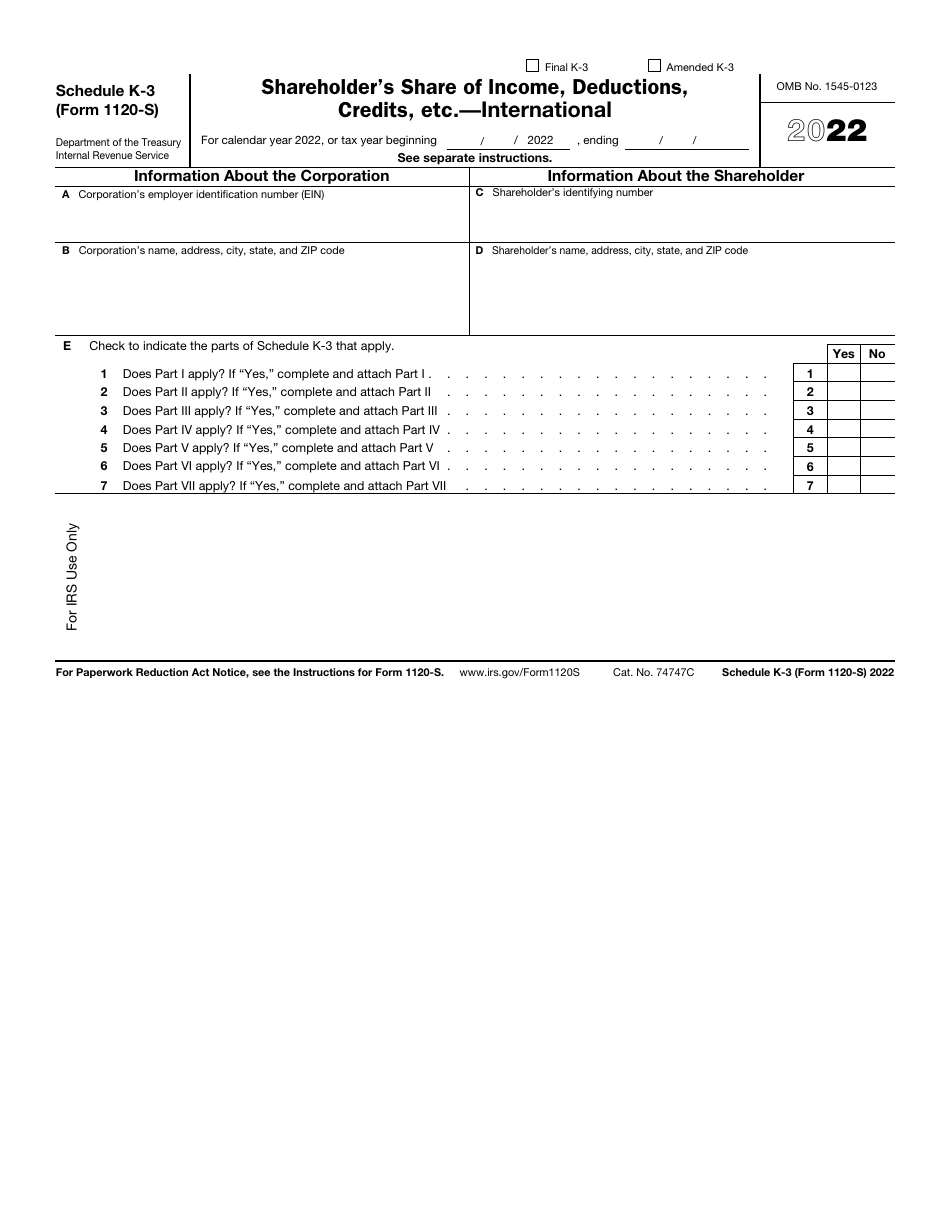

This version of the form is not currently in use and is provided for reference only. Download this version of

