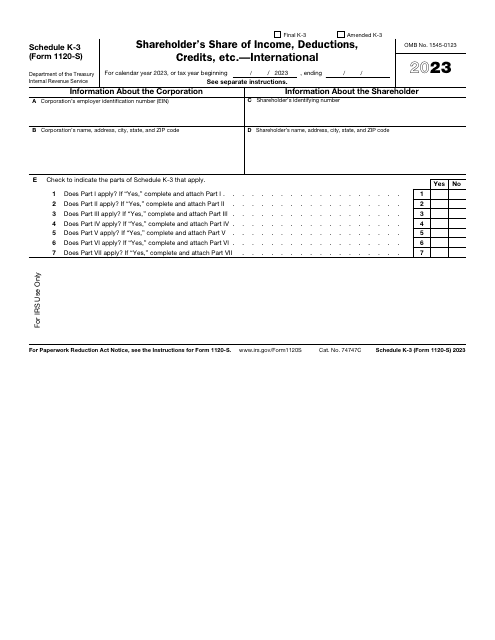

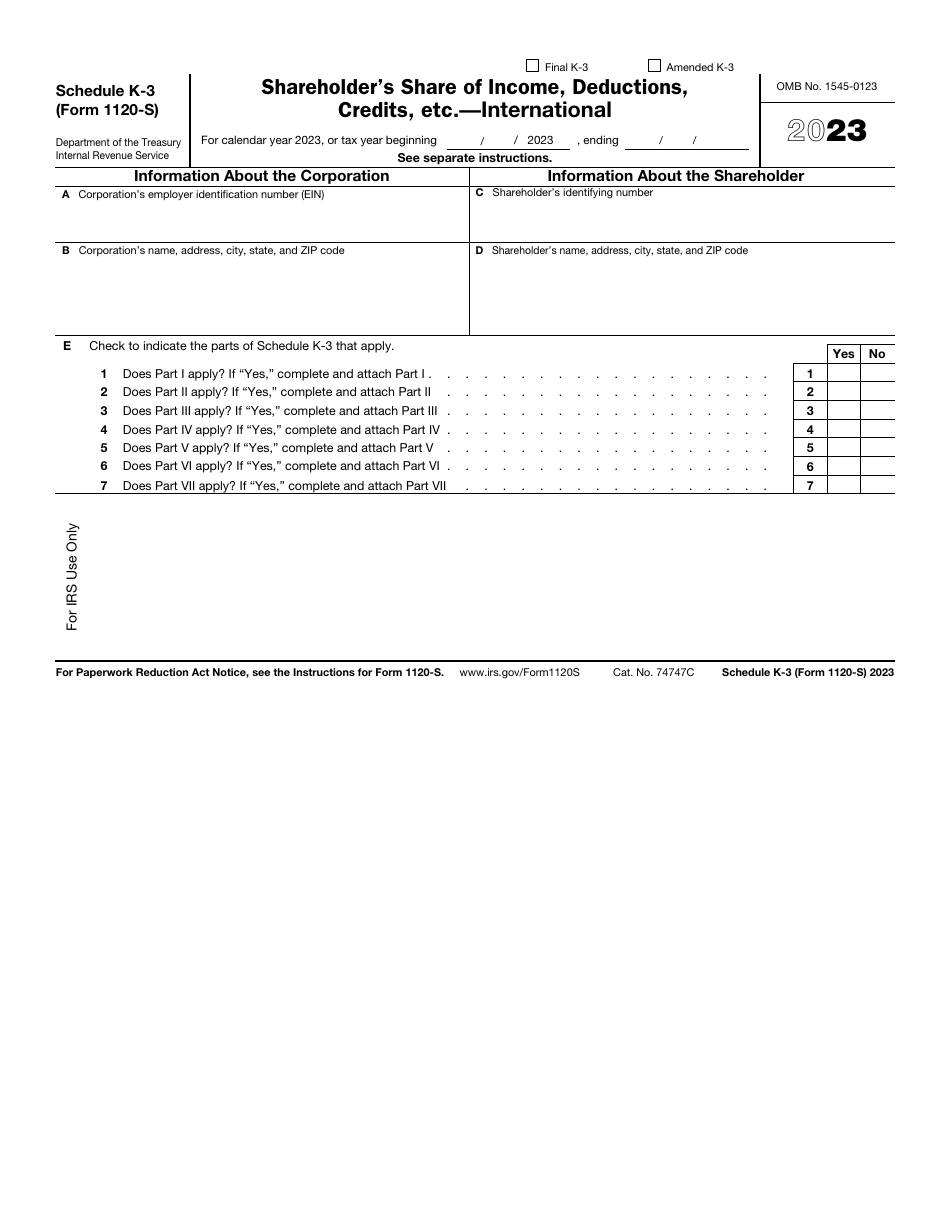

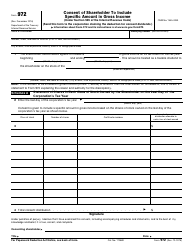

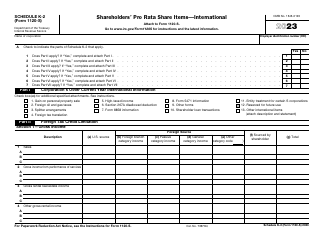

IRS Form 1120-S Schedule K-3 Shareholder's Share of Income, Deductions, Credits, Etc. - International

What Is IRS Form 1120-S Schedule K-3?

