This version of the form is not currently in use and is provided for reference only. Download this version of

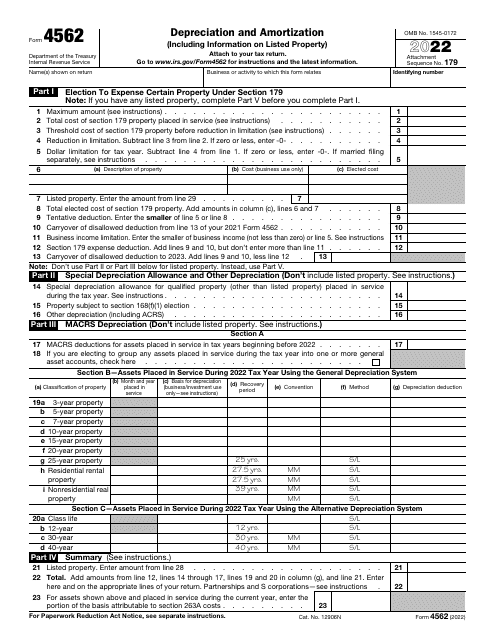

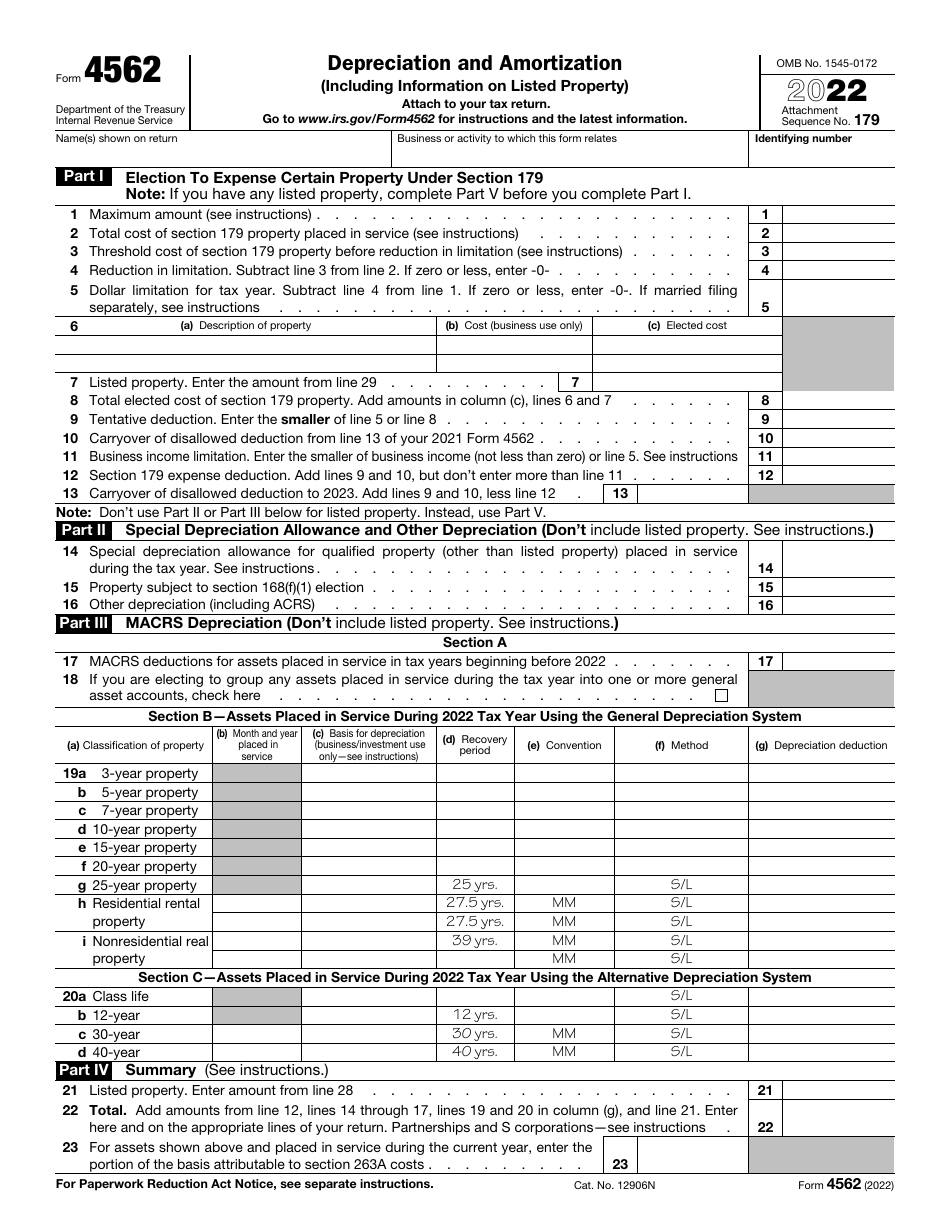

IRS Form 4562

for the current year.

