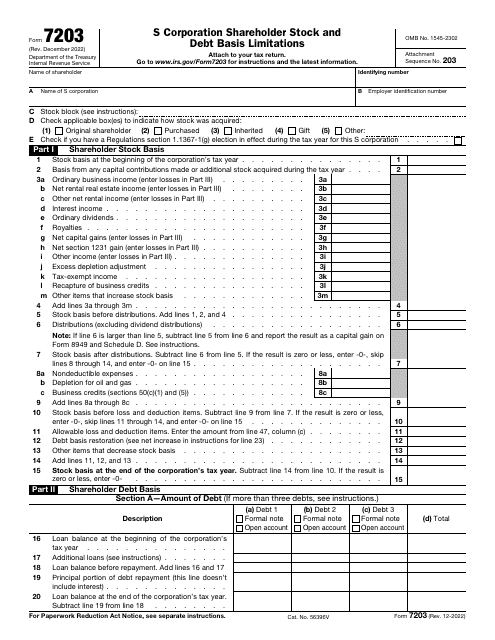

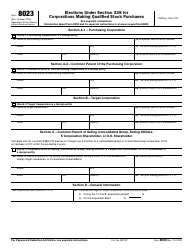

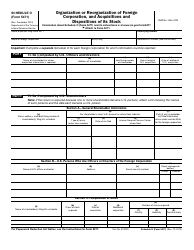

IRS Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

What Is IRS Form 7203?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on December 1, 2022. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 7203?

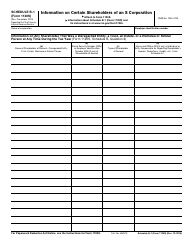

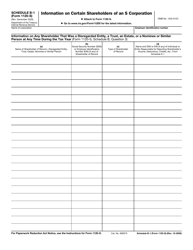

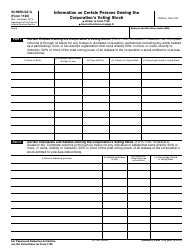

A: IRS Form 7203 is used by S Corporation shareholders to calculate and report their stock and debt basis limitations.

Q: What are stock and debt basis limitations?

A: Stock and debt basis limitations determine the amount of losses and deductions that S Corporation shareholders can deduct on their individual tax returns.

Q: Who needs to use IRS Form 7203?

A: S Corporation shareholders need to use IRS Form 7203 to calculate and report their stock and debt basis limitations.

Q: What information is required to complete IRS Form 7203?