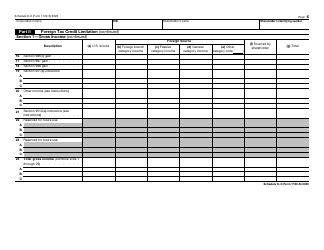

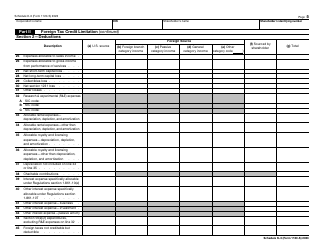

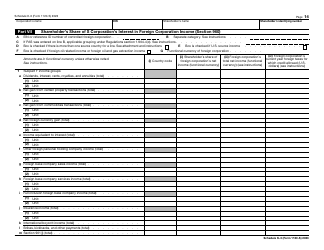

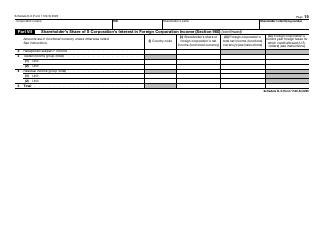

IRS Form 1120-S Schedule K-3, Shareholder's Share of Income, Deductions, Credits, Etc. - International , is a fiscal instrument filled out by S corporations to inform the tax authorities about their international operations subject to tax. Every shareholder must prepare this schedule to identify themselves and notify the government about their portion of income and deductions related to foreign operations of the entity.

This instrument was released by the Internal Revenue Service (IRS) in 2023 , rendering older editions obsolete. You may find an IRS Form 1120-S Schedule K-3 fillable version through the link below.

Check out the 1120 Series of forms to see more IRS documents in this series.

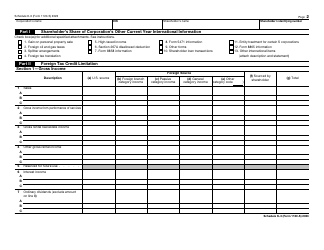

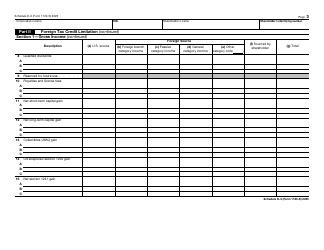

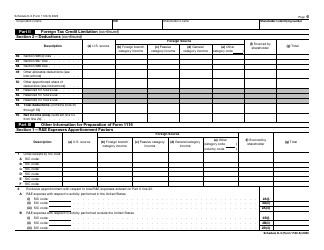

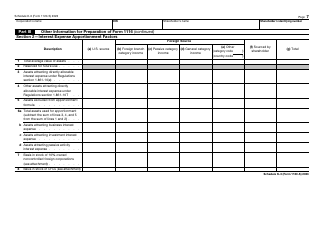

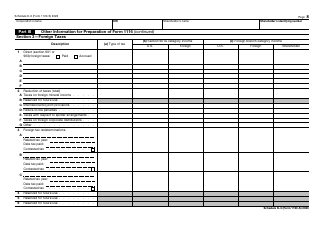

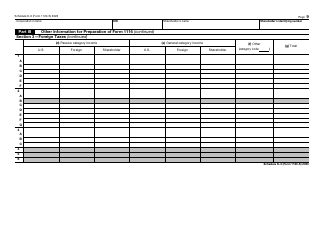

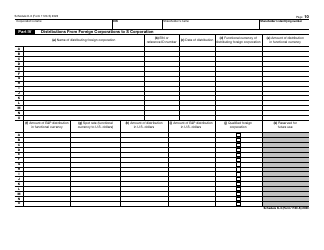

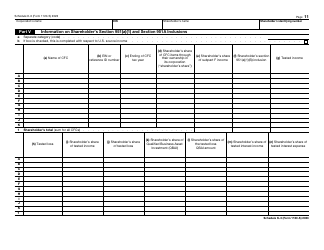

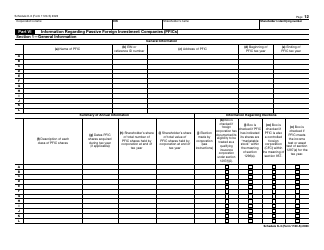