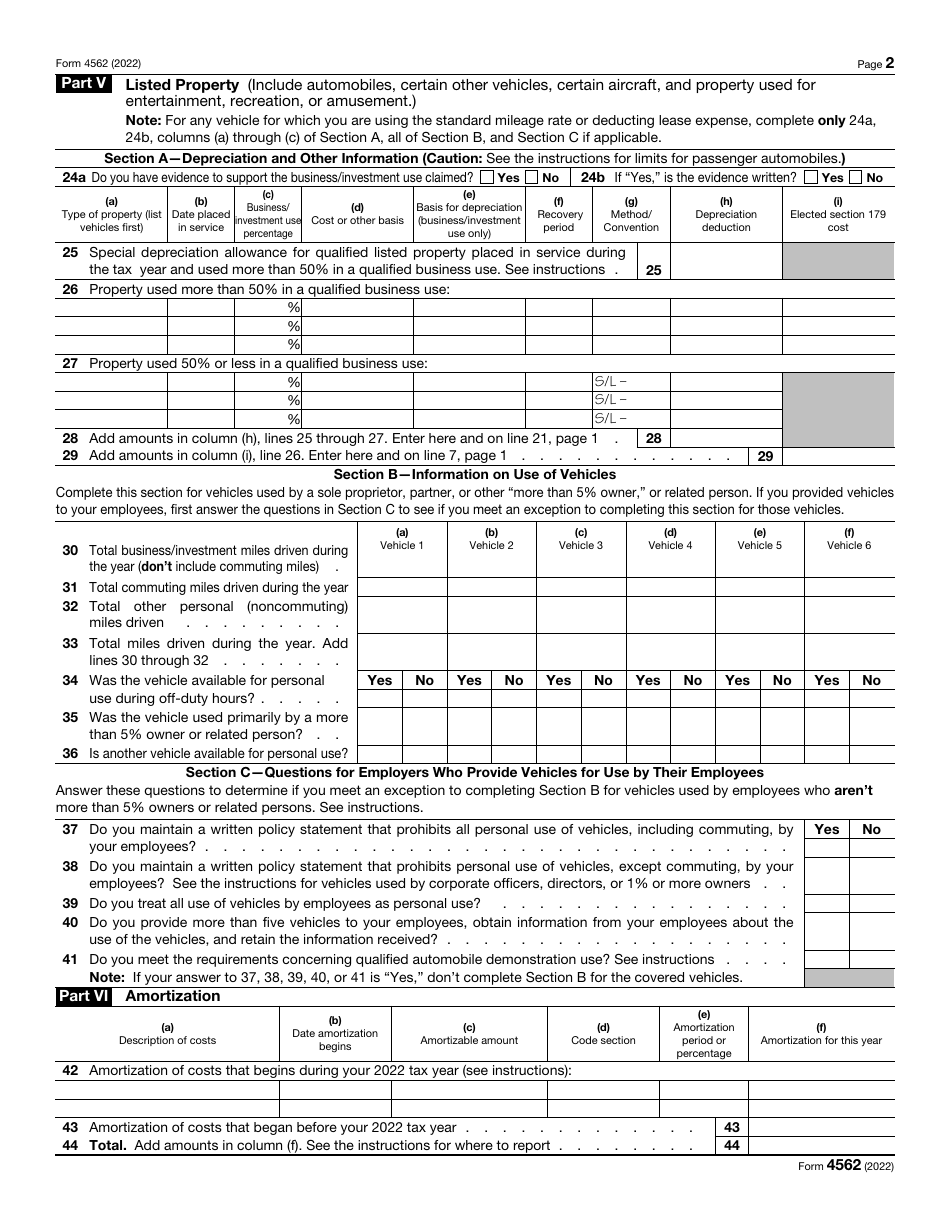

IRS Form 4562 Depreciation and Amortization (Including Information on Listed Property)

What Is IRS Form 4562?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 4562?

A: IRS Form 4562 is used to report depreciation and amortization expenses for business assets, including listed property.

Q: What is depreciation?

A: Depreciation is the gradual decrease in value of an asset over time due to wear and tear, obsolescence, or other factors.

Q: What is amortization?

A: Amortization is the systematic allocation of the cost of intangible assets over a specific period of time.

Q: What is listed property?

A: Listed property refers to certain assets that have both business and personal use, such as vehicles or computers.

Q: Who needs to file Form 4562?

A: Business owners who have depreciable or amortizable assets, including listed property, need to file Form 4562.

Q: How do I calculate depreciation?

A: Depreciation is calculated based on the cost of the asset, its useful life, and the depreciation method chosen.

Q: What is the purpose of filing Form 4562?

A: Filing Form 4562 allows businesses to deduct the depreciation and amortization expenses, reducing their taxable income.

Q: When is the deadline to file Form 4562?

A: Form 4562 is typically filed along with the business owner's annual tax return by the tax filing deadline, which is usually April 15th.

Q: Are there any penalties for not filing Form 4562?

A: If you fail to file Form 4562 or make errors on the form, you may be subject to penalties and additional taxes.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 4562 through the link below or browse more documents in our library of IRS Forms.