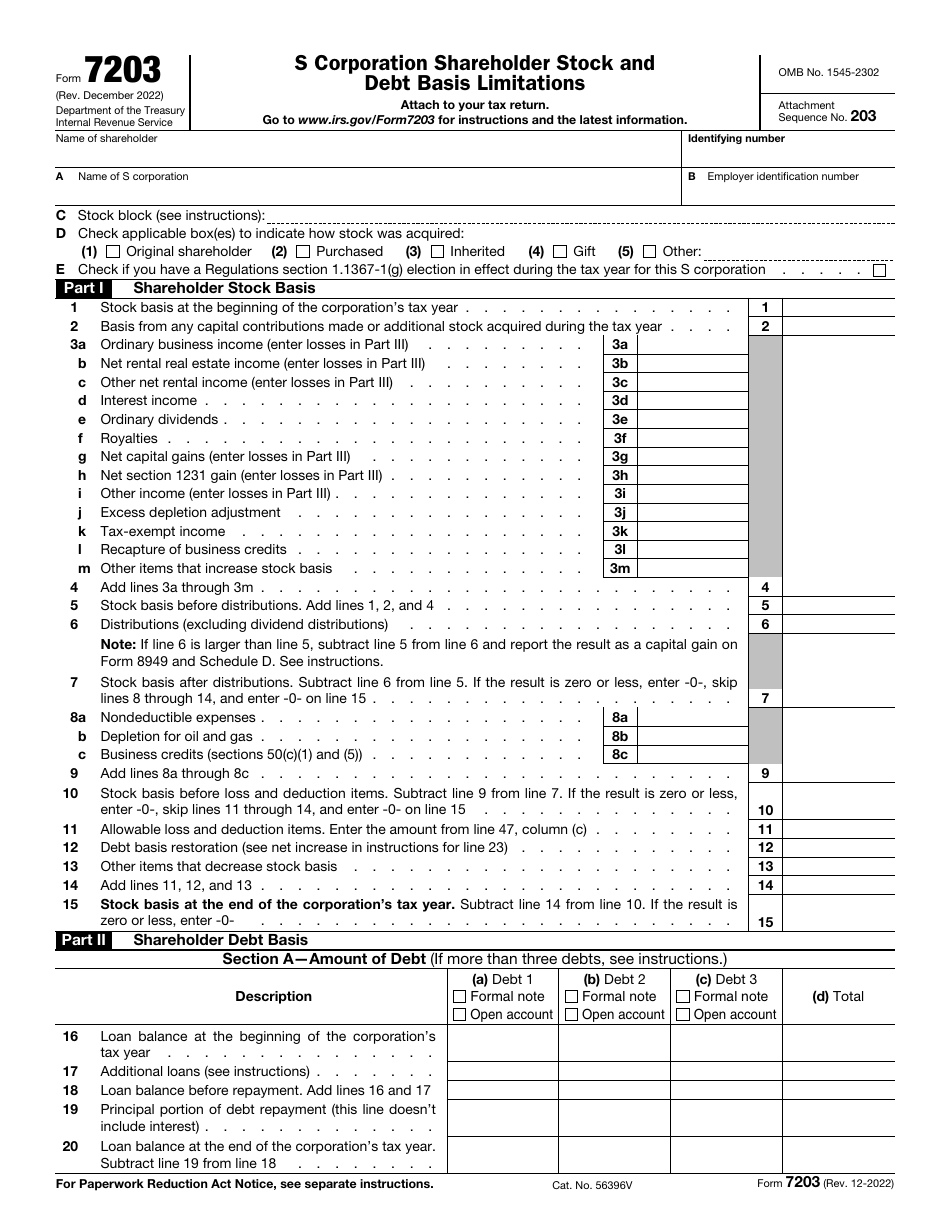

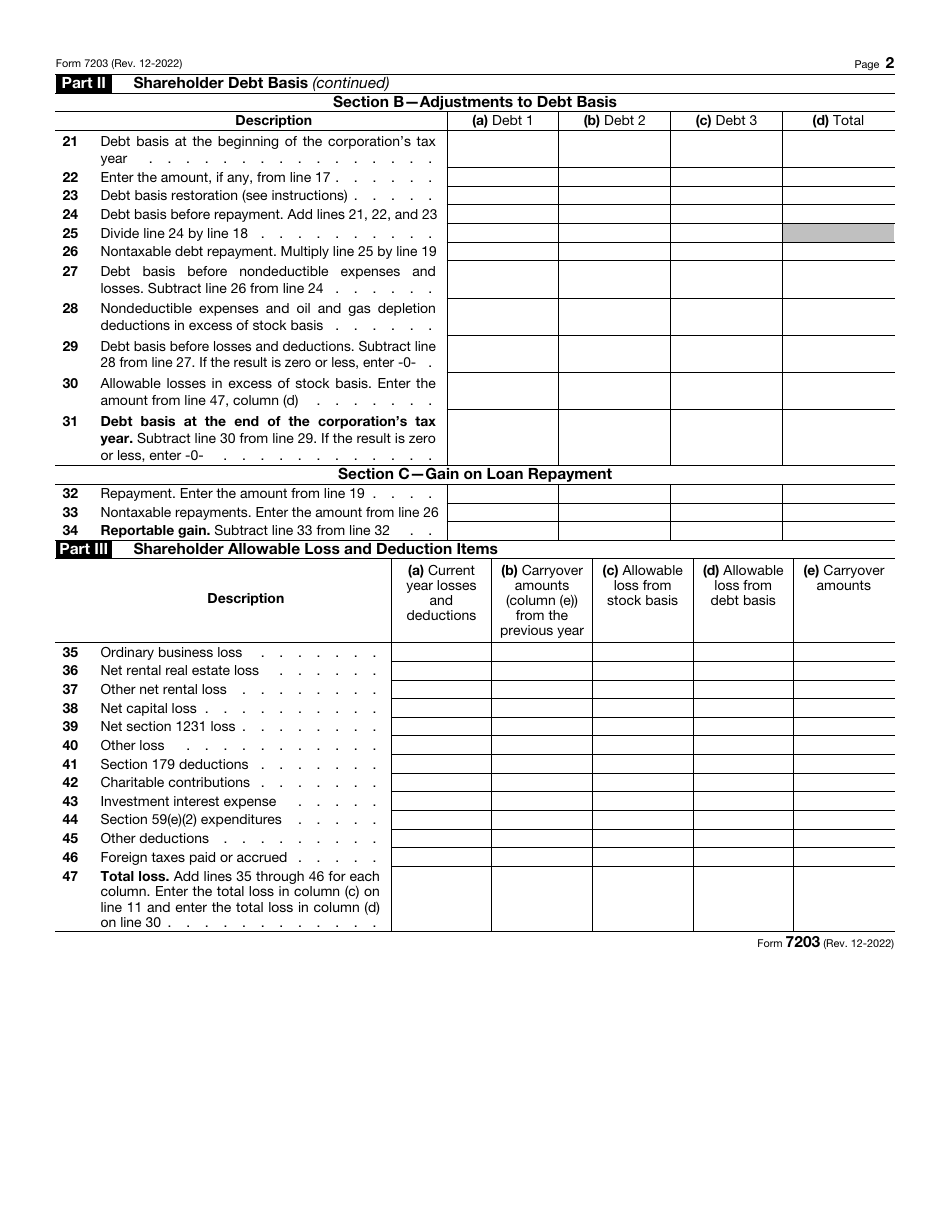

A: To complete IRS Form 7203, shareholders need to provide information about their stock basis, debt basis, and any distributions received from the S Corporation.

Q: Why are stock and debt basis limitations important for S Corporation shareholders?

A: Stock and debt basis limitations are important because they determine the amount of losses and deductions that shareholders can take on their individual tax returns.

Q: When is the deadline to file IRS Form 7203?

A: The deadline to file IRS Form 7203 is typically the same as the deadline to file your individual tax return, which is April 15th, unless it falls on a weekend or holiday.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 7203 through the link below or browse more documents in our library of IRS Forms.