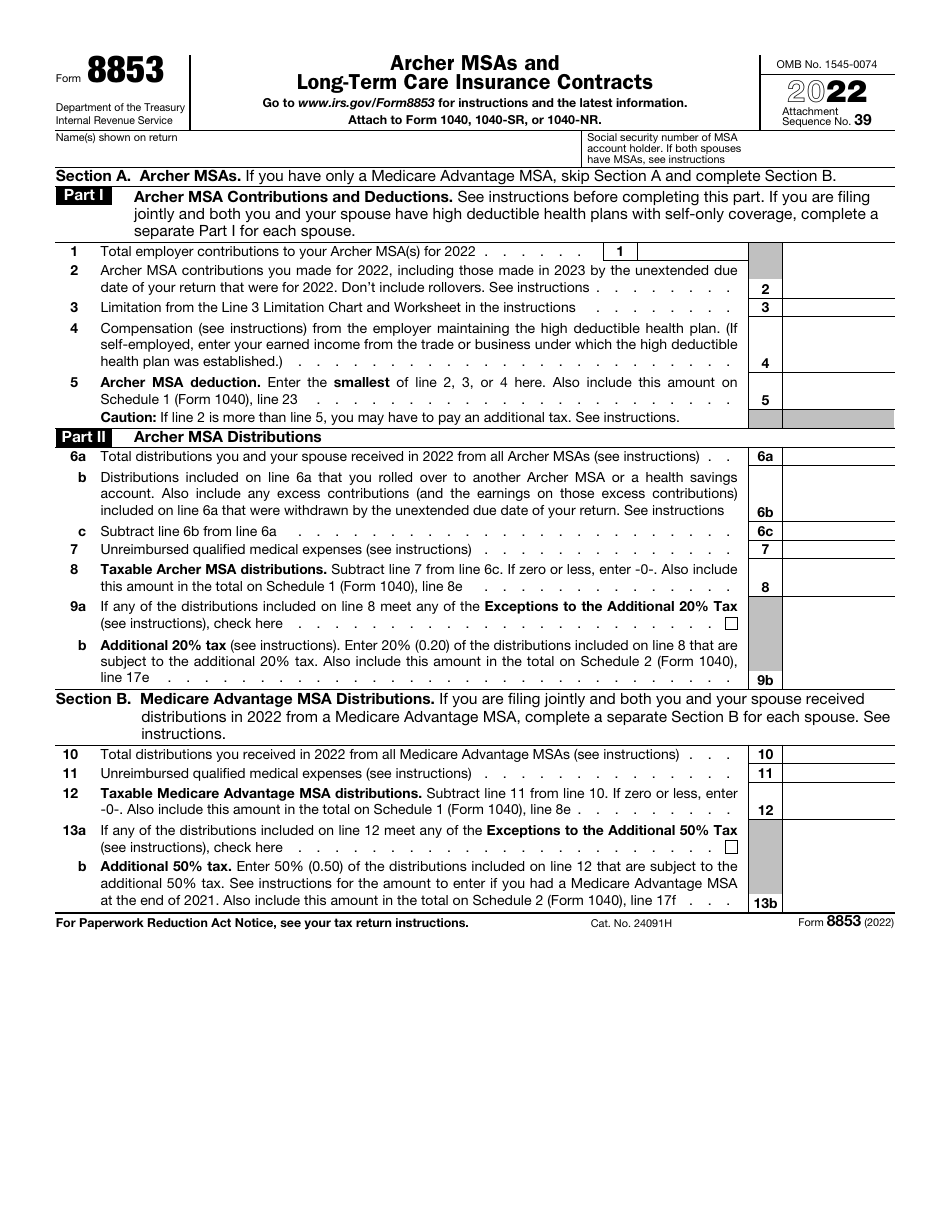

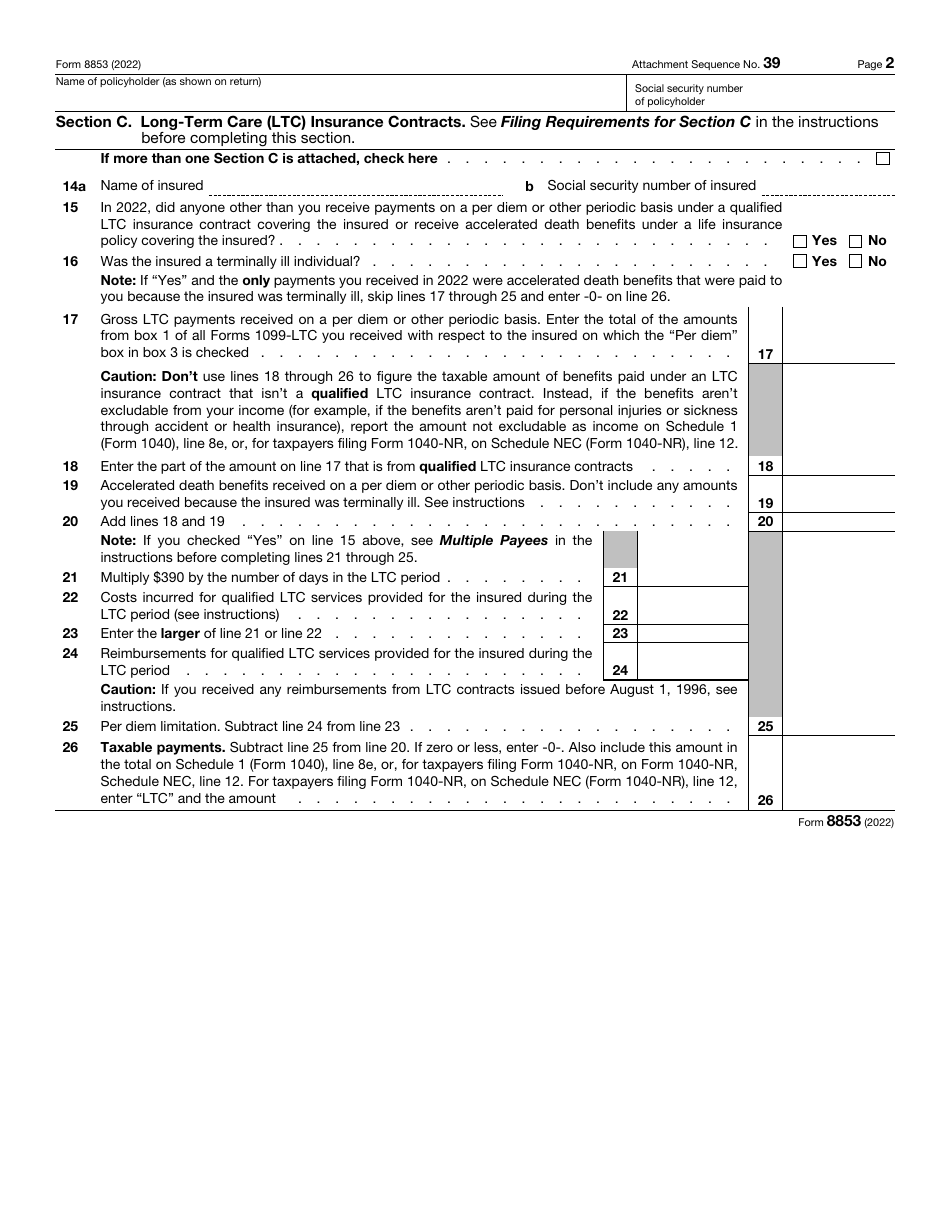

IRS Form 8853 Archer Msas and Long-Term Care Insurance Contracts

What Is IRS Form 8853?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8853?

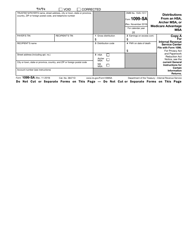

A: IRS Form 8853 is a form used to report contributions to Archer Medical Savings Accounts (MSAs) and long-term care insurance contracts.

Q: What are Archer MSAs?

A: Archer MSAs are medical savings accounts that allow individuals covered by high-deductible health plans to save for medical expenses.

Q: What is a long-term care insurance contract?

A: A long-term care insurance contract is an insurance policy that provides coverage for long-term care services, such as nursing home care, home health care, and assisted living.

Q: Who needs to file Form 8853?

A: Individuals who made contributions to Archer MSAs or have received long-term care insurance benefits during the tax year need to file Form 8853.

Q: What information is needed to complete Form 8853?

A: To complete Form 8853, you will need information about your Archer MSA contributions, long-term care insurance benefits received, and other related details.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8853 through the link below or browse more documents in our library of IRS Forms.