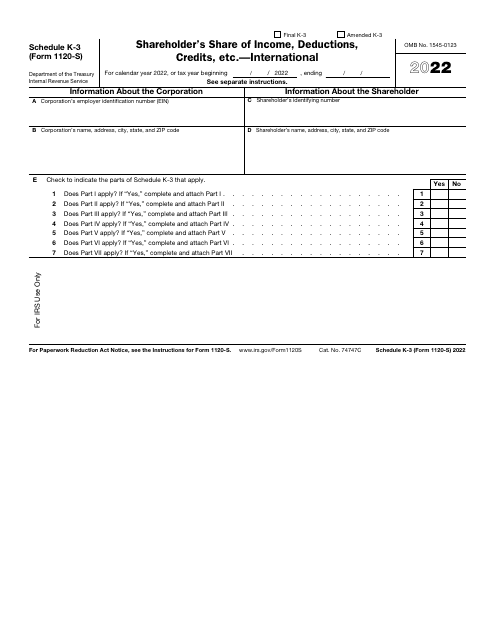

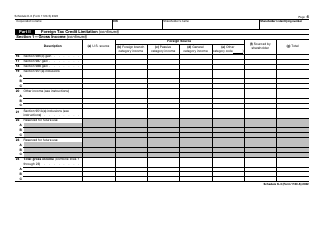

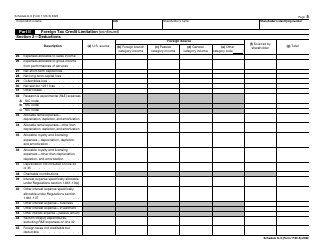

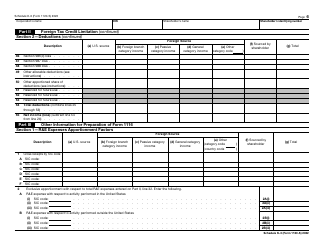

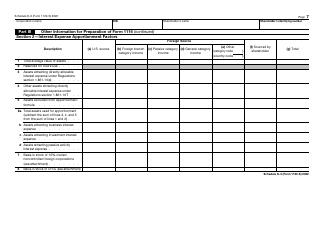

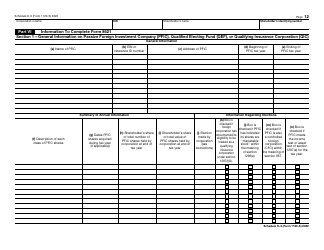

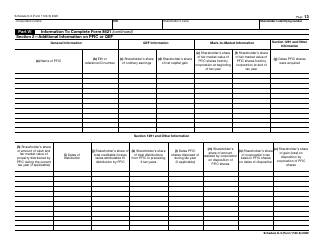

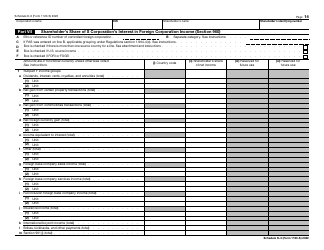

