This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 7203

for the current year.

Instructions for IRS Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations

This document contains official instructions for IRS Form 7203 , S Corporation Shareholder Stock and Debt Basis Limitations - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 7203 is available for download through this link.

FAQ

Q: What is IRS Form 7203?

A: IRS Form 7203 is a form used by S Corporation shareholders to report their stock and debt basis limitations.

Q: Who needs to file Form 7203?

A: S Corporation shareholders need to file Form 7203.

Q: What are stock and debt basis limitations?

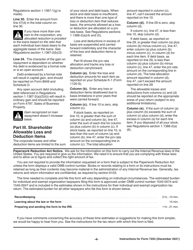

A: Stock and debt basis limitations refer to the maximum amount a shareholder can deduct for losses and deductions from their S Corporation.

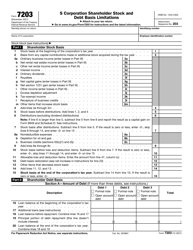

Q: How do I calculate stock and debt basis?

A: You can calculate stock and debt basis by adding your initial investment, income, and loans made to the S Corporation, and subtracting distributions and losses.

Q: What happens if I exceed my stock and debt basis limitations?

A: If you exceed your stock and debt basis limitations, you may not be able to deduct certain losses and deductions from your S Corporation.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.