This version of the form is not currently in use and is provided for reference only. Download this version of

IRS Form 1116

for the current year.

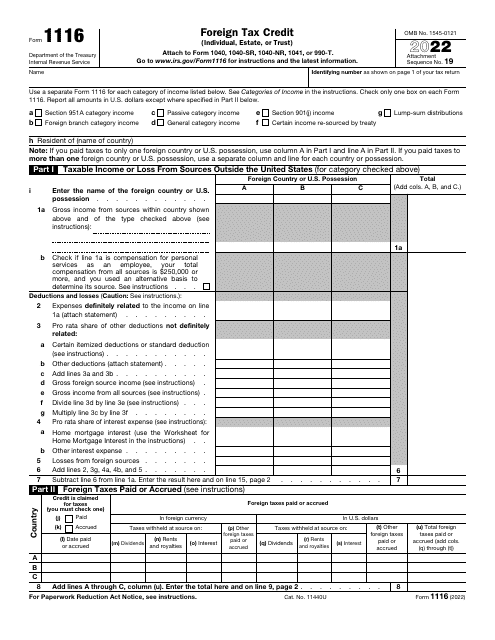

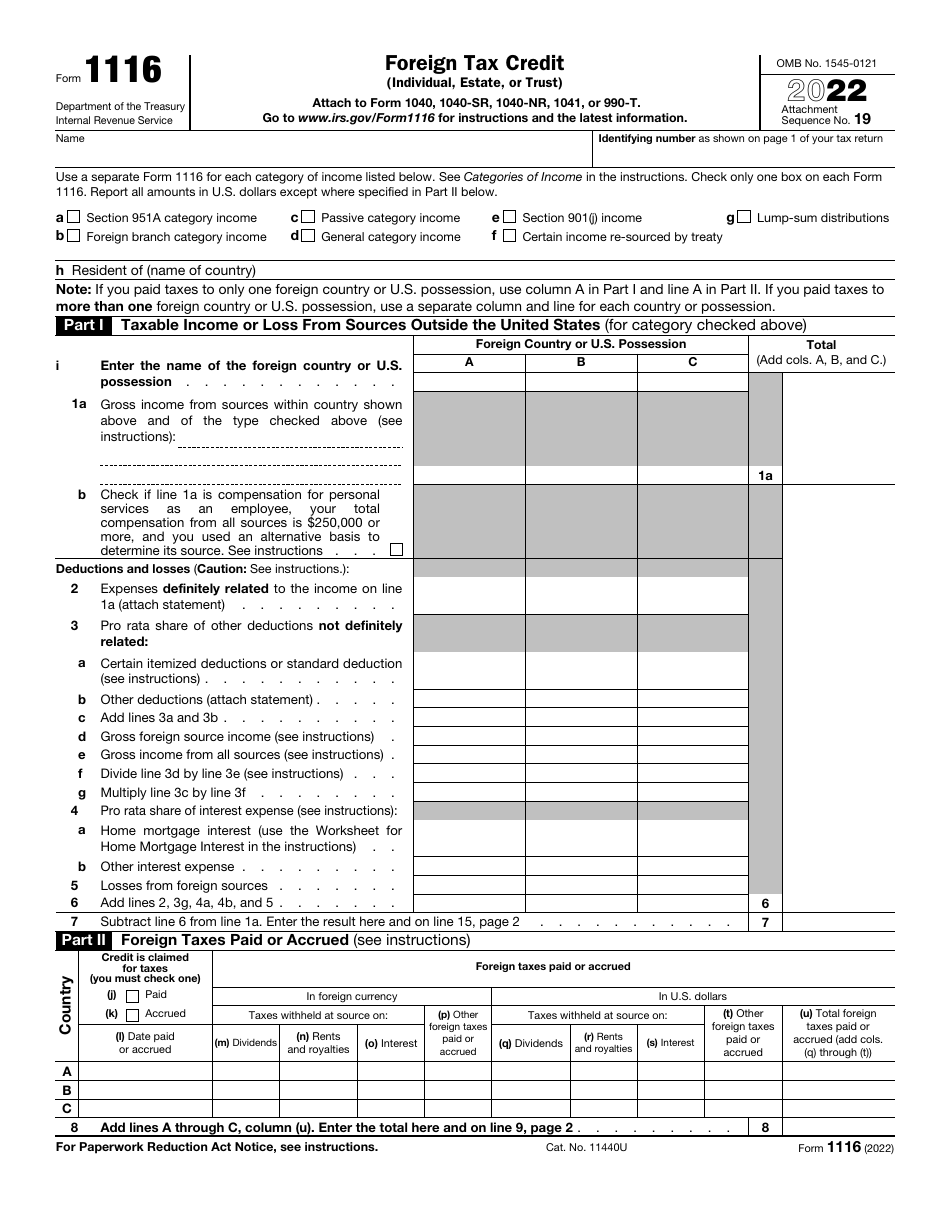

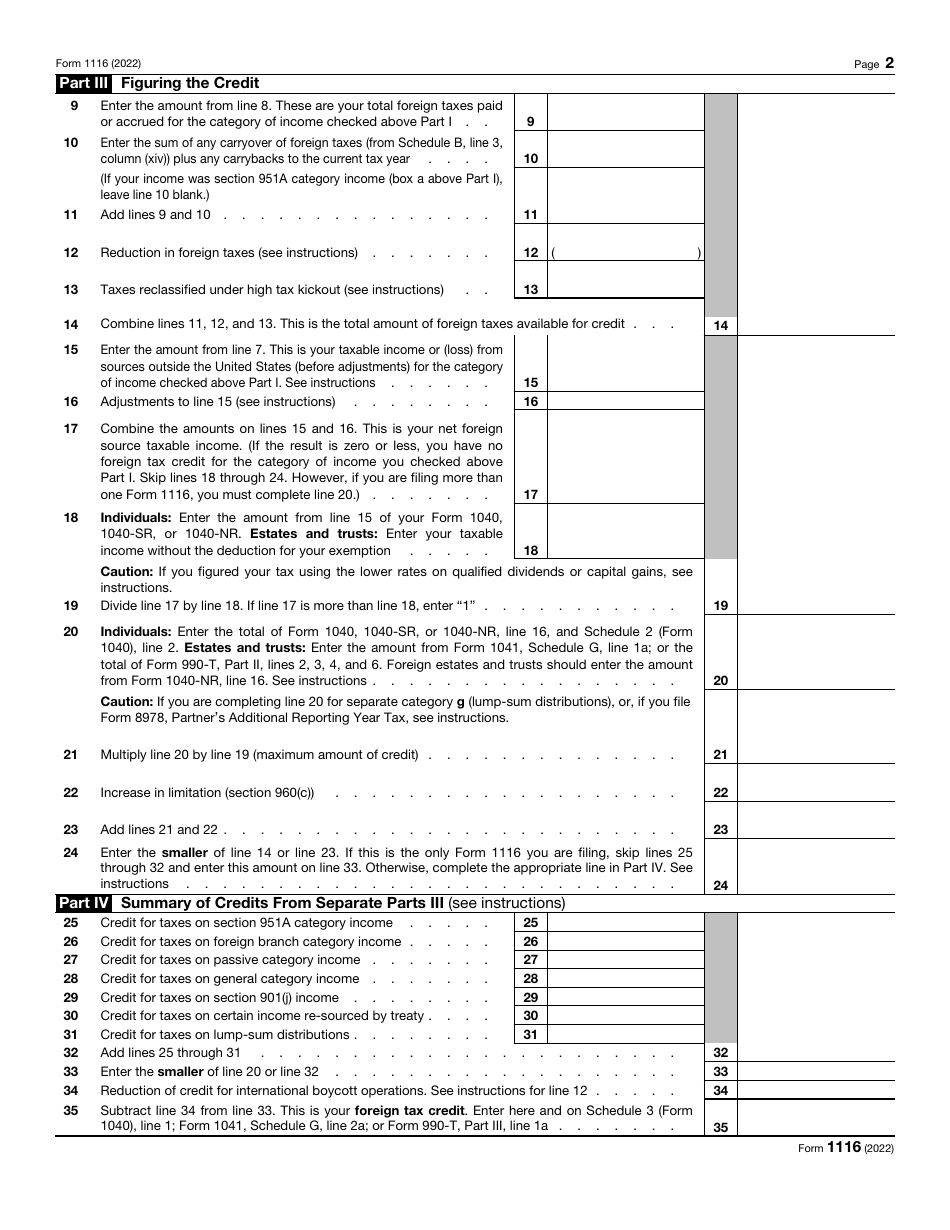

IRS Form 1116 Foreign Tax Credit (Individual, Estate, or Trust)

What Is IRS Form 1116?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is Form 1116?

A: Form 1116 is the Foreign Tax Credit form provided by the IRS.

Q: Who needs to file Form 1116?

A: Individuals, estates, or trusts who have paid taxes to a foreign country or U.S. possession may need to file Form 1116.

Q: What is the purpose of Form 1116?

A: The purpose of Form 1116 is to calculate and claim a tax credit for taxes paid to a foreign country or U.S. possession.

Q: How does Form 1116 work?

A: Form 1116 allows taxpayers to calculate the amount of foreign tax paid or accrued and claim a credit against their U.S. federal income tax.

Q: What information is required to complete Form 1116?

A: Taxpayers need to provide details such as the foreign tax paid, income subject to foreign tax, and the foreign tax credit limit.

Q: When is Form 1116 due?

A: Form 1116 is typically filed with the taxpayer's annual income tax return, which is due by April 15th of each year (or the next business day if it falls on a weekend or holiday).

Q: Are there any limitations on the Foreign Tax Credit?

A: Yes, there are certain limitations on the amount of the foreign tax credit that can be claimed, including a limitation based on the taxpayer's overall foreign-source income.

Q: Can I e-file Form 1116?

A: Yes, taxpayers can e-file Form 1116 along with their federal income tax return.

Q: Do I need to attach supporting documents with Form 1116?

A: In most cases, taxpayers do not need to attach supporting documents with Form 1116, but they should keep them for their records in case of an IRS audit.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1116 through the link below or browse more documents in our library of IRS Forms.