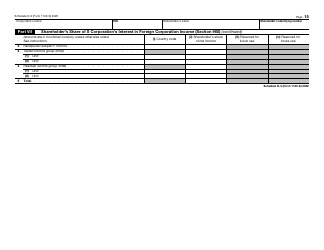

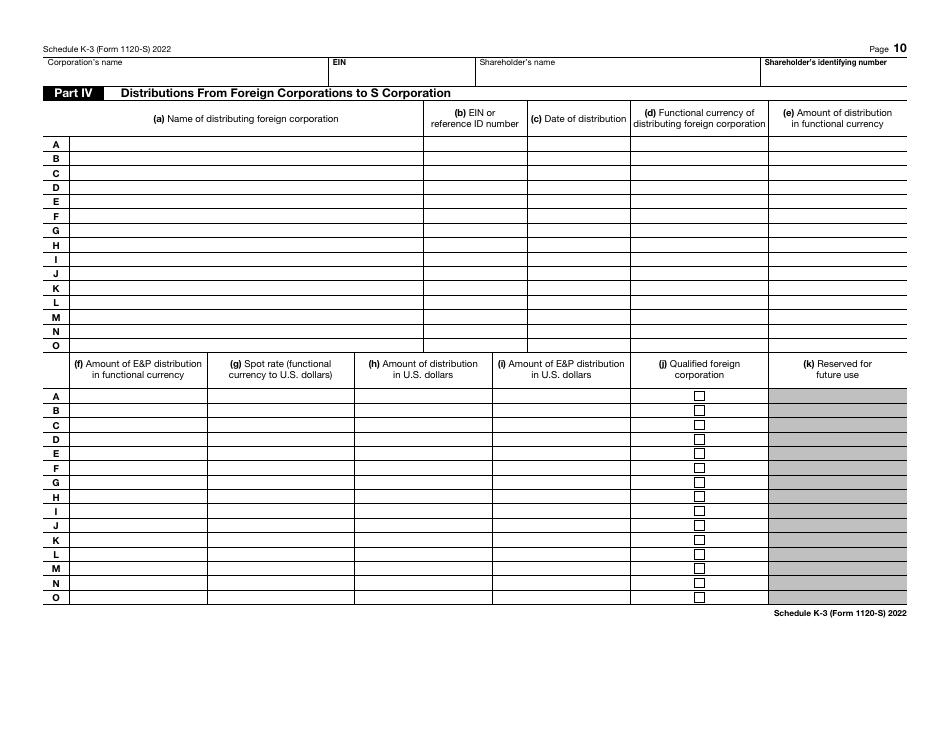

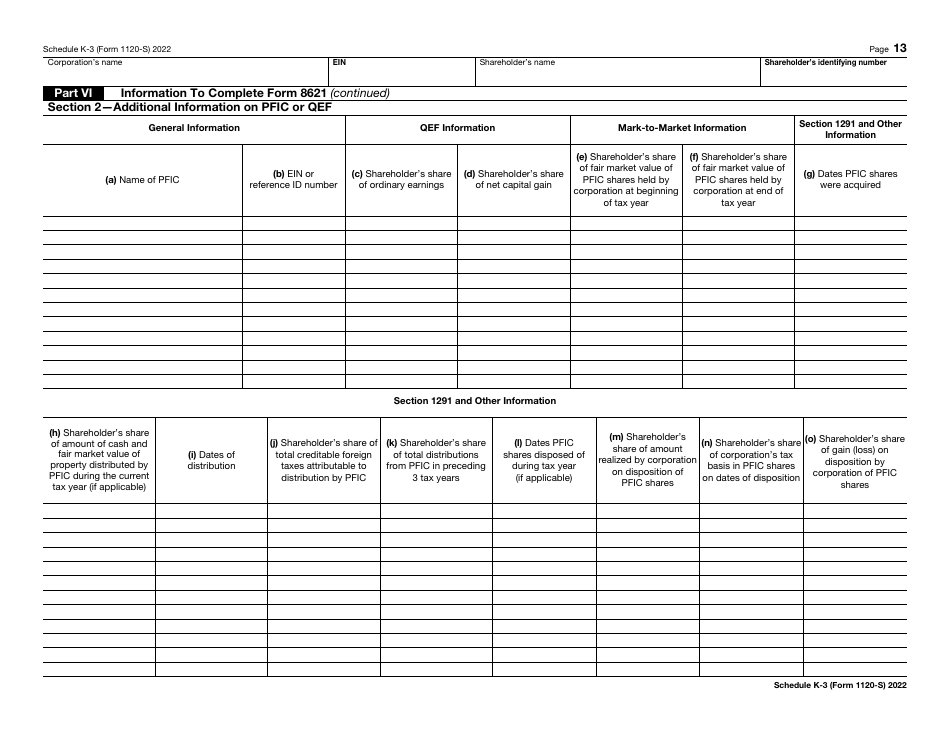

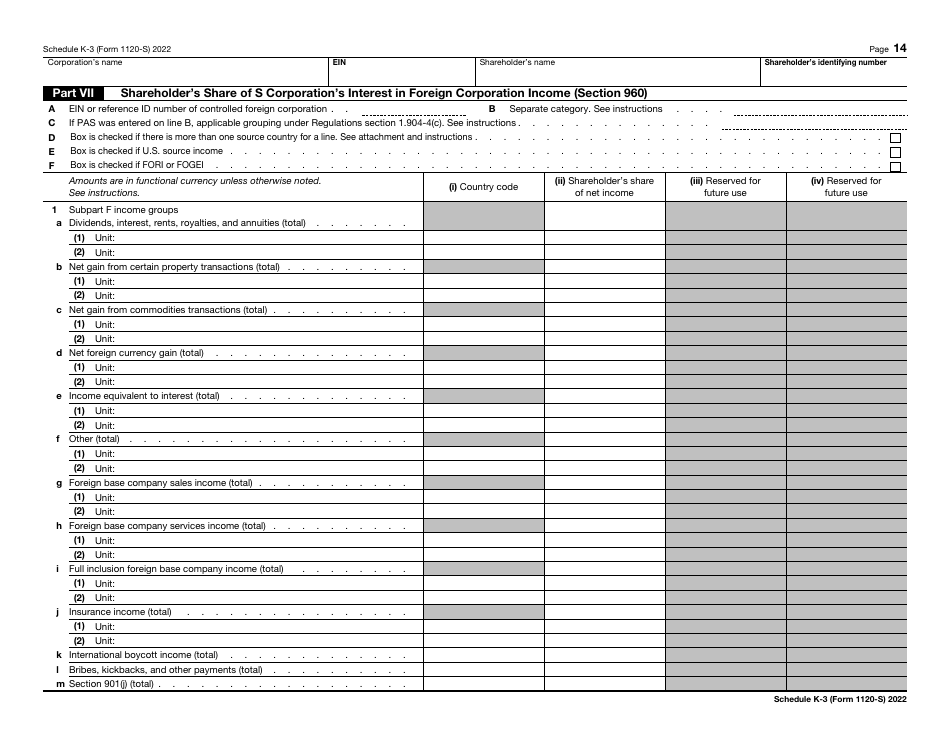

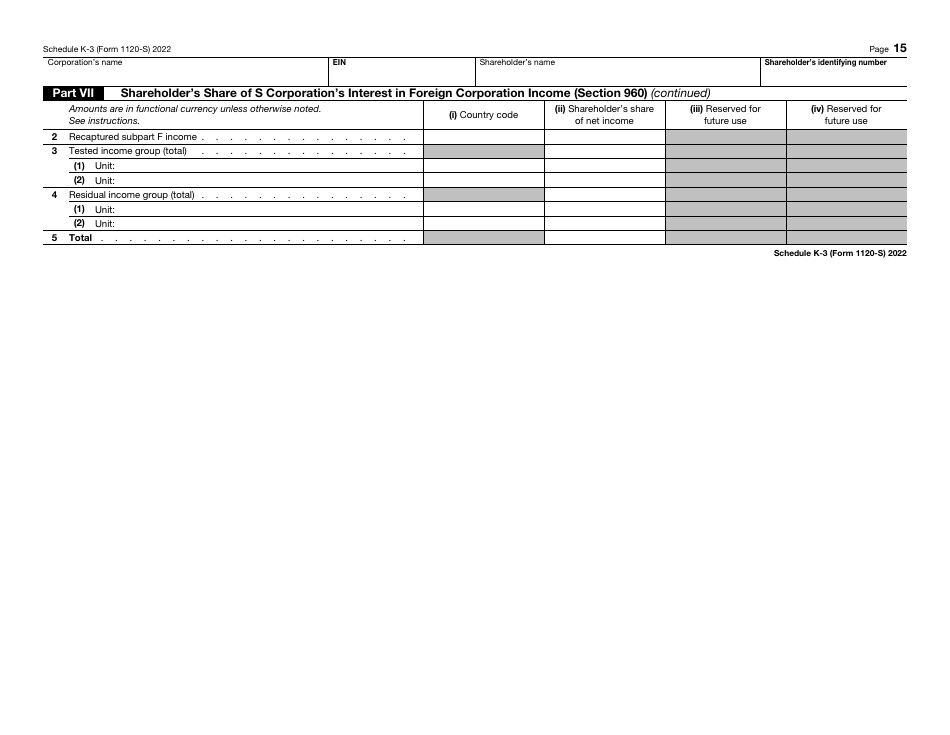

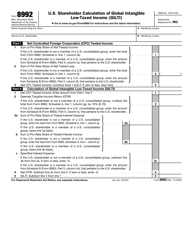

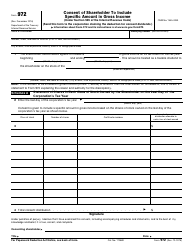

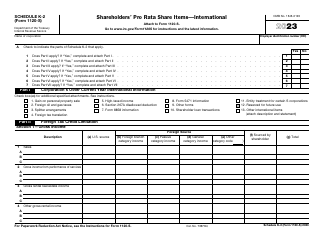

IRS Form 1120-S Schedule K-3

for the current year.

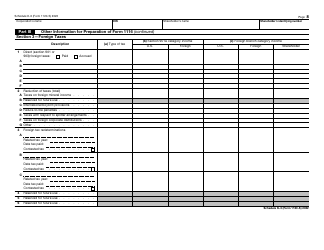

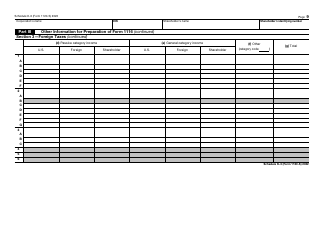

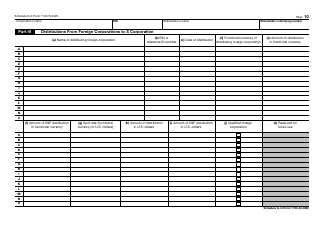

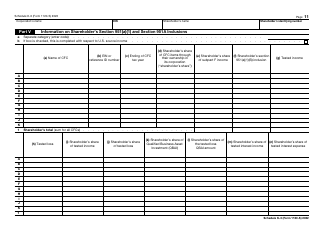

IRS Form 1120-S Schedule K-3 Shareholder's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1120-S Schedule K-3?