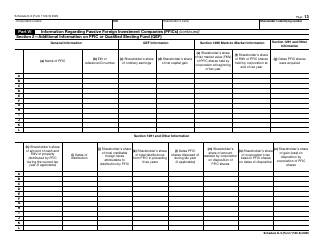

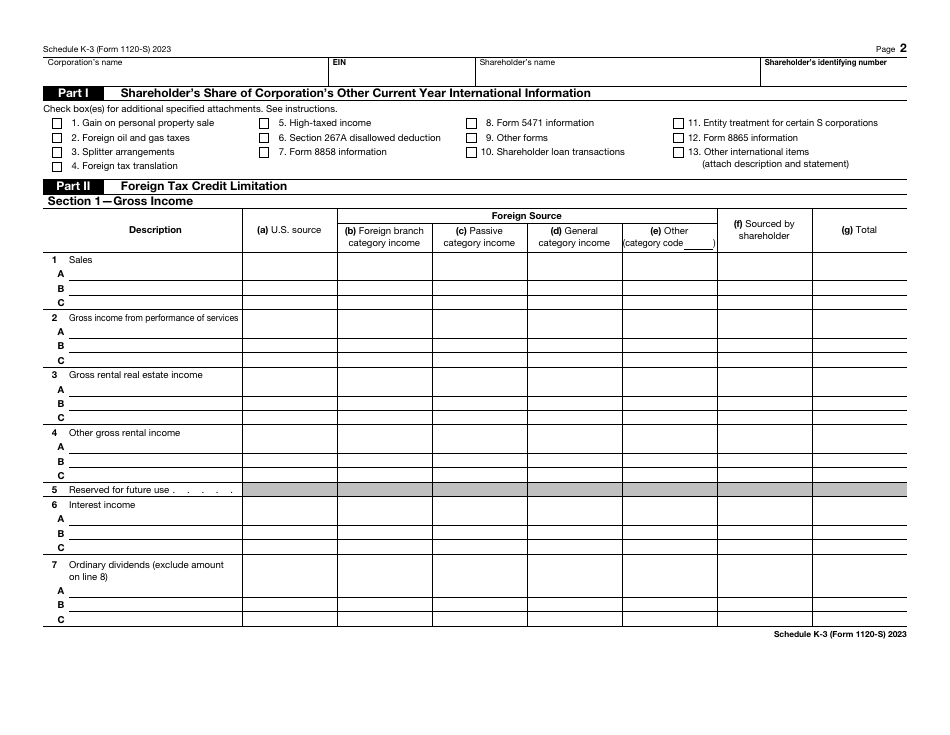

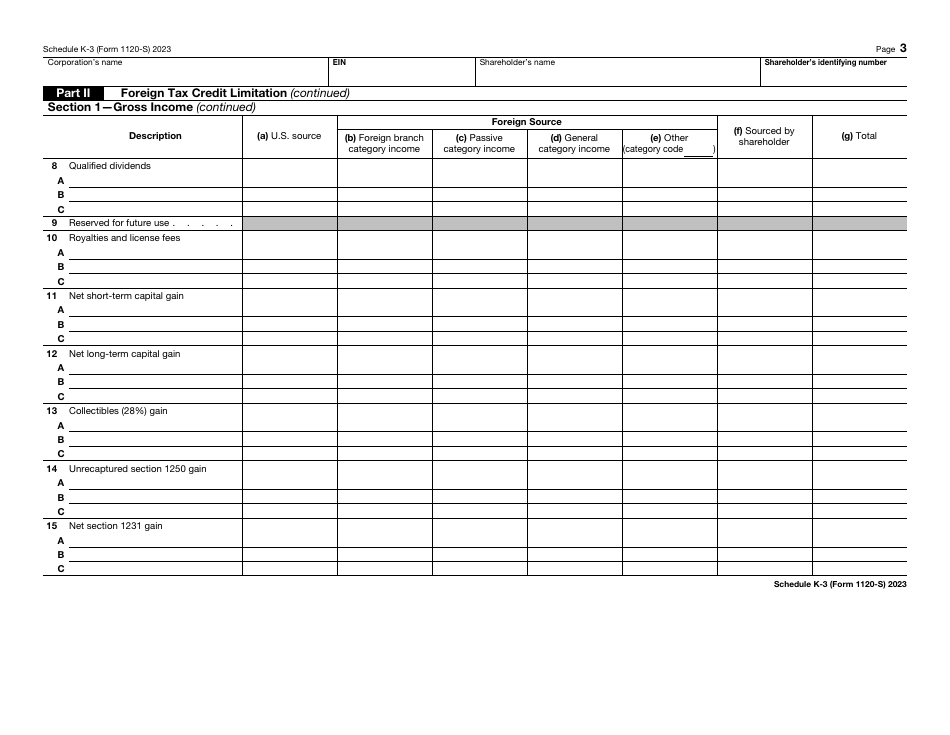

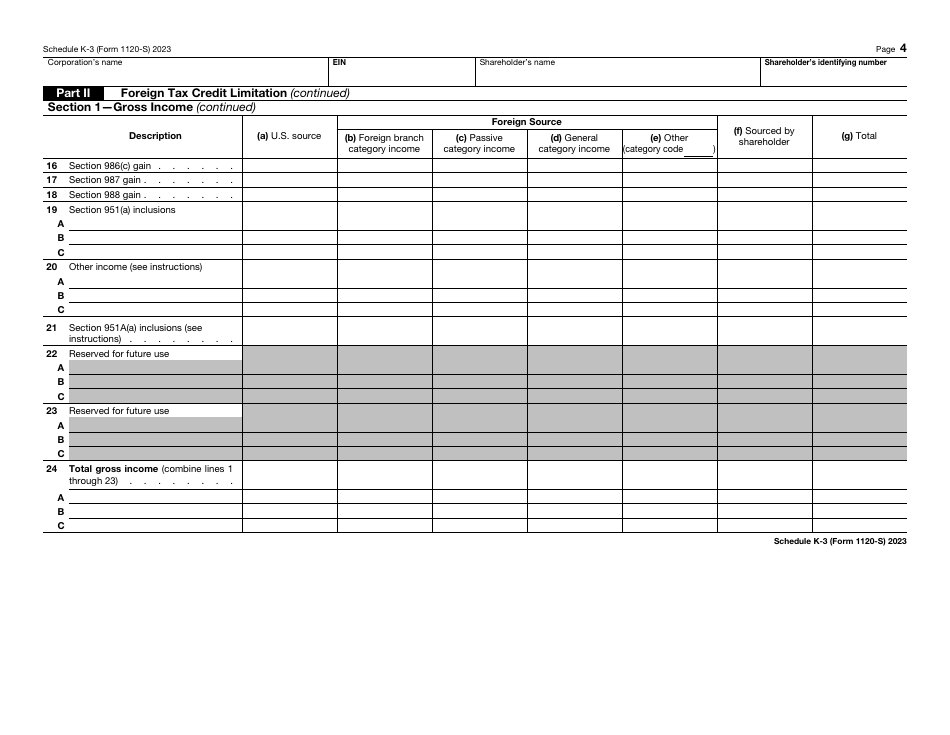

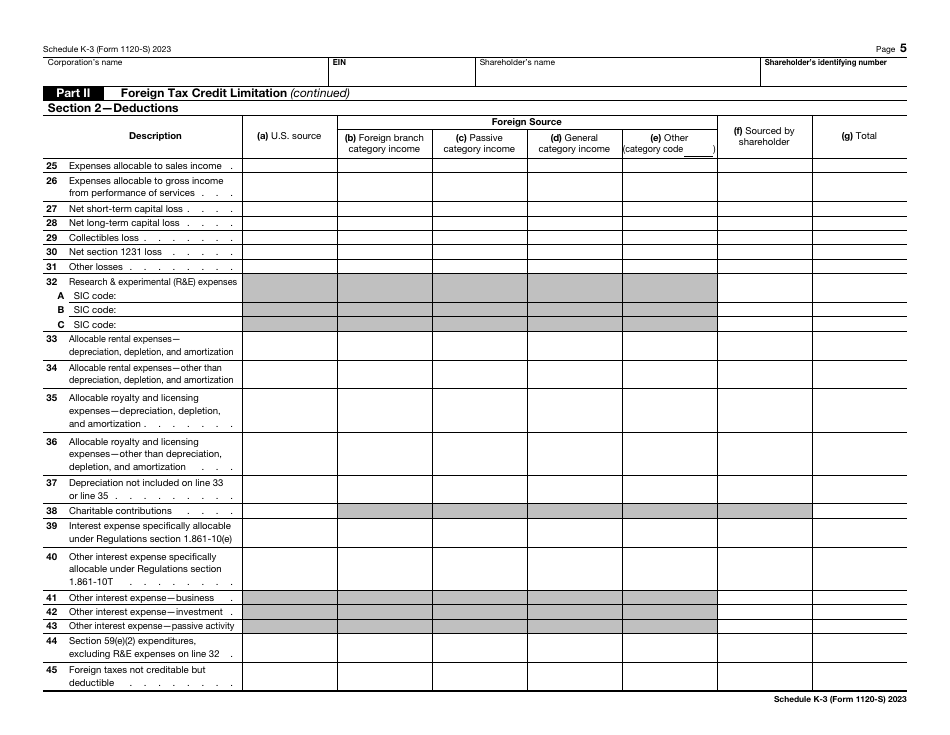

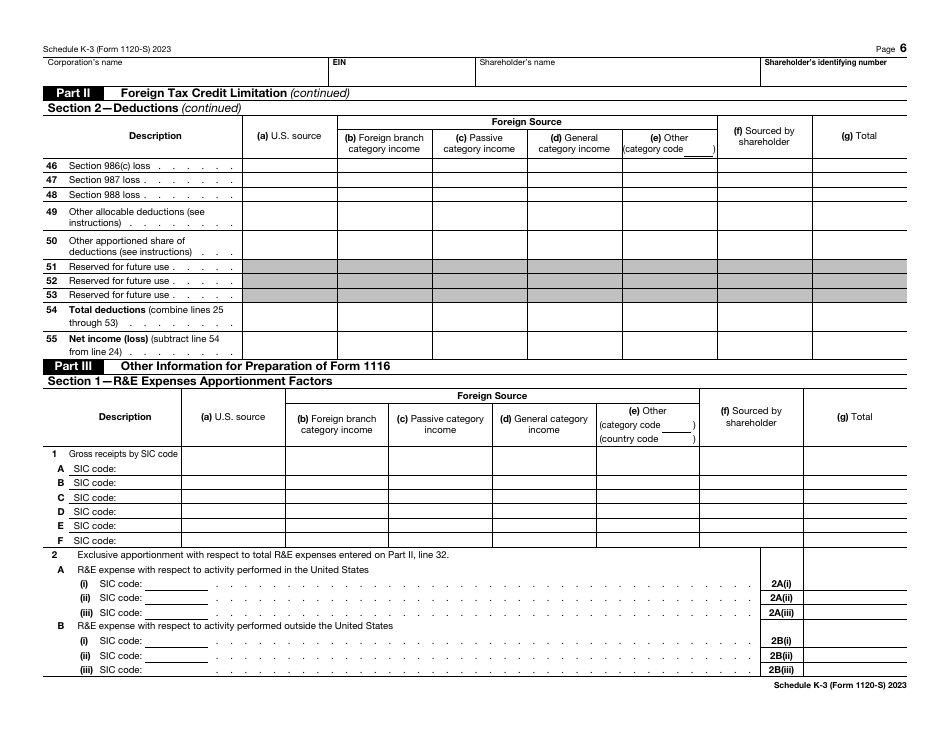

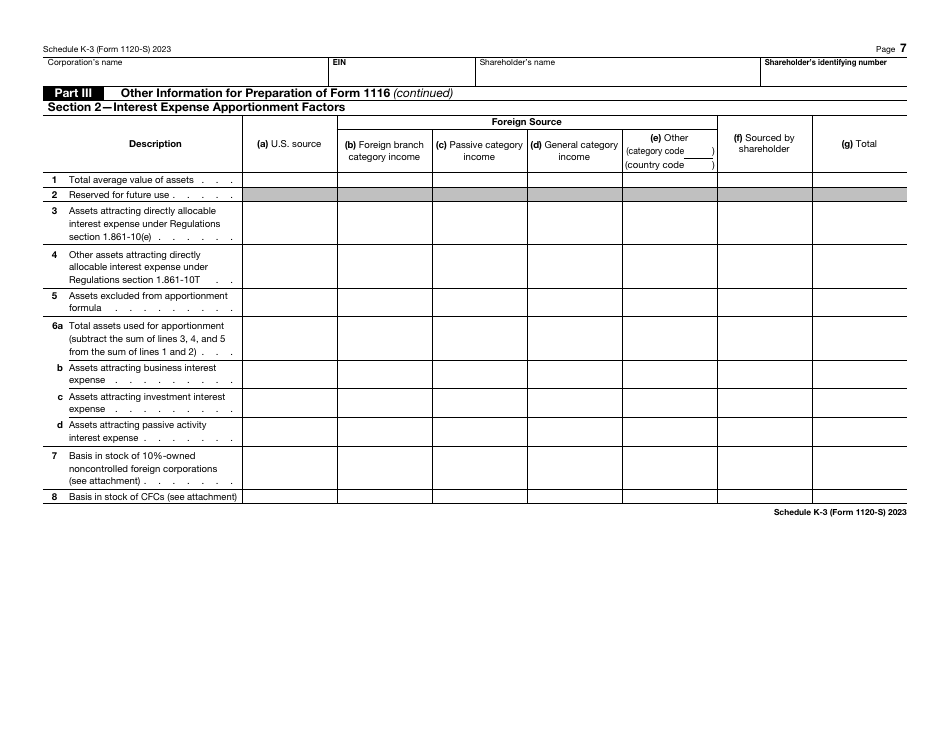

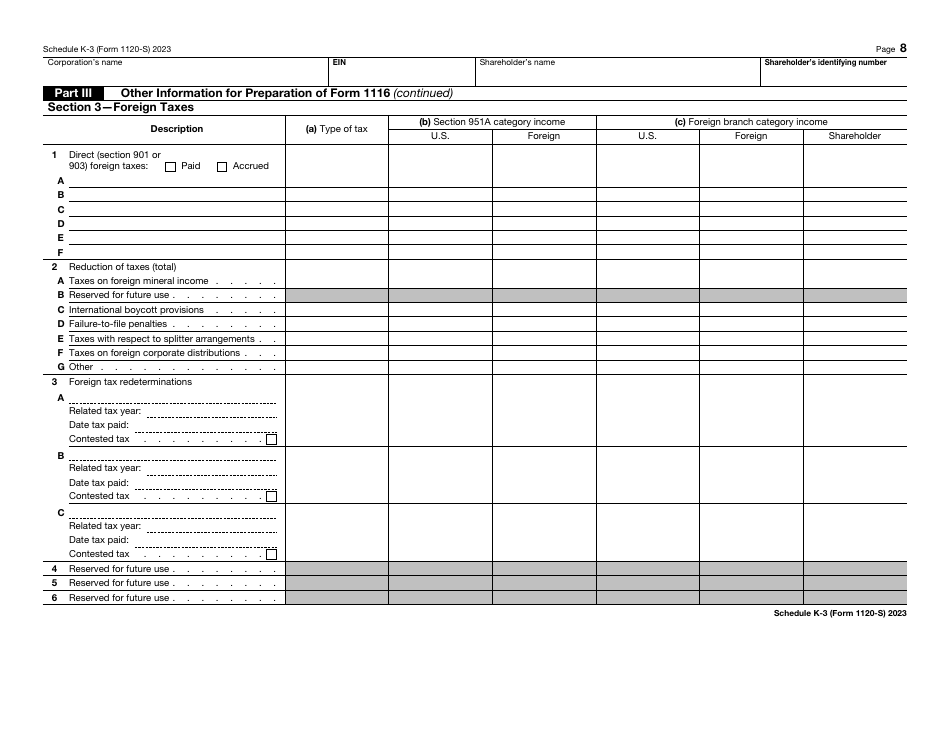

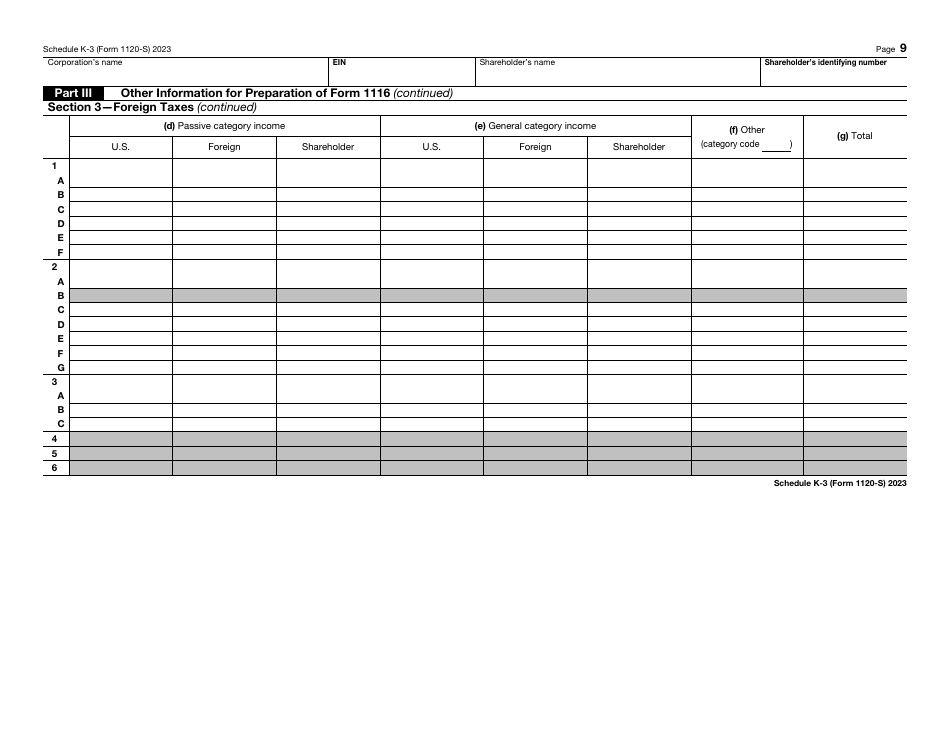

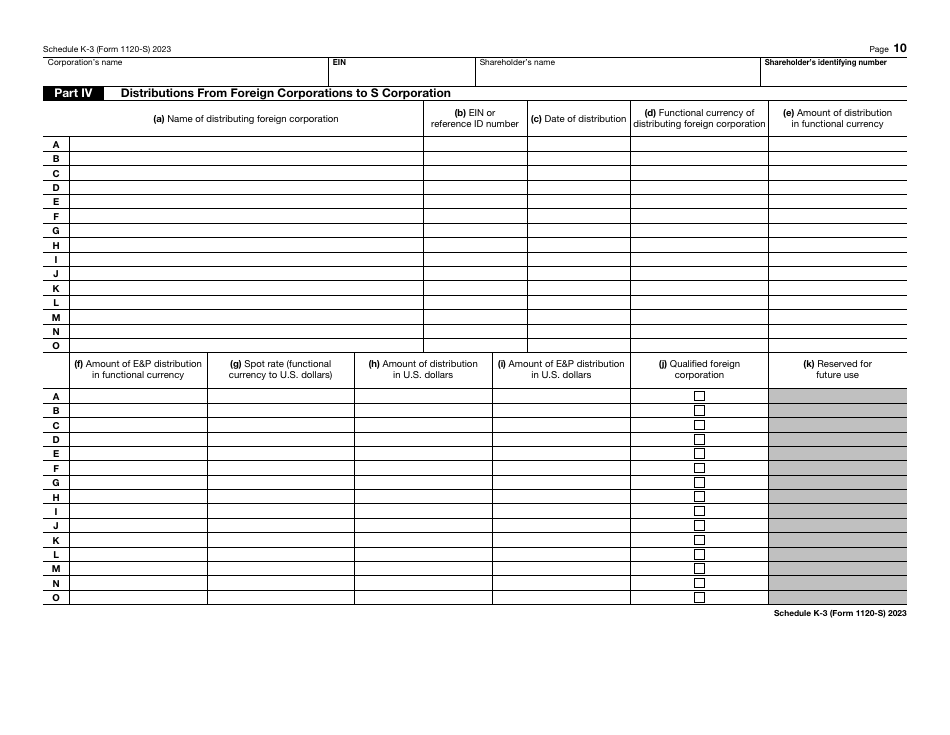

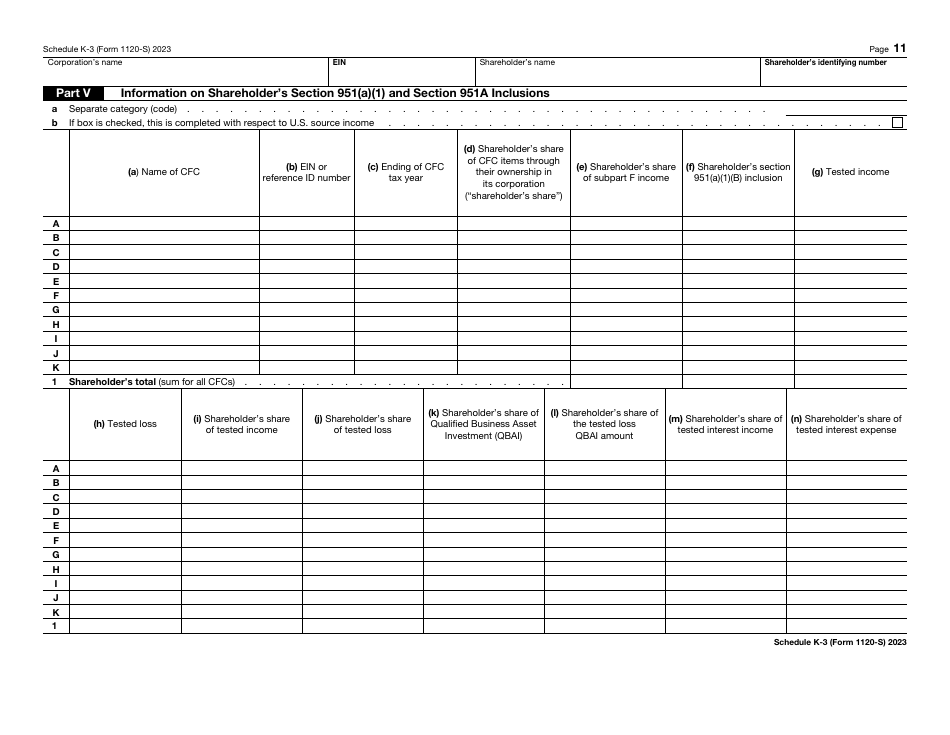

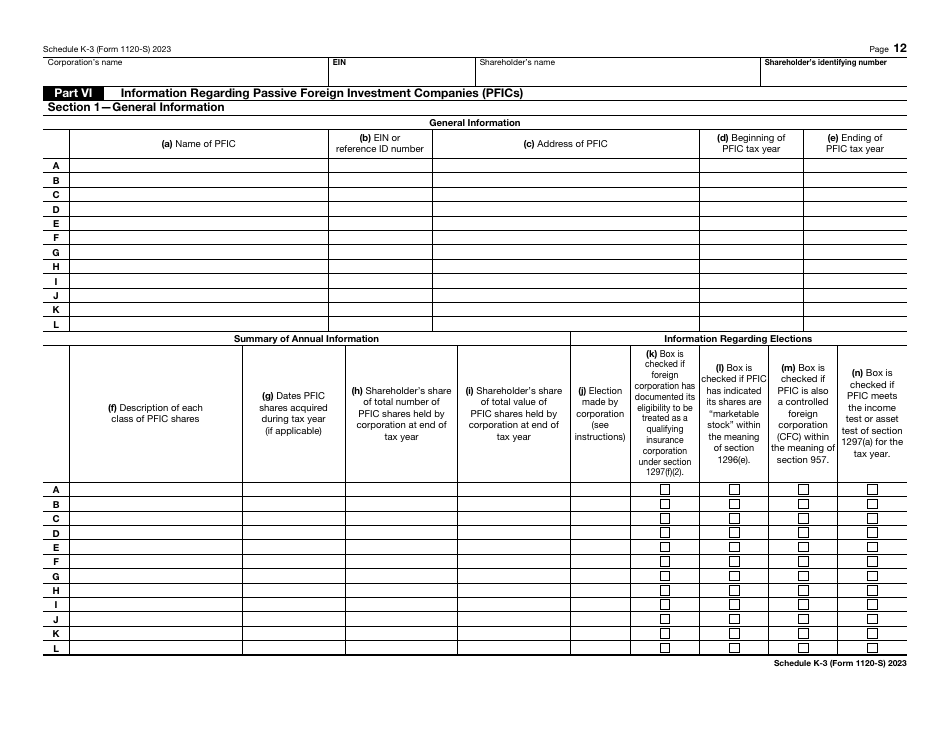

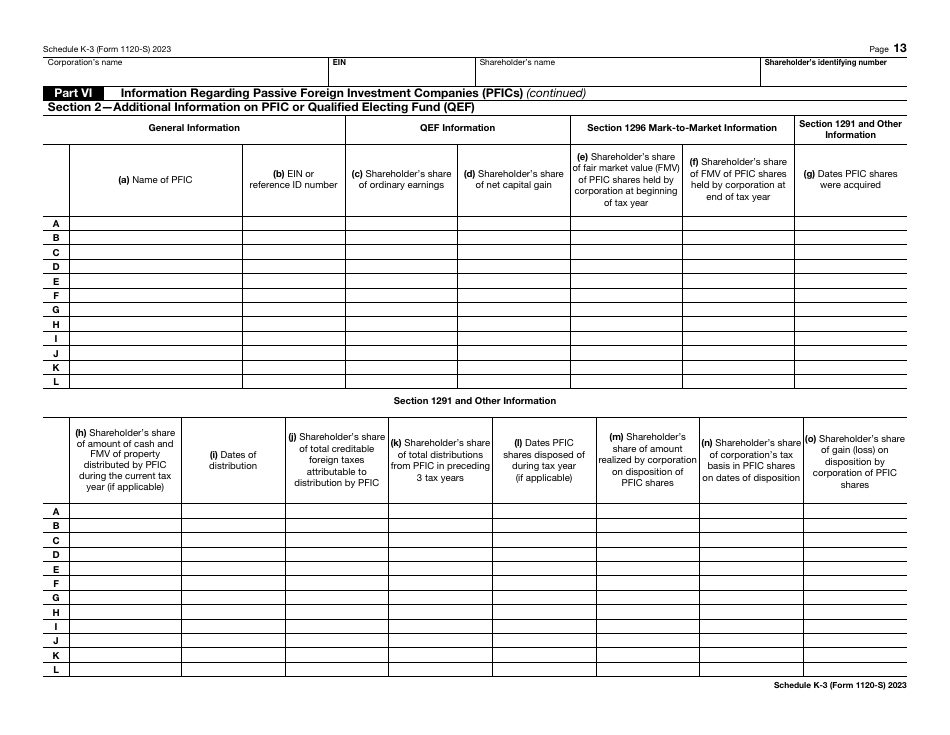

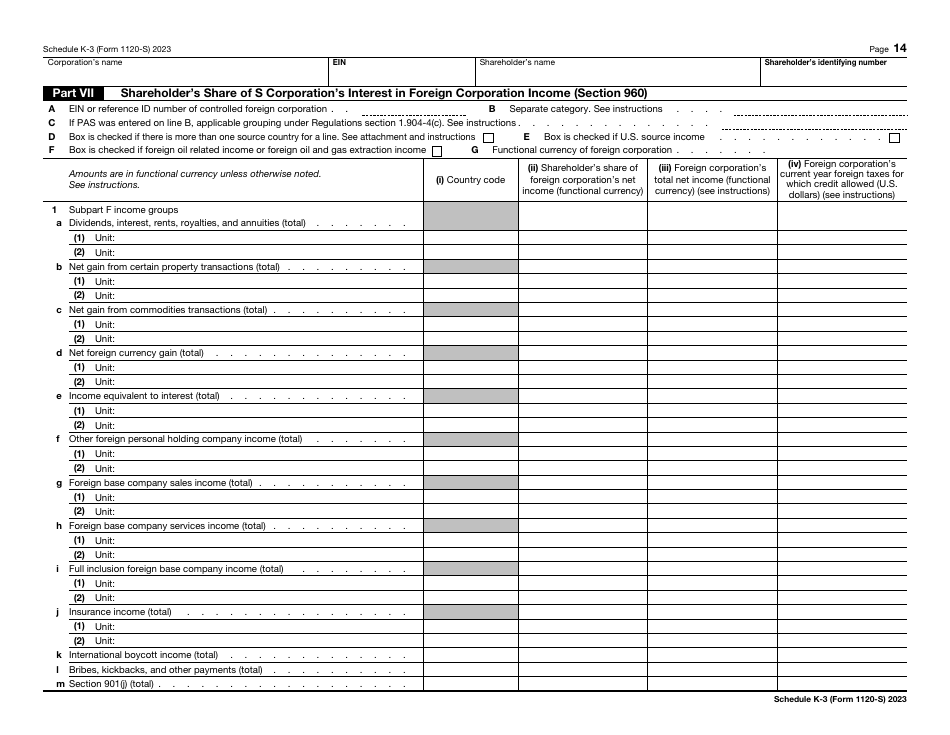

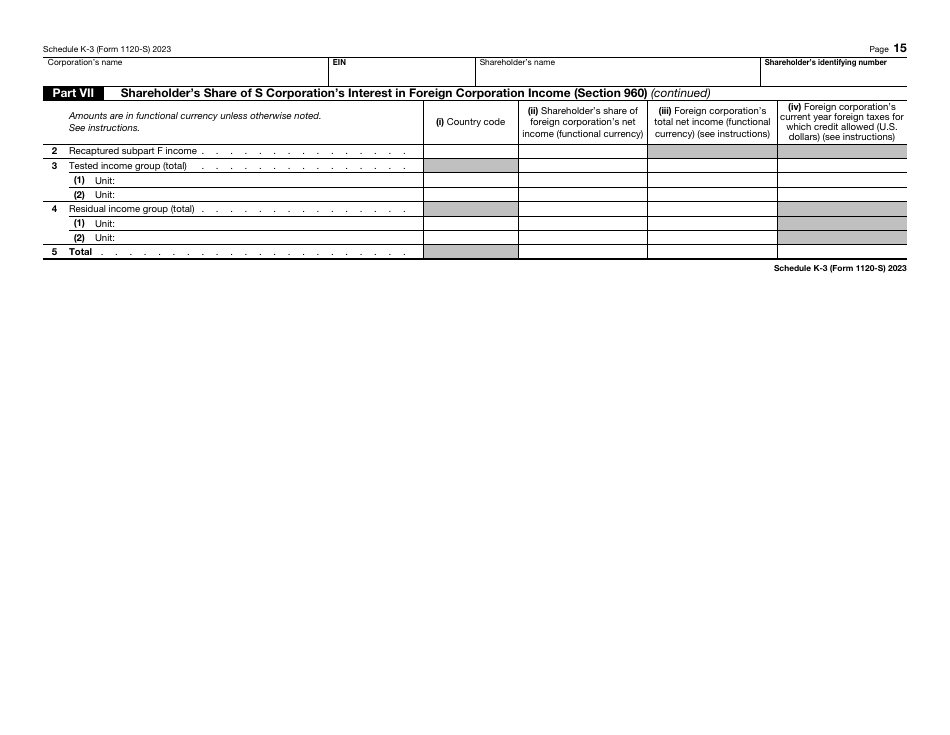

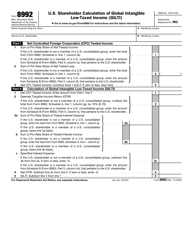

Provide details about the corporation and identify yourself, check the boxes to confirm which parts of the schedule apply to you, list the international tax items you do not report on other tax returns, figure out your own share of the income and loss of the S corporation, indicate how many expenses are involved in limiting the foreign tax credit, specify how many distributions to the S corporation in question you received, record the wages, salaries, and other income inclusions if you are a shareholder of a controlled foreign corporation, summarize the details about your inclusion in relation to the passive foreign investment company, and compute the taxes you already paid.

Note that the shareholder often does not receive Form 1120-S Schedule K-3 from the S corporation especially if the entity had no foreign activity or those operations were limited; however, it must send a copy of the document to the shareholder upon their request.

The document is a supplement to IRS Form 1120-S, U.S. Income Tax Return for an S Corporation.

Check the official IRS-issued instructions before completing and submitting the form.