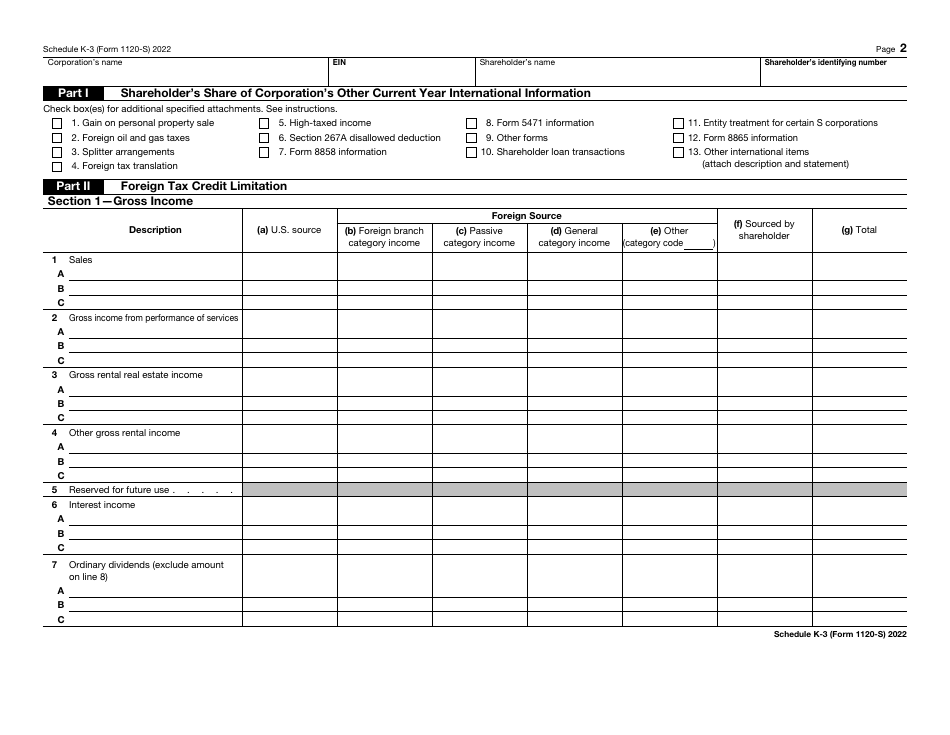

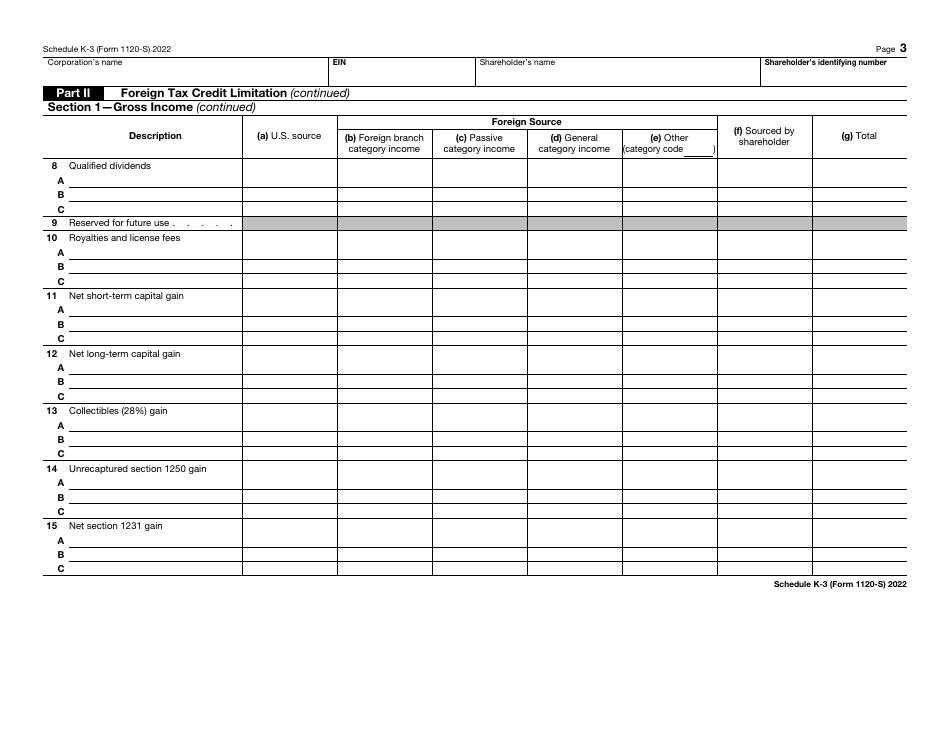

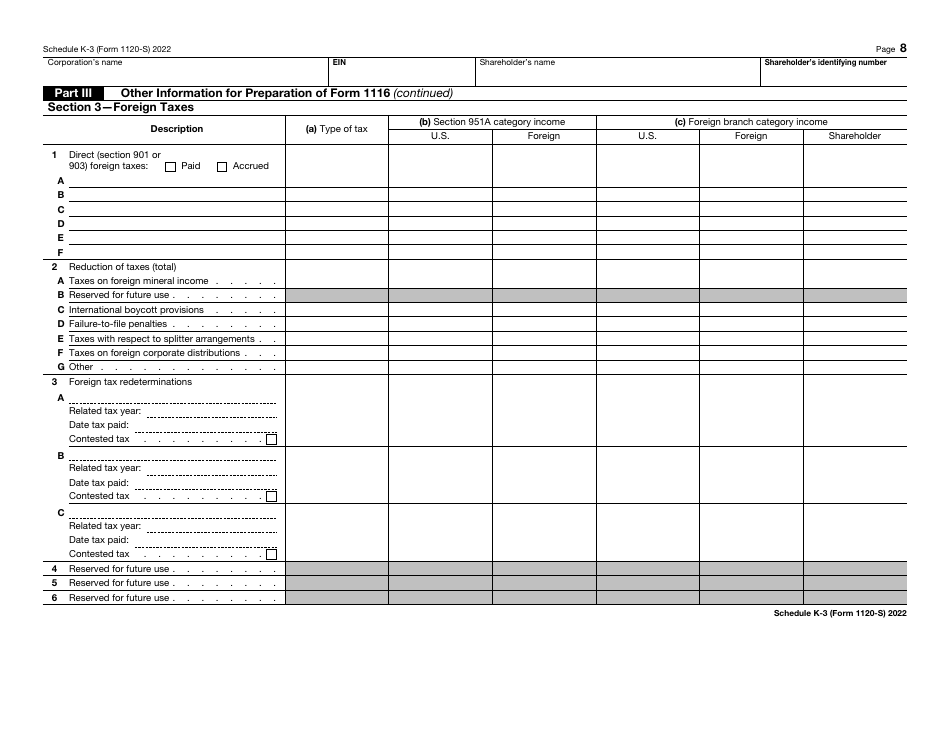

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 1120-S Schedule K-3?

A: IRS Form 1120-S Schedule K-3 is a form used by S corporations to report the shareholder's share of income, deductions, credits, etc.

Q: Who needs to file IRS Form 1120-S Schedule K-3?

A: S corporations need to file IRS Form 1120-S Schedule K-3.

Q: What does IRS Form 1120-S Schedule K-3 report?

A: IRS Form 1120-S Schedule K-3 reports the shareholder's share of income, deductions, credits, and other relevant information.

Q: Is IRS Form 1120-S Schedule K-3 for international purposes?

A: No, IRS Form 1120-S Schedule K-3 is not specifically for international purposes.

Q: When is the deadline to file IRS Form 1120-S Schedule K-3?

A: The deadline to file IRS Form 1120-S Schedule K-3 is usually the same as the deadline for filing the S corporation's tax return, which is March 15th for calendar year filers.

Q: Are there any penalties for not filing IRS Form 1120-S Schedule K-3?

A: Yes, there can be penalties for not filing IRS Form 1120-S Schedule K-3 or for filing it late. It is important to comply with the filing requirements to avoid these penalties.

Form Details:

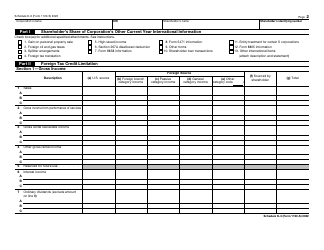

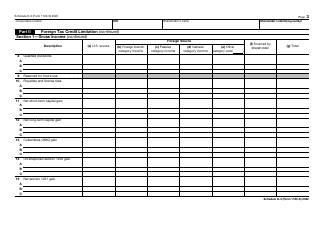

- A 15-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1120-S Schedule K-3 through the link below or browse more documents in our library of IRS